There has been a lot of angst over the last couple of weeks about a potential banking crisis. There have been 4 failures so far: Silvergate, Silicon Valley Bank, Signature Bank, and Credit Suisse. The first of these hasn’t been mentioned much because it was primarily associated with lending in the crypto market and, as far as I know, there were no losses by depositors. Silicon Valley was shut down on March 10th and Signature was shut down the same weekend. The FDIC is backing all deposits at both banks. Credit Suisse was forced into a shotgun wedding with UBS just last weekend.

The problems at SVB and Signature were pretty simple when you get down to it. They both suffered pretty classic bank runs when depositors withdrew a large portion of total deposits in a short period of time. The reasons for the loss of confidence are somewhat different in the two cases, with SVB facing losses on long-duration investments made when interest rates were lower and Signature seen as vulnerable due to its connection to crypto.

The question now is whether these problems exist at other regional/small banks and whether more failures are in our future. We don’t think there is a widespread banking problem in the US but there are certainly other banks with unrealized losses on long-term bonds (Republic fits that description) and mortgage-backed securities. There could also be some banks with problems connected to the crypto industry but if so, I haven’t heard about it. But that isn’t the real issue. Both SVB and Signature were probably solvent and could have eventually returned all their depositors’ funds. The real issue is whether there is the potential for a panic that drains deposits from vulnerable small and regional banks, healthy or not.

That is a question that is basically unanswerable because it depends primarily on psychology. I don’t think there is a financial reason to withdraw your funds from a small bank, especially if your deposits are below the FDIC limit. But bank runs aren’t really rational because there is a prisoner’s dilemma element involved. It doesn’t really matter what you personally believe. What matters is what the majority believes and what the majority does. If everyone else runs, there is nothing to be gained by being the last one out the door.

There has been some movement of deposits from smaller to larger banks over the last few weeks. And there has been a general drop in deposits that has been ongoing for months because bank deposit rates (CDs, savings, etc.) haven’t kept up with TBills. For large banks, this hasn’t generally been a problem because they have excess reserves but smaller banks don’t have as much cushion. For now, it appears that deposits are stabilizing although that could change quickly as we discovered with SVB and Signature. Bank runs today don’t feature long lines at the teller windows.

