It’s really not hard to appreciate why markets are freaking out right now. The economic narrative is, and has been, all wrong. Jay Powell says that faraway overseas pressures had taken just a little off what had been awesome economic growth. Despite what had become an obvious drag on trade and manufacturing, the unemployment rate, to Powell, spoke softly to him how everything else was doing just fine.

That plus last year’s three rate cuts as insurance explains where stocks went over the interim.

Bonds traded very differently. Instead, the bond market foresaw only risks, the more serious possibilities for not just the downturn which had already arrived but risks that such a thing could yet get worse. As I’ve often written since 2018, the more time passes and nothing materially changes the greater the chance, not less, that something even more unpleasant does take hold.

In other words, the bond market the view of the economy was one of a slowly eroding situation. A precarious rather than strong position; and that was just 2019.

This other view, a very different one, is what has taken ahold of the NYSE this week.

And bonds, unlike stocks, have the data to prove it. Everything was not good starting off 2020, especially where it counts the most. If the labor market is the underlying strength, where’s the income? That’s what Treasury-holders have been asking as curves barely budged from September to January.

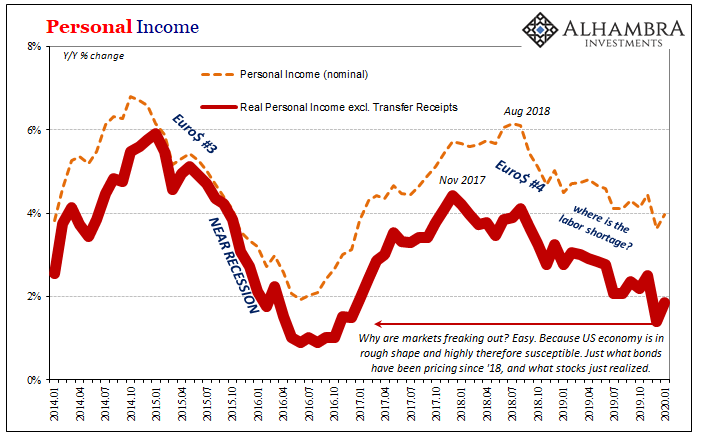

According to the latest monthly update from the Bureau of Economic Analysis, Personal Income and all its downstream derivatives has been decelerating ever since the middle of 2018 – with a nasty tumble right during that year’s landmine. Nothing has changed since.

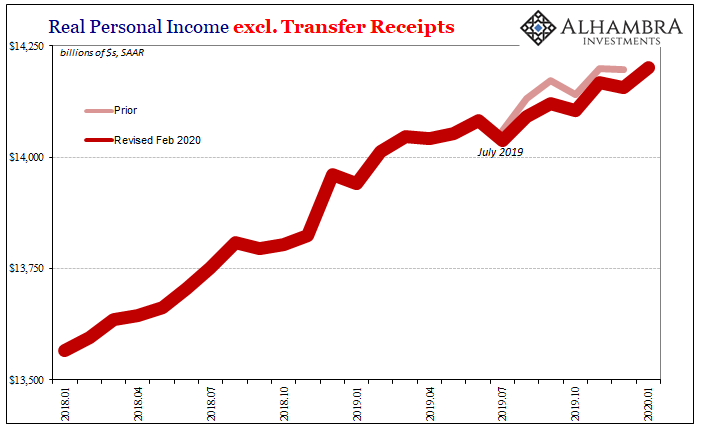

The latest figures have been revised downward such that December’s estimates (particularly Real Personal Income excluding Transfer Receipts) were in line with the lowest parts of Euro$ #3’s near recession!

That is where we are in the first month of 2020. In short, if the heart of the US economy, income, began this year at that kind of lowly state then what are the real risks to it? They sure aren’t on the upside, coronavirus or not.

Not only that, to a substantial degree the income data refutes the BLS’s CES figures like the Establishment Survey. According to the curiously unrevised 2019 situation, the labor market staged a significant comeback (refuted by JOLTS) in the second half of 2019 (once you account for the big downgrade to 2018 that no one talks about).

Again, bonds are asking, if payrolls are right rather than job openings, where is the income?

