This is basically a rhetorical question drawn from a generally rhetorical exercise. We’ll never know for sure, this is about China, after all. Transparency is a Western obsession and a curse for the committed Communists. Particularly when the Party of “Science” starts to lose control of the situation when such a possibility has been treated as pure blasphemy.

Did the Chinese purposefully withhold import buys in 2015?

Again, no need to offer an answer when the whole array of data does so for you. Of course authorities curtailed imports of materials! Why wouldn’t they? If there is any real question, it’s only when trying to figure by how much.

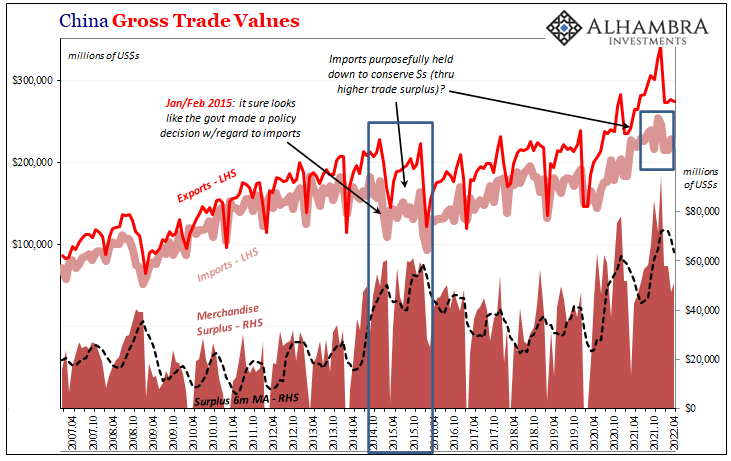

Faced with a ravaging, worsening (euro)dollar problem in 2014 even the deployment of hundreds of billions in so-called foreign reserves couldn’t satiate, either to stem the “outflows” or to rescue CNY’s plunge, it would only make sense to pull back on imports relative to exports to conserve “dollars.” Fewer imports mean fewer “dollars” leaving Chinese pockets at a time when having “dollars” had become the main issue.

Yes, commodity prices had fallen and imports were certainly declining of their own economics; meaning, China’s economy was itself falling apart, leaving lower demand for imported resources.

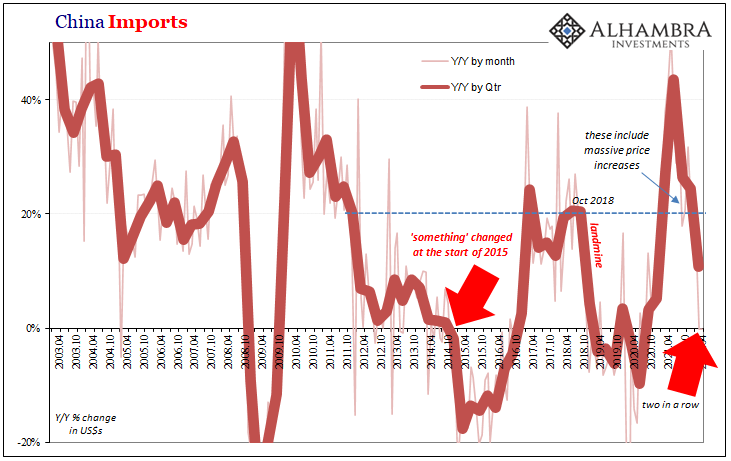

Still, after factoring those decisively negative factors, what’s stands out is how Chinese imports really fell apart and more so when – the exact beginning of 2015, which is how China’s Communist masters make decisions most times.

Imports had been decelerating yet still barely positive throughout 2014. Then, bam, right from the outset of 2015 (above) it was as if someone had flipped a switch. After it, China-tanic struck the iceberg. Which one? The eurodollar iceberg forced into the path of policymakers because of their growing and unrestrainable dollar shortage problem.

