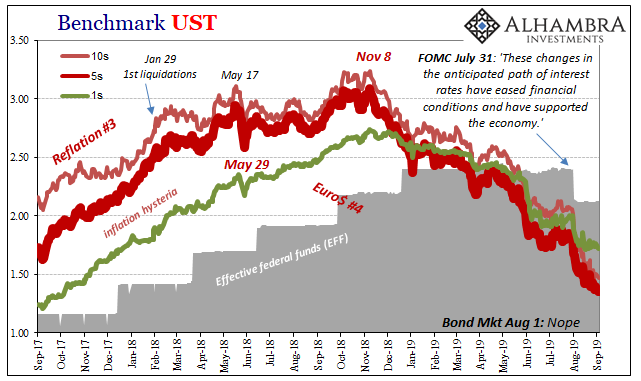

Where things stand right now is actually a pretty simple matter. How and why everything might change, as well as how and why we got here, those are more complex issues which depending upon your understanding may not lead to a clear picture of conditions. Right now, we are told, there will be just the one rate cut, maybe a second one coming up, because the US economy while not as robust as last year is still very strong underneath everything else.

This mainstream view is predicated on only one factor: the labor market. It is employment which will see us all through the darkness and get the positive economic forces realigned so that the system gets back on track and we can all go on with our booming lives.

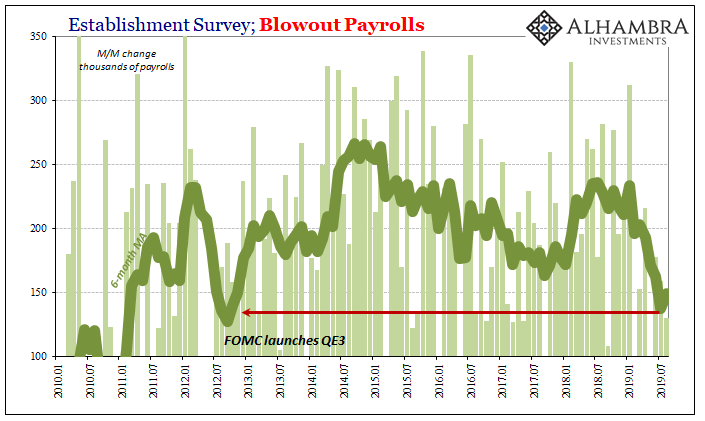

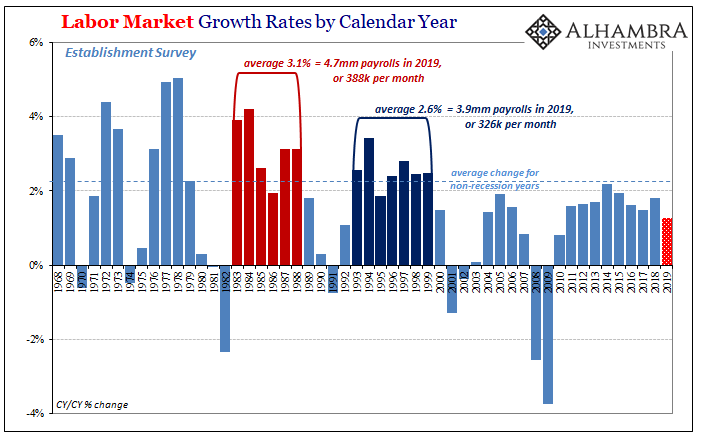

That’s either the case right now, or it isn’t. In the past, such as last year, for example, everything hinged upon your interpretation of the word “strong.” It was said that a steady stream of +240k payrolls was it, and that was highly arguable (see: CY percentages). OK, setting that aside, if +240k is strong then +130k must be something else.

The last time the US labor market was averaging this few payroll gains the Federal Reserve decided it needed to launch a third round of quantitative “easing.”

