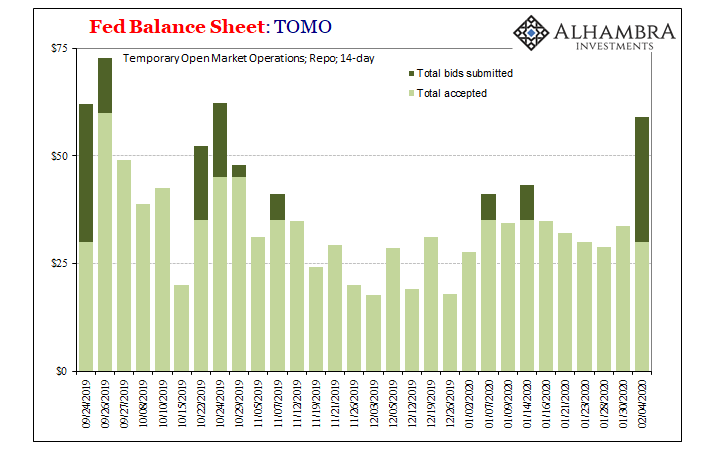

On January 14, FRBNY announced that it would continue offering its short-term liquidity operations for another month, until at least February 13. In setting the scene in order to slowly wean primary dealers from its non-repo repo program, the New York branch also declared that at its term repo window the cap would be reduced from $35 billion to $30 billion beginning with the auction scheduled for February 4 – yesterday.

It was surely a shock to authorities, then, when dealers showed up and bid for just about $60 billion – nearly twice the new limit – when the 14-day auction had been completed. Along with persisting overnight demand, you can begin to see why Jay Powell now thinks (hopes) that maybe by April they’ll be able to scale back.

As with September, competing theories are being advanced about what surely must’ve been yet another benign technical reason (rate spreads) for the high oversubscription.

Some people want to make this into a warning sign of imminent financial disaster, others small plumbing matters which should concern only the four or five people who pay regular attention to repo. Reality finds itself, as usual, somewhere in between.

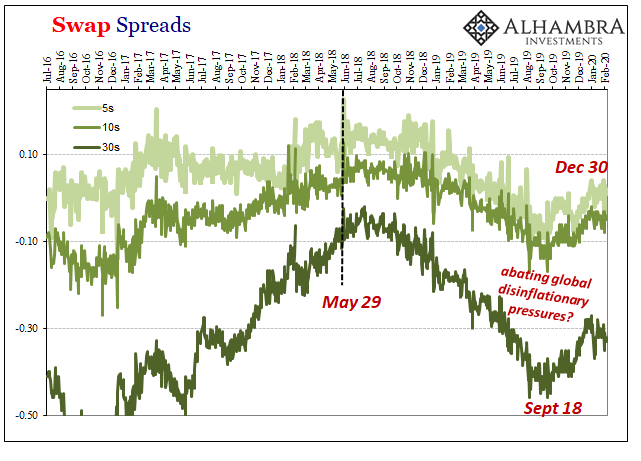

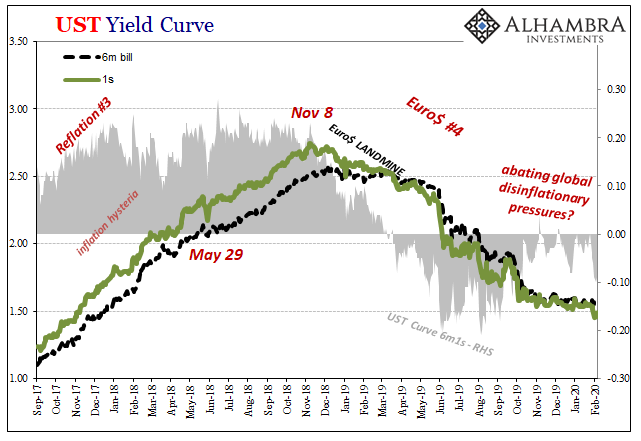

The high level of repo bids especially for term don’t suggest a crash is hiding around the corner; after all, we all survived September’s much larger and more sustained repo rumble quite well. Decently well, anyway, since it did represent an outgrowth of those global disinflationary pressures pressuring the global economy.

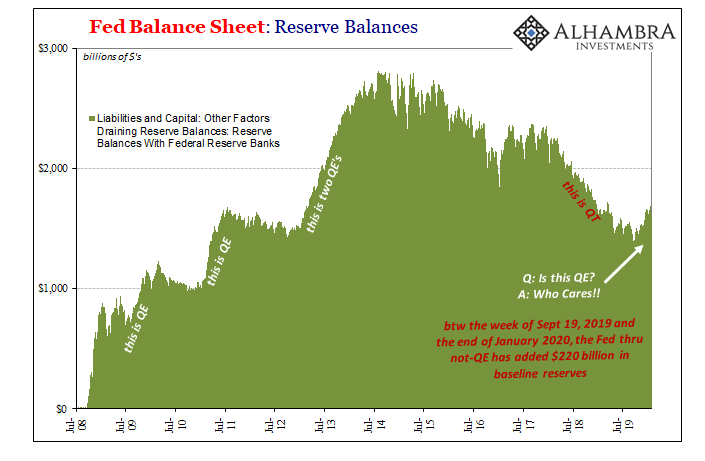

What’s indicated here is two things: the first is the plumbing. There remains something wrong in it, even after all the busyness of the Federal Reserve since September. A couple hundred billion more in baseline reserves, too. What that something might be continues to be a matter for speculation, itself a clue.

And because no one can say what’s really going on in the shadows the Fed just isn’t able to get a handle on its own parameters, including these repo operations. That’s the other thing, an important factor, as well. As noted at the beginning, the Fed had been expecting demand for “repo” “liquidity” would be visibly less by now, authorities clearly had been anticipating as much for a much quieter February. Thus, the drop in the term cap to $30 billion which was surely intended to be just the first.

With yesterday’s result, however, what is clear instead is that officials don’t have a very good sense of how and where things stand, let alone where their own efforts might come into it. The repo problem is still a problem despite four now almost five months of constant effort.

That’s a problem not because this suggests the world will crash tomorrow, rather because it indicates this part of the global disinflationary pressure and economic headwind is quite stubborn indeed. Not abating, you might say. Perhaps a squeeze that won’t stop squeezing.

As to what it might really be, you can read my own take on it here. Not so much repo, this is just one facet of a much larger and unresolved scarcity.

Stay In Touch