The Trump administration raised tariffs last week from 10% to 25% on $200 billion worth of Chinese goods and are considering tariffs on another $300 billion of Chinese goods. The Chinese retaliated this morning, raising tariffs to 25% from 5% and 10% on various goods totaling $60 billion. Obviously, the trade negotiations are not going well. Stock markets around the world have fallen as a result, fears of recession rising again as institutional memories of Smoot-Hawley trigger investors’ flight response.

Stocks are not one of the market indicators we follow to inform us about the current state of the economy. The main reason for that is that stocks and economic growth are not highly correlated except over the very long term. The other reason is that stock investors tend to be more emotional than bond investors, reacting to every bit of news whether it is truly newsworthy or not.

That isn’t to say the trade negotiations with China aren’t important, although newsworthy is debatable. They are important but not for the immediate tariffs being imposed. The numbers associated with these tariff levels just aren’t large enough to impact the US or Chinese economy that much. The monetary value of the Chinese retaliatory tariffs is roughly $9 billion on a US economy of nearly $20 trillion. The direct impact is tiny. The US tariffs on China are slightly larger, amounting to about 0.25% of Chinese GDP. Still, we aren’t talking about a large direct impact.

And when we look at our bond and other non-stock market indicators, we see that the response has been quite a bit more muted than in the equity market. Even in stocks, despite some big Dow numbers on my screen today, the selloff hasn’t even reached the 5% threshold. That’s no bear market, not even a correction. About the only name I could assign to the move so far is “profit taking” after a double digit move YTD.

I last wrote an update on our market indicators back on March 25th, during a time when a trade deal seemed a lot more likely than it does today. The change in most of our indicators is almost imperceptible. The 10 year Treasury Note yield is down a grand total of 2 basis points. The 2 year is basically unchanged. The yield curve is unchanged. Credit spreads are actually narrower. The dollar has screamed higher by…1%. Gold is down 1.6%. If I told you seven weeks ago that trade negotiations with China would deteriorate to the point that the Trump administration would follow through with their threat to raise tariffs, would you have expected these markets to be essentially unchanged?

I said at one point that the tariffs the Trump administration places on China will still be in effect when he leaves office, whenever that is. As recently as last November (see here) I said I was skeptical a deal with China would actually happen because blaming China for whatever ails the US economy is a proven political winner, especially for President Trump. So it isn’t very surprising to me that we seem to have hit an impasse. What is surprising is that the market hasn’t really reacted much to the breakdown.

Bond markets started pricing in an economic slowdown at the end of last year. We actually saw some signs of it as early as last July (Welcome to the Slowdown) but market positioning today isn’t as extreme as it was back then. Speculators in the Treasury market are basically flat on the 2 year and the 10 year. Eurodollars are also flat with specs taking a slight long position in the front contract. A year ago, when all the speculators were short the 10 year, it was pretty easy to be a contrarian. Today, with that short position largely covered, there is not even a consensus to buck. About all I can say is that bond yields peaked at the beginning of Q4 and the trend is still down but there has been little movement over the last two months.

We will certainly, at some point, fall back into recession. I don’t know if that time is now although our market indicators certainly aren’t acting as if it is. But I am skeptical that lack of a trade deal with China will be the culprit whenever the time comes. Just as our problems are home grown, so are China’s. If the business environment in China is as bad as the trade hawks say, foreign companies won’t need the additional encouragement of tariffs to get out and set up shop somewhere else. They’ll move to Vietnam or Cambodia or Korea or somewhere else if the terms are better. And our trade account will still be in deficit even if the composition changes somewhat. As I said, our problems are home grown and tariffs aren’t the answer.

