The biggest thing about September’s repo rumble wasn’t the double-digit GC rate(s), it was the timing. Beginning on the Monday the day before the FOMC’s regular policy meeting, Jay Powell couldn’t accomplish what he had set out to. The Fed’s Chairman wanted what was the second rate cut in the series to be a more placid one. A confirmation, of sorts, about how these were all no big deal.

Instead, because of turmoil in repo, everything had spilled over into federal funds. And that meant the Fed had to respond; federal funds, by the FOMC’s choice, remains to this day both a relatively unimportant money market as well as policymaker’s preferred lever for (conveying) monetary policy.

More than that, though, repo meant for the first time since 2008 that repo was being mentioned in mainstream financial conversations. The public at large mostly unaware of what goes on in money started to notice and for all the wrong reasons. What should have been another reassuring rate cut was instead stomped all over by a monetary system seemingly gone haywire.

Not only did it bring about unwelcome notice, for the first time in memory this event unleashed broad criticism. Beyond the usual dissatisfaction, even reliably friendly and compliant mainstream outlets expressed shock at how lackadaisical and unprepared the central bankers seemed to have been.

Pressured to respond, Powell’s gang has been busy. Overnight repo ops, term repo ops, and a small-scale asset purchase plan that everyone is calling QE over the heated objections of officials buying the assets. A whole lot of…something.

Has it helped the repo market, though? Not really. But that wasn’t necessarily the intended primary goal. Expectations policy, not money. For a time, in October and November, the public went back to sleep. Repo, a hot topic for a few weeks, fell off the front pages as those more interested in these things began to debate QE or not-QE exclusively in the context outside of repo considerations.

Mission accomplished. Transitory success, anyway.

It is now December, nearly three months past the original date, and the world is talking about repo again. We’ve got technical quarter-end issues like September, and the asking for term funding into year-end is getting ridiculous. Whatever was wrong back then appears to be still wrong now.

How can that be, you ask? The Fed whatever it wants to call this program is raising the level of bank reserves again, “printing money” as everyone is left to imagine this.

The real problem is that no one really knows even now what’s truly going on. And that goes for all the so-called experts.

First, inundated with questions about the BIS taking on the issue recently and now another one from Credit Suisse. Zoltan Pozsar has chimed in (h/t Zerohedge), too, as he has done quite often over the last several months.

Except, you won’t know it but he has been forced to rewrite his whole story. What he says now is:

“…dealers and banks loaded up on collateral as a trade – a trade they were supposed to be taken out of by eventual coupon purchases by the Fed.”

That’s not what he’s been saying, however. Before recently, Pozsar as many others had been absolutely certain that the problems in repo were related to the budget deficits; that the federal government’s tax reform led to too big of a fiscal shortfal which forced dealer banks to absorb it at bill, note, and bond auctions. Because he said it, the idea of “too many Treasuries” gained wide acceptance, repeated often especially in the context of repo and fed funds.

And it was always a ridiculous position – even in 2018 when UST’s were actually selling off. But they didn’t sell off that much, which had the effect of collapsing the curve. A warning about liquidity that people like Pozsar ignored in search of validating “interest rates have nowhere to go but up.”

Coming up with the “too many Treasuries” excuse was a way to hold on to that idea while attempting to reconcile it with 2019 “unexpectedly” going in a very different direction.

That different direction, lower not higher interest rates, also posed another big problem. The facts have totally, completely, comprehensively undercut their entire theory. Every UST price told you that dealers, if they chose to, could have easily sold what they were holding in inventory.

As I wrote in early August, weeks before the repo fiasco in September, the “too many Treasuries” story didn’t hold up to the smallest scrutiny:

I guess we aren’t supposed to notice that the rest of the world has been buying UST’s at a furious pace. How else did the yield curve invert in the first place? Sure, the money market fund and other nonbanks like it may have preferred commercial paper or even unsecured LIBOR to a very low UST yield, but someone is buying to push every UST yield lower to begin with.

Not just someone, but a whole ton of someones. To believe in this convoluted theory, you are asked to believe that primary dealers whose entire job is to find buyers for Treasuries are disrupting repo markets and other funding mechanisms because they can’t find enough buyers for Treasuries during a time when there is otherwise so much demand for Treasuries it has upended the natural order of curves everywhere.

The market said quite the opposite, that there were too few and that they were increasingly more valuable because of it.

Now Mr. Pozsar has had to reform his thoughts. In light of the overwhelming evidence, he finally comes around to seeing how dealers weren’t, as he said for over a year, being forced into a position they didn’t want. No, they really had chosen to hold that many bonds all along.

But, as is usual in these cases, he stops well short of coming up with a reasonable explanation for why they are choosing. Mr. Pozsar today surmises the conspiracy. Dealer banks must be trying to front-run the Fed. Yeah, that’s it.

