The Bureau of Economic Analysis (BEA) has revised its preliminary estimate of GDP. That can only mean one thing: time to look at corporate profits again. Included along with the recalculated headline output estimate is the BEA’s first run of profit figures. If you are Jay Powell, you aren’t going to like what you find.

First, real GDP in the third quarter was practically unchanged. Revised from around 1.90% (continuously compounded annual rate of change) to a touch above 2.10%, either of those estimates are pretty much equivalent to the unrevised 1.99% growth believed to have taken place in Q2.

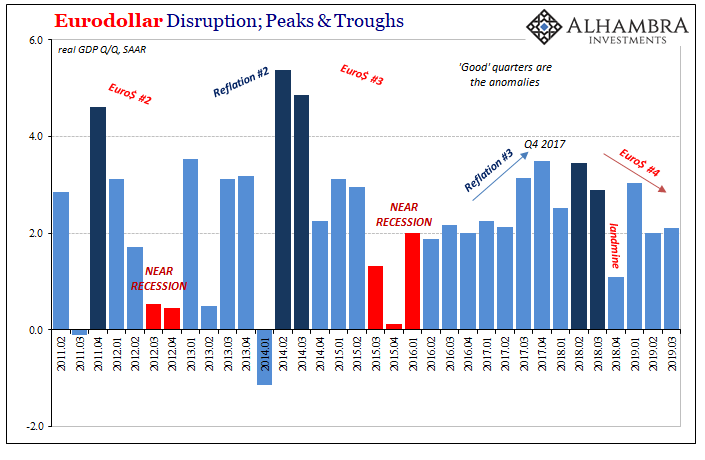

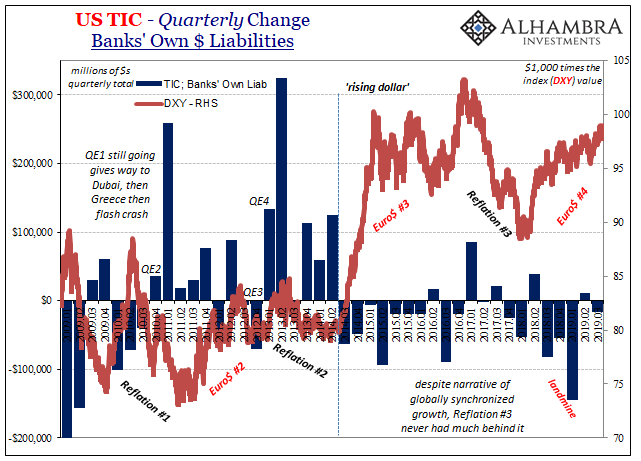

Still the slowdown from 2017-18. But what everyone wants to know is, what does this downshift really mean? Did the US economy simply revert to its (already too low) mean potential after a minor reflation high last year? Or is it transiting from reflation into a weaker possibly more dangerous state beyond the simply lackluster? The last time around, four years ago, it was the latter.

Jay Powell and the official position says it is the former. Buoyed by tax reform and slightly more favorable global conditions (he says), 2018 was equivalent to a very small sugar rush. Taking on some unknown but “transitory” cross currents late in the year, as 2019 wears on the unflinchingly strong labor market will more and more support the economy keeping it around average at worst.

In order for that to happen, though, the labor market has to actually be strong. Not just the unemployment rate, either.

That’s where corporate profits come in. As much as anything, the general willingness of businesses in the US (as anywhere else) to add more labor is related to both the top and bottom lines of their income statements. Revenue growth driving profit growth means a lot more net hiring.

No revenue growth and therefore profit problems, a lot less. I’m not really going out on a limb here, illustrating nothing more than the basics you already know quite well.

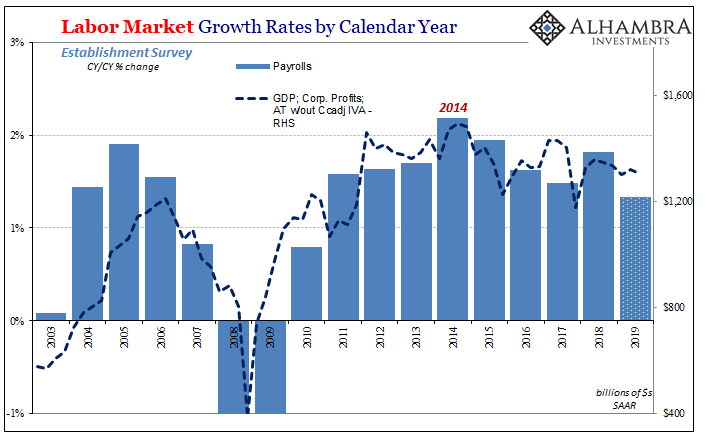

As economic profits accelerated in the past, the rate of payroll expansions did, too. This isn’t rocket science.

