Reports that say that something hasn’t happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don’t know we don’t know. And if one looks throughout the history of our country and other free countries, it is the latter category that tends to be the difficult ones.

-Donald Rumsfeld, 2002

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.

– Mark Twain, Josh Billings, and/or several other people you’ve never heard of

I saw the Rumsfeld quote again recently and it got me to thinking (as many things do). In investing, do we really have known knowns, things we know we know for sure? There are certainly known unknowns and unknown unknowns (black swans) but do we really know anything for sure when it comes to investing? I’ve been doing this for 30 years and so many things have happened that never happened before or weren’t supposed to happen during my career that I’ve come to believe that we don’t know anything for sure.

2 years ago, we knew that an inverted yield curve was an omen of recession. Now, not so much. Maybe the recession signaled by the inverted curve is just around the corner but we don’t know that either. I’ve seen a number of research reports recently that now that the real yield curve (rates adjusted for inflation) has inverted that the recession could come soon. How soon? Well, in the past recession followed an inverted real yield curve by between 7 and 27 months. If you think that is nigh on to useless as a recession indicator you are correct.

In June of 2022, Larry Summers said:

We need five years of unemployment above 5% to contain inflation — in other words, we need two years of 7.5% unemployment or five years of 6% unemployment or one year of 10% unemployment (to bring inflation down). There are numbers that are remarkably discouraging relative to the Fed Reserve view.

That was a very conventional view of how to reduce inflation. I’ve had someone tell me repeatedly over the last couple of years that for inflation to come down, unemployment had to go up. When I asked why he just said, well that’s the way it’s always been – recession kills inflation. And yet, here we are with inflation almost down to the Fed’s target and unemployment is up from 3.4% all the way to 3.7%. Turns out it doesn’t take a recession to kill inflation. One more thing we knew for sure that just wasn’t so.

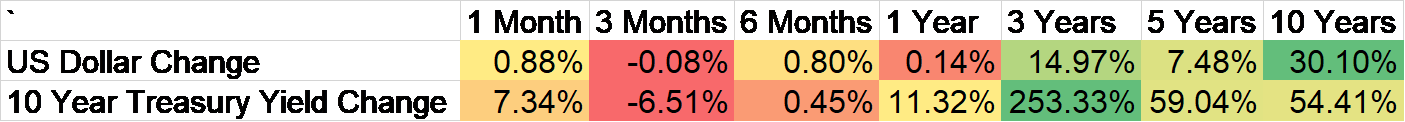

The only things we know for sure in investing are the things we can directly observe. I can tell you that the 10-year Treasury yield is in an uptrend that started in the summer of 2021. I can also tell you that the rate is essentially unchanged since October of 2022, roughly 16 months ago. I can also tell you that the dollar is unchanged over the last year and that, despite some ups and downs, it is essentially unchanged since May of 2022 but that, despite that, the long-term trend is still up. The movements of interest rates and the dollar are, at least in my opinion, the most important information for investors to track. You can’t predict either one but you can at least observe the present trend and act accordingly. And by accordingly, I mean based on how markets have performed in the past when similar conditions prevailed. That isn’t a crystal ball though because things didn’t always act the same in the past and certainly won’t in the future. The fact that value stocks have performed better in a rising dollar environment in the past does not mean they always did or that they always will. But given a choice, if you know that 2/3 of the time in the past, value stocks rose with the dollar, that’s the bet you make.

But most things can’t be observed in real time and can’t be predicted even though they may have a large impact on your portfolio. These are the known unknowns and there are a lot of them today. I think it is important to ask ourselves, on a regular basis, about these known unknowns, to make a list of things for which we are awaiting answers. That way we can, hopefully, know what to do when they are resolved. Here’s my list:

- Do high stock market valuations today indicate lower future returns or higher earnings growth than currently anticipated by analysts? US stock markets are highly valued today with large-cap stocks the most expensive at around 20 times expected 2024 earnings. We know that stock prices track earnings – with some variations around the trend – so are stocks telling us that we’re being too pessimistic about earnings? If so, why? Is the productivity surge we saw over the last year sustainable? Or do high valuations today just mean that a lot of future returns have been realized in the present?

