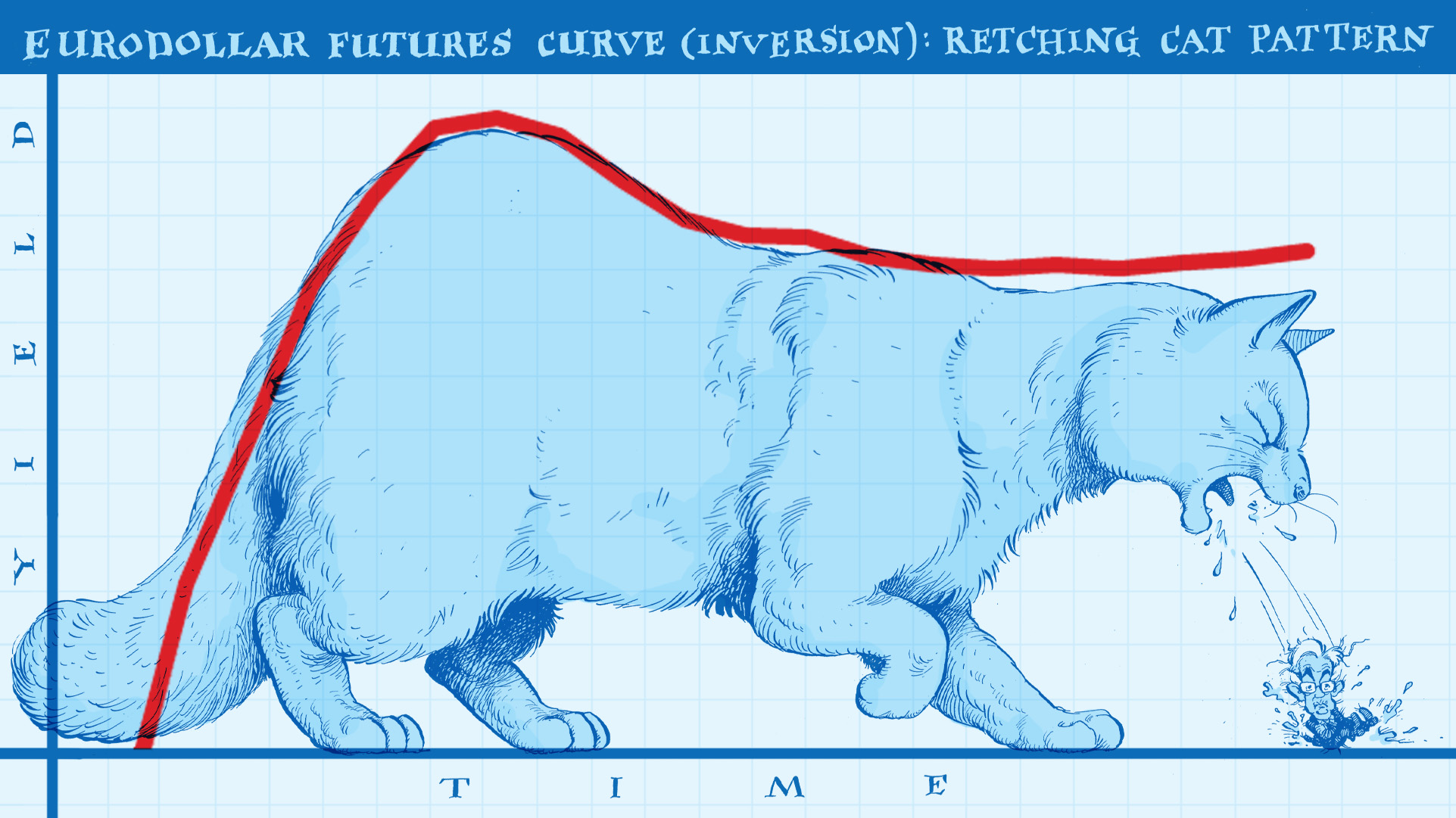

Inversion Is The Real March Madness, Just Don’t Take It Literally

With such low levels of self-awareness, it isn’t surprising that the FOMC’s members continue to pour gasoline on the already-blazing curve fire. March Madness is supposed to be on the courts of college basketball, instead it is playing out more vividly across all financial markets. One reason why is that policymakers at the Fed really still believe, even after so [...]

Stay In Touch