When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil. The non-standard “flood of liquidity” was an about-face from his predecessor (who had been raising rates in 2011 before the wheels fell off), an early test of his new way of doing things.

As is usual whenever central bankers get creative, it doesn’t take them long to pat themselves on the back. Almost as soon as the LTRO’s were announced they were pronounced a great success. So much massive monetary-ness couldn’t possibly be ineffective, and so all the mainstream models forecast the future just the way they liked.

Thus, what Draghi said of Europe in early April 2012 sounds every bit like what Ben Bernanke had said of the US in early November 2010 (QE2). Things were definitely looking up!

The information that has become available since the beginning of March broadly confirms our previous assessment. Inflation rates are likely to stay above 2% in 2012, with upside risks prevailing. Over the policy-relevant horizon, we expect price developments to remain in line with price stability. Consistent with this picture, the underlying pace of monetary expansion remains subdued. Survey indicators for economic growth have broadly stabilised at low levels in the early months of 2012, and a moderate recovery in activity is expected in the course of the year.

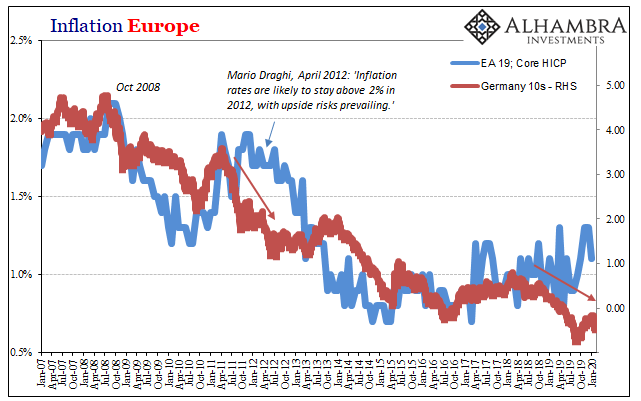

Inflation in Europe, in particular, had only experienced a modest setback to that point. The overall HICP rate had peaked at 3% the prior November but decelerated just a tad to 2.6% during the month Draghi spoke. Though the rate would decline a little further, no lower than 2.4%, by summer it was right back at 2.6%.

The core inflation rate was likewise modest in its step back (from the central bank point of view). Just a few tenths of a percent cooling early on in 2012, otherwise apparently indicating outwardly the economic stability Mario Draghi had sought by unleashing his non-standard LTRO’s.

But there was a problem; a big one. The bond market, the bund market specifically, wasn’t buying all the talk. It was buying instead all the German federal debt securities it could get its hands on. For all the mainstream media love of the “massive” flood of euro “liquidity”, holders of Germany’s bunds and schaetzes remained unenthused. Yields dropped and would never recover.

That had meant a key divergence; while Draghi sounded confident in his April 2012 forecast, market-based inflation expectations were sinking like a stone. Not only that, this discrepancy was already one year old by then, dating back to April 2011. It hadn’t changed with the LTRO’s.

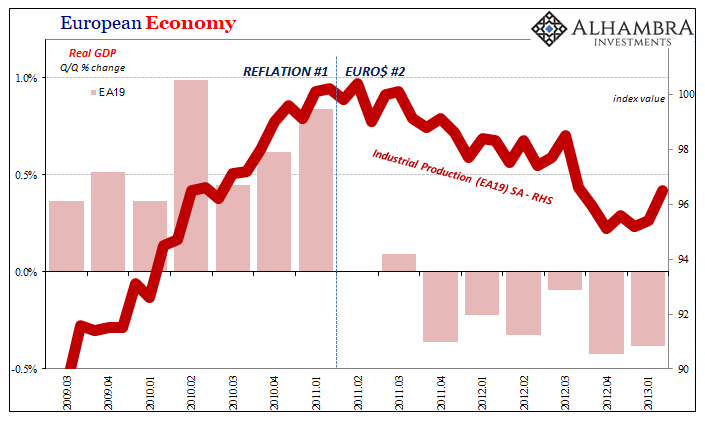

Of course, today we know which view prevailed. It sure wasn’t Draghi’s. Not only did inflation rates eventually collapse in 2012, so much for upside risks, the European economy had already dropped into a pretty nasty recession, as well. The bund market was right; the non-standard monetary policies were irrelevant.

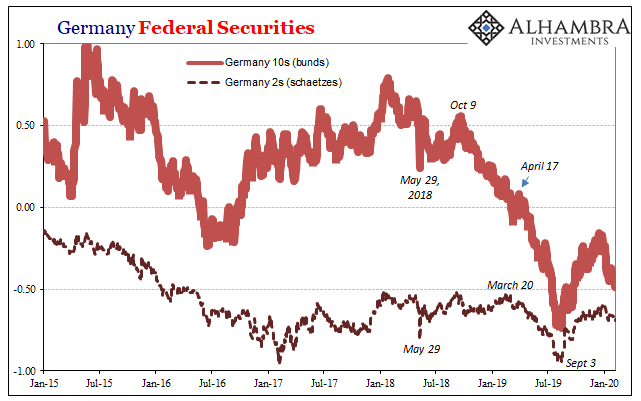

The reasons for bringing this up today should be pretty obvious. Once again, the bund market is priced for one thing which is and has been diverging from both recent inflation results as well as the official line about them. Mario Draghi’s successor, Lagarde, is pretty sanguine about re-launched QE.

German bunds and schaetzes are not.

Even at their “best” during the final few months of 2019, too much was made about what had been a relatively small back up in yields (UST’s, too). The way it was told in the mainstream media was that the bond, and bund, market had changed its mind about the risks.

It hadn’t.

There had been a midpoint in European bonds just as there had been in UST’s; as there had been in both 2011-12 (the global bond market, because global monetary system). During that earlier one, Germany’s market had given Mario Draghi a chance to prove himself. Instead, he didn’t actually do much that was different even though the LTRO’s like everything else were and are celebrated as new innovations.

They were just different costumes for the same puppet show.

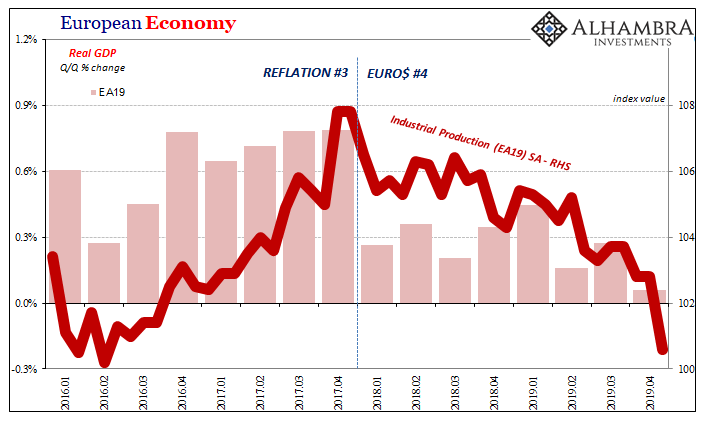

Coronavirus or not, Europe is back again revisiting the same precipice – and with the same baggage. Just as its economy in 2012 hadn’t yet recovered from the previous recession in 2008-09 before falling into another one, six years on it still hasn’t recovered from either. The monetary policy response is basically the same, too.

And you can just substitute Mario Draghi’s April 2012 prognostication for anything and everything Christine Lagarde will be saying over the coming weeks maybe months. For however long it is she believes she can plausibly deny reality. That is, until the bond market view is either meaningfully, completely withdrawn for once, or proved correct for still another time.

Stay In Touch