They bought bonds all throughout 2018 thinking about how by the end of 2019 Jay Powell would be forced to buy the instruments from them at an absurd premium? Huh?

Why go through all that trouble? Again, as before, why not just sell the bonds to the more reliable and predictable (curves don’t move fast) financial public that clearly wants to pay a premium for them? If their goal is a trade profit, as he now suggests, then profit on the trade that’s already right in front of you. No need to wait for the Fed buying, go right at the public buying.

But dealers haven’t, and aren’t, doing that. So, in the absence of getting this right we will now hear about how it’s because they must be waiting for the next QE – and whether this current monetary thing is it, or just the beginning of it.

Poppycock. What these guys are all missing is always the same thing: collateral. Pozsar even talks about it in that way (dealers loading up on collateral), but clearly doesn’t appreciate the implications. Like the BIS, none of them seem able to understand the importance of it, as I wrote on Monday:

If these banks were “hitherto a net provider of collateral” but no longer are, and remember, this was around the end of 2017 not the middle of 2018, are we really just supposed to leave it at that? After all, if a very important source of available collateral (securities lending) suddenly becomes unavailable, that sounds like a more immediate point of real weakness than a dismissible non-factor that only showed up in September 2019 by technical accident.

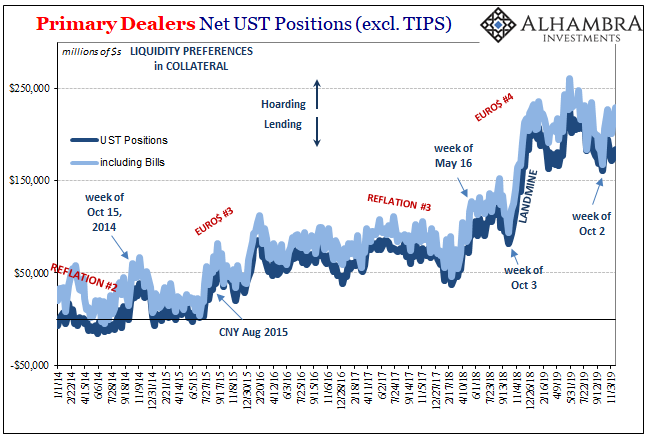

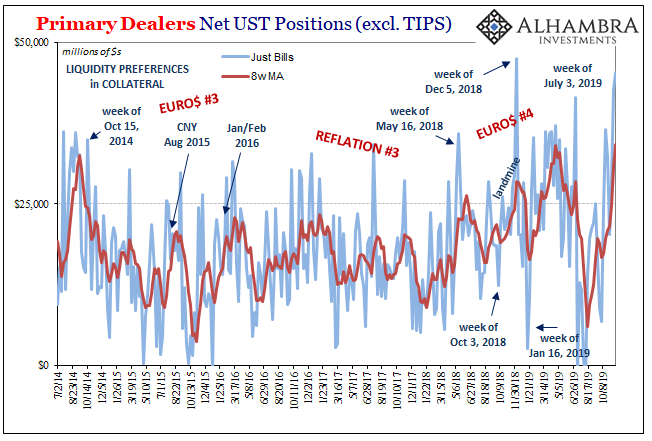

Understanding the real nature of repo, collateral availability and multiplication factors, you knew all the way back on May 29, 2018 (and even before, but after May 29 there was no doubts) what dealers were up to. Building collateral reserves, stocking up for the increasingly dicey conditions we have found ourselves in this year – predictably, not unexpectedly.

Dealer behavior has been telling you most of what you needed to know this whole time. No one wanted to listen because the vast majority, including the experts, all wanted to believe the Fed’s liquidity fiction for its recovery fiction and how those would lead to interest rates moving only upward. Caught totally off guard, they are all playing catch up and not doing so well at it.

To be perfectly frank, the “too many Treasuries” canard was one of the most frustrating aspects of this past year and a half. The Fed lied about it, and then the “experts” piled on even though it was so blatantly, obviously false. Facts are indeed very stubborn things, as they are learning. I suppose it’s not nothing that its biggest proponent has had his mind changed for him.

But we are only one too-small step closer to realizing the repo situation for what it is – an important maybe even major part of this fourth global dollar shortage. That’s what people like Pozsar can never get to, and that’s why they keep spinning their wheels in opposition to the facts. Collateral matters far more than reserves or “cash.” It certainly did in the Autumn of 2008.

Having finally settled on dealers’ choice, onward, now, to the next battle: collateral utility, the real reason dealers are choosing to hold UST’s, versus the conspiracy of QE’s bred from a viewpoint that still refuses to take on collateral and shortage(s).

Stay In Touch