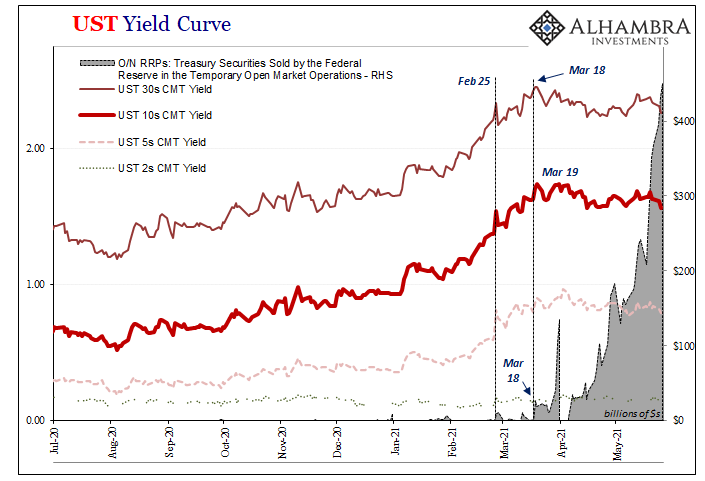

Bills Down, RRP Up

The Federal Reserve has done us a solid favor by opening wide its RRP window. Quite by accident, obviously, these policymakers hardly useful monetary stewards, we now have another indication, and a more direct one (though still indirect overall), relating on the surface two seemingly very different factors. The correlation found there between T-bills and that has increased the visibility [...]

Stay In Touch