Why aren’t we in recession yet? That’s a question that has been asked often over the last year but with no real satisfying answer. I have my own beliefs on the subject, rooted in the distortions of COVID. (You can read about it in my latest Follow The Money piece) I think my explanation is a pretty good one but even if I’m right about the origins of this strange economy, I can’t tell you with any great confidence what comes next. Yes, I speculate about that in the Follow the Money article so you’ll get your money’s worth, so to speak, but I am the first to admit that I don’t know what the future holds.

At the beginning of this year, the consensus was that a recession was imminent (within 6 months) so stocks would perform poorly in the first half of the year; bonds were the better choice. There was also an expectation that any recession would be mild and the Fed would cut rates quickly so stocks would perform better in the second half of the year. (I wrote about this in The Consensus Will Be Wrong back in January). My only expectation was that the consensus would be wrong and it was our job to figure out how. What’s amazing about Wall Street’s soothsayers this year is that they basically got everything wrong. The economy is not in recession, bonds are flat to down on the year and stocks had a very good first half of the year. I would even add that the gain in stocks was global, with China the notable exception (what happened to the reopening surge?).

So, here we are at mid-year and there is a new consensus – which will also probably be wrong. That consensus is that recession doesn’t arrive until sometime next year and based on Fed Funds futures, not until the second half of next year. The consensus for stocks and bonds is still pretty much the same as it was at the beginning of the year, just with a different timeline. All the strategists who said stocks would perform poorly in the first half now think they will perform poorly in the second half. And the strategists who said to load up on bonds at the end of last year, now think you should just keep those bonds and maybe add some more long-duration Treasuries. In other words, they weren’t wrong, they were just early. Uh huh.

I don’t think the consensus is all that strong, to tell the truth. And there are signs that market sentiment has gotten a little too bullish recently. The NASDAQ and S&P 500 (especially growth) are both extended and due for a pullback of some kind. But there are plenty of areas of the market that are not so well loved as the big cap growth stocks (REITs, small cap stocks, commodities, energy stocks, banks and other financials, healthcare, China and the Yen, just to name a few off the top of my head) so sentiment is far from uniform, even within the stock market.

One thing I’ll agree on with most of the rest of the investing world is that large cap growth stocks are expensive. But an investor can easily avoid those stocks (most of them or all of them) and do something else. You don’t have to own the S&P 500 and you don’t have to own Nvidia or whatever high-priced stock is giving you indigestion. It’s a big market out there; find something else. And forget about the “benchmark”; you don’t have to chase any particular index. All you have to do is produce a return that allows you to reach your financial goals. Trying to keep up with the Joneses has caused a lot of heartache over the years.

Investors don’t need to make predictions to produce good returns. And it’s a good thing since no one seems all that good at it. For those who want to make shorter-term tactical changes, the best option is to determine the consensus and then spend your efforts trying to figure out how it will be wrong. It’s still hard but at least you start with a pretty good idea of what won’t happen.

So, what’s the non-consensus outlook for the second half? Well, if consensus is that recession doesn’t arrive until mid-2024, then it could be wrong because:

- The recession arrives in the second half of this year, maybe fairly soon.

- There is no recession in 2024 either.

I honestly don’t know which one of those will be right. My head says the first one makes more sense but I can’t help but think the odds on the second one are better than anyone thinks. It would also be consistent with the election cycle. The market’s best year of a presidential term is usually the third one (that’s this year) and the worst are the first and fourth. Could 2024 be the down year in anticipation of a 2025 recession?