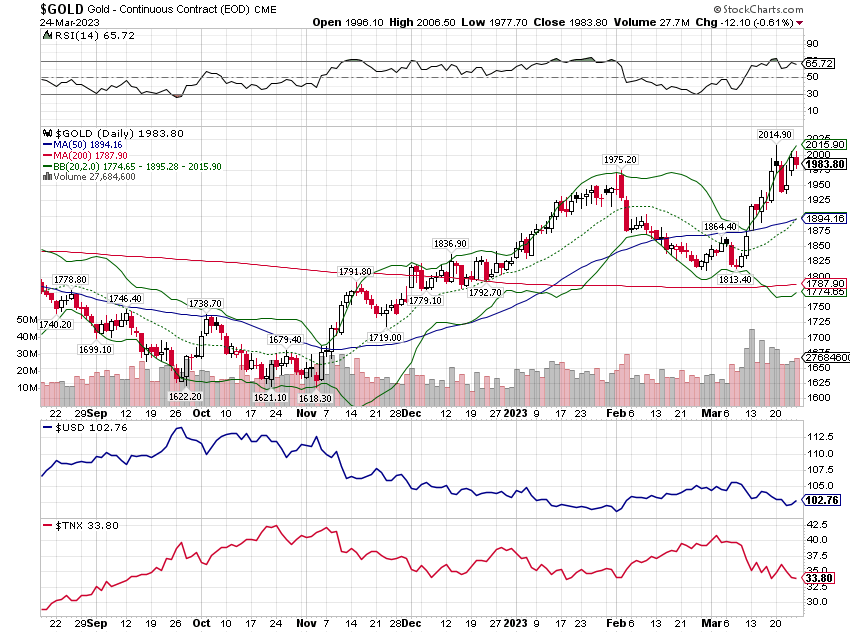

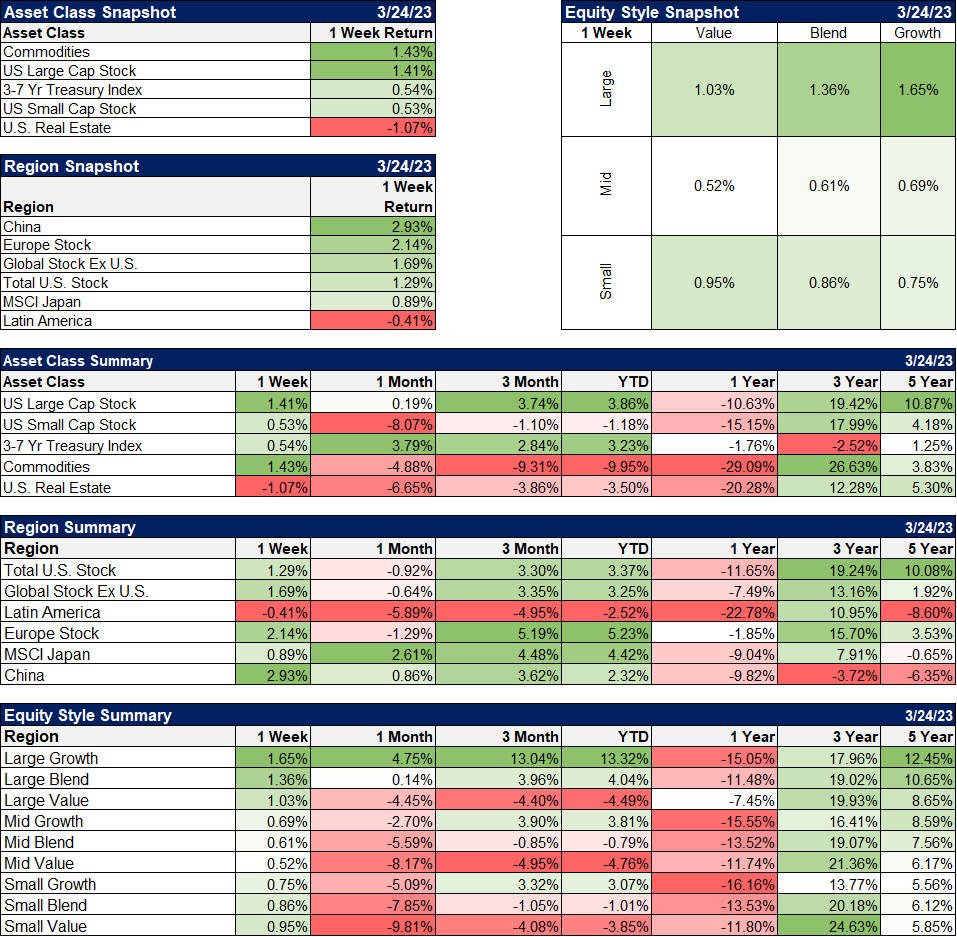

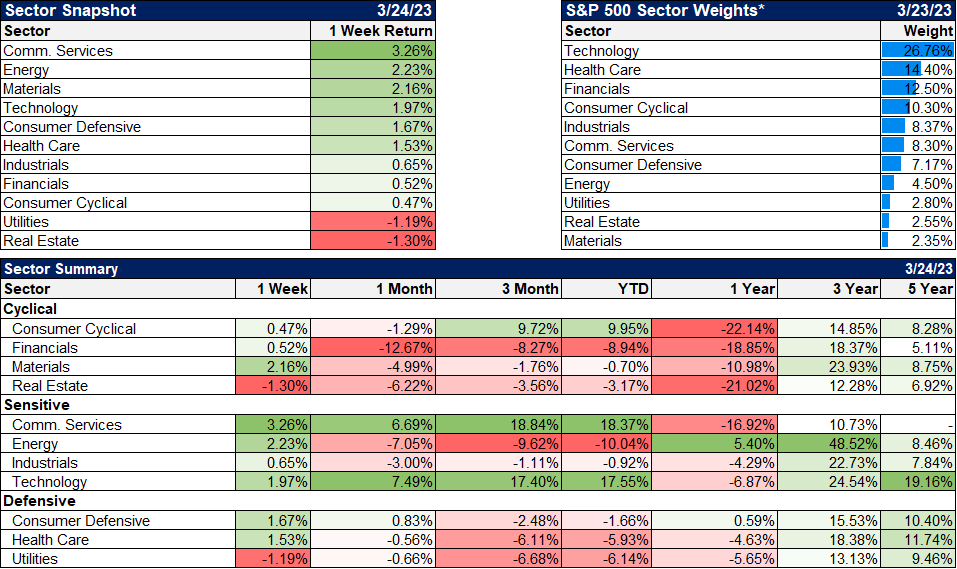

One of the most interesting aspects of this bank “crisis” is that it hasn’t had a big impact on markets yet outside of changes in expectations regarding Fed policy. About the only “flight to safety” we’ve seen is in gold which is up 5.6% since the failure of SVB. Bonds are up too but not that much and the Fed still raised rates last week. Small-cap stocks are down a little over 2% but that is a function of their larger allocation to financial stocks. Value stocks have also underperformed some but the S&P 500 value index is up while the Russell 2000 value (small cap) is down. Strangely though, the darlings of the bank crisis of 2023, so far, are US growth stocks.

| Since SVB Failure | |

| 3/10/2023 | |

| Gold | 5.6% |

| S&P 500 Growth | 4.8% |

| S&P 500 | 2.9% |

| 7-10 Year Treasuries | 2.6% |

| 3-7 Year Treasuries | 2.4% |

| Emerging Market Stocks | 2.2% |

| 60/40 Benchmark | 2.2% |

| S&P 500 Value | 0.9% |

| EAFE (International Stock) | 0.2% |

| Europe Stocks | -0.3% |

| International Small Cap Stocks | -0.7% |

| US Dollar | -1.5% |