Market Indicators

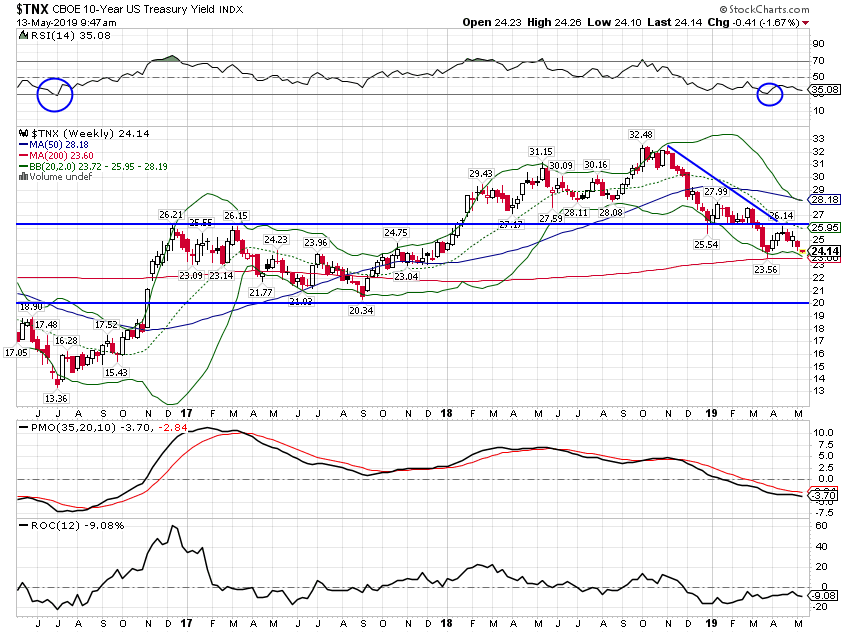

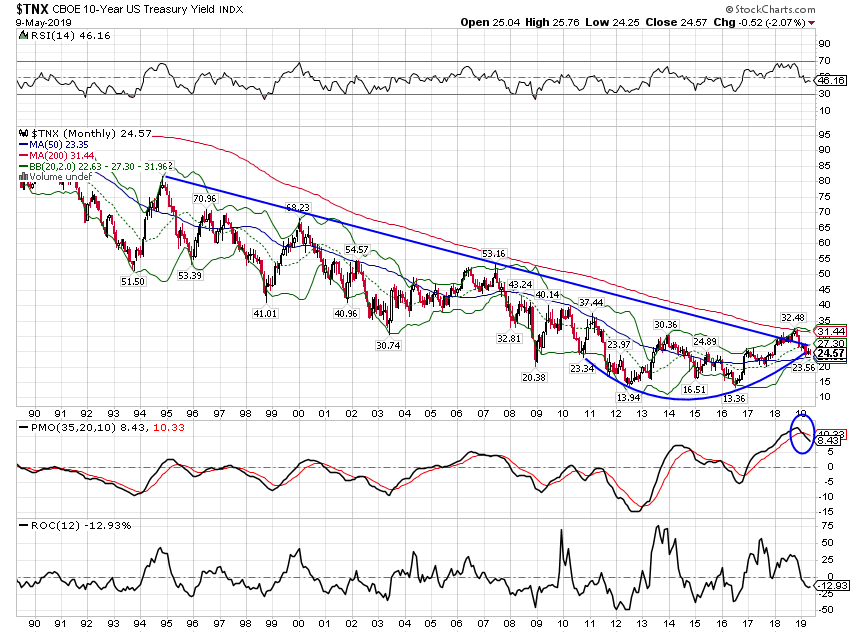

10-Year Treasury Note Yield

The 10 year yield is back flirting with the lows of March. Bond yields have certainly fallen but current rates are still well above the levels seen in the last slowdown in 2016 which was not, obviously, a recession.

It still seems more likely to me that rates have bottomed on a secular basis. I suspect inflation has as well but my reasons for believing that are, at this point anyway, more about narrative than anything concrete. From a Bloomberg cover recently which wondered if inflation was dead to the mainstreaming of MMT, complacency about inflation is rampant.

