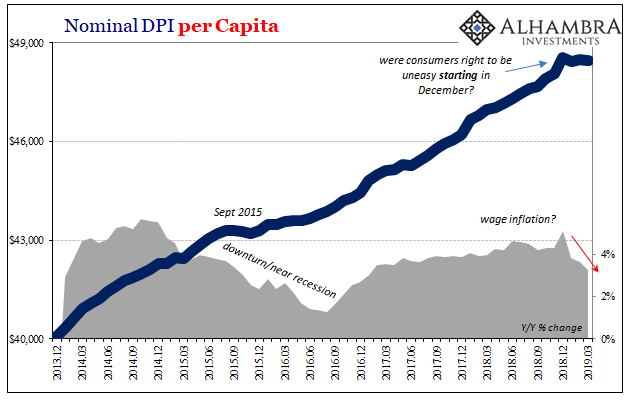

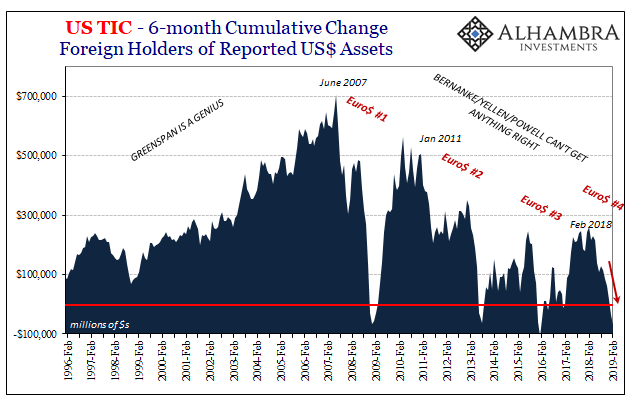

Ever since the first major outbreaks of Euro$ #4 last year, the balance of data has tipped further and further toward the minuses. Yesterday was a big one. US income growth in 2019 is no longer growth. Not huge declines, but minus signs where, if the prior boom narrative had been valid, large plus signs should rule unchallenged.

The business cycle used to be relatively easy and intuitive. A recession shows up, the economy quickly, violently plunges, and then just as fast back to normal. The whole thing wrapped up in a year, maybe a year and a half for the nastier ones. It isn’t fun, but everyone knows the score.

What we’ve witnessed since Euro$ #1, what people still call the Great “Recession”, is an elongation of not business but these monetary cycles and what they do to the global economy. There had always been a transition period before, these today are now almost phases unto themselves. Extended periods of economic gray.

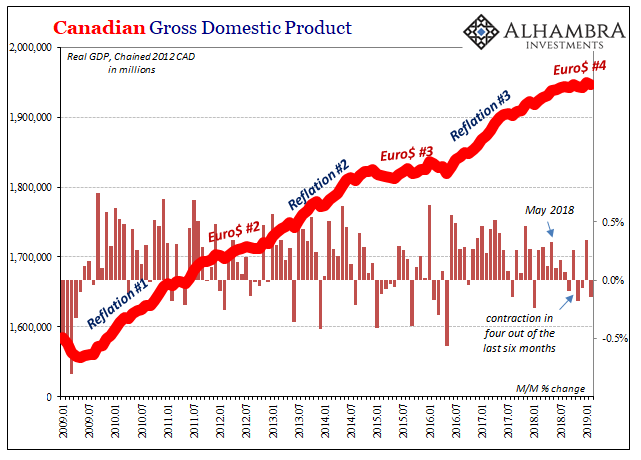

Canada provides us with another good example. Today, that country’s government reports GDP in February 2019 was just slightly less than it was in January. According to StatCan, real output declined 0.1%. By itself, no big deal. Certainly not outright recession.

The rate was +0.3% growth in GDP during January. But there were also minus signs in three of the prior four months. February makes four negatives out of the last six. Definitely not boom, maybe not recession though perhaps an elongated transition toward one. Very much gray.

