Curiously short on star power, the Jackson Hole gathering this year has already taken an odd turn. It’s been practically subversive. Usually when the Kansas City Fed gets together for these things each and every August, the main attraction is the top central bankers in the major economies. Outside of the Bank of England’s Mark Carney, this year there’s only Fed Chairman Jay Powell.

And the only real worthwhile mention is all the discussion about bears.

The symposium typically opens with a speech by whomever is president of the Fed’s Kansas City branch – which encompasses Wyoming. That means Esther George and her dissenting brand of hawkishness yesterday gave the first word. It had been George who in 2015 kept voting no against not voting for a rate hike. Sorry for the double negative but it fits this absurd dance like a glove.

There has been very few times Ms. George has been unhappy with the US economic performance. She wanted to get on with the rate hikes, regular every-meeting rate hikes, in the earliest months…of 2015. It was only in those first few FOMC meetings of 2016 that she backed into the stunned, cautious majority position.

This proposes her as a huge hawk and her behavior over the following years bears that out. As does her staunchly optimistic take on the current economic situation.

You can read it for yourself here, but I’ll save you the trouble. Nineteenth century railroad-building had meant hotels in Wyoming which, in a bid for expedience, would simply have kitchen scraps tossed out the back door.

As is the case in any a wilderness, the surplus of excess human food attracted bears among other animals. The grizzly being incompatible with railroad and business, eventually someone got the good sense to prohibit the practice in order to discourage mingling too many dangerous ursine with the non-locals.

Whether or not central bankers can actually draw any lessons from this natural ecosystem, I highly recommend while you’re here that you do not feed the bears and avoid encounters with them while hiking in their territory.

It doesn’t take much to see her (mixed) metaphor – George’s artificially fattened bears are the western equivalent of William McChesney Martin’s famous drunken punchbowl drinkers. Central bankers need to stop fattening the bears before they bite, swipe, and destroy the hand that supposedly feeds them. Take away the punchbowl – I mean kitchen scraps.

On the other hand, perhaps this crude, childish story was really a next-level, purposeful swipe at Jay Powell. I’m probably reading too much into this, and for little more than the sake of entertainment. After all, this is Esther George we’re talking about here; not one for deep thoughts on economic and financial matters.

Still, what is a central bankers first job? Like doctors with their Hippocratic oath monetary officials tell themselves when faced with uncertainty don’t make it worse.

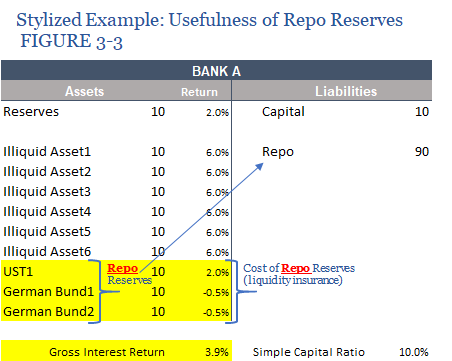

How does that usually happen? Simple. Markets are an ocean of opacity, and then there is the proliferation of markets in the 21st century (so many kitchen scraps, George presumes). When questions arise, it’s often difficult to get straight answers on them.

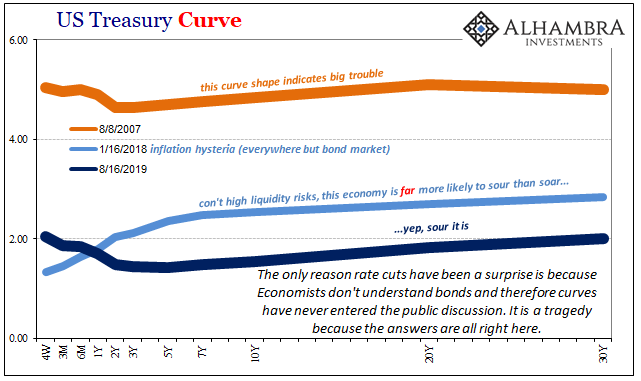

Take now, for instance. You’ve got stocks perched very near their highs – the very thing which seems to disturb the Kansas City leadership. On the other hand, bonds sinking ever lower into the depths of what are now outright recessionary signals. If the latter is right about them, what happens to the former?