- Is inflation dead or just taking a nap? Inflation has fallen rapidly toward the Fed’s 2% target but we don’t know that it will get there or stay there. There are a number of factors that will determine the outcome. I’ve written about them in a couple of longer-form articles you can download on our site: Dawn of a New Era and The Times They Are A-Changin’. Demographics will play a large role and I don’t agree with the consensus that an aging population means deflation; no we’re not all turning Japanese. I suspect that the Fed’s 2% inflation target is going to be more like a floor rather than the ceiling it has been for so long. If I’m right and inflation is more volatile – and generally rising – in the future, bonds are going to have a tough time. If I’m wrong, it’s ZIRP and QE here we come.

- Will commercial real estate be the catalyst for a financial crisis? That is a popular belief but one that I don’t share. Yes, there are banks that have too much exposure to some asset types and there are real estate operators who were too leveraged coming into a rate hiking cycle. That is as it has always been after a period of easy money. But there’s still a lot of cash out there waiting for bargains to emerge, for sellers to get desperate enough to sell at a big discount. There’s approximately $500 billion sitting in private equity funds dedicated to real estate (and more in distressed funds; SL Green just raised a $1 billion fund with no problem). All that cash has to be put to work and because there are so many players flush, the discounts they’re all looking for probably won’t emerge. Or maybe the most anticipated banking crisis in history is just around the corner.

- Is reshoring or deglobalization or whatever they’re calling it this week really happening? Are US companies actually going to bring production back to our shores? Or is manufacturing just shifting out of China to other low-wage countries? Our imports from China are basically unchanged over the last 10 years but our imports overall have continued to climb as we import more from Mexico, Vietnam, and Korea (among others). How much of those new imports are just Chinese companies shifting production out of China or rerouting products through third countries to avoid tariffs? That’s unknown but we know it isn’t zero. This needs to be watched because both political parties today seem to believe they can use tariffs to force companies back to the US. If they are successful the likely outcome is higher prices and, eventually, lower quality goods. Anyone remember how awful American cars were in the 1970s?

- Are oil prices poised to rise? A big rise in US production over the last few years has been essentially offset by lower Saudi production but US production may be peaking. Production rose by over 1 million bpd last year but the US Energy Information Administration just cut its growth estimate for this year to a mere 170,000 bpd. If that is correct, the balance of power in the oil market seems likely to shift back to OPEC+ and I don’t imagine the Saudis and Russians want lower oil prices. The US has more capacity, by the way, but not the will to drill. US energy companies are more concerned with cost control and returning cash to shareholders, which is why we continue to own energy stocks. It is hard to gauge the impact of higher oil prices on the US economy today with the US as the world’s largest producer. In the past, rising oil prices were often a precursor to recession. Is that still true? Good question.

- Will the application of artificial intelligence raise productivity? Is it already raising productivity? I am generally a skeptic of new technologies or at least the timeline that usually accompanies such things. New technologies usually take years or decades to realize their potential. I don’t have a good answer for this but I worry that we will overreact to the potential problems and strangle it in the crib. I also worry that we won’t overreact.

- Will the push for electric cars continue to flounder and if it does, how much of the capital invested in new capacity will turn out to be wasted? More generally, will the government continue this new push for industrial policy? The Biden administration just handed out $1.5 billion to Global Foundries -and another $1.6 billion in Federal Loans – and is poised to hand out another $10 billion or so to Intel. Will these subsidies pay off? And what exactly does that mean? More jobs? With unemployment under 4%, I am mystified as to where the workers would come from, especially when both parties seem hostile to immigration.

- Will companies force workers back to the office? Should they? Office vacancies are high but the problem is concentrated in places like NYC, Boston, Chicago, and San Francisco. The south and the midwest have largely returned to the office – with more flexible schedules. There does seem to be a more concerted effort to get workers back in the office as management dislikes WFH every bit as much as workers love it. CB Richard Ellis, the commercial real estate services company, announced better-than-expected earnings last week and said they are “cautiously optimistic” that the worst is over for office leasing. That may depend on what interest rates do from here. Another leg up in rates is not going to be positive for CRE.

