There is one additional important point to note in all this repo uproar. Why did the Fed conduct the overnight repo operation this morning? The answer isn’t what you might think.

It sounds like officials particularly at the Open Market Desk sounded the alarm about repo and the FOMC forcefully responded. And if you think that, policymakers would be beyond thrilled because that’s just what they want you to think. Expectations-based policy demands that you believe in a competent central bank overlord watching every little detail closely.

And it could not be farther from the truth. Well, it could be farther from the truth; 2019 isn’t over yet.

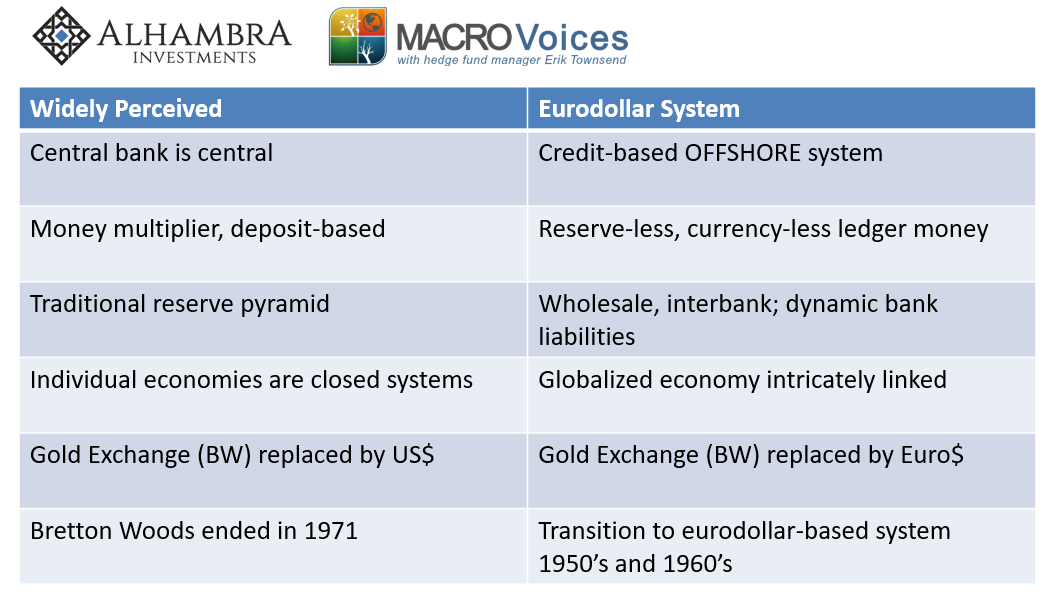

Even in this day and age, having gone through 2008, the Federal Reserve still conducts its monetary policy via federal funds. Fed funds is nothing; an afterthought. But because officials were concerned about changing to another rate, in 2014 when planning for their “exit” from crisis measures they really worried you and I are too stupid to understand their intentions if they used something other than fed funds, they kept the same relative framework. The whole thing runs on EFF even though EFF doesn’t by itself matter.

Adding, of course, IOER and the RRP to the apparatus. But by and large, monetary policy is all about fed funds – not repo.

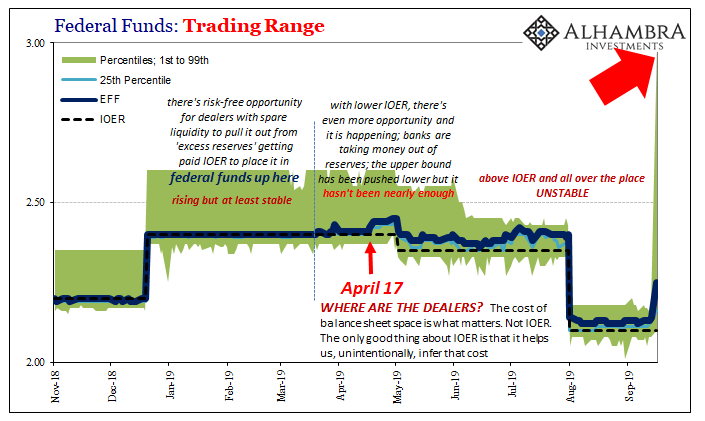

What that means is yesterday’s closing EFF rate, exactly 2.25%, was right at the upper bound of the target range. That’s the only thing policymakers care about here. The whole disaster unfolding in repo, it’s only a policy matter when it spills over into fed funds.

This is, of course, entirely backward.

So, the only reason they did the overnight repo operation today was because yesterday’s skyrocketing fed funds range left the nontrivial chance that today’s EFF could be, and likely will be, outside the policy range today. Yep, the only reason the FOMC acted was because EFF was already 2.25% yesterday with many of those transactions compiled before the real repo chaos got started.