Environment

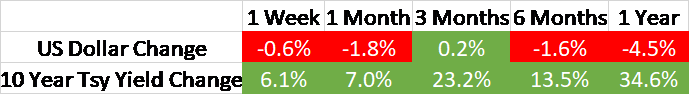

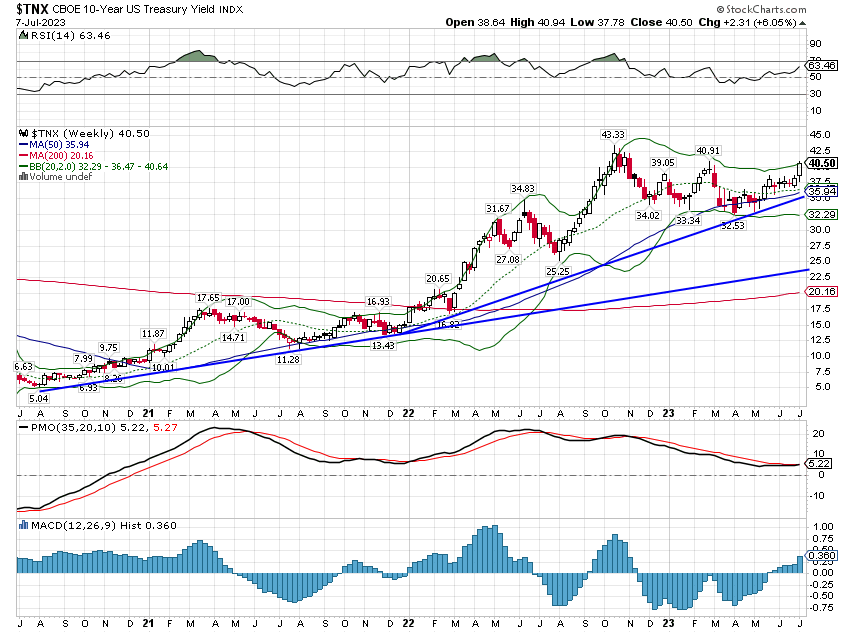

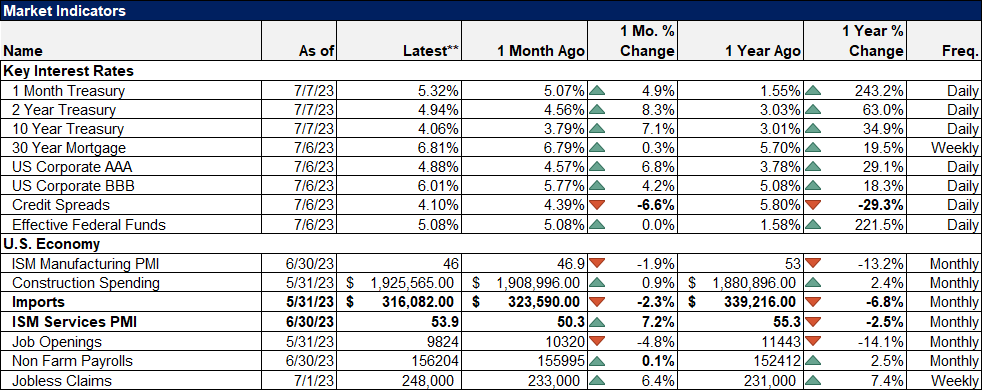

The 10-year Treasury yield finally broke above the short-term downtrend line we’ve been tracking since last October. This was the third consolidation of the uptrend since it started in August of 2020. The rate is still below the October high and there is no guarantee that it will break above that, but the trend is obvious here; long-term rates are rising. That is an indication that nominal growth expectations are rising. Even more impressive in my mind is that real rates are hitting their highs for this cycle. The 10-year TIPS yield sits at 1.78%, the highest since early 2009 and around the bottom end of the range that prevailed prior to the financial crisis of 2008.