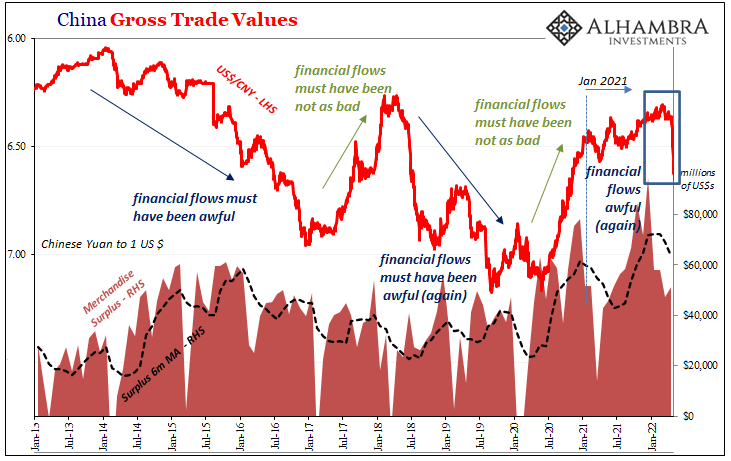

The evidence is about as conclusive as it can get given the target of our examination, particularly when you add CNY’s behavior to our (still largely rhetorical) review.

Late last night, early morning Beijing time, China’s General Administration of Customs reported that Chinese imports were essentially flat year-over-year (both the smallest minus) for the second month in a row. Given prices, that must mean actual volumes are decidedly in the negative. China’s economy is weak and getting worse as it was seven years ago, and that’s still a factor.

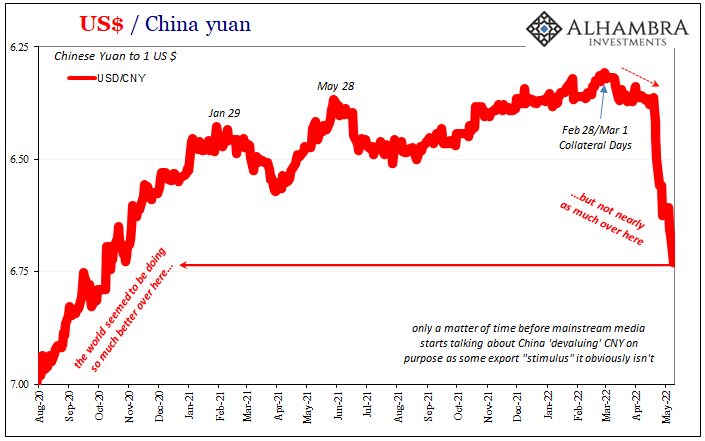

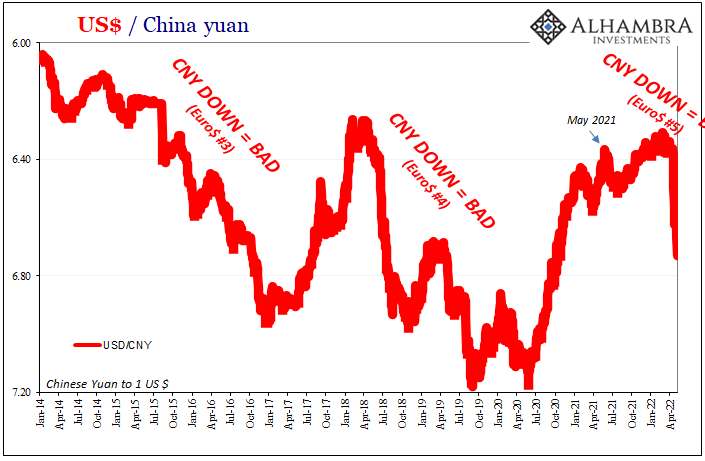

But, as you’ve probably heard, CNY has pretty much crashed over the past couple of weeks. Some will say “devaluation”, others might claim the Fed and interest rates (differentials). Both are absolutely wrong.

Beginning at the end of February, the Chinese currency finally joined Euro$ #5, a late entry almost certainly due to the country’s huge, historic trade surplus from throughout 2021 which for China appears to have somewhat cushioned the local effects of this growing global monetary disease.