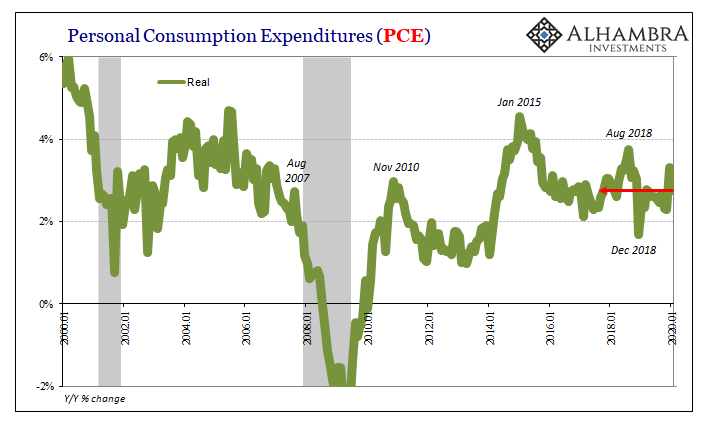

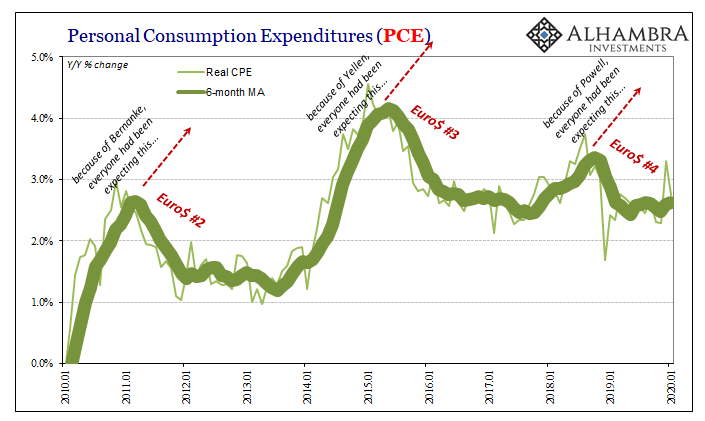

Quite naturally, as a result of a deteriorating income situation Personal Spending has been lackluster – confirmed by last quarter’s GDP figures. Real PCE had languished throughout 2019 when again it was supposed to have accelerated; just as in 2014 or 2012. That kind of “unexpected” deviation does not go unnoticed in the real economy (inventory).

The longer it stays this way, the more, not less, likely something larger breaks.

Again, a perilous situation where the domestic economy is much too close to the edge, especially given what’s already been transpiring in other parts of the global economy (Europe, Japan).

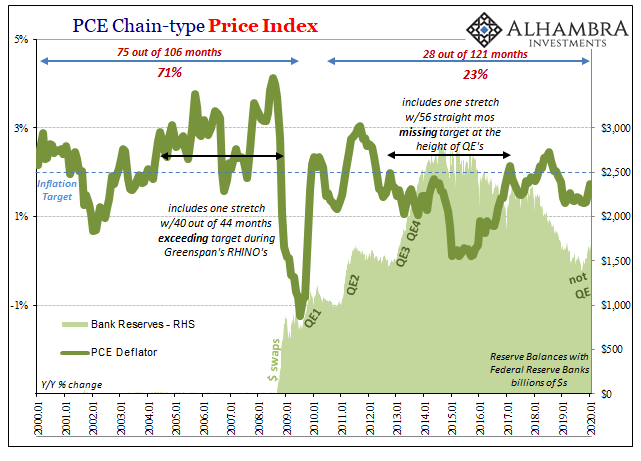

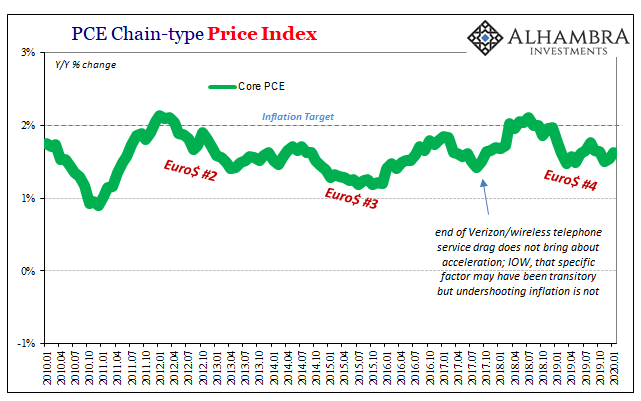

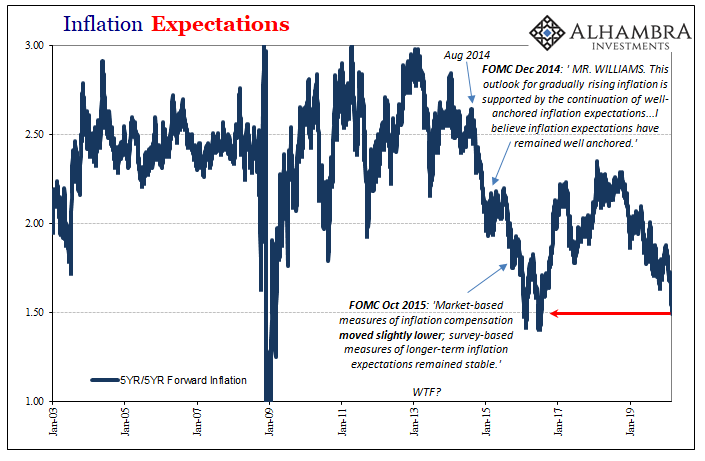

Undoubtedly additional rate cuts are forthcoming not as a solution but as a response, and a confirmation, to a deteriorating situation. Reluctantly, kicking and screaming, Powell is due if not late (as always) for more. Given the lack of growth in 2019 and now tumbling oil prices, the FOMC’s “mysterious” inflation undershoot has been given a new leg.

The PCE Deflator accelerated in January 2020 to 1.73% year-over-year, if only because oil prices, despite the setback in the latter half of the month, they were still, on average, 20% higher than in January 2019. The Fed won’t have that “advantage” moving forward. Given where WTI is now, the monthly average is set for February 2020 to be 9% or so less than it had been in February 2019.

Thus, the PCE Deflator will be back down to ~1.50% if not lower, further expanding this latest undershoot episode (by virtue of the Fed in 2012 having explicitly declared 2% as its inflation mission). There are no inflationary pressures evident anywhere, no matter how many times officials speak of the unemployment rate and imply the labor market is unusually, beneficially tight.

It just isn’t.

And more and more the data continues to say that 2019 ended the wrong way, 2020 begins under a cloud of suspicion, and now the world economy is going to have to figure in yet another significant headwind. Which it is in the process of doing right now.

Just the way bonds have been ignoring Jay Powell and pricing things for a long time already. And now stockholders are running toward the exits (valuations), at least some of them wondering what they were thinking listening to that guy.

At some point, the widely claimed economic turnaround should have actually turned the economy around…before it got to be one disinflationary pressure too many.

Stay In Touch