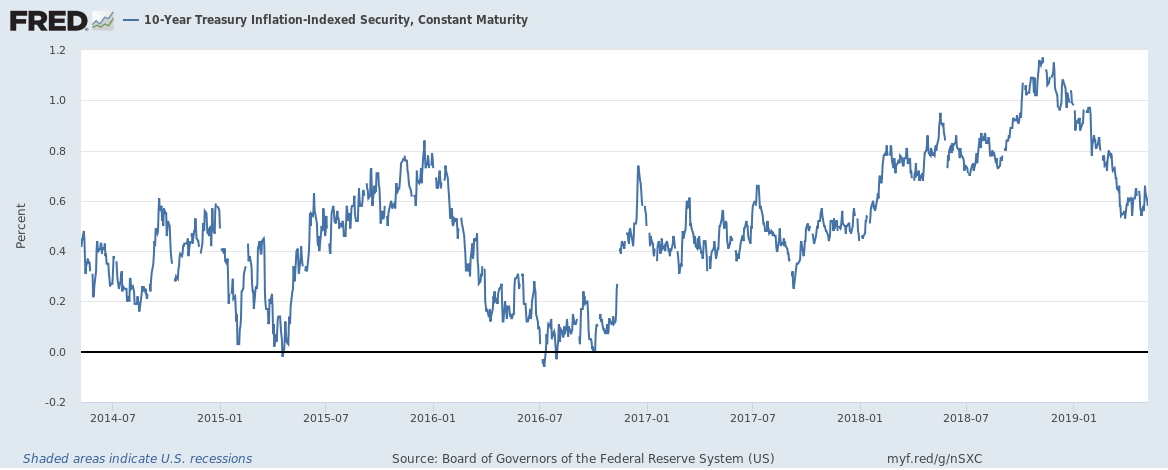

10-Year TIPS Yield

Growth expectations, as expressed by the TIPS market, appear fairly stable if also quite low. Real rates at 60 basis points surely doesn’t say much good about the US economy but it is a lot better than zero or negative where things stood just a couple of years ago.

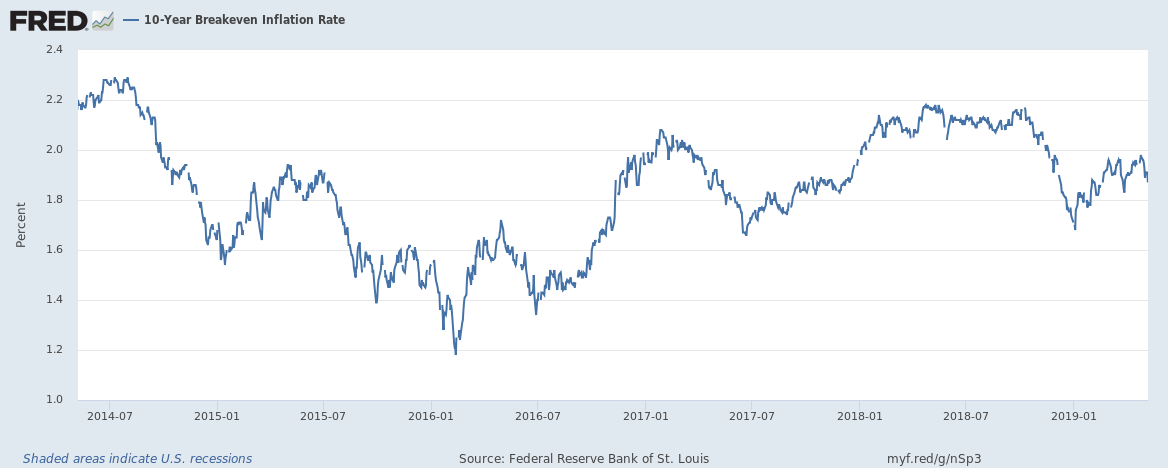

Inflation expectations – for now – are still pretty tame and recently falling a tad.

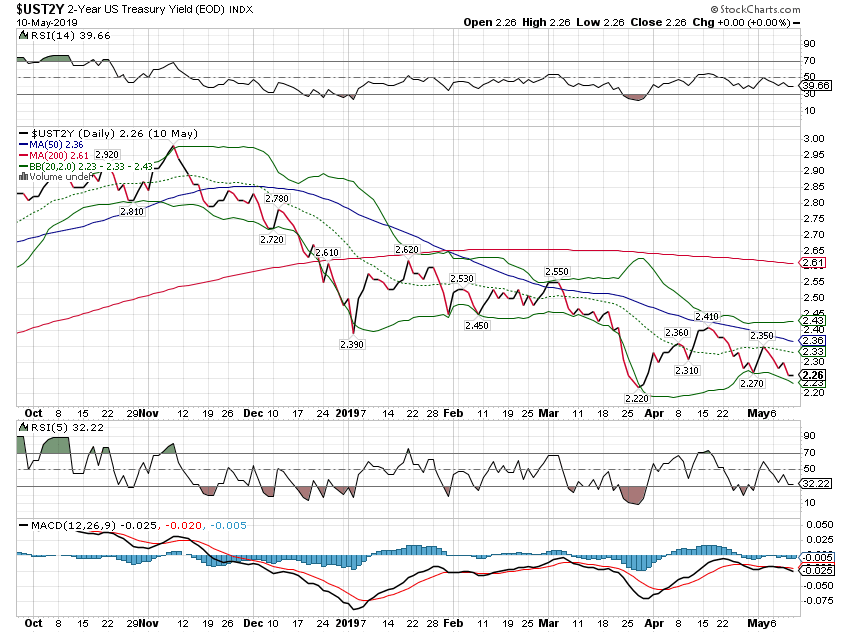

2-Year Treasury Yield

The 2 year yield has fallen at basically the same rate as the 10 year. Markets are pricing in a rising probability of a rate cut in the future but it is far from a certainty and there is little urgency.