In March, “something” finally broke – which we could see all over the monetary data and indications. Repo, collateral, curves, etc. Now CNY has clearly been sucked into the still-growing vortex of Euro$ #5. Despite Mao’s Xi’s reassurance, the yuan continues to plummet, puking to another multi-year low of 6.73 just today.

Two straight months of zero import growth (and only 3.75% year-over-year exports in April) will be blamed on the Chinese government’s pursuit of a zero-coronavirus outcome. Shuttering port facilities like entire cities isn’t going to help trade (though ports like manufacturers have been granted special concessions), for sure, though for all these reappearing factors and outcomes it’s fair to question whether there’s more going on particularly with CNY abruptly tanking (unlike last summer when delta corona showed up).

“Something” big has changed.

And if China is rerunning the 2015 save-dollars-by-cutting-back-imports playbook, the real economy effect will be, just like in 2015 (and 2018, to a smaller extent), to transmit the contagion of Euro$ #5 throughout the rest of the world’s monetary and financial system right into the real economy as other parts of the world suffer from the curtailing of Chinese purchases everyone further down the chain sorely needs.

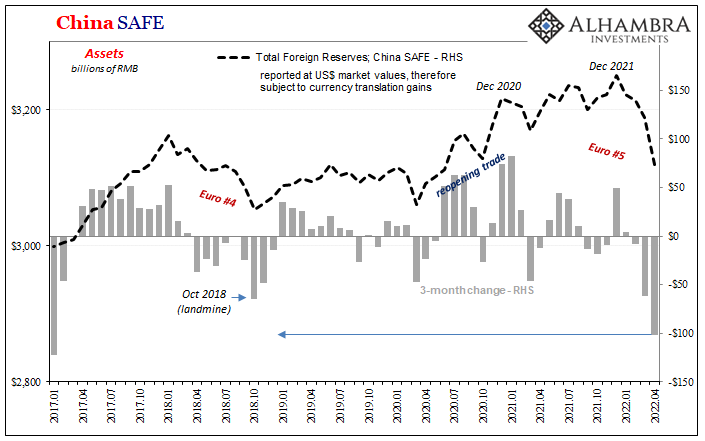

To put one final fine point on this exercise, China’s State Administration of Foreign Exchange, or SAFE, also reported over the weekend that the country’s official total holdings of, you guessed it, foreign exchange fell sharply during April, too.

Dropping by $68.3 billion last month alone, the largest single-month decline since…2016. China’s foreign exchange balance has been declining all year thus far, well beyond typical seasonality. On a rolling 3-month basis (below), February through April also represented the biggest decrease in five and a half years.

As I just wrote, it is getting serious. Don’t call them “outflows”, however, nor is this simply the market value of reserve instruments falling as yields worldwide have risen (most are ultra-short term).

Imports suddenly stop. CNY begins to crash. SAFE reports rapidly falling foreign reserves.

We’ve seen all these things before. Twice: 2015 & 2018. The mainstream will do everything it can to try to come up with other explanations, each one sounding more benign yet increasingly absurd, desperate, and, in the end, unable to explain all the facts.

Meanwhile, Jay Powell’s rate hike path is about to get mugged by a very different reality from the out-of-control inflation due to a red-hot economy allegedly requiring the FOMC’s interventions. While it may be easy to dismiss China’s issues here as those of pure China, nothing for Americans to worry about, including Xi’s power demonstrations, as everyone should have learned during those prior episodes there is no decoupling.

Even if there ever could be in the real economy, there won’t be once the eurodollar gets involved.

The global dollar shortage of Euro$ #5 has finally seized China in its viselike grip, and the Chinese are almost certainly acknowledging it by their actions (and some inactions).

It’s the simplest “equation” in all the economy and markets. CNY DOWN = BAD. Not because of CNY, nor China, really, but because of what CNY and China have to do when the Euro$ gets its next number.

Stay In Touch