| US REITs | -1.5% |

| Dividend Stocks | -1.7% |

| Global REITs | -1.7% |

| US Small cap stocks (Russell 2000) | -2.1% |

| US Small Cap stocks (S&P 600) | -2.7% |

| Commodities | -3.0% |

| Small Cap Value | -3.7% |

The performance of growth stocks over the last two weeks has surprised a lot of people, us included. The fall in interest rates due to economic growth concerns has seen investors shift back to the assets that worked prior to the Fed’s rate hiking campaign, namely growth stocks and specifically technology stocks. We think that is a mistake for valuation reasons but also because there is a larger, more important trend in place. A little perspective tells a different story.

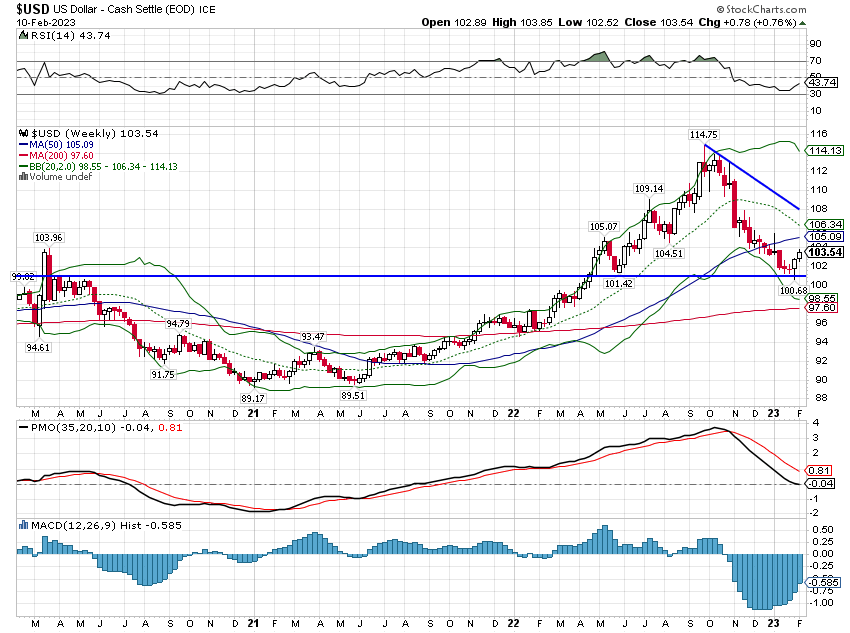

If we look back 6 months, we get a much different – and we think clearer – picture of what is doing well. In our process, the big important macroeconomic factors are the trend of the dollar (inflation) and the trend of interest rates (economic growth). The dollar peaked on September 27th and interest rates peaked on October 21st last year. The leaders since then are exactly what we expect from a falling dollar, falling rate environment:

| Since Dollar Peak | |

| Name | 9/27/2022 |

| Europe Stocks | 36.2% |

| EAFE (International Stock) | 24.4% |

| Gold | 21.3% |

| International Small Cap Stocks | 18.7% |

| S&P 500 Value | 13.7% |

| Emerging Market Stocks | 10.6% |

| S&P 500 | 9.8% |

| 60/40 Benchmark | 8.0% |

| US Small Cap stocks (S&P 600) | 7.9% |

| 7-10 Year Treasuries | 6.9% |

| 3-7 Year Treasuries | 5.4% |

| S&P 500 Growth | 5.2% |

| Dividend Stocks | 5.2% |

| US Small cap stocks (Russell 2000) | 5.2% |

| Global REITs | 4.9% |

| Small Cap Value | 3.3% |

| US REITs | 0.8% |

| Commodities | -2.7% |

| US Dollar | -9.7% |

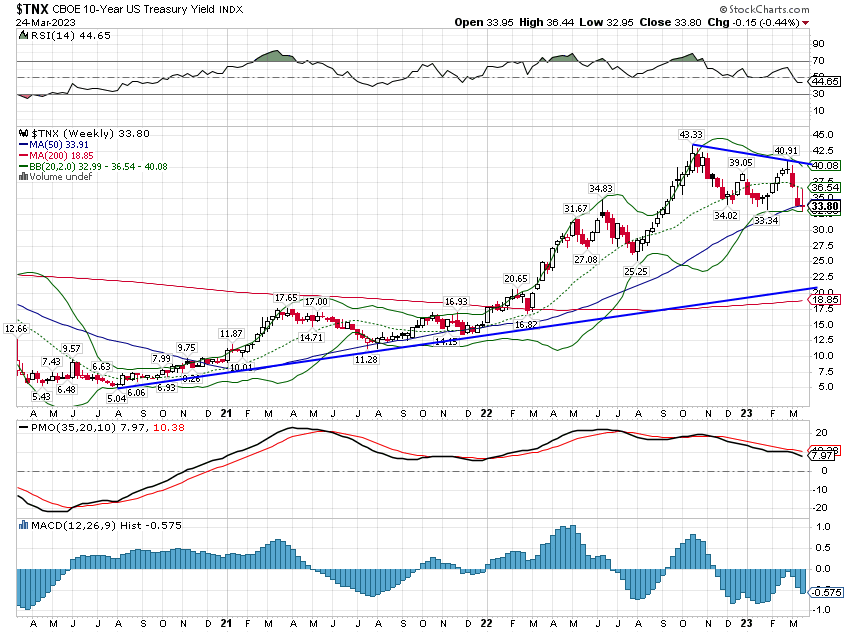

The falling dollar is the more important and influential during this time because as recently as the beginning of March, the 10-year yield was still only down about 25 basis points from the high. The expectation of weaker growth has only really emerged since the beginning of the bank issues. There isn’t, as yet, any evidence of significant economic slowing, however. The recent steepening of the yield curve is a warning but one that, like the inversion before it, can come with a significant lead time to recession.

I don’t think there is any way to quantify the impact of the banking issues yet. One might think that it would make banks more conservative but lending standards were tightening long before SVB failed so I don’t know that it changes much. I think it is important to remember too that it wasn’t lending, traditional banking, that brought SVB down. SVB failed because it didn’t have much traditional banking. That’s why they loaded up on Treasuries and MBS. Even if they haven’t bought a lot of long-term Treasuries, small and regional banks have certainly made loans in the last two years at lower rates. But stopping lending isn’t going to help that. Indeed, more loans at higher rates is exactly what they need. So, I’m not sure a credit crunch should be our base case.