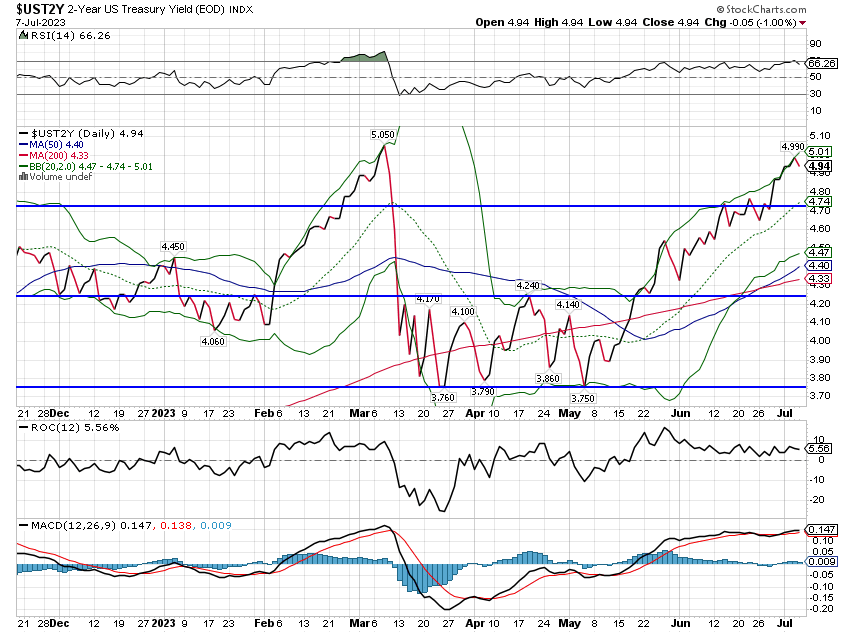

Shorter-term rates rose last week too but not nearly as much as long-term rates. The action in the short end of the curve indicates that the market believes the Fed rate hikes are about over but there are no cuts in sight. A look at Fed funds futures tells us that market expectations are for a rate hike this month and then nothing to happen until May of next year. That seems highly unlikely by the way so the market is likely to be surprised one way or the other.

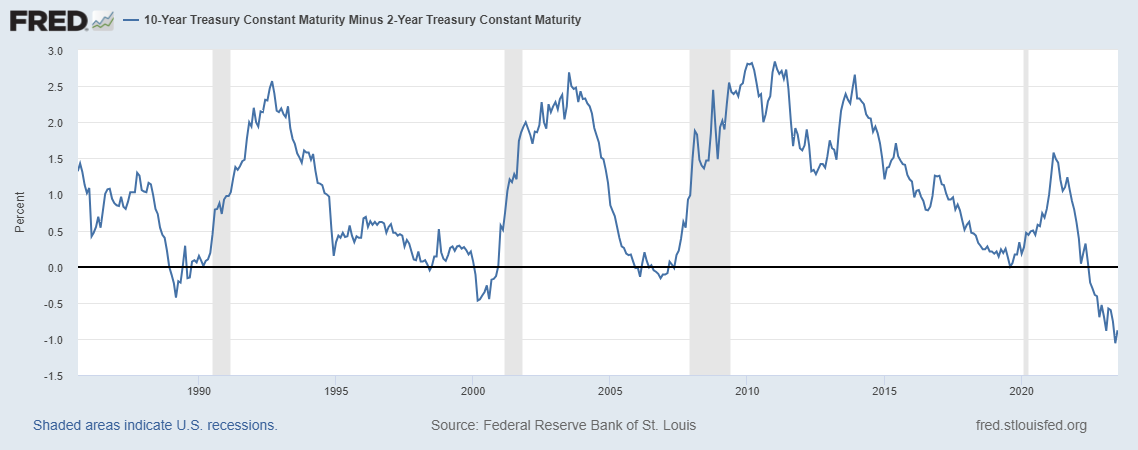

The yield curve steepened some last week and on a shorter-term chart it looks pretty dramatic. I’ve already seen numerous charts on Twitter over the weekend hyping the move as the precursor to recession. Yes, the yield curve does usually steepen prior to recession. As you can see below, the yield curve actually turned positive before the last four recessions.

But that isn’t how it has to happen. The 1980 recession started with the yield curve at its most inverted. It also matters for interpretation how the curve steepens. In the four recessions below the curve steepened because short-term rates fell faster than long-term rates. That makes sense because as we near recession the market anticipates Fed rate cuts. That isn’t where we are now with both short and long-term rates still rising. That could change obviously, but until it does this minor steepening doesn’t mean much.

