The Reason For So Many Lies: He Finally Realizes He’s In Way Over His Head

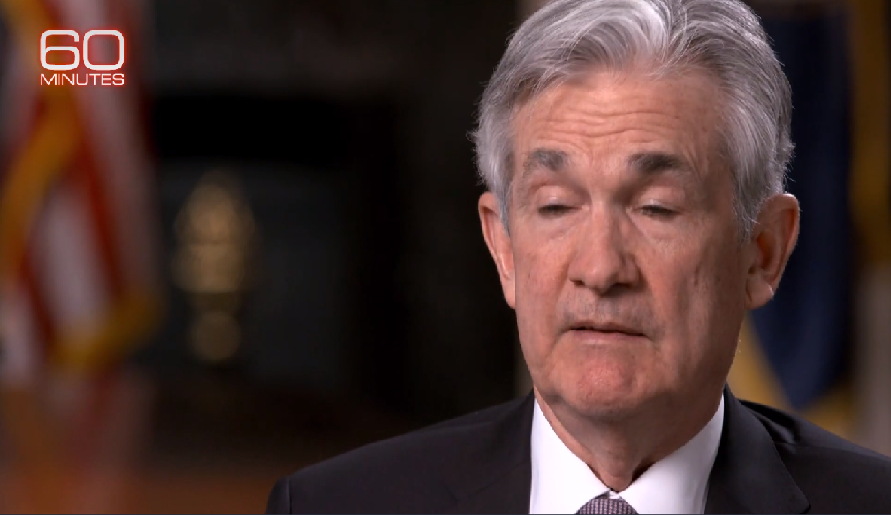

This is not a man who’s comfortable thrust into a position of leadership. Say what you want about Ben Bernanke, and there’s a lot that still needs to be said, he at least carried on with the arrogance through thick and thin (almost entirely the latter). Jay Powell sounds like a boxer who just realized the lightweight he thought he [...]

Stay In Touch