For the second time this week, the ISM managed to burst the bond bear bubble about there being a bond bubble. Who in their right mind would buy especially UST’s at such low yields when the fiscal situation is already a nightmare and becoming more so? Some will even reference falling bid-to-cover ratios which supposedly suggests an increasing dearth of buyers.

Bid-to-cover, however, is irrelevant. That only tells you about one part of the buying equation, the number of insiders who show up at an auction. The primary market. It says absolutely nothing about the secondary market. Therefore, the only real evidence which ever matters is the market price.

If there was a lack of buyers overall in both, the crux of the theory behind “too many” Treasuries that somehow has overcome basic common sense and become popular, then primary dealers in the primary market would be bidding at lower and lower prices. It really would be that simple. Small “e” economics.

Dealers are obligated to buy these bonds and if fewer buyers show up at auction, as bid-to-covers somewhat suggest, then, sure, dealers are going to be buying more than they might otherwise. The law says nothing, however, about the price they must pay or what they must do with the securities once they’re bought. If they can’t sell them once they buy them, they would bid much less for them.

As always, simple supply and demand. Even though there is more supply, the price keeps going up both at auction and in the market. Therefore, primary and secondary markets are in harmony. The problem isn’t too many UST’s, it’s that there aren’t enough. Dealers are choosing to pay more and hold onto these bonds despite the fact the financial public wants them more. The financial public in the secondary market includes banks other than primary dealers.

Price is the only relevant factor.

What the bid-to-cover folks are trying to say is that when the bond market realizes things aren’t really that bad, then panicky morons who have been buying up all these Treasuries will end up selling them – and then there really will be no one left to buy.

That’s really the crux of the matter; who is right, those bond buyers or Jay Powell? Those mostly inside the global monetary system who see it in real-time, or the guy who keeps having to erase his forecasts? The bond bears say it is the latter, the Fed Chairman. The economy really is otherwise fine except for a minor growth scare a few insurance rate cuts will easily handle.

Betting on Powell, though, that’s probably the most absurd part of it. Even more so than trying to use bid-to-cover as some kind of adjudication. After all, the Fed has been consistently behind…the bond market.

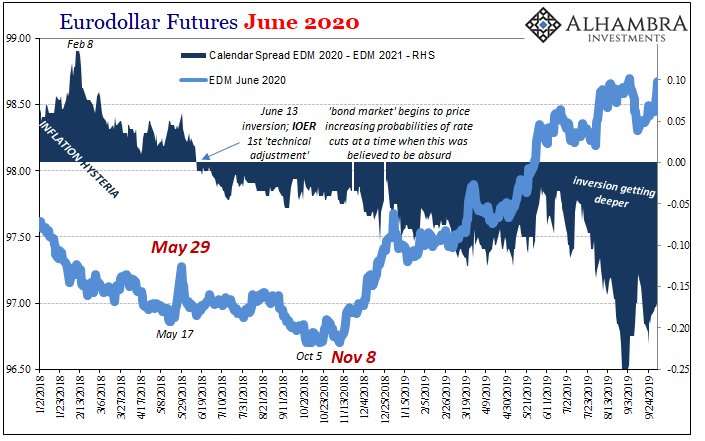

Recall, it was all the way back in June 2018 when the eurodollar futures curve inverted for the first time. That part of the bond market was hit with an overwhelming demand for hedging toward safety and liquidity, so much that it bent the very structure of a money curve in one of the deepest, most sophisticated markets ever conceived.

Inversion said there was a growing chance of rate cuts not hikes. And that was at a time when interest rates supposedly had nowhere to go but up.

Now there have been rate cuts, as the curve predicted a long time ago over the repeated objections of Jay Powell, the bond market says there are a lot more coming. The strong worldwide demand for safe assets isn’t over with yet; not even close. The economy and more so the funding markets behind it aren’t fine.

Powell will continue to object, but markets have already been eating his lunch. That was perhaps the big picture revelation in September. Does anyone really want to rely on the guy when even former Fed insiders are openly and publicly questioning on the basics of something like fed funds?