The last two weeks look to me like more of a countertrend move than the start of something new. US large-cap growth stocks are cheaper than they were at the beginning of 2022 but they are far from cheap. The S&P 500 growth index trades for 20 times forward earnings and 2.7 times sales. That is not cheap. We would not chase these short-term trends in tech and growth stocks. If the dollar and interest rate trends change that might trigger a tactical change but we haven’t seen that yet.

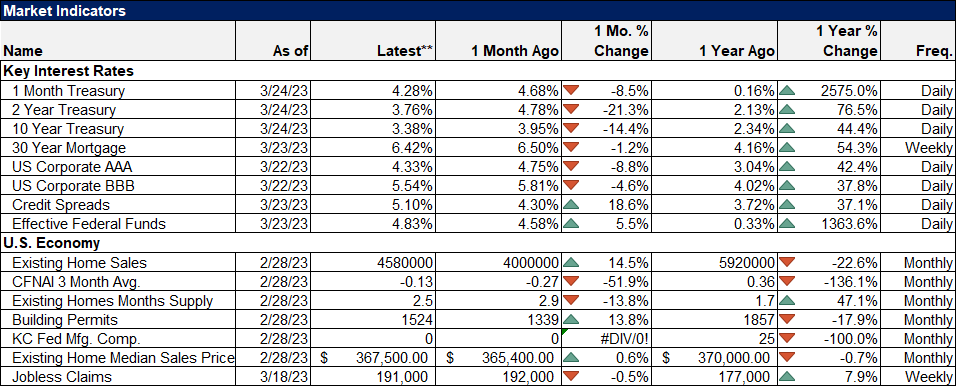

Environment

The 10-year Treasury yield and the US dollar remain in short-term downtrends. While there was continued volatility in the bond market last week, in the end, there wasn’t much change in rates. The 2-year Treasury fell 5 basis points for the week while the 10-year fell just 1.5. Those moves are generally not noteworthy except that one might expect more movement with all the angst about the banks. The 3-month bill rate, which is influenced mostly by Fed policy, rose 21 basis points as the Fed hiked rates by 25. Regardless, it still does look like rates, across the entire curve, may have peaked for this cycle.

What does that mean for investors? For now, all it means I think is that investors can normalize their bond investments. If you’ve been sitting in short-duration bonds, it probably makes sense to start moving out the curve, taking on some duration risk. No, that doesn’t mean run out and buy TLT. Moderation folks, moderation. I said last week that the yield curve hitting its maximum inversion for the cycle – assuming that is what we just saw – means it is time to start lengthening duration in anticipation of an economic slowdown (recession or not). That still applies but remember even if the max inversion has been seen, it doesn’t mean recession starts tomorrow. We could still be as much as a year from the onset of recession. So, yes, it is probably okay to take on some duration but take your time and ease your way out on the curve.

The short-term trend of the dollar is obviously down while the longer-term trend is still just as obviously up. But these short-term trends, which can run from months to several years, are important and need to be factored into your asset allocation. The dollar drives capital flows on a global basis and can have a large impact on growth in places far from US shores. A weaker dollar is generally positive for non-US markets and economies – capital flows out from the dollar to other currencies – and particularly Emerging Markets. At a time when we’re seeing so much worry about global banks, it is interesting to note that EM currencies have been rising as the dollar has been falling. That is not what I would expect if we were truly on the verge of some big crisis. EM currencies were up over 1% last week, more than the Euro and the Yen.

A falling dollar also tends to favor commodities and if rates are also falling, gold usually outperforms general commodities. And that is exactly what we’ve seen since September when the dollar peaked. Of course, the peak in rates was not as clear as the peak in the dollar so it is only recently that gold has become the clear winner during this short-term dollar downtrend.