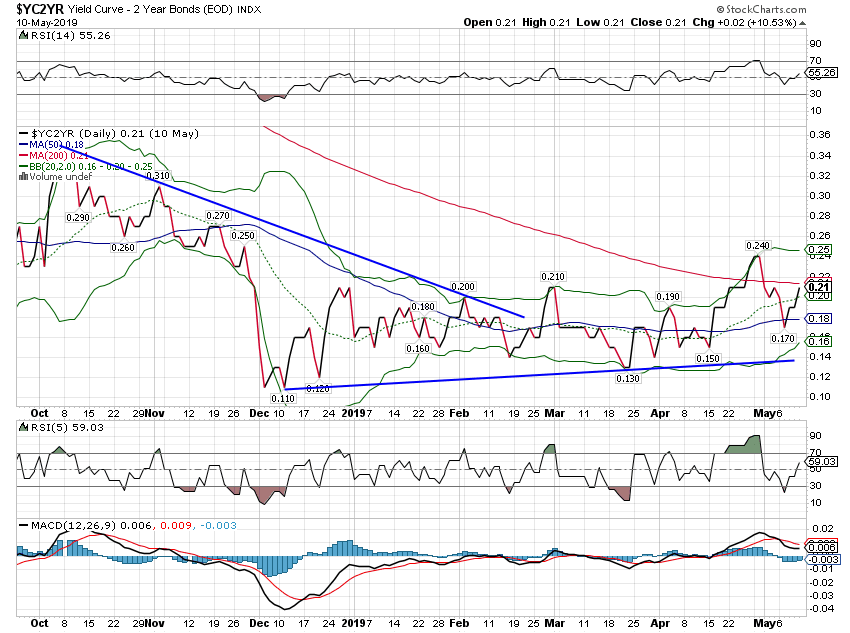

10/2 Yield Curve

The yield curve has steepened a few basis points since the last update but due to rising long rates not falling short rates. The magnitude of the change is so small that it really doesn’t mean anything.

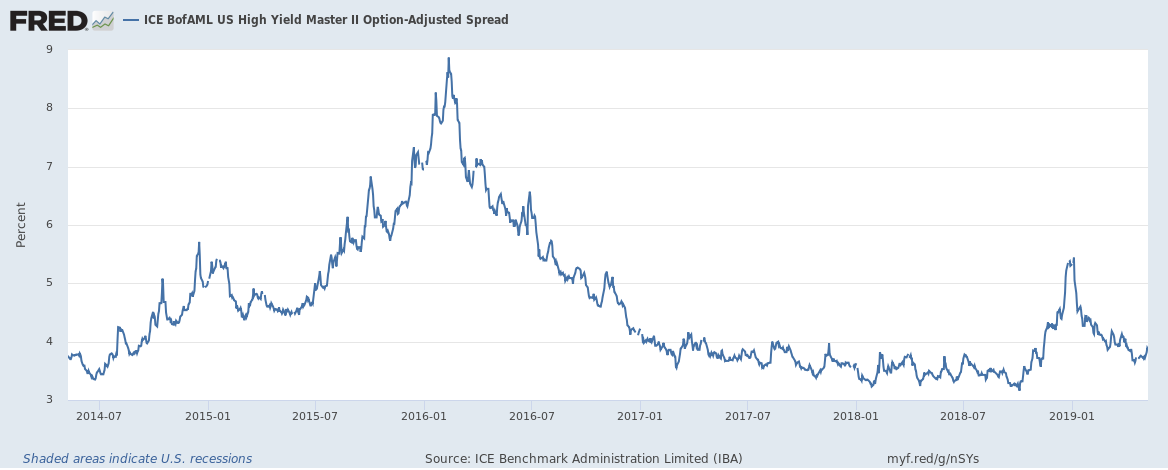

Credit Spreads

Credit spreads are actually narrower since late March but they did rise somewhat during last week’s market selloff. Still, the change here is very minor and indicative of nothing.

