The idea of a midpoint can be misleading in that we might immediately think of one in terms of time. The middle being exactly in the middle, halfway from the beginning while also halfway to the end. A midpoint need not be so pedant. In looser usage, it can instead denote merely the separation in between two otherwise irregularly spaced trends.

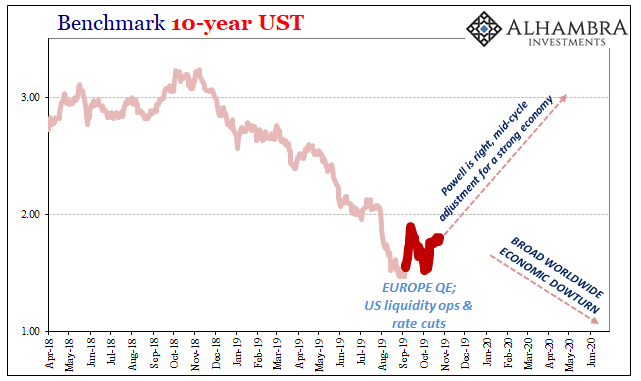

Trade wars and QE’s, not-QE’s and confidence. For the longest time during 2019, the global bond market had prevented the itchy desires of many in position of authority to declare a complete end to the “softness.” Nothing ever goes in a straight line, but for a near solid nine months interest rates almost did. Lower rather than higher, the direction of rates forced the world’s clique of economic officials to shelve their sunshine.

It was never going to be permanently abandoned.

Now two months into what has finally been an interruption in the straight line, we’ve arrived, I believe, at the midpoint. Mostly because central banks are finally on the case and, as we all know, right, there’s nothing that a committed central banker can’t do! The crows are out clucking (as these crows do) “it’s over”, “that’s it”, “the bottom is in.”

And it might seem that way in terms of time; not the midpoint, but the end. As I keep writing (because it keeps going), this “soft patch” is closing in on two years already. Such a long stretch already in the books seems to suggest it just can’t go on for much longer. Therefore, generally speaking, any change in direction seems like it should be the final act. A midpoint doesn’t show up at the two-year mark.

Or does it?

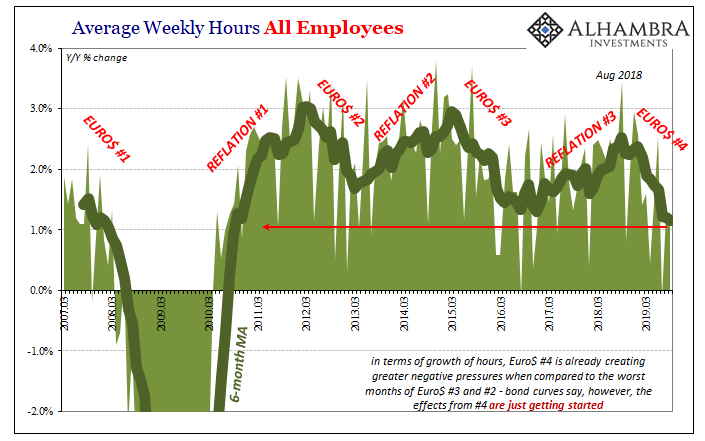

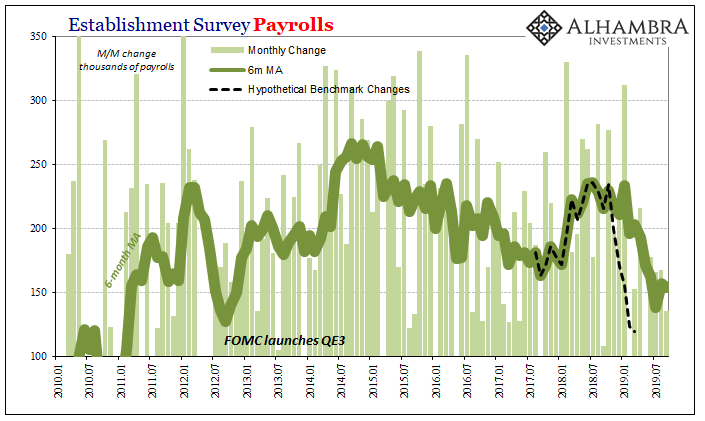

Quite often, as a matter of fact. In each and every eurodollar “cycle” so far, you can make the case that this is the entrenched pattern – an initial blow which slowly squeezes the life out of the economy while injecting markets with growing uncertainty, followed by a mid-cycle point of relief where everyone convinces themselves that’s all there is, and then the second verse which might not be near as long in terms of time as the opening stanza but often far more serious as to its eventual downward end.