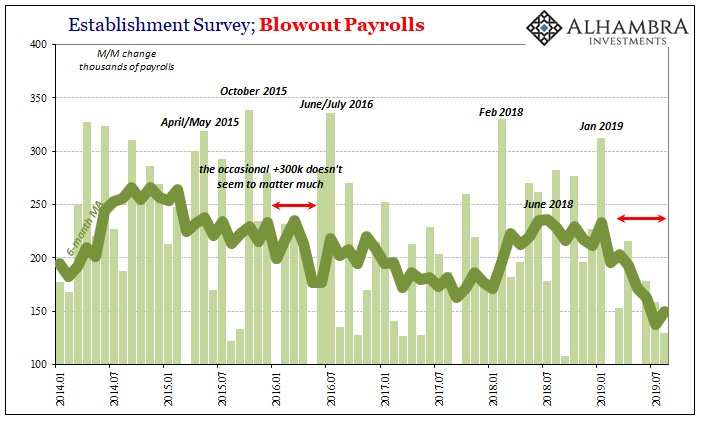

The current payroll report for August 2019 is, as always, nothing to fixate on. One monthly number means very little, high or low. In this case, low. Estimated at just +130k, more importantly this is another month below +150k which continues a trend absent any blowout months. The last time there was one above +200k was April, the only one out of the last seven.

There’s only been one better than +250k out of the last ten (January).

In short, a conspicuous lack of even the occasional blowout monthly number. And in their place, more and more to low side. Not in a single, isolated instance, rather more frequent suspect months without any arguably good months to balance them out.

Even if the labor market was strong last year, it cannot be this year. Something has clearly changed, undercutting the very basis for the mainstream expectation that this is all just some soft patch easily withstood with the aid of a little monetary policy push.

And that’s just the beginning of the downside news. There’s much more heading in that direction than in the other, or at least maintaining a steadier state which might indicate a stable employment platform from which the whole economy (via consumer spending) might mount a serious and easy comeback.

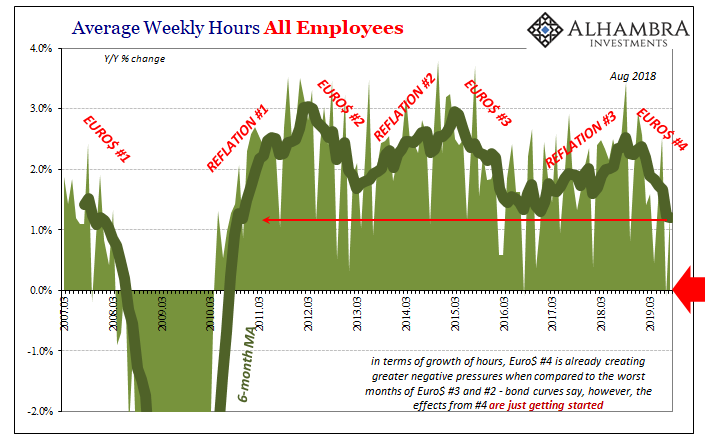

As in the headline, there are a number of details inside the payroll reports suggesting an unusual level of downside. Total Hours, for example, the revised estimate for July 2019 is now negative (-0.1%). That would mean American labor put in fewer hours in this last July than they did the July before. A whole year of purported booming growth, not to mention population, and somehow fewer hours.

Also like the headline, though, it’s not just the one monthly figure. It is the more frequent and more severe lesser months combined with less frequent “better” months. The average change is the lowest since 2010. It may not be catastrophic, but it’s not strong, either.