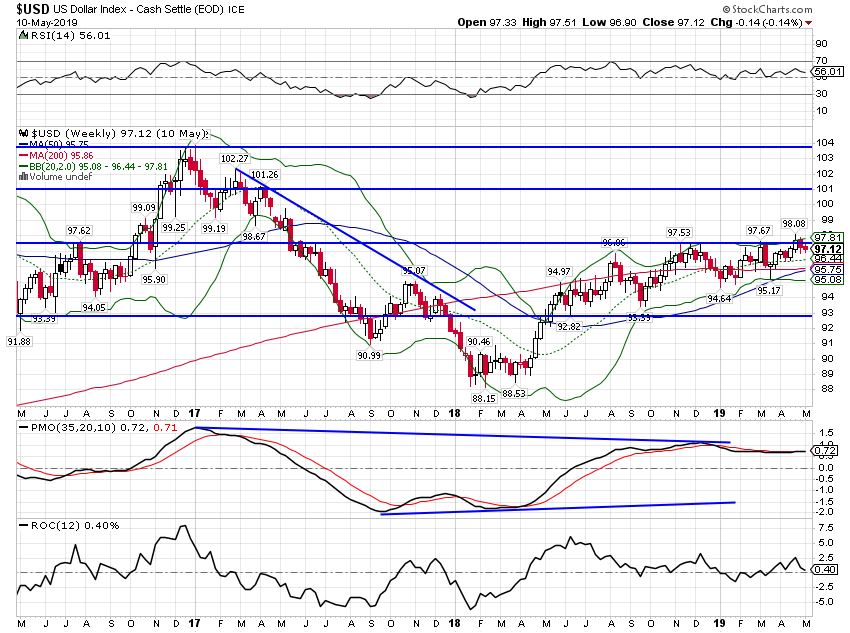

US Dollar

Why hasn’t the dollar rallied more? That’s a question I’ve been asking for months now and I still don’t have an answer. The tariffs on China should be dollar positive but the reaction has been very muted. In fact, currency volatility in general is quite low right now which seems strange considering all that is going on around the world.