Markets

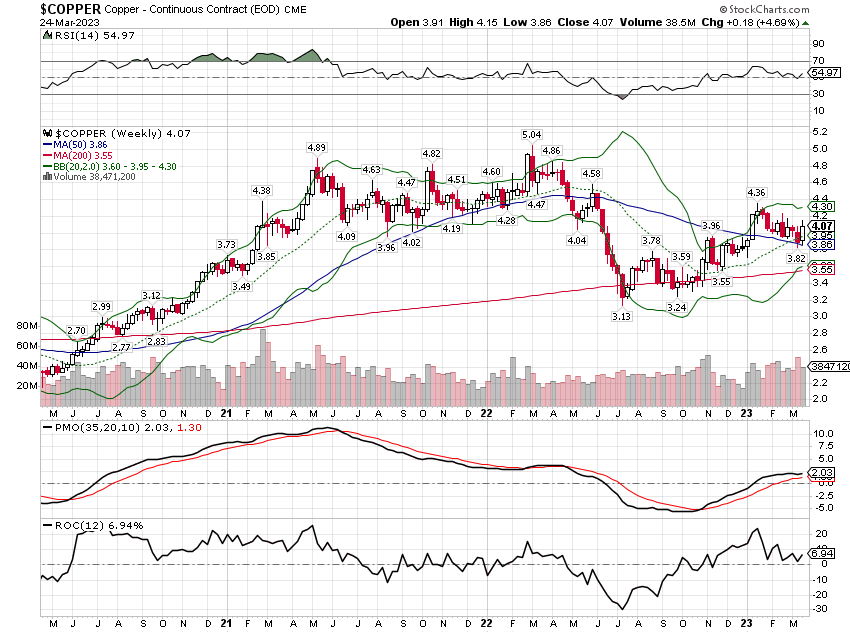

Of the major asset classes we follow, only real estate fell last week. Commodities had a good week as crude oil rebounded (+3.5%) along with copper (+4.7%), neither of which says a lot about the future economy by the way. I know a lot of people point to these two as important economic indicators but I think it is important to remember that they are volatile commodities influenced by their own supply/demand dynamics that may not have anything to do with economic growth.

Crude oil, in particular, is subject to a wide range of geopolitical influences. At the moment, we may be seeing a major realignment in the geopolitical landscape that could have a big impact on crude. The timing of the Xi visit to Russia and the thawing of relations between Saudi Arabia and Iran and Syria would not seem coincidental. If Xi can keep his emerging coalition from fighting amongst themselves, we could see Russia and the Middle East countries providing cheap oil to the Sino bloc while keeping prices higher for the West. Of course, oil is fungible – to some degree – and there will always be cheating in any such arrangement but with the West actively discouraging fossil fuel use and production, we may find ourselves in an uncomfortable situation somewhere down the road.

Copper, the so-called commodity with a PhD in economics, is, at best, a coincident indicator, falling during recessions but providing little or no advance warning. It also tends to provide lots of false warnings. In other words, it is about as useful as you would expect an economist to be. But, even if you assume it is a good coincident indicator, it isn’t saying anything bad right now. Notice too how it seemed to confirm a recession last summer which, of course, didn’t happen.

US stocks were also up for the week and value performed better than it has in recent weeks. But international markets performed better with the dollar continuing its downtrend. China and Europe were again winners while Latin America lagged the field. Japan was also a bit of a laggard but has outperformed the US since the Yen bottomed. Since 11/1/22, Japan is up 13.4%.

The drop in real estate stocks is being driven by fear about the regional banks and office occupancy. Regional banks are certainly important players in the commercial real estate market but there is no evidence yet that they will be unwilling or unable to lend. Regional banks do not want to own and operate commercial real estate so I expect most of the fears will prove overblown; they’ll work out deals with real estate operators to keep them in place. In addition, companies in most places are pushing for a return to office and there is some evidence they are being successful (see here):

Some 72.5% of business establishments said their employees teleworked rarely or not at all last year, according to a Labor Department report released this week. That figure climbed from 60.1% in 2021. The survey showed about 21 million more workers on-site full time in 2022, compared with the prior year. An establishment is defined as each business location—such as an individual restaurant in a chain.

The new number is also close to the share of establishments—76.7%—that said they had no employees teleworking before the Covid-19 pandemic, and that were open in February 2020, the Labor Department said. Employers recently have begun pushing harder to get staff to work on-site more often, as recession fears prompt an increased emphasis on worker productivity.

