When we talk about money dealers (not just primary dealers) and liquidity, we aren’t just zeroing in on the repo market. Money market conditions such as what we can observe in the part of the global repo market that ends up hitting the tape can be helpful in assessing overall liquidity. It isn’t, however, the complete picture.

If money dealers are shy in repo, where else might they be reluctant to willingly add their resources (balance sheet capacities)? Whether we fully appreciate it or not, we count on them to step in during good times and bad in many other places. Other key parts of the fixed income system – Eurobonds included.

Liquid asset markets, as separate from liquid money markets, are those where any significant increase in selling or buying pressures don’t push prices too far in any direction. The reason is simply those dealers, or in this case market makers. Flush with capacity, they’ll attempt to pick up a spread on either the bid and ask so as to keep the bid/ask to an easy, fluid minimum.

Market participants act very differently when they believe they can sell, if necessary, on a moment’s notice should the need ever arise. Pure risk-on/risk-off type stuff which depends upon the dealers to make sure the exits are as wide and dependable as possible.

And those exits are not static; which means if there is a perceptible increase in selling pressures, they have to be met by a comparable step up in dealer presence. That’s liquidity. The absence of it, in extreme cases, creates all kinds of self-reinforcing negatives and feedback loops.

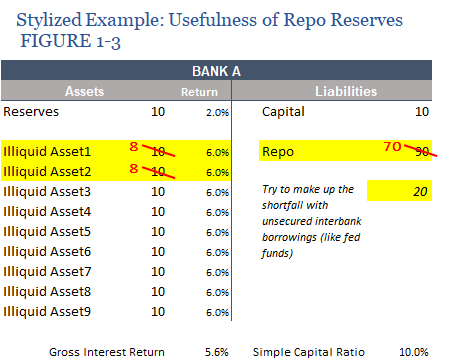

I wrote about it not long ago when diagramming the links between these credit markets and repo collateral:

…you can’t just sell the asset because if you do sell into an illiquid market you take an enormous loss which might confirm to the rest of the world that you really are a troubled bank. It may not have been 22 cents on the dollar for Merrill in July 2008, but those ABS CDO’s produced billions upon billions of impairment losses (and another $4.4 billion which were booked in Q3 2008 after the sale).

That’s the real risk of illiquid assets being used in liquidity functions. At some point, they can just return to type.

It is what economists call procyclical behavior. Since the global eurodollar system is incestuous by its design, that is, the dealers are the dealers everywhere, in markets as well as among themselves, shyness in repo liquidity very likely means shyness in credit market activity, too. And vice versa.

Once it shows up in either one, market participants take note all over. You see repo markets behaving by displaying serious, persisting illiquid characteristics you’re going to wonder about the true state of credit market exits should those selling pressures emerge.

In the aftermath of September’s repo rumble, and the persisting problems of the Fed’s (not) repo (not) fix, there are anecdotes of just those kinds of concerns filtering out of credit markets (thanks M. Simmons).

According to [Pascal] Blanqué [CIO of Europe’s largest money manager, Amundi], a cause for concern is that banks have reduced their dealer and market making activity following the global financial crisis. Banks have retreated from their past role by scaling back the amount of risk they take in part because of more stringent capital requirements from regulators.

Blanqué said that banks’ diminished ability to absorb liquidity demand during selloff periods could pose wider problems for fund managers.

They always say it has to be due to regulations because no one has ever offered a more complete (and consistent) explanation. It can’t be the persisting if intermittent dollar shortage due to a wrecked eurodollar system because of what everyone says about QE. They always say the Fed injected trillions of “liquidity” and even though every single liquidity indication has consistently rejected that idea it remains consensus convention nonetheless.

Regardless of the cause, the symptom remains and there are growing signs in this post-repo rumble environment there’s more studying of the exits than might otherwise seem warranted.