Commodities

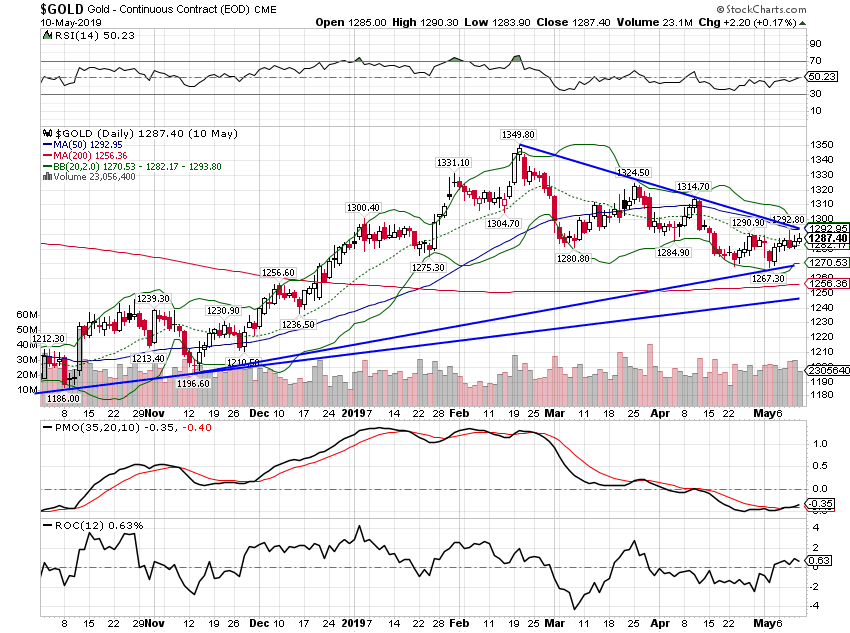

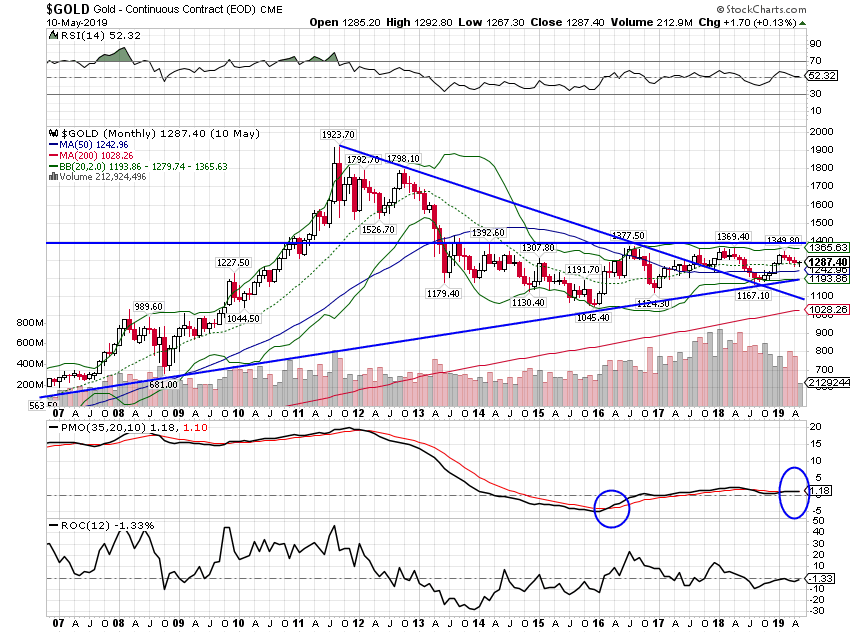

Gold backed off a little since the last update but is trying to turn higher with the trade tensions. Not much luck though so I guess not much fear.

Gold prices have been remarkably stable since 2013. Say what you will about monetary policy but if you value dollar stability this is it.

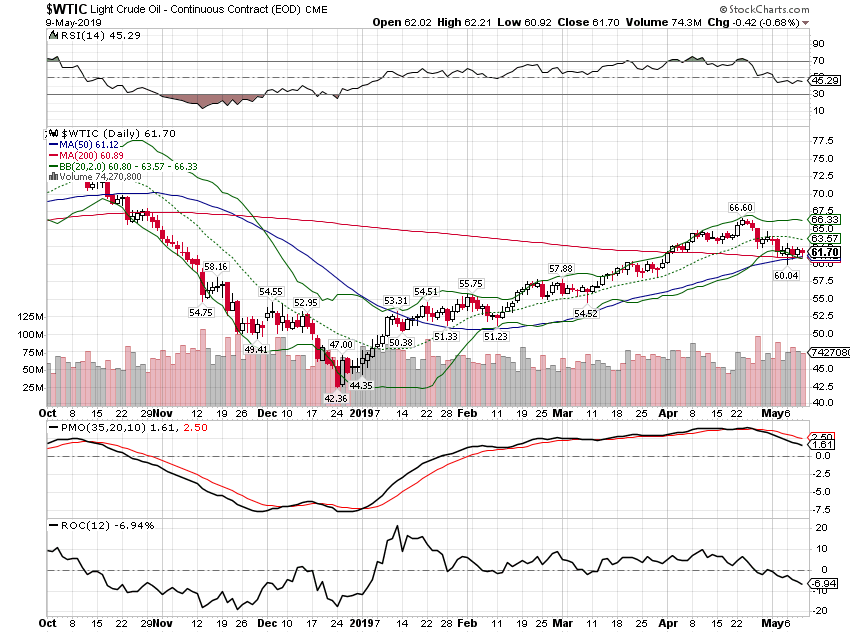

Crude has pulled back recently and momentum is waning. The selloff is modest though and oil is a lot higher on the year.

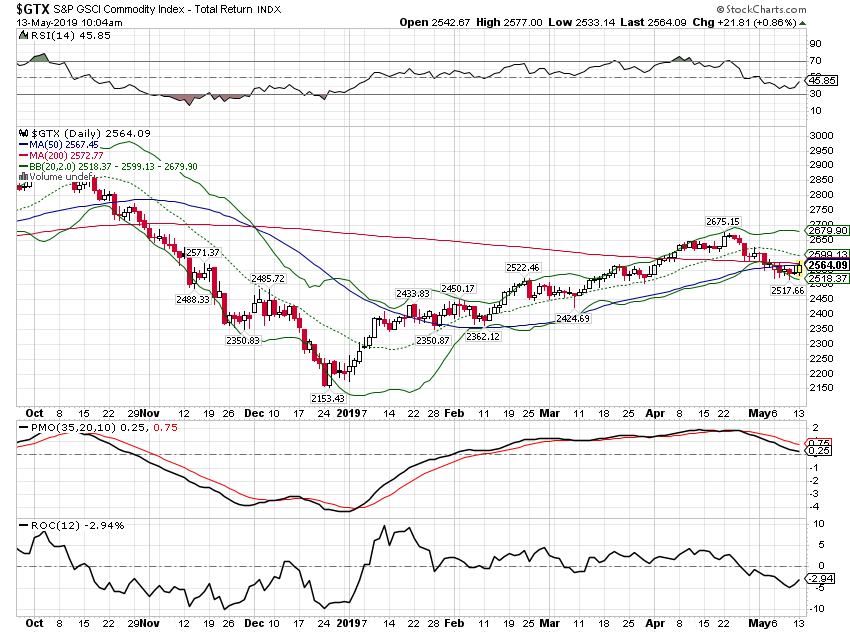

The GSCI is energy heavy and looks almost exactly like crude.