Communication Services led again last week and is way ahead for the year along with technology. I do not expect this to continue if the dollar stays in a downtrend. Growth stocks don’t generally perform that well in falling dollar environments. The recent outperformance seems to be more a matter of muscle memory and hope if you ask me. Some traders obviously think we are headed back to the pre-tightening mode where low rates make growth stocks attractive. I’m not sure the whole “growth stocks are long-duration assets” thing ever made much sense in any case. It is true that growth stock earnings are farther in the future than value stocks, which tend to be more established companies. But growth stock earnings are also very uncertain and investors should probably be a bit more skeptical of Silicon Valley’s latest fad (I’m looking at you AI). Nvidia may indeed benefit from AI spending but paying 25 times sales and 60 times next year’s wild guess about earnings might be a tad optimistic.

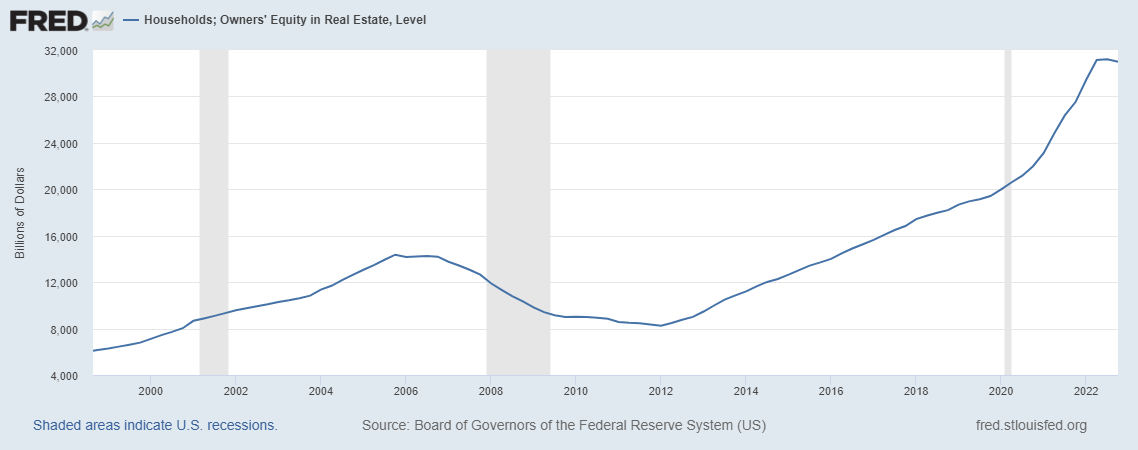

The economic data last week was pretty sparse but we did get some good news on the housing market where existing home sales rose nearly 15% from January to February. The housing market appears to be trying to make some kind of bottom as both new and existing home sales have recently surprised to the upside. Mortgage rates have come down some recently but I don’t think that is the major driver. It is more likely the large amount of cash held by households combined with this:

Home equity is up over 50% compared to pre-COVID. If you are looking to move, you have the problem of higher mortgage rates but you also have the advantage of a lot more existing equity. If you are selling in one place and buying in another, you can still keep your mortgage payments low by putting more cash in the deal. Existing homeowners have two sources for that cash and they appear to be using it.

We did see a modest widening of credit spreads last week and we’re back above 5%. It’s still below the long-term average of 5.4% but it is moving in the wrong direction. The latest widening is almost certainly being driven by the current fears of a credit crunch so an easing of the banking angst will probably see spreads narrow again.

It is easy to get distracted by short-term trends, especially when it comes in the context of a crisis that isn’t fully understood yet and may, in the end, be a tempest in a teapot. It is important at such times to have a process for making tactical changes. Our process is rooted in the trend of the dollar and US interest rates because they both have such an impact on the global economy. Anything that happens of importance in the global economy is going to be reflected in those two prices. And right now, we aren’t seeing much impact from the financial sector problems.

That doesn’t mean we won’t by the way, but I have no way of knowing if there is some big problem lurking out there on a bank’s balance sheet. I have no way of knowing how regulators might respond to anything new or how their current policies might change if no new problems emerge. I could guess and I do have an opinion but I don’t make portfolio decisions based on guesses. And you shouldn’t either.

Joe Calhoun

Stay In Touch