- Will goods production pick up now that the inventory correction appears to be over? The Philly Fed survey released last week was a positive number for the first time since last August and only the third time in the last 21 months. New orders improved to -5.2 from -17.9, capex rose to 12.7 from 7.5 and business conditions rose from -4 to +7.2. On the other hand, employment and prices paid both worsened. The NY Fed report was similarly mixed but a big improvement from last month. Inventories to sales ratios are generally low with retailers below the level that prevailed for the entire decade prior to COVID. Goods consumption continues to rise so it seems that production – or imports – will have to ramp up to meet continued demand. That is not consistent with widespread expectations for an economic slowdown this year. How will that impact Fed policy and market sentiment?

- Will our politicians ever get their spending under control? Ok, this one I know, and the answer is no. It doesn’t matter who wins the elections this year, who controls Congress or the White House. The budget deficit will persist. How long can that go on? Is there a debt level that makes the world say enough? Probably not for a long time. Private debt to GDP, by the way, has been falling since COVID so the total debt to GDP ratio isn’t much higher now than it was in 2008.

I have opinions about most of these things but I don’t know what will happen; the future is inscrutable. Some of my opinions will turn out to be right and some will turn out to be wrong. All we can really do is observe the trends in the markets and try to determine when sentiment has reached an extreme that might trigger a reversal. Those extremes actually don’t happen very often so big changes in your portfolio shouldn’t either. In the meantime, we invest based on what we know, not what we think we know.

Joe Calhoun

Environment

There is no change in the interest rate or dollar trends. The 10-year yield short-term trend is neutral, intermediate is up (barely), and long term remains neutral to up.

The short to intermediate-term trend of the dollar is down (barely) while the long-term trend remains up. The really, really long-term trend is neutral.