With more disorder, because that’s exactly how trading in repo has been, disorderly, FRBNY was directed to act in repo so as to (try to) keep EFF from breaking the policy rule. It’s nothing about fixing what might be wrong in repo, it is instead entirely about making sure EFF behaves itself regardless of what’s really behind what’s happening in repo.

We won’t know where EFF landed today until 9am tomorrow when FRBNY compiles and publishes the full data. If it is above, there’s a good chance of another overnight repo operation tomorrow. I can only imagine Jay Powell’s confused consternation; all this just in time for his press conference where he wants to talk about how everything’s just fine.

It’s not at all the same thinking the Fed is watching all the details and can act on a moment’s notice and then realizing they are constrained in so many different ways, only beginning with intellectual capacity. I mean, how many more times are they going to downplay and dismiss these problems? I gets harder to do so when you are forced into emergency “liquidity” actions with a total take-up greater than the first two emergency TAF auctions almost twelve years ago.

And even when they do “see it”, if it doesn’t impact fed funds then there is very little they can or will do; meaning they can’t even put on the puppet show of having the public think they are doing things. They’re effectively on the sidelines anyway, but if the repo rate jumps back to 10% tomorrow with little spillover into fed funds, the Fed can’t even appear to be acting.

The real problem was only somewhat identified all the way back in 2011:

CHAIRMAN BERNANKE. I think a point that was somewhat underemphasized is that our transmission of monetary policy is an issue here as well. So to take an example, doing repos to keep the RP rate from uncoupling from the federal funds rate, arguably there are issues there relating to transmission.

Again, backward. What I mean by that is policymakers see bank reserves as “base money.” Therefore, if they add base money it should show up in federal funds as a rate which behaves according to policy. That should then spillover into other funding markets such as repo. Therefore, by making fed funds behave with additional reserves it is supposed to make repo behave, too.

That was the theory. Abundant reserves.

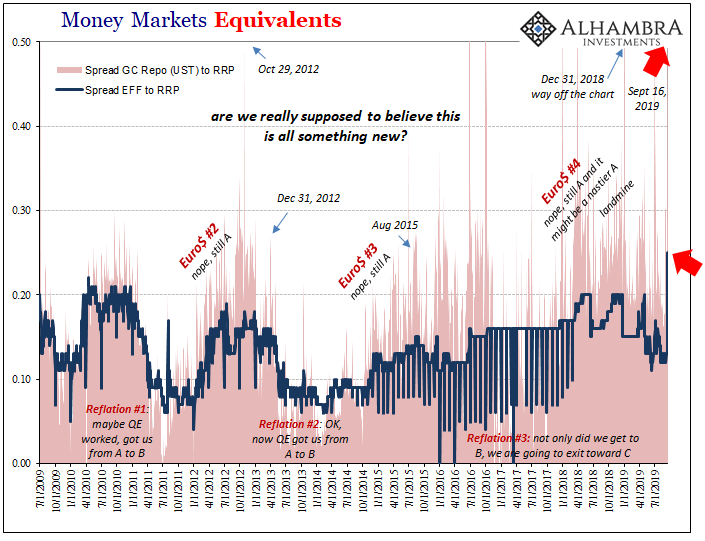

Instead, what showed up in 2010 (forcing Bernanke into a second QE to add even more reserves) and again in 2011 was the repo rate behaving independently of fed funds. Something wasn’t right with the “transmission” between the one and the other. Even though fed funds moved a round a little, it was the repo rate uncoupling which signaled big problems (which you can see above beginning in early 2012).

But now in 2019 we have an even bigger problem. It is the repo rate which is in control rather than the other way around. As repo gets crazy, it is making fed funds crazy, too. The one which is supposed to be influenced is doing the influencing.

And the central bank can and will only react if that influence is sufficient to break its own rules which were designed looking at everything backward.

So, the mainstream media will focus on “technical factors” that everyone and their mother knows is on the calendar especially each and every September (Lehman ring any bells?) and practically no one will ask, why this time? What has changed in 2019 that is making repo go insane and spillover into fed funds?

The only answer we’ve been given is, ironically, UST’s. This one guy at Credit Suisse keeps saying that primary dealers are being stuck holding treasuries they are forced by law to buy at auction, funding them in repo, and that combined with “technical factors” is how yesterday and today resulted. Dealers, whose entire job is to find buyers for these assets, we are supposed to believe cannot find any among a public which overwhelmingly wants to buy UST’s at nearly any price (thus, the yield distortions along the UST curve).

Including bills.

Everything is backward, explaining much about the current trajectory (heading no place good). That includes an overnight repo operation that has less to do with repo than you are meant to think. The overriding problem, where it all goes wrong, is incredibly simple but intuitively a very difficult hurdle to overcome. Some people will never accept it no matter how much evidence continues to pile up.

Central banks are not central.

Stay In Touch