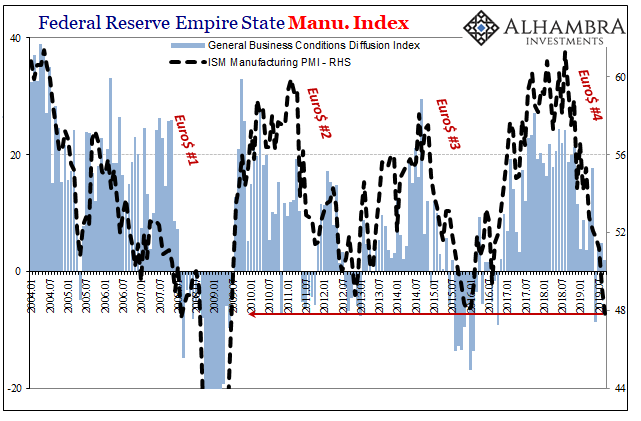

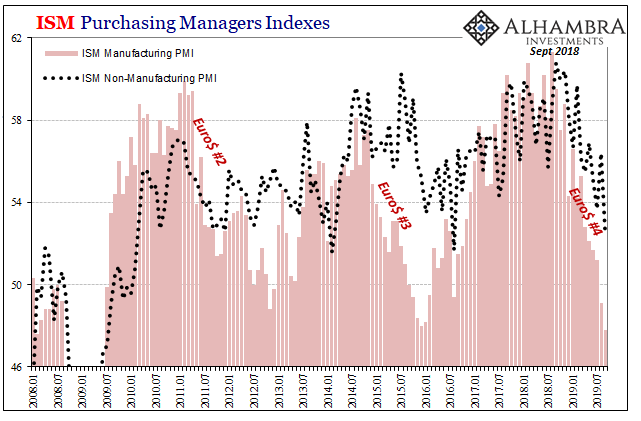

The ISM’s role in all this is straightforward. Both the Institute’s PMI’s have gained mainstream currency as relatively sound measures of at least the direction of the economy. People pay attention to them and give them a decent amount of weight in their own analysis and consideration.

The Manufacturing PMI which came out two days ago was sharply lower in September even though it had already fallen below 50 for August. It was therefore the lowest since 2009. As if to remind everyone about demand for liquidity and safety, bond yields tumbled.

The mainstream comeback to weakness in manufacturing has always been, hey, it’s only manufacturing. A mere 12% of GDP. It’s not good if the manufacturing sector is contracting but it’s not the end of the world, either.

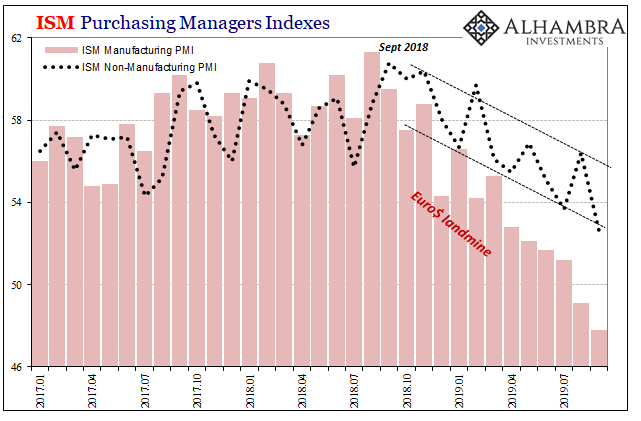

Then the ISM drops the other shoe. Today, the Institute reports that its Non-Manufacturing PMI also dropped sharply last month. Falling to just 52.6, since 2009 it has only been lower on just two occasions.

More than that, the services PMI is consistent with the ISM’s manufacturing picture of the economy. Ever since late last year, the last few months of 2018 when bond yields “unexpectedly” tumbled, the economy in the US as well as overseas has only become weaker and weaker. There is consistency between these markets and a broad slide of the economic data.

Each month further into 2019 we go, there really does seem to have been a landmine. A eurodollar landmine. Just as the bond market had priced.

Jay Powell isn’t unleashing some “mid-cycle adjustment”, he’s just being obviously slow to accept and correctly interpret the way things are going in its aftermath. The strong worldwide demand for safe assets he and the FOMC dismissed well over a year ago has only become a lot stronger and if the ISM is right will get a lot stronger still.

Maybe there are fewer buyers for UST’s in the primary market. So what? There is an overwhelming number of them in the secondary market. That’s why the price keeps going up in both. The ISM, like the repo market, reminds us of why that is.

We are repeatedly told how there is supposedly no liquidity risk not with Jay Powell’s determined group watching over things. But then two weeks ago it blew up in their face on little more than a seasonal low point.

They keep saying the economy is otherwise fine and that it will get back on its feet in the second half. Yet, it is already through September, halfway through that second half, and the numbers keep dropping and for what are more leading indicators.

Manufacturing and services.

Stay In Touch