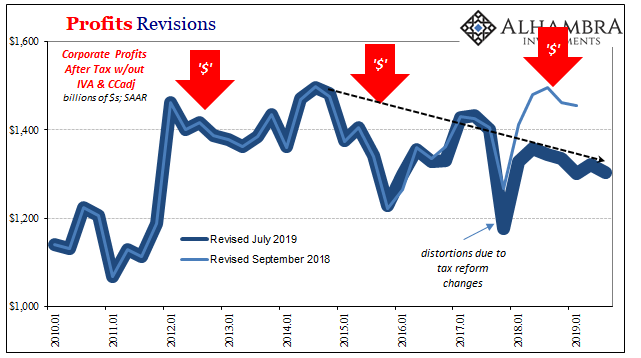

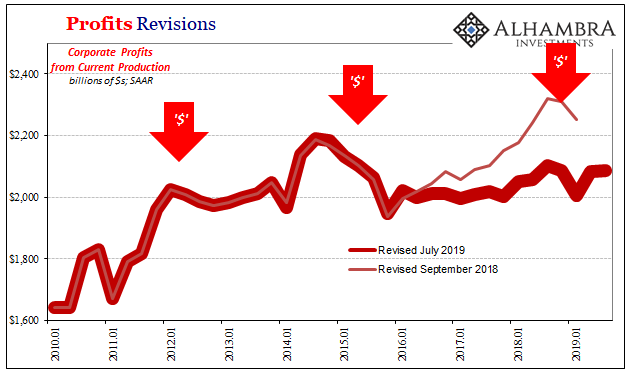

What the BEA’s income accounts have been suggesting is that they aren’t accelerating, having reached a peak rate all the way back in 2014 (which wasn’t all that high, even though it added up to the “best jobs market in decades”). Since, profit growth has been at best stagnant (depending upon the BEA series) and at worst declining.

Unsurprisingly, as you can see above, that near exactly matches what the Bureau of Labor Statistics (BLS) has been consistently reporting for years as far as its Establishment Survey has been concerned. The only difference is that this has gone unreported by the mainstream media which continuously described the situation as “robust” no matter how much it wasn’t.

The labor market is already materially weaker this year than it was in reality last year. And I mean the actual payroll gains which won’t be revealed until this upcoming February. As the FOMC even admitted at its last policy meeting, 2018 wasn’t nearly as good as advertised as far as the labor market was concerned, and 2019 is in all likelihood to be materially weaker still.

The BEA data gives us the reasoning behind it. For all his talk about a strong economy, Jay Powell can’t influence company income statements. And if profit conditions are the way the BEA data puts them, small wonder the labor market in reality is quite different from how it is talked about.

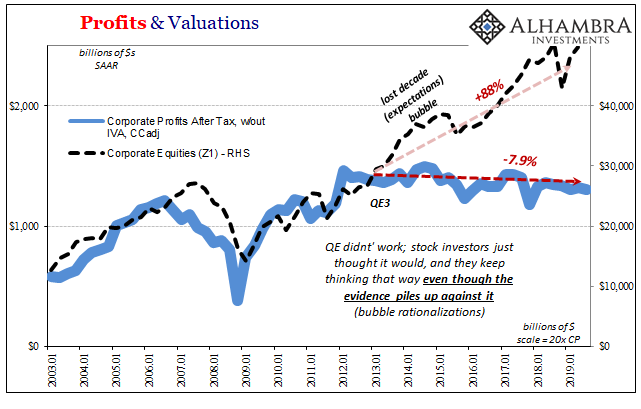

What the Federal Reserve Chairman does influence instead is stock market valuations. At the NYSE, the legend of the “maestro” refuses to die. Partly because of how corporate boardrooms react to his schtick as well as the temporary effects of “tax reform”, buying back shares as fast as possible, in macro terms economic earnings don’t ever rise while share prices absolutely do.

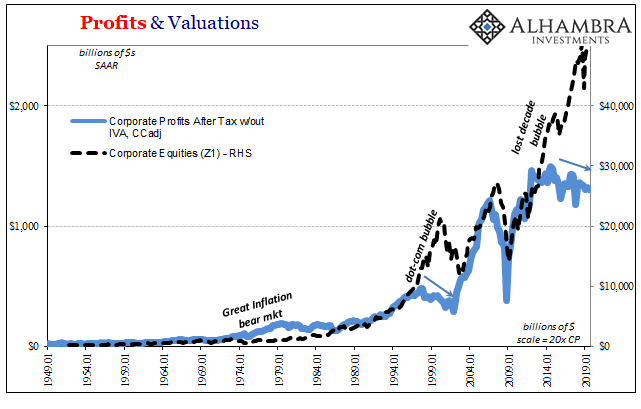

You’ve probably heard by now how this difference is at extremes – the most since the height of the dot-com era. Going by the BEA’s estimates for profits, they are down 8% since the launch of QE3 in 2012. Over the same time span, however, the value or price of corporate equities (taken from the Federal Reserve’s Z1 data, updated through Q2 2019) has exploded, up almost 90%.

By virtue of corporate earnings, the economy hasn’t recovered and isn’t accelerating suggesting more and more it never will. By virtue of stock prices, recovery is still guaranteed to happen…someday.

That may be true, but as this fourth eurodollar-related downturn continues to unfold it already means at the very least another multi-year period where it cannot happen. As the best case, if there is going to be a recovery then it has been yet again delayed.

Of course, the more reasonable interpretation is that given now four downturns meaning three false dawns the likelihood of any actual recovery and acceleration is exceedingly small. If it was going to, it would have long before now. One false dawn (Euro$ #2) may be random, two starts to look like a pattern (Euro$ #3), so three (Euro$ #4) cannot be an overly strong labor market which will finally deliver the macro goods in a timely fashion.

At this juncture, what most people usually ask is, if the economy is so bad how can stock prices keep pushing to record highs? The answer is simple; mainly central bankers who have let equity investors fool themselves into believing in QE and how it must have produced a real economic boom over the last several years despite earnings.

That boom will (somehow) create the earnings.

The lack of macro growth and therefore profits, though, has left Corporate America in a precarious position. Top heavy. Without real top or bottom line growth the last half decade, corporate strength has been vastly overestimated. That is why this year and last the sudden mainstream recognition of “zombie” companies who wouldn’t exist if there had been actual growth derived from an actual boom.

Where that becomes a much thornier issue is if or when these zombie-like businesses are forced to confront the reality of their true bottom-line situations – especially if the BEA is right about where those are heading. Recession is a surefire way for that to happen, but it needn’t go that far.

The zombie stock bubble? Perhaps the most fitting description yet.

Stay In Touch