That’s the thing about these eurodollar cycles; they aren’t short. We’re conditioned on the belief that the business cycle is, or at least the recession piece. According to convention, the economy peaks and within a relatively short period of time it falls apart. The shock and its very immediate aftermath.

The lengths of time involved here in the post-crisis era have contributed so much to the confusion; as has the absence of official recession at least in the US. Without a declaration and without the “next” Lehman it gives off this impression that things must be fine. The public doesn’t get the obvious signal it can grab onto in order to more easily understand the nature of what’s really going on.

But we know something remains wrong nonetheless. Even without the more blatant aspects of a global dollar shortages that doesn’t mean there is a dearth of signals. In fact, they are and remain overflowing.

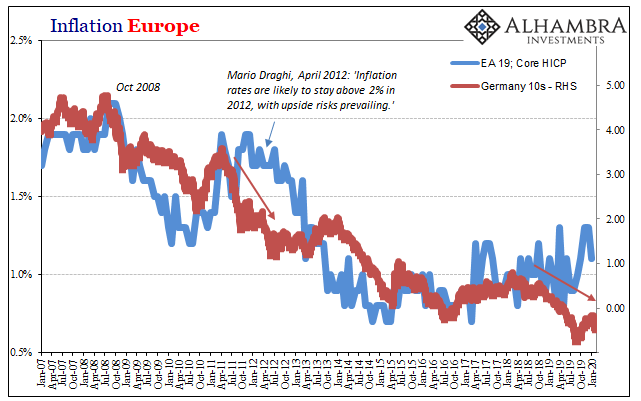

Much of the interpretation problem stems from central bankers who downplay and misunderstand the bond market…and time in it.

Right when it seemed like it was all going right, when Jay Powell was at his maximum, treasury rates poised for nowhere but up, on October 30, 2018, I wrote:

Given what’s going on now, I wouldn’t be at all surprised if over the next multi-year period UST rates not only register new lows less than 2016 but follow Japan’s under zero for a large part of the curve. It may take some time, there will be resistance from the short end with central banks the last to figure out what’s really happening.

Why?

Because nothing has changed. Eleven years of “accommodations”, ZIRP’s, and global QE’s and we are still staring at another downturn. The (non-linear) contraction remains in place – worldwide.

I wrote that 328 trading sessions ago, just about sixteen months. And now here we are, just getting to record lows at the long end of the UST curve.

That’s the thing about these eurodollar cycles, they aren’t short.

It’s been almost four years since the last prior lows in 2016 – just as it had been years in between that one and the one before. The fact that these cycles seem to take their time developing leaves everything open to misinterpretation. Well, nearly everything.

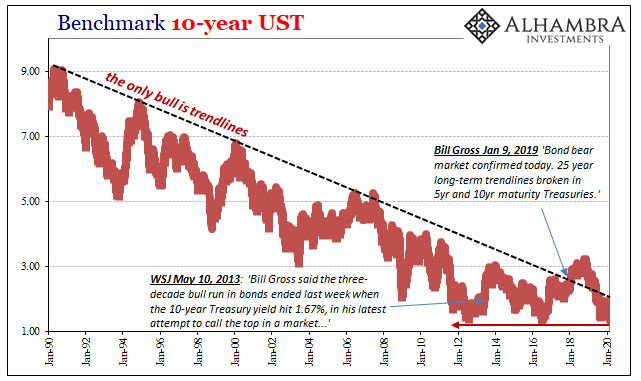

That’s why we don’t look at the bond market purely as a construction of nominal levels. These are important, sure, but even when in 2018 Treasury yields had broken, supposedly, their 30-year trendline it would’ve only meant something if it had been confirmed by the curve shape. For Bill Gross (and so many others, from Gundlach to Jamie Dimon) to have been right, flattening so dramatically was the last possible outcome.

How did all the Bond Kings miss all these telltale signs?

Patience is more than a virtue here, it is a necessity. The flattening had been, in fact, the signal that nothing had changed; nothing meaningful, anyway. Bonds sure weren’t pricing that inflation hysteria. Why was everyone so damn sure it was going to happen?

For reasons I fail to understand (fallacy of authority), the chief central banker still holds sway. Amplified by a compliant (somewhat understandable) financial media, and there is just no way for the public to gain a reasonable understanding of the economy’s true picture. Forget shadow money.

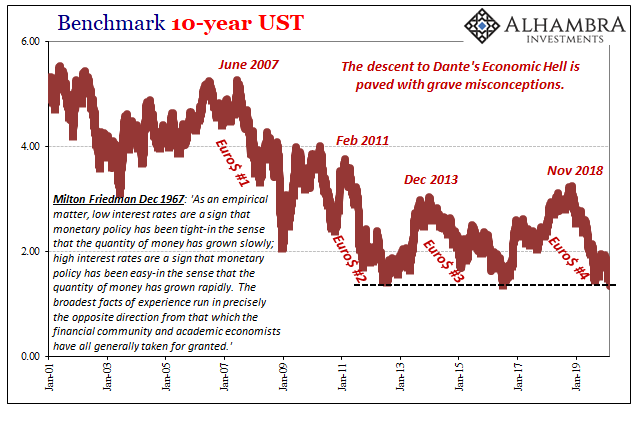

So long as nothing changes, this is all you can realistically expect. Prolonged eurodollar cycles. From one to the next. And with the monetary system as it is since 2014, these cycles are going to push nominal yields lower and lower. It won’t matter how broke the federal government gets, how fiscally insane and irresponsible, all that overridden by the more immediate and consequential liquidity risks embedded within these tortured curves and sinking nominal levels.

That’s ultimately the key. The interest rate fallacy further proved yet again. QE’s don’t matter nor does the Federal Reserve all that much beyond short run sentiment (and signals to the stock market). The real economy needs (euro)dollars only the private system can provide.

And that private system consistently wants only UST’s and the like, the world’s safest, most liquid assets. Even during the “best” of times, the interspersed reflation episodes that also last for years, the constant demand for safe assets during them tells you all you really need to know.

If things are going so well the most return-hungry players in human history wouldn’t be sitting here backing up the truck for less than 135 bps in UST’s, or paying out a rate, a guaranteed coupon loss, for bunds.

Nothing about this is quick. I don’t know if the world’s collective attention span has really been as shortened as it so often seems, but I doubt it would matter either way. Fixated by the lack of another Lehman or Bear, the public can’t see the forest for those insignificant trees, not in the way those on the inside do.

The bondholders, hoarding bonds.

While Jay Powell and the Bond Kings hoard the public’s misguided attention.

Stay In Touch