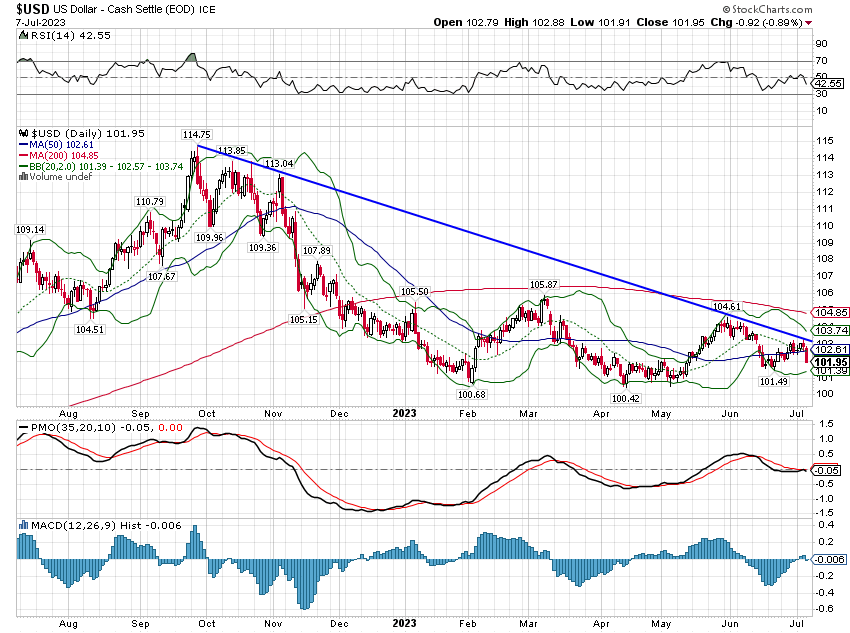

The dollar, by contrast, fell last week which seems a bit odd with higher long-term rates. A lot of the loss was Friday after the less-than-expected payrolls report and bonds did rally a little too. But maybe don’t spend a lot of time on interpretation here because, again, the trend is pretty obvious (although this is shorter term than with interest rates). The dollar is still in a short-term downtrend.