Rather than simply take Jackson’s wildlife to mean punchbowl, what if, in my imagined view of a doubly clever Esther George, she is instead subversively signaling to Jay Powell don’t give the economic bears in the bond market any ammunition. There’s a case to be made about which bears should go on a diet.

If bonds are right, that’s going to be chaotic in stocks; and bonds don’t even have to be right for someone like Ms. George. The serious hint of lower rates could very well spook stock investors, triggering a meltdown (not unlike, say, last December). Better to allow rate hikes to gently nudge prices into more reasonable territory (in the fevered theory of policymakers) than to fatten these bears who will wreak total havoc should they get too full of themselves.

Don’t feed them with any more talk of rate cuts because rate cuts risk confirming everyone’s darkest fears at the worst possible time (up to this point; there might be opportunities ahead to make worst-er times that much more worst). Was President George trying to warn Powell off his dovish routine before he made a big mistake?

The buzz today is all about Trump tweets on trade. The markets actually moved long before them once the text of Powell’s speech was released. He may have tried to make his presentation about the history of long expansions (wink, wink, we’ve done an awesome job already making this the longest one on record)!) but all anyone heard was:

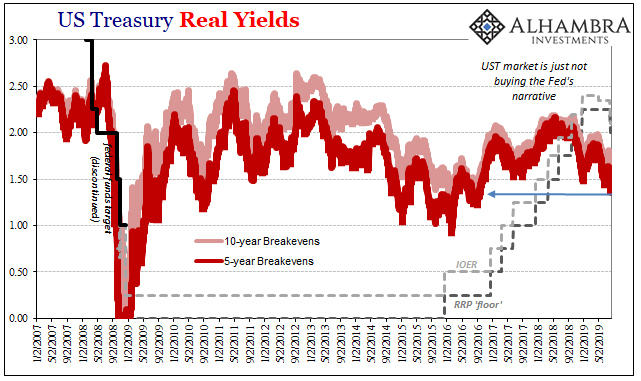

The global growth outlook has been deteriorating since the middle of last year…We have seen further evidence of a global slowdown, notably in Germany and China. Geopolitical events have been much in the news, including the growing possibility of a hard Brexit, rising tensions in Hong Kong, and the dissolution of the Italian government. Financial markets have reacted strongly to this complex, turbulent picture. Equity markets have been volatile. Long-term bond rates around the world have moved down sharply to near post-crisis lows.

Unlike Ben Bernanke’s August 2010 appearance in Wyoming which may have cheered up a lot of people when he pre-announced QE2, many but not all people have learned to tell the difference. They are called bond buyers. If the Fed is hinting at more “stimulus”, whether the Fed can supply any or not the need for it must be substantial. They are the last ones to figure these things out.

Don’t make it worse. Don’t feed the bears. The bears know that if the Fed Chairman is worried and admitting to anything less than perfect economic conditions (balanced risks) then it must already be pretty bad. Emboldened bears in the bond market (not to be confused with bond bears who are on Esther George’s side) put the stock market at risk and it’s already too fat on punch (supposedly).

Powell isn’t a dove he’s bear food; and to the bears he tastes more and more like chicken. He didn’t mention the dollar once during his entire speech. The only thing left in this farce is for him to ditch the pretense of office and just straight up challenge President Trump to a WWE style cage match to settle who’s to blame for this growing mess – with Esther George as referee.

Twenty nineteen was supposed to be rate hikes and inflation, recovery and acceleration. I think officials are having a very hard time coping with a very different reality. Simple stories about bears must be an anxiety technique. Hopefully, for their sake, it will be an effective one. For the rest of the world, we’re all gonna need a bigger boat (sorry, that’s sharks).

Stay In Touch