Markets

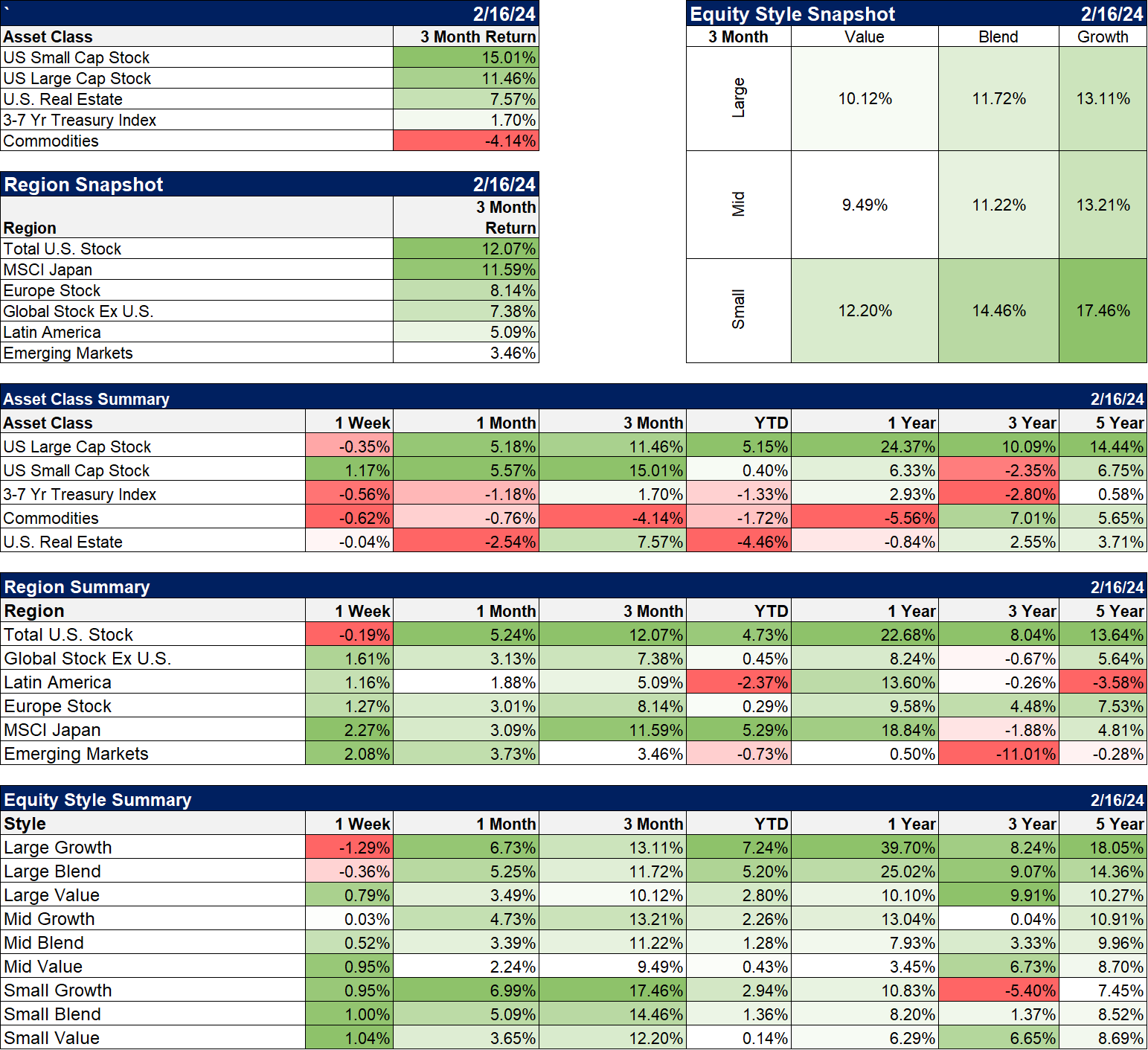

US large cap stocks took a bit of a breather last week but were only down 0.35% on the week. Small cap stocks rose 1.2%, real estate was flat and commodities were down even as crude oil continues its recent rally. International markets were higher even with the dollar unchanged.