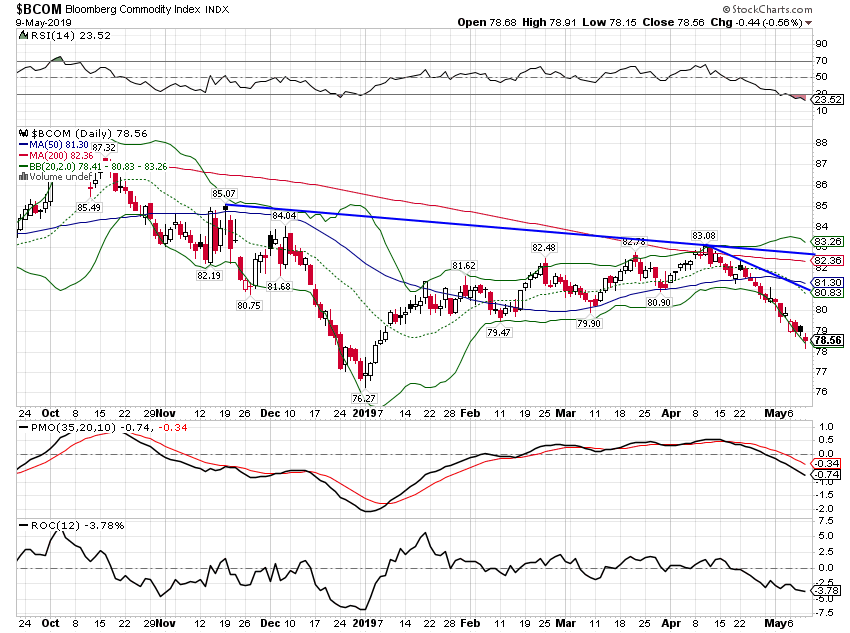

The Bloomberg commodity index is more diversified and is getting hurt by weakening agriculture prices. That is one area that has been hurt by the trade wars.

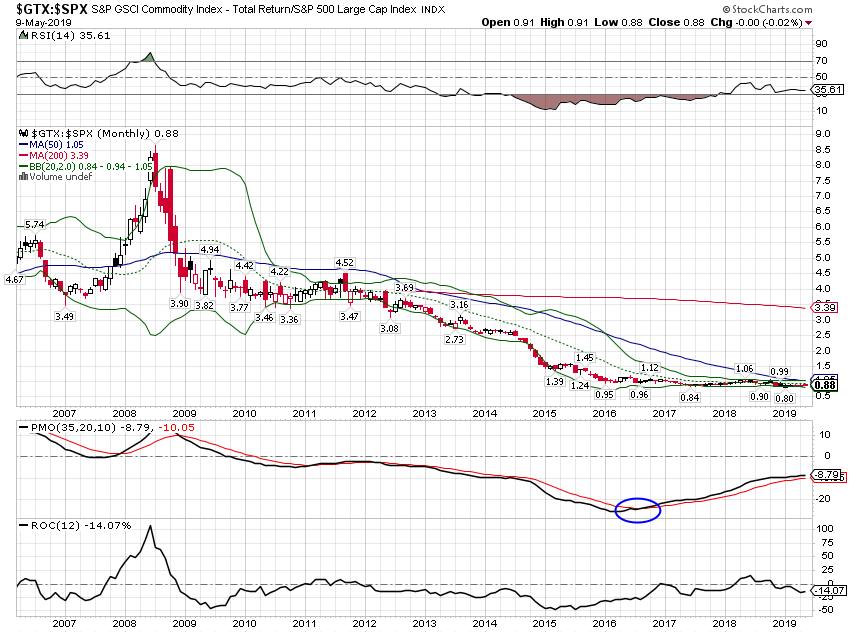

The fall of commodities relative to stocks ended quite some time ago although it is not widely acknowledged. Just another sign, in my opinion, that inflation is more of a worry than most people – including the Fed – think.