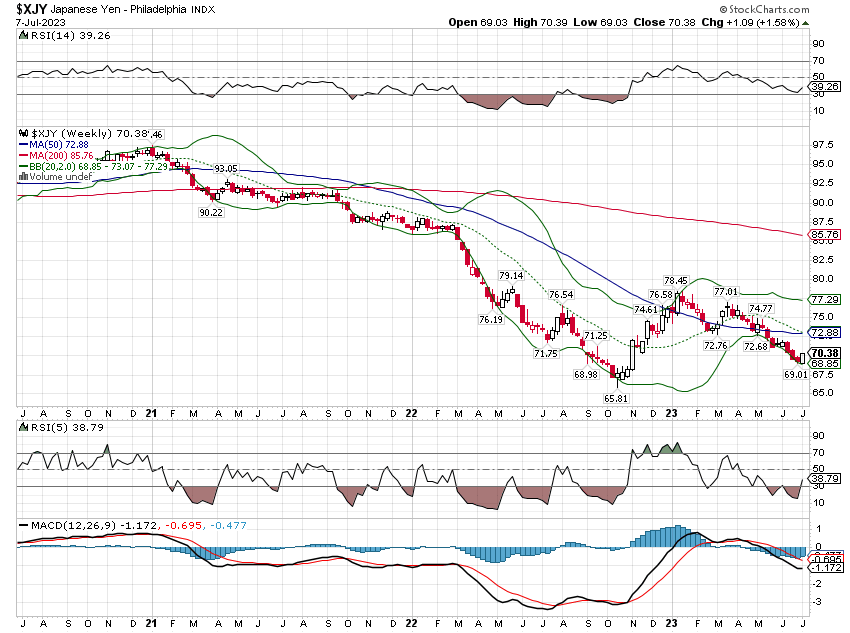

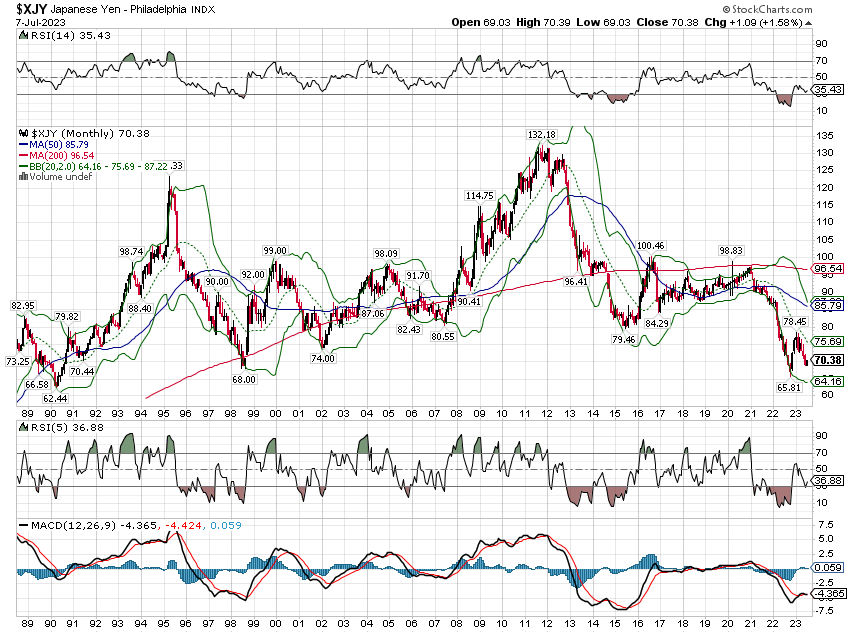

One difference with this latest move is that the Yen rallied instead of just the Euro. The Yen is very undervalued here and it only took a comment from a BOJ official about excessive Yen weakness to turn the tide. The Yen has been a very popular – and profitable – short over the last couple of years so it is a very crowded trade.

With the Yen at a 25-year low, it might make sense to start thinking about ways to benefit from a rise.

Markets

Note: The returns below are for the preceding 5 trading days, not the calendar week.