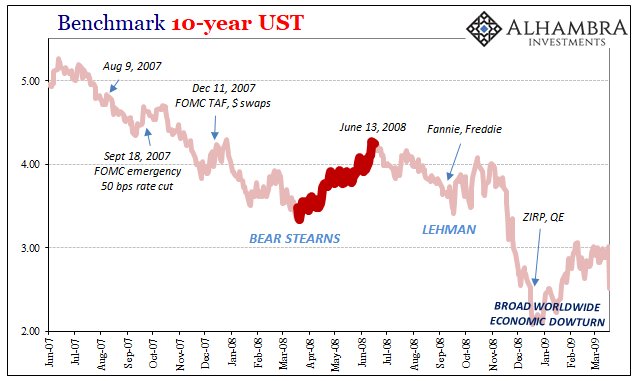

The housing bubble began to burst in late 2006, with eurodollar futures importantly inverted in December of that year. And yet, after Bear Stearns in March 2008 we were told the worst was behind us and how Bear would represent the low point because of the skillful response of central bankers. Here’s how one put it in June of 2008:

MR. HOENIG. More broadly, turning to the national economy, I have revised up my growth estimate for the first half of 2008, but it has made little change in my longer-run outlook. Compared with the Greenbook, I see somewhat stronger growth in the second half of this year and somewhat weaker growth next year and in 2010. I continue to judge that the potential spillover effects from the financial distress have understandably been overestimated in this Committee’s recent decisions and in Greenbook forecasts in recent months.

Just a few weeks earlier, then-Chairman Bernanke had said:

The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.

Even the bond market superficially agreed. Rates at the time were rising and curves steepening (the good kind), outward signals of a more positive direction (not that officials took note of bonds either way).

But there was a key difference. The bond market wasn’t really growing positive; it had merely entered a period of a little less pronounced and assured negatives.

Not one of timing, but one of reassessing the situation under color of uncertainty. That’s the midpoint. Bad things develop, officials dismiss them as they grow worse, and after it becomes obvious they are serious central bankers finally are forced to react. Then what?

None of us have a crystal ball, so in the thick of everything it makes sense to let things settle awhile following that initial outbreak. See where it all might be heading. It’s not optimism so much as wait and see on resuming the downward trend.

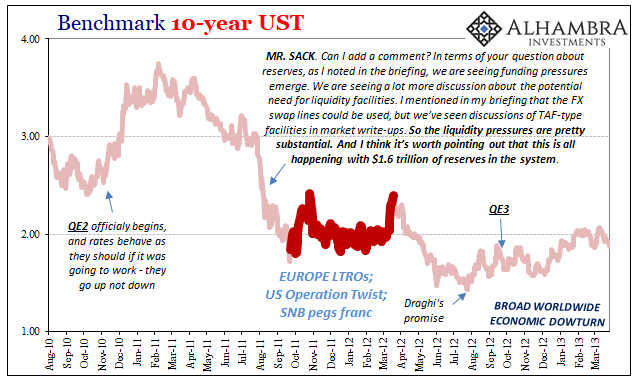

So far in the four eurodollar eruptions to date, each time the midpoint has turned out to be…the midpoint rather than an endpoint. For #2 beginning in 2011, there was one that lasted six months:

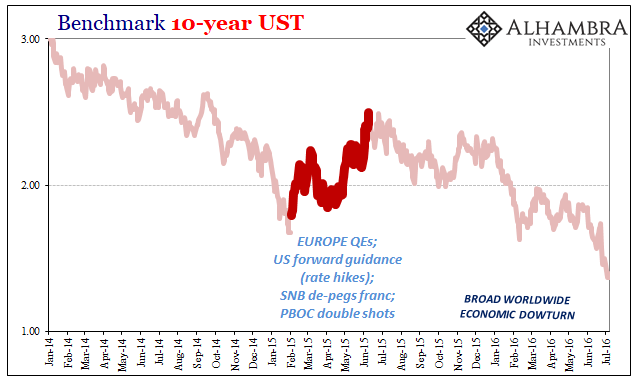

It was shorter during Euro$ #3, only a few months, but more movement in bonds and yields (the first BOND ROUT!!!). European QE, the constant talk of the “best jobs market in decades” and finally the Chinese had gotten in on the dovish act with some “stimulus” of their own – double shots, meaning RRR cuts to go along with traditional rate cuts.

Each every one, however, was followed in turn by the arrival of a broad worldwide economic downturn. Every single time. Action, official counteraction, and finally consequences as to the initial action never effectively counteracted. Primary downward trend, midpoint, and then the more serious second act once it becomes clear monetary policy just doesn’t work.

This time, of course, could be different. But if it is, why is it different? It can’t be the unemployment rate because in each of the last three Euro$ numbers the unemployment rate has been lower and lower and lower in each one. The labor market, we are told, is always and forever strong. And yet it doesn’t seem to make any difference.

Things are picking up, they say, but things always seem to be picking up in the middle.

Even if this time is not different, it doesn’t mean recession – at least in the US. Broad worldwide economic downturn is an imprecise term, and has been variable during this history. Someone somewhere will get a recession (or worse) but it’s not clear who or how much.

In 2008, Euro$ #1, it was pretty easy: everyone got a bad one.

Euro$ #2, a 2012 global slowdown (which is proving to be the permanent blow) during which the US nearly entered recession but ultimately avoided one while Europe could not.inte

During 2015 and into 2016, Euro$ #3, again the US came close, Europe was barely bothered, but EM’s were largely devastated (they have yet to recover even partway).

In 2019, Europe likely to see recession and China again talking about hard landings. The US has, to this point, only slowed down though the vaunted labor market strength is the least strong since maybe 2009 (and we don’t really know how much less strong that might be).

The amount of time doesn’t matter for the midpoint. These eurodollar squeezes take an enormous amount of it to get where they are ultimately going. While central bankers and Economists will talk about the end, as they always do, it sure seems, to me, like another episode of somewhere in the middle.

Even after almost two years.

Stay In Touch