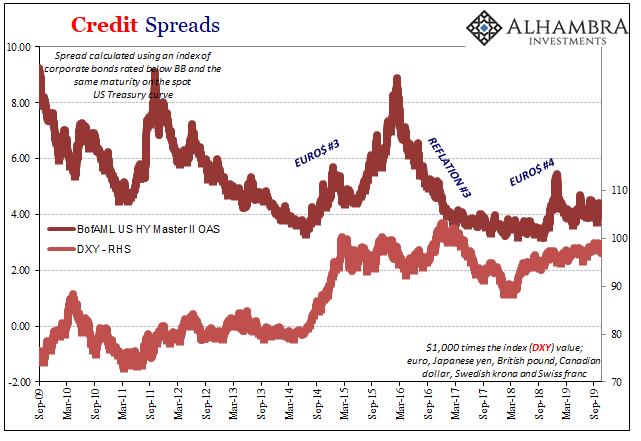

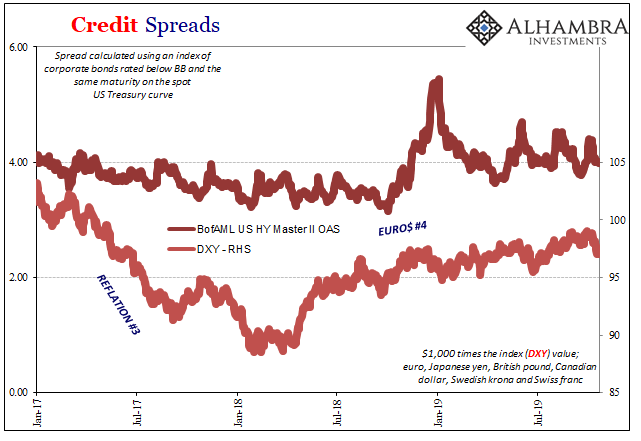

A lot of that has to do with what happened late last year – the landmine. My colleague Joe Calhoun always (rightly) focuses on credit spreads. As we’ve discussed quite a few times this year, the reaction to the jump in spreads late last year seemed way, way out of proportion. They didn’t rise all that much, and yet you would have thought by market (and economy) responses the world was on the verge of Armageddon.

It was nowhere near the scale of decompression during Euro$ #3 or even Euro$ #2. In relative comparison, December 2018 was a minor blip.

How do we reconcile what sure seems a pretty large disparity; the seemingly small increase of selling in risky credit compared to the enormous consequences observed all across global markets including stocks (which sold off the most in years)?

Whether Jay Powell says so or not, inside the global dollar system there are big concerns about liquidity. Those elasticity fears meant amplified selling across-the-board; very little faith that the entire financial system was at all robust or anything like it. The exits. At the absolute first sign of trouble, everyone rushed toward them.

As with Treasury yields falling so much, those insiders got seriously liquid real fast whether in hoarding the most liquid assets or in selling the riskier types (and therefore potentially illiquid). They even sold equities indiscriminately. A small blip turned into something much worse that it “should” have.

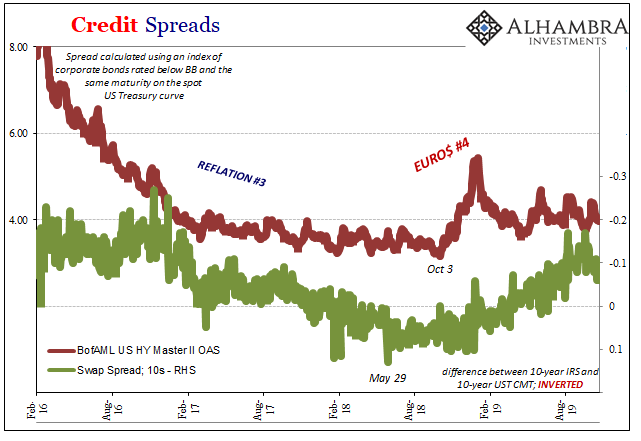

I think that’s what’s behind the persistent pessimism in the global bond market. Having observed how the entire system reacted, and how it didn’t go well at all, it had to have raised everyone’s eyebrows that much further heading into, and through, the balance of this year.

And then September’s repo dress rehearsal put even more emphasis on the same potential liquidity risk.

We keep having to ask, where are the dealers? Not for nothing, the crossover between risky credit and repo is often direct – the potential for this bottleneck. The less certain anyone is about the prices of those risky credits, and how robust they might really be, the more nervous they have to be about the potential negative spillover into repo collateral chains. For dealers acting in both places, shyness begets shyness.

Credit spreads have remained slightly elevated throughout 2019 when compared to 2018. Nervousness continues to persist though it might not be perceptible without this context.

In other words, if we can’t find dealers in money markets like repo, and we can’t, then we shouldn’t depend much on them being there in credit markets, either. It sounds like more are starting to think this way. And if we don’t believe they’ll show up when needed in credit markets, then we are even more suspect of repo and collateral. Procyclical.

All the while the Fed is gearing up its smoke machine for more fog, and repositioning its mirrors for what it hopes is a more realistic liquidity-like appearance.

Stay In Touch