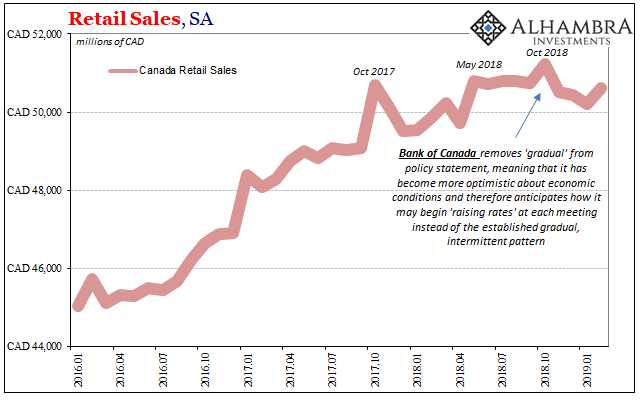

It’s not just GDP, either. Canadian retail sales are sharply lower but still positive. There’s very clear weakness to Canada’s economy, so much so that it’s made its way into Ottawa’s considerations. After upgrading its forecasts last October, the Bank of Canada last week put all “rate hikes” on hold. Central bankers are always the last to figure things out.

Canada is a bellwether and not just for oil and gas. Last year’s collapse in oil prices didn’t help, of course, but that’s not what recent weakness has been. Regarding today’s GDP report, one economist at CIBC Capital Markets admits:

The surprise versus consensus showed up partially in mining, oil & gas, but after looking at the details that appears to have had nothing to do with oil production cuts. It was actually a broad-based decline in mining and quarrying attributed to weaker international demand that drove that sector.

“Weaker international demand.” Global growth. Global currency.

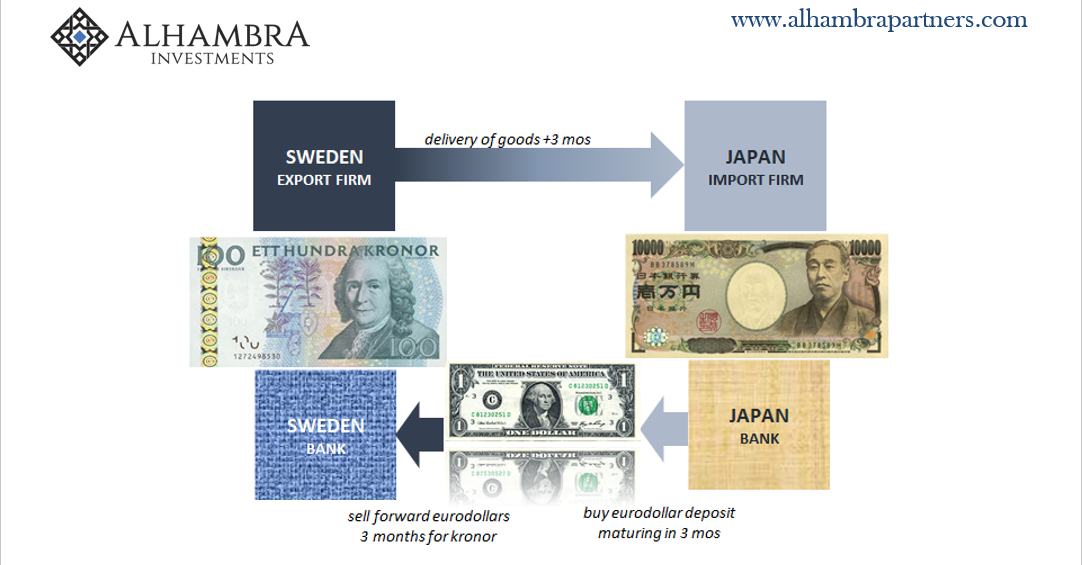

The way in which a reserve currency works is misunderstood if it is ever considered at all. Occasionally you hear reference to a petrodollar, as if that was an actual case. A global reserve currency plays a vital role in economic growth. A globalized economy could never have become this way without it.

And without it functioning properly, what follows is very much like a tightened noose. It squeezes, slowly, depriving the system of its very necessary oxygen. Second and third order (negative) effects show up before anyone realizes what’s happening. The small minus signs reappear while officials are still trying figure how to stay the course.

