There has been a lot of talk over the last few months about the US economy slowing but there is scant evidence of it in the economic data. The latest lack of evidence came last Friday with the release of the September employment report which was quite a bit better than expected. The establishment survey showed the economy added 254k jobs in September versus the average monthly gain of 203k over the last 12 months. The totals for July and August were revised higher by 55k and 17k respectively. The household report showed a decline in the unemployment rate, for the second straight month, to 4.1%. The labor force expanded by 150k, the participation rate was steady at 62.7%, the number of employed rose by 430k while the number of unemployed fell by 281k. Meanwhile, part time due to slack work or business conditions fell by 304k. There is nothing in this report that is weak although I’m sure the dedicated pessimists will find something.

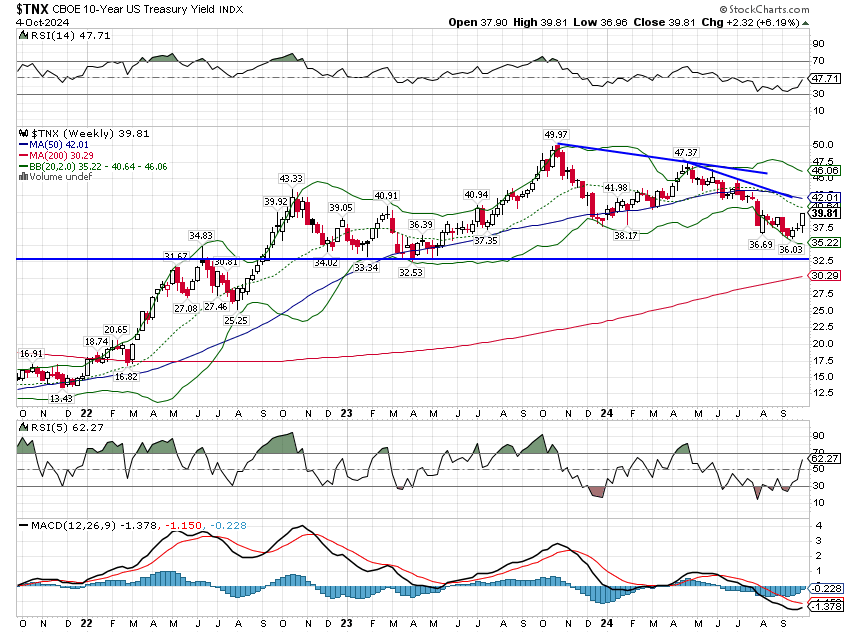

The manufacturing part of the economy continues to struggle, as it has for the last two years, but overall the economy continues to grow at, or slightly above, trend. The ISM manufacturing survey released last week was 47.2, unchanged from the previous month and indicative of a contraction in manufacturing. There has been one reading over 50 (indicating expansion) in the last 23 months so this isn’t new. If we dig into personal consumption expenditures we find that the stagnation in the goods side of the economy is focused on durable goods, which isn’t surprising given the rise in interest rates; durables like vehicles and household goods often require financing. With long-term rates rising 34 basis points since the Fed’s rate cut two weeks ago, the recovery may continue to be delayed. Any rise in the 10-year Treasury rate feeds directly into mortgage rates which rose back to 6.5% last week after falling briefly to 6%. And recovery in housing seems necessary for a recovery in durable goods consumption and then manufacturing.