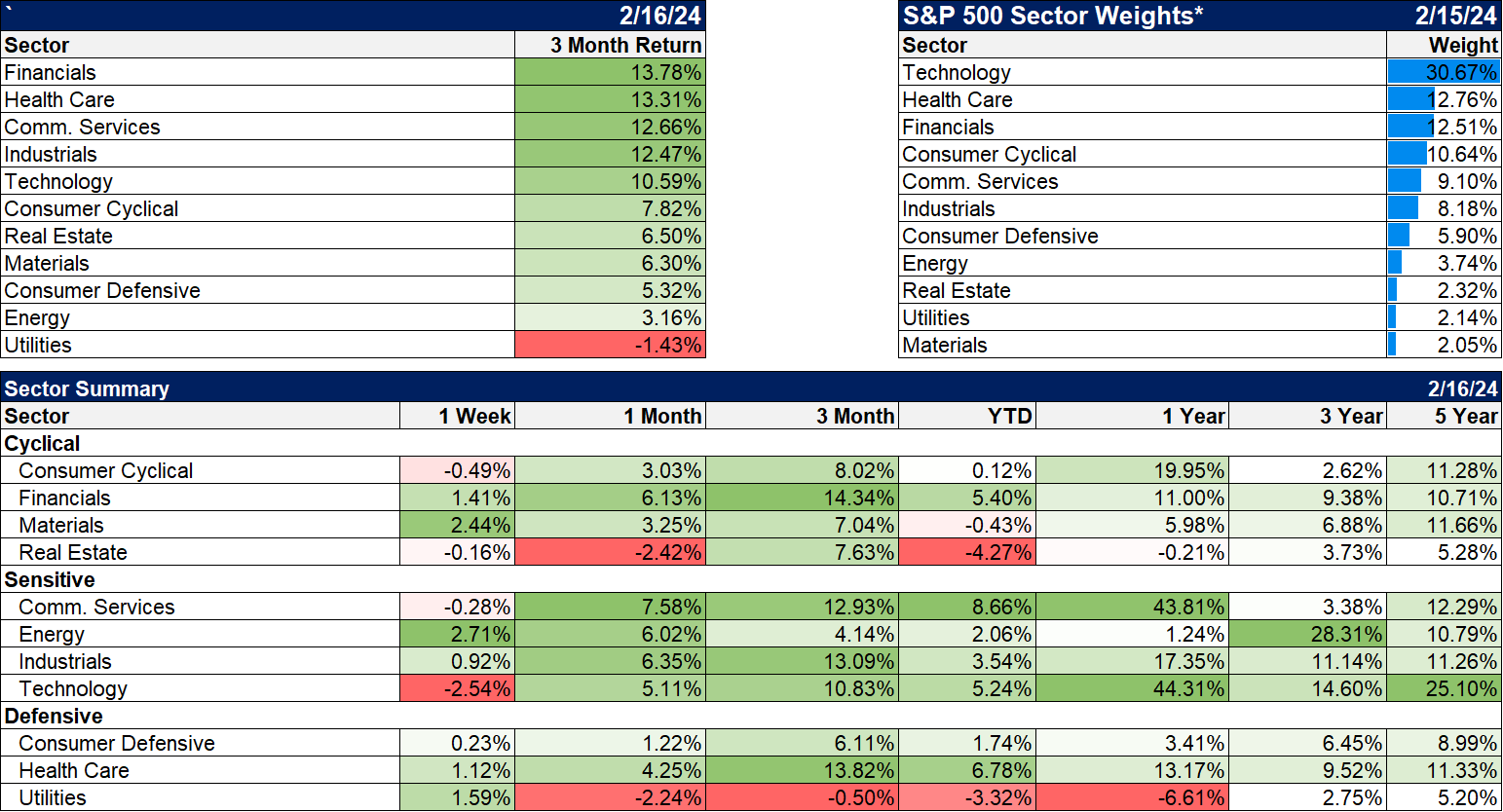

Sectors

The sector winners last week were materials and energy as communications services and technology saw some profit taking.

Market/Economic Indicators

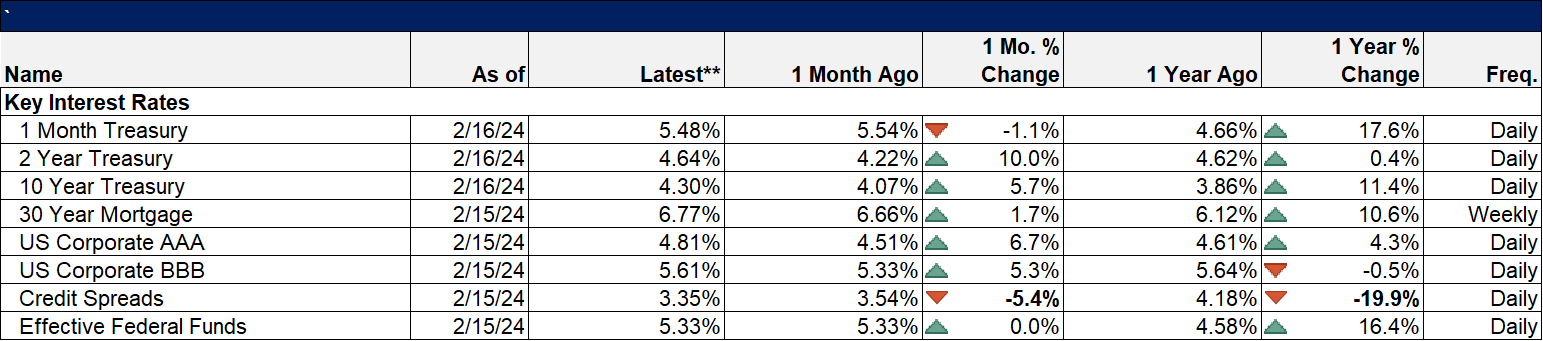

Credit spreads continue to contract. There is still no stress in credit markets.

Here’s a little something to brighten your day. This is from my garden.

Stay In Touch