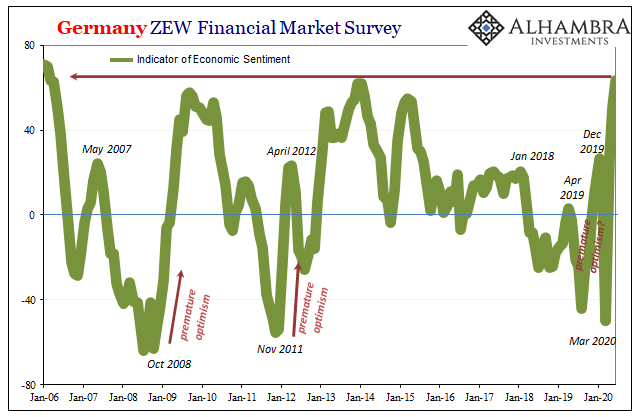

According to Germany’s ZEW, economic prospects for the intermediate future in that country (and for Europe, separate survey) haven’t been this positive since 2006. Back then you might remember the rip-roaring contributions of asset bubbles, and I don’t mean the stock market and valuations. A huge wave of credit expansion in pretty much every corner of the globe courtesy of shadow eurodollars defying Alan Greenspan’s “rate hikes.”

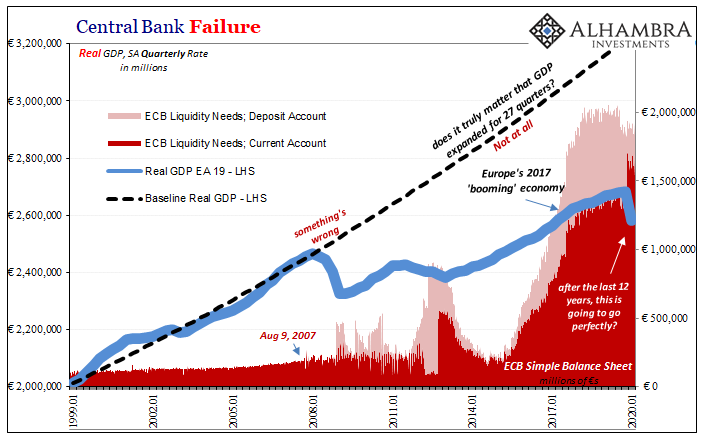

While the US housing market was certainly bubbly, it was perhaps most across Germany; thus, by December 2007 it was “New York banks” with very German names showing up for the majority of the Fed’s badly conceived TAF auctions.

Are we really supposed to believe that the ECB has finally managed to re-ignite that sort of credit-based zeal for the whole European economy? If so, the magic number must’ve been finally discovered after two decades of major central banks trying.

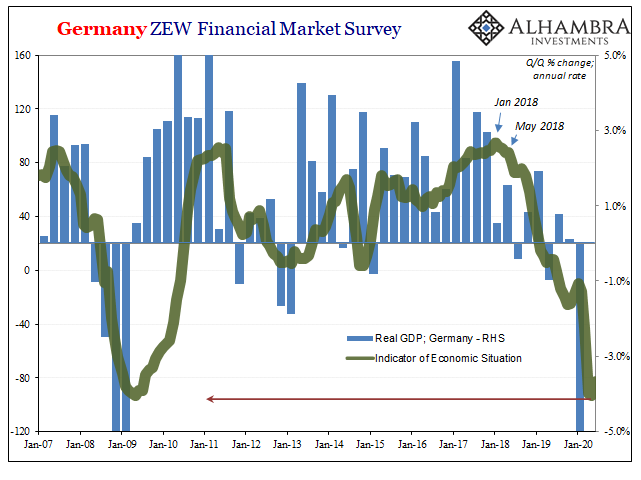

The situation index by contrast to the sentiment indicator hasn’t much moved from its recent low when it was equivalent to the worst parts of the Great “Recession.” In fact, the level of disparity between the two hasn’t been this great since 2003.