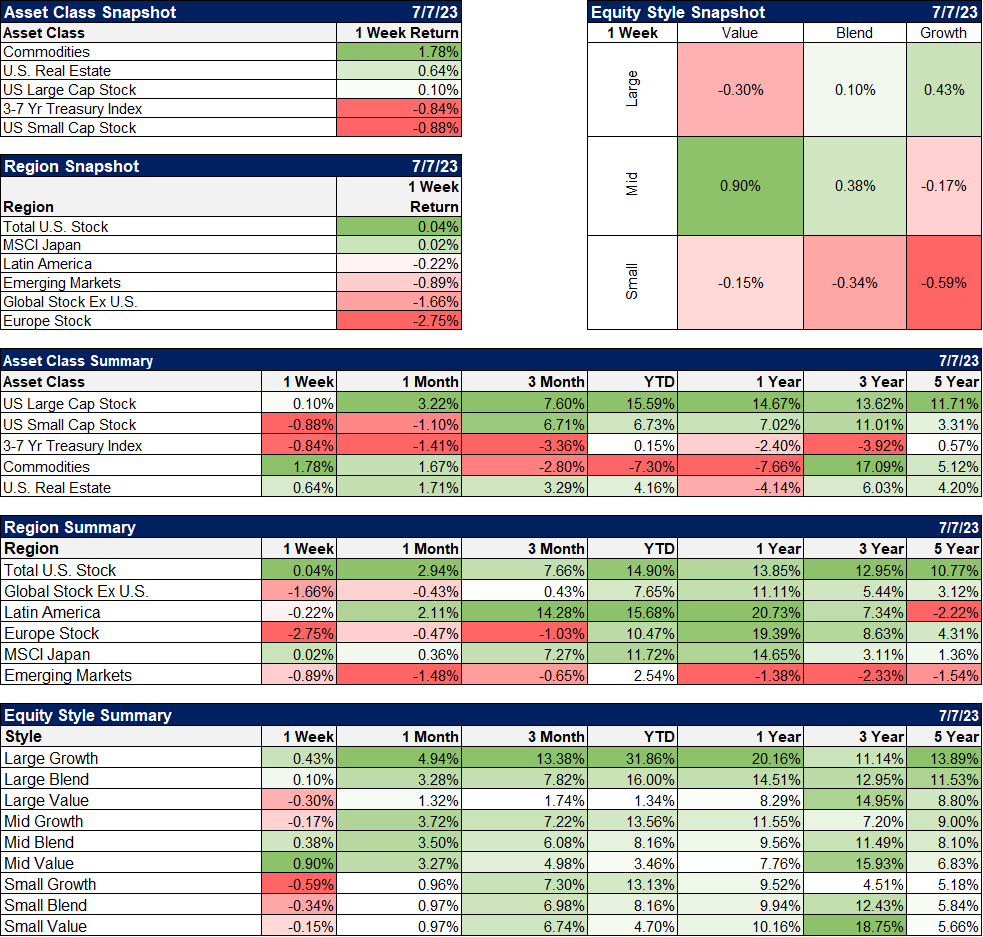

Commodities had a good week with crude oil up 4.6% although natural gas started the month on the back foot, down 7.7%. Still, nat gas is up over 10% over the last month. Gold was up a bit too on the weak dollar although the rise in real rates makes me wary of any rally in gold. Gold rallies when real growth is weak and real rates are falling. So unless gold is anticipating something, I wouldn’t put much weight on it.

Real estate continued its recovery but the gain was minimal with rates rising. Sentiment in the sector is still very bearish so while upside may be somewhat limited until rates peak, I don’t think there’s a lot of imminent downside.

Small cap stocks were down a little on the week but outperformed for the calendar week. Small caps have been in recovery mode versus large cap since the beginning of June and I think there is likely more to go. Whether we see a sustained outperformance from small caps is impossible to know but I would point out that small caps outperformed strongly in the inflationary 1970s. If you think inflation will prove sticky, small caps may be your US play. They are certainly a lot cheaper than their larger cousins. If you want to split the baby, maybe midcaps would be a good compromise.

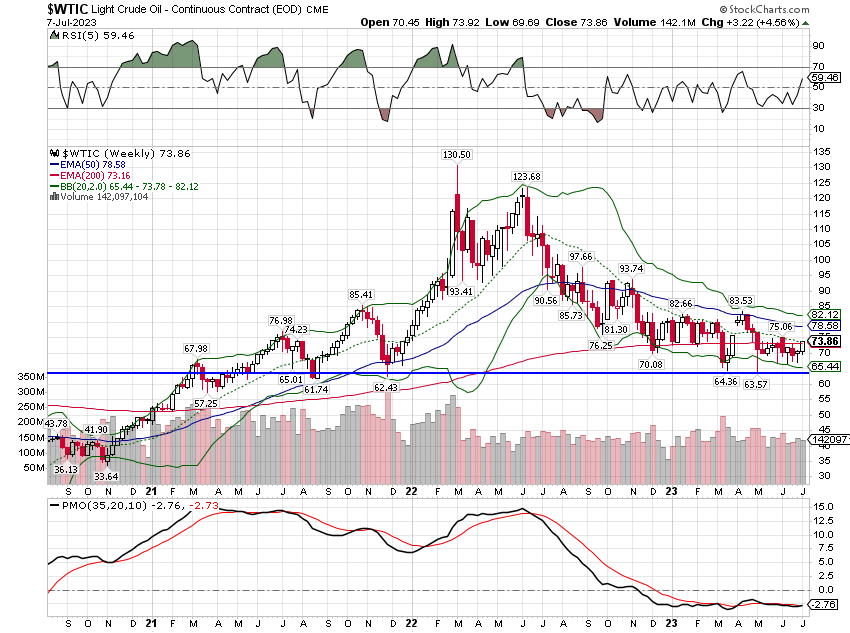

Crude oil has been in a consolidation pattern for most of the year and sentiment is mostly just indifferent. Large spec accounts have been trimming longs all year but there isn’t any extreme in the futures positioning. There is still a very minor contango so supply/demand is pretty well balanced. We don’t trade crude oil specifically but if you are long commodities, you have to pay attention to crude. And it looks poised for a move higher in my opinion.