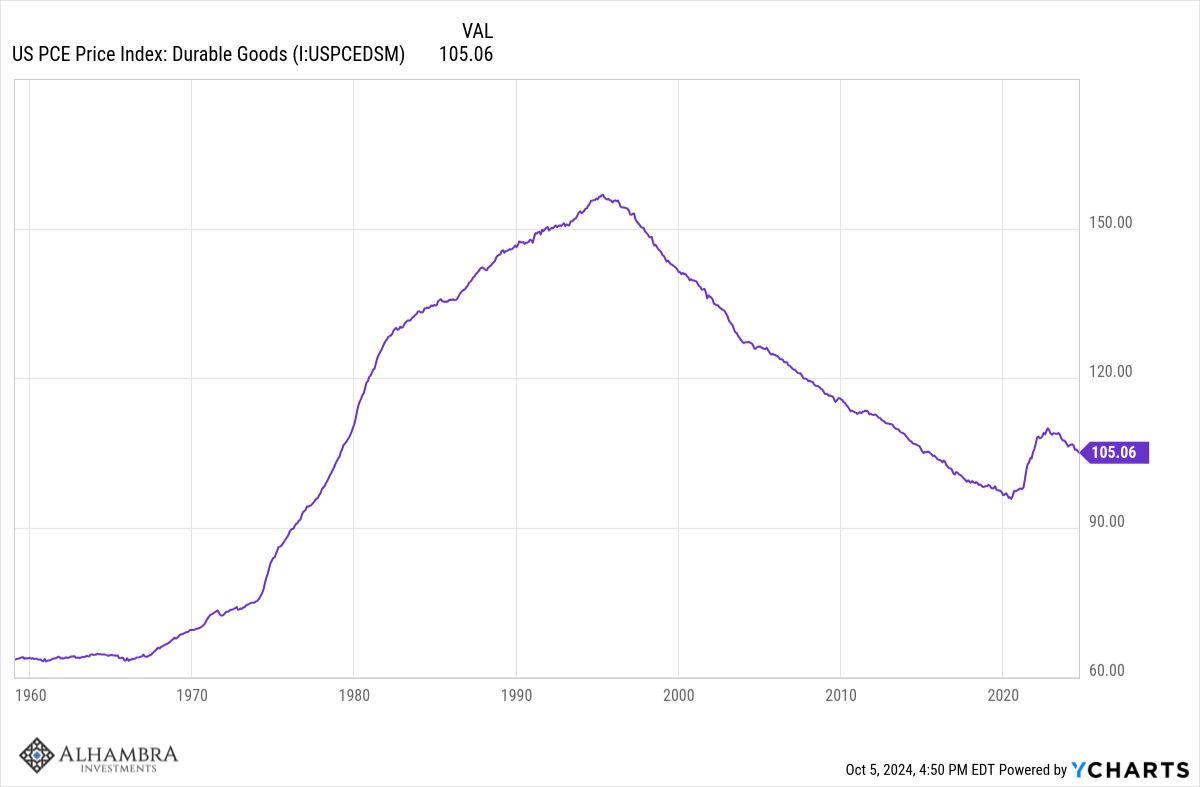

The service part of the economy, on the other hand, is doing great. The ISM services survey, also released last week, rose to 54.9 in September from 51.5 in August and versus expectations of 51.7. Business activity and new orders both clocked in over 59 which is about as good as it gets. The price index rose to 59.4 so it wasn’t all good news but services have been the main source of inflation going back a long way before COVID. Except for the blip higher during COVID, durable goods prices have been falling since the mid-90s. They started to fall again 2 years ago in the summer of 2022.