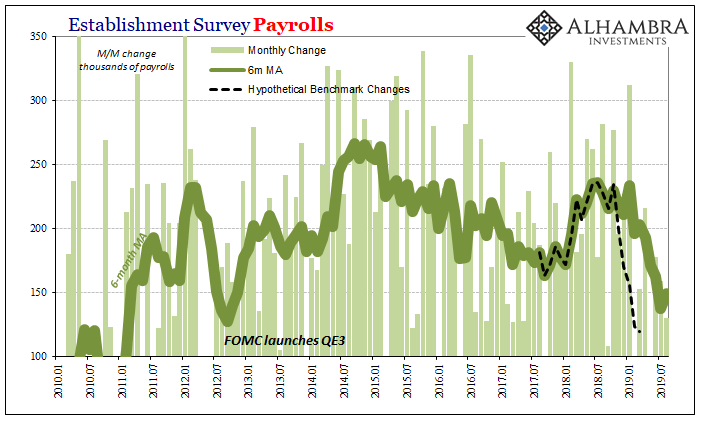

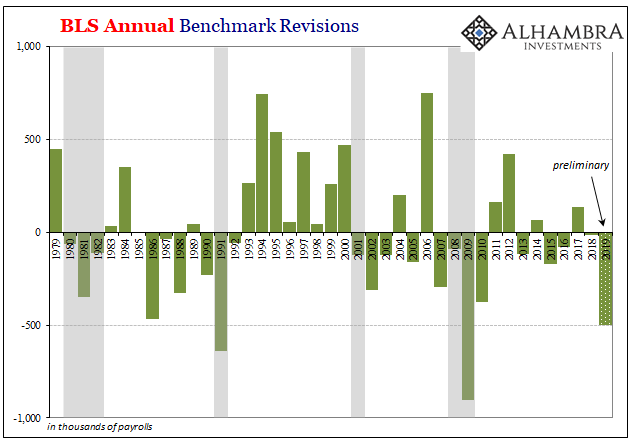

And yet, this is actually the best-case scenario. What I mean by that is the BLS continues to work off its last benchmark estimates; as is standard practice. But we already know, because the BLS told us, that these payroll numbers are severely over-estimated. The preliminary benchmark assessment, which you can read about in detail here, was -501k for the month of March 2019.

All that said was when the BLS went looking in state unemployment tax filings to check and verify its preliminary estimate of 2.5 million jobs gained between March 2018 and March 2019 it could only substantiate 2 million of them. One-fifth of purported payroll increases very likely never happened.

What we don’t know, and won’t until the full set of revised benchmarks is released next February, is when and how the labor market changed in a way the BLS wasn’t anticipating nor picking up in its surveys (the statistical process embedded within these kinds of economic accounts are subject to a little more subjectivity than you might think).

I happen to believe that the labor market experienced a much bigger bout of weakness entering 2019; the very trend that already shows up in the current benchmarked figures. In other words, the landmine at the end of last year, in my view, almost certainly had an even greater negative impact than the clearly negative impact that has shown up to this point – which is already substantial.

Putting this preliminary finding in historical context, you can already see (above) just how unusual the result. Maybe it changes between now and February, the BLS secures some other data source that softens the number, but that’s not very likely. As it stands, that big of benchmark adjustment is typically associated with time periods more consistent with recession (especially after the 1990-91 recession).

There aren’t many reasons why the BLS would reduce its benchmarks to the extent it appears outside of serious, broad economic weakness.

That doesn’t mean the US is right now in recession. All it tells us is that the labor market is probably substantially weaker still than it is currently being estimated. And, once more, the current estimates are not strong.

Even though 2019 is on track to be the worst one since the immediate aftermath of the Great “Recession” under the current benchmark, when the next one is issued there’s a very good chance we’ll find out it is down to maybe even less than 2010. That’s a level of softness which confirms rather than refutes the risks priced in bond yields.

That along with all the other details show that the labor market, the one pillar of strength and support, is already uncomfortably close to 2010 maybe 2009 without ever having the debate about what counts for a good number. As I wrote last month, this is bad, folks. And that was before the preliminary benchmark. August’s payroll figures are merely consistent with the interpretation.

It’s a very simple matter as far as that goes. Is the labor market strong or not? Definitively not. Without the labor market, there will almost certainly be more than one rate cut – as just the start of the more complex discussion and analysis.

Stay In Touch