A reserve is simply one that is common enough everywhere, so much that it makes global trade second nature. Trade can still happen without this currency situated in the middle, but it’s not nearly so fluid, easy, and consistent with globalization-based growth.

A reserve currency is an intermediator, more than a buffer between national systems often with very little in common. Starting with currency denomination and monetary terms. The example I often use is an export firm in Sweden obtaining goods in that country to be shipped to Japan for final use. The trade can certainly happen without a global reserve, but not efficiently.

The Japanese importer somehow has to find kronor and then send it to Sweden for payment. Otherwise, the Swedish exporter has to accept yen and then find something to do with it while the funds are now trapped far away from their home. These are not likely to be successful scenarios.

The firms can appeal to help from each’s local banking networks, though here, too, there are serious drawbacks. The Japanese bank must find and maintain a stockpile of kronor made available to Japanese importers. Alternately, Swedish banks must be capable of regularly and efficiently disposing of yen. These are not likely successful scenarios, either.

The lack of a middle currency doesn’t kill the global economy outright, it is slowly strangled by more difficult even impossible trade terms. And then the second and third order effects, reduced trade leading to reduced localized activity, that’s where even central bankers begin to notice.

By then, it’s already too late. What’s done is done. That’s why these processes once they start one way or the other, they tend to keep going for long periods; several years each way.

On the other end of America’s income downturn and Canada’s sideways GDP is China’s multi-faceted sorrow. The Chinese are squeezed in more ways than the one. Not only do they have to contend with a sustained squeeze on “global demand”, they have the internal problem of their own RMB monetary pyramid backed by eurodollars in the first place.

It is, as I noted last year, a double whammy. The noose tightens twice as harshly there as a result. Whereas North America is seeing signs of obvious weakness but not yet anything more severe, thoughts on China are, like early 2016, back to wondering about hard landings already.

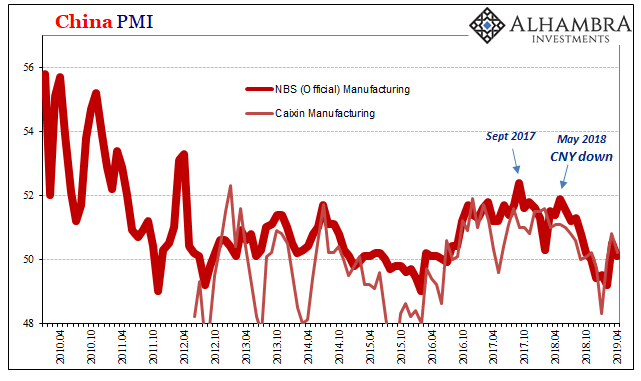

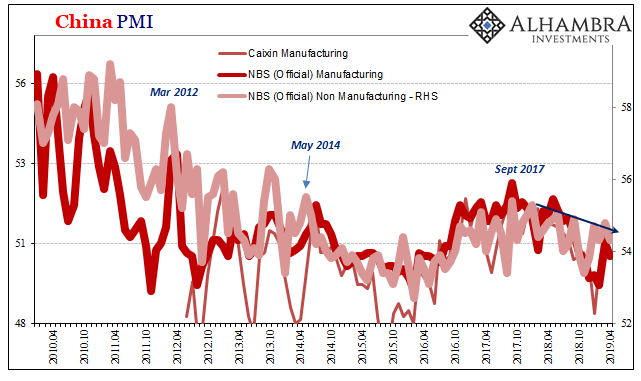

After rebounding sharply in March, China’s National Bureau of Statistics reports that in April its official manufacturing sector Purchasing Managers Index (PMI) fell back to just about the contraction point. At 50.1 this month, it has renewed fears that what were called Chinese green shoots were instead another head fake.

The Caixin manufacturing PMI registered the same up and now down pattern over the same months, amplifying those fears. The NBS Non-Manufacturing PMI continues its slower, less noticeable rate of descent. Coming in at 54.3 in April 2019, the lower trend continues.

Without eurodollar support, the noose will tighten, the world’s system strangled which, deprived of necessary oxygen, only leads to a proliferation of weakness, then minuses. You and I don’t need the eurodollar. Economic growth does.

Stay In Touch