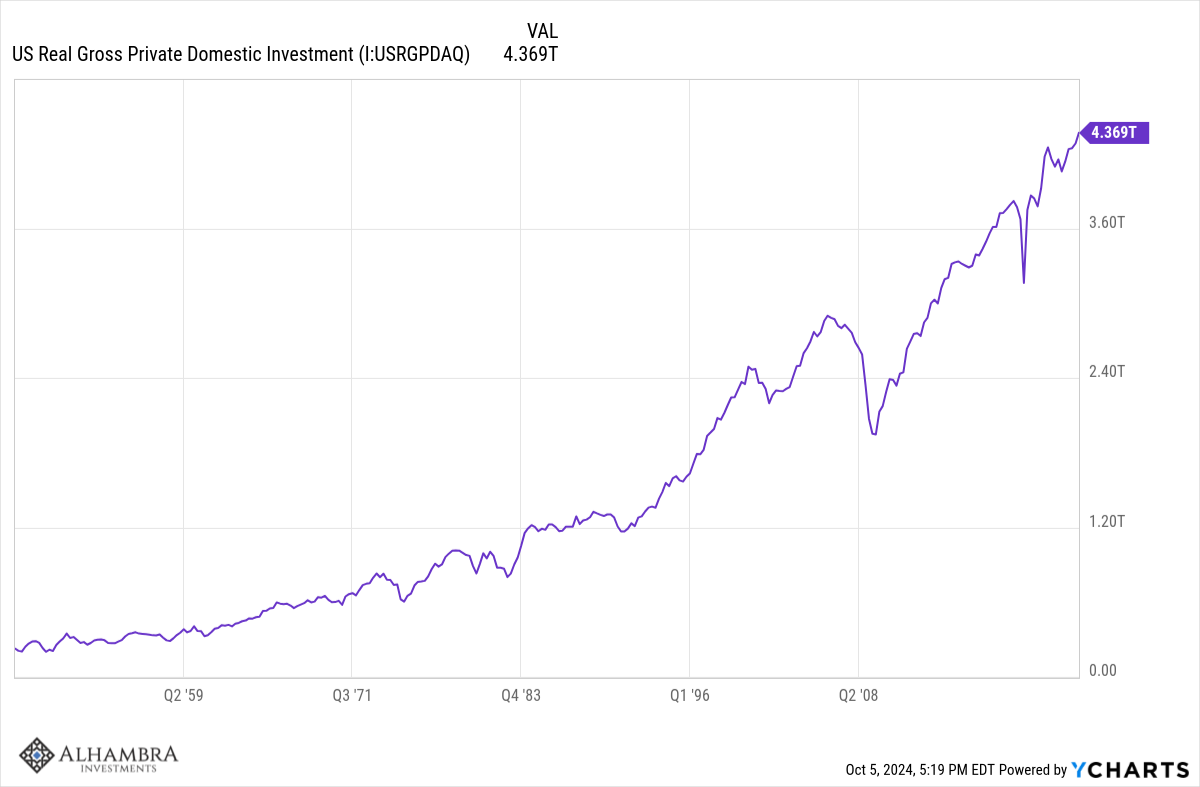

With services consumption roughly twice the size of goods consumption ($13.6 trillion vs $6.3 trillion), it isn’t surprising that the overall economy continues to grow. The simple explanation of the economy over the last two years is that interest rates rose, restraining real estate activity and durable goods consumption while having little effect on services consumption. The more complicated explanation involves investment and that’s where I think things get more interesting. Real gross private domestic investment rose 5.6% year-over-year in Q2 and based on recent Artificial Intelligence investment trends, I think it is highly likely that run rate will rise in coming quarters and with it overall GDP growth.

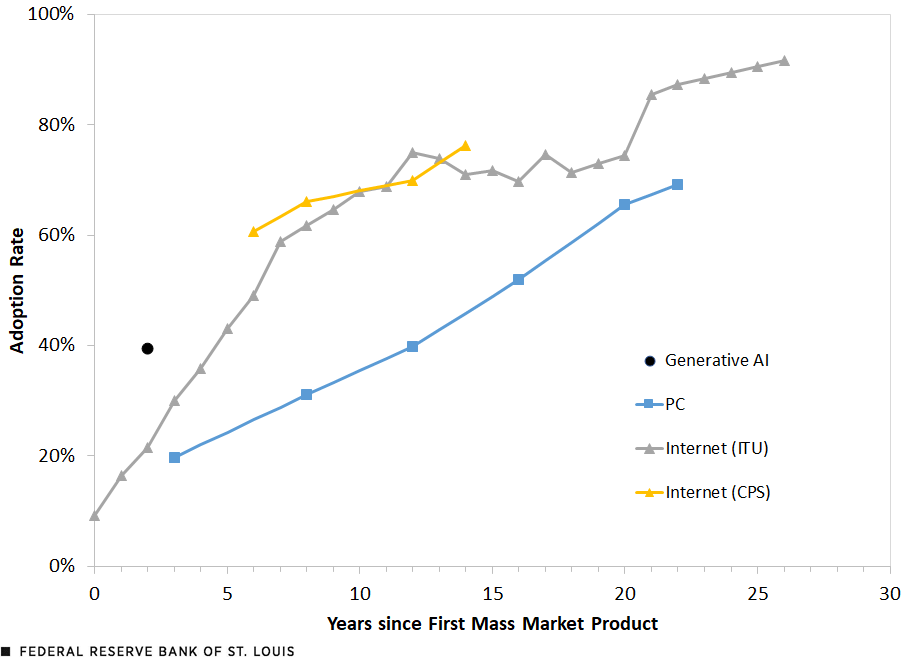

The St. Louis Federal Reserve recently published a working paper on generative AI that shows the adoption rate over the first couple of years is greater than we saw for PCs or the internet:

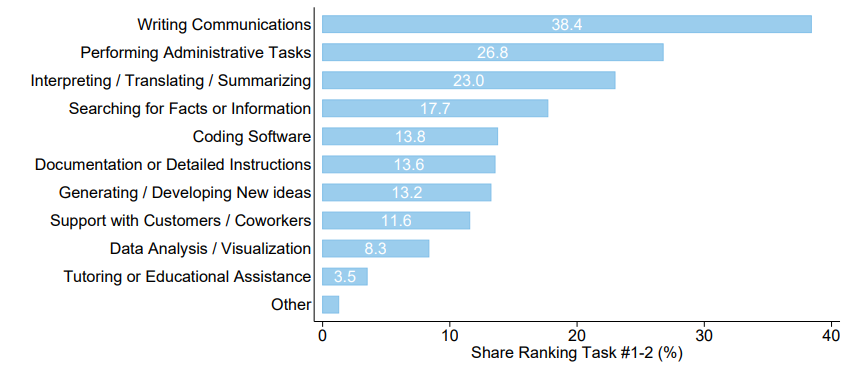

The adoption isn’t confined to technical fields but is quite widespread across industries and uses:

Whether this adoption translates into higher productivity is a question that can only be answered in retrospect but the authors of the paper estimate that generative AI could increase productivity by 0.125% to 0.875%. That seems quite modest considering the amount of corporate cash being spent but they also admit their estimate is little more than a WAG. We do know that this initial investment phase is creating economic activity today – building data centers and power generation capacity for instance – but we have no way of knowing the long-term payoff. The internet was also adopted fairly rapidly and there was a similar period of vast investment – which turned out to be way too much, way too early. That’s what we now refer to as the dot com bubble and bust, a model that could be useful in the next few years. Much of what was imagined in that initial dot com boom turned out to be correct but the vision was easier than the implementation. That boom produced, for example, a large investment in fiber optics capacity that took years to absorb. Today we’re seeing large investments in the infrastructure that is needed to support the widespread adoption of AI and I can’t help but wonder if we’re seeing the same sort of over-optimism.

OpenAI raised $6 billion last week like it was nothing. That it comes less than two years since Microsoft’s $10 billion investment tells you how much cash the premier AI company is burning through; they are spending it as fast as they can raise it. I must say, I greatly admire Microsoft’s investing acumen. They invested $10 billion in exchange for a share of the profits (which are currently non-existent) but also host OpenAI’s infrastructure which means they are collecting most of what OpenAI spends on training costs ($3 billion this year) and keeping ChatGPT running ($4 billion this year). Microsoft may well have made back their investment already. OpenAI is raising and losing billions while they build out their AI offering with little indication of how they intend to recoup the investment. I have to say, having lived through the dot com era, it gives me more than a bit of deja vu. Back then, the metric everyone loved was eyeballs or clicks which didn’t translate directly into profits. Today it is adoption rates and number of users which also don’t translate directly into profits.

Utility stocks have been the biggest stock market winners this year based on the expectation that AI will require large amounts of electric power and that is no doubt true if its use becomes as ubiquitous as is now easily assumed. The price run up has stretched valuations and the sector now trades for over 18 times next year’s estimated earnings. That might be a bit rich for a sector with earnings growth in the high single digits. There are individual utilities, such as Constellation, trading for a lot more, some in the range of 30 times. Constellation owns Three Mile Island, one reactor of which they are planning to restart. Microsoft has agreed to purchase the full 835 MW output of the plant at a premium price of $110-$115 per MWh. If that seems like a lot of power for one company (enough to power roughly 700,000 homes) you are correct, which means that unless a large increase in demand materializes by 2028, Microsoft will be in the wholesale electricity business (or maybe the carbon free energy business).