Clearly, that’s what European officials are hoping is taking place. While the dot-com recession produced a mild setback globally, it lingered on afterward for several more years. It wasn’t until 2003 that it finally took shape, and then took off, sentiment first, on the wings of global balance sheet expansion (and I don’t mean central bank balance sheets).

Reading the ZEW this way, Germany’s surveyed professionals seem to be saying that as bad as it is now and has been for the last few months, thanks to Christine Lagarde this nightmare will all be over very soon.

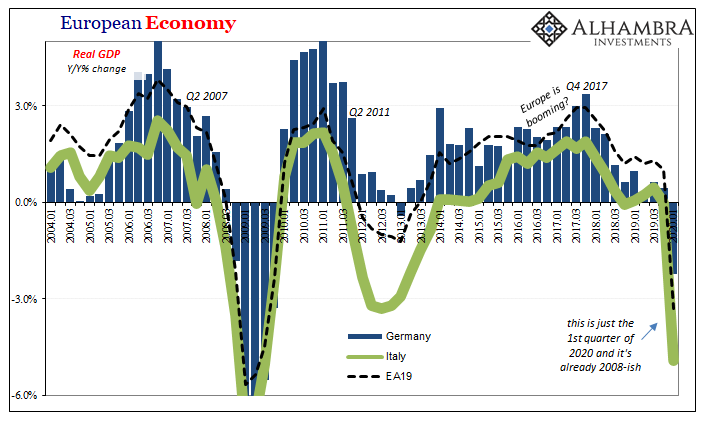

The problem with this interpretation is more recent history than 2006 and 2003, as well as the unbreakable state of especially European banking.

Sentiment has gotten way, way ahead of the situation each of the last two times Europe was grasped by recession. In both those cases, belief in “stimulus” wasn’t just premature, it was misplaced – an awful lot of further, excruciating economic damage took place while the situation was “catching up” to sentiment over longer than the short run.

Whoever it is responding to the ZEW, they like the financial media are overly impressed by central banks (because they like hearing how its written up in the financial media, apparently) and don’t seem able to factor the far more important situation among banks.

On the ground, where there’s more reality being discounted, it’s far more like the situation index.

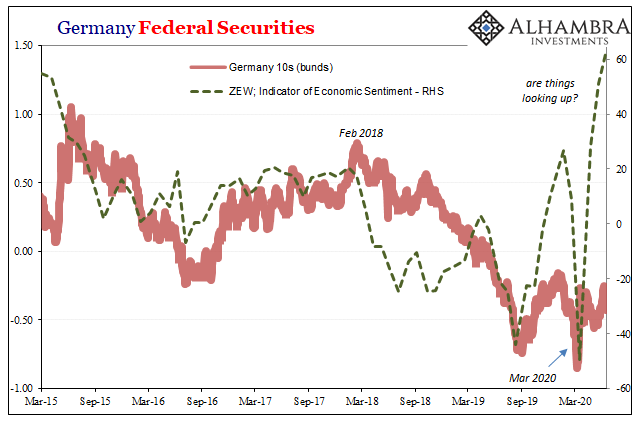

Bond yields, obviously, are forward looking; that’s the point, it’s the curve. Unlike the ZEW’s sentiment index, but very much like their situation index, not so much has changed since March (or since last year, for that matter).

Double the QE has nearly doubled the ZEW, but yields remain obscenely low (and therefore negative). No inflation on nor over the horizon, barely an improvement from the GFC2 flush.

It’s somewhat of a shame because on the way down, at least, sentiment, situation, and bund yields were all in agreement stacking up against the ECB’s increasingly confident but evidence-free hawkish position under Mario Draghi. That might better explained, it seems, on survey respondents disliking Draghi’s threat to remove QE.

You have to hand it to these central bankers and the others like Jay Powell in the US. If there is one thing they know, and it probably is only that one thing, they know very well their audience and have perfected their real art, the puppet show. Too bad the world is and has been overflowing with irrelevant drama.

Stay In Touch