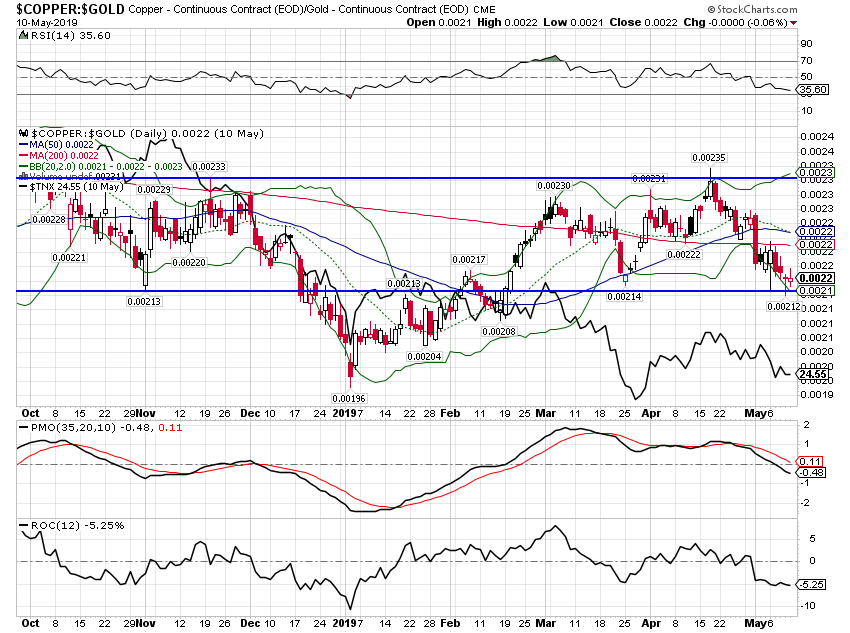

The copper/gold ratio is at about the same level now as late March. It did rally in the interim but has recently pulled back some. A gap has recently opened between this ratio and the 10 year yield. They don’t usually part company for very long so either this will fall or bond yields will rally fairly soon.

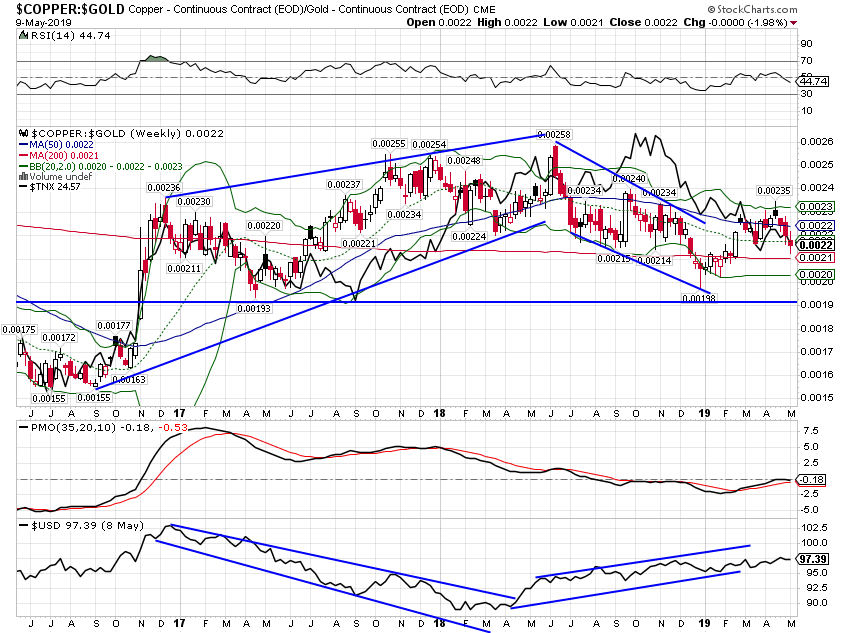

If the copper/gold ratio does rise, recent history shows this consistent with a weak dollar (see bottom panel). Most people would not associate higher nominal yields with currency weakness but there it is. Real yields tend to have a bigger impact on currency values.

The economy is slowing and the trend is toward slower still. But the rate of change has definitely slowed and neither the yield curve nor credit spreads point to imminent recession. The trade issues with China – and the rest of the world under the Trump administration – are not an immediate threat. Restrictions on trade are not a positive – far from it – but magnitude matters and so far the tiff with China is a tempest in a teapot. Will it stay contained? I don’t know but as I said above, bashing China is good politics if bad economic policy so I wouldn’t expect a deal soon.

I think most of the trade issues are fairly minor on the economics but there are feedback loops and unintended consequences – that may come in areas seemingly unrelated to trade – that make the ultimate impact impossible to predict. A world of less trade is more dangerous than one with more.

Stay In Touch