With the rally in crude, it is a bit strange that energy stocks were down for the week. The small drop in XLE (which is the ETF we use for this chart) maybe wasn’t representative of the entire sector. If you drop down to the industry level, you see oil equipment and services (IEZ or XES) up nearly 7% on the week.

BTW, while indifference may describe sentiment on crude oil, the sentiment on the stocks is a bit more negative. XLE has seen outflows over 1-month, 3-months, 6-months, and 1-year. The outflow over the last year represents about 12% of assets. It is interesting to see investors give up on a sector that seems intent on sending them cash. Dividend yields average around 4% and most of the large companies are buying back stock. Total yields (dividend + buybacks) for many of these stocks over the trailing 12 months are in the high single digits. For some of the big foreign stocks (SHEL, TTE), the total is in the double digits. There is no guarantee they’ll keep that up I suppose, but payout ratios are low and capex budgets, in case you didn’t know, are too.

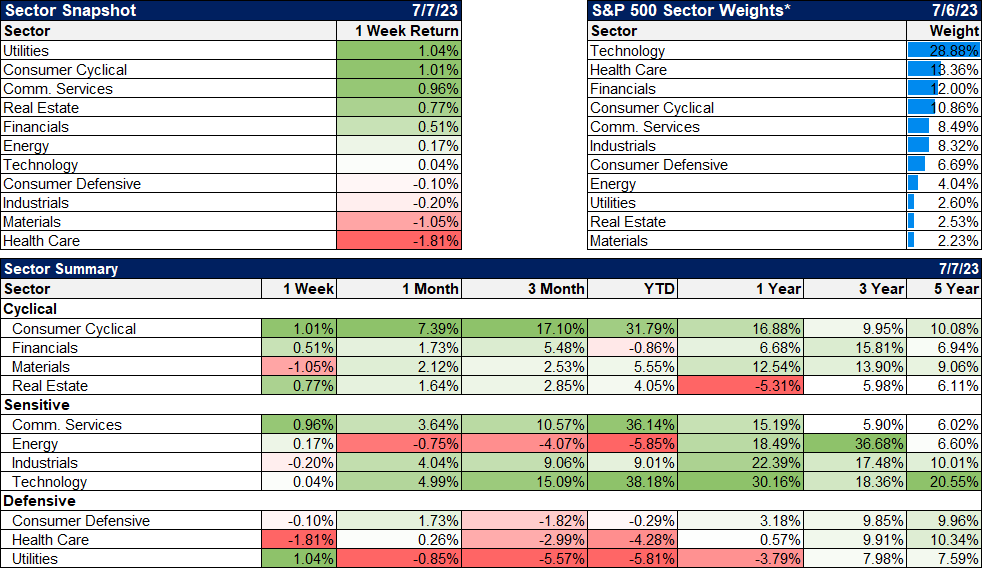

Cyclicals and utilities were the leaders last week in what I think is a perfect snapshot of this year’s market. No one knows what to expect and they appear to be covering all the bases.

Market/Economic Indicators

The economic data last week wasn’t particularly great but bond yields rose anyway. The ISM manufacturing survey remains below 50 but there was improvement in the new orders component from last month’s terrible 42.6 to 45.6. I still think we may be seeing the lows on these reports right now as inventories have flatlined for the last half year.

The services version of the ISM did improve and remains above the 50-level marking expansion. This is the story I’ve been telling for the last year, one of services continuing to recover while goods retrenches. It hasn’t changed but if goods start to grow again, recession is going to get pushed out again.

Another metric being skewed by the slowdown in goods consumption is imports which fell again in May and are now down 6.8% over the last year. Exports are down too as the goods slowdown isn’t confined to the US.

Joe Calhoun

Stay In Touch