I don’t know what the future of AI holds, whether it will be a boon to productivity or a bane. I do feel pretty comfortable saying that the investment being made today to find out is impacting the economy now. The data centers are being constructed and the equipment is being produced to build them out. There are currently 133 gas-fired power plants in the works and at least two nuclear power plants will be restarted with the government providing multi-billions in financing. This is real activity in the here and now so it will show up in the GDP numbers. The impact of AI right now is positive because it involves investing a lot of money in real things. The long-term impact on growth is a very large unknown.

Markets, on the other hand, are acting as if the outcome is a foregone conclusion. The market sentiment measures I watch are all in the overly bullish range, flashing at least yellow and a few bright red. If, as the saying goes, one is supposed to be fearful when everyone else is greedy, how do you think you should feel right now?

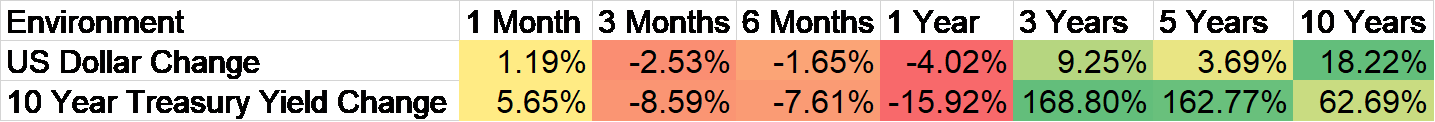

Environment

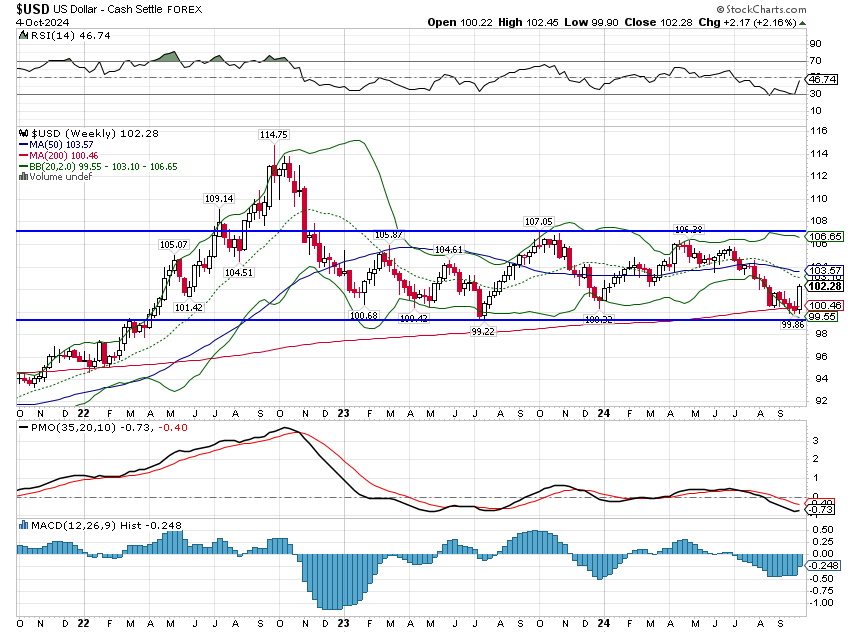

With the release of the employment report last Friday, the dollar and interest rates bounced from the bottom of the range in which they’ve traded for nearly two years. The dollar was already climbing some, likely due to nervousness about the Middle East, but the solid employment report moved it more. The trend for rates and the dollar are still neutral with the short term downtrends now seemingly over. That could change if the perception of the economy changes but for now the trend is no trend. And that is a good thing by the way.

The stability of the dollar and interest rates reflects the stability of the economy overall. It may not seem that way because the economic data on a month-to-month basis is volatile but a little perspective makes it pretty obvious. I have some long-term concerns about future growth and inflation, much of it rooted in demographics and fiscal/regulatory policy, but markets are speaking rather clearly here that those concerns are not being realized. It may be that my concerns are overblown or it may be that the market is too complacent about the risks but we won’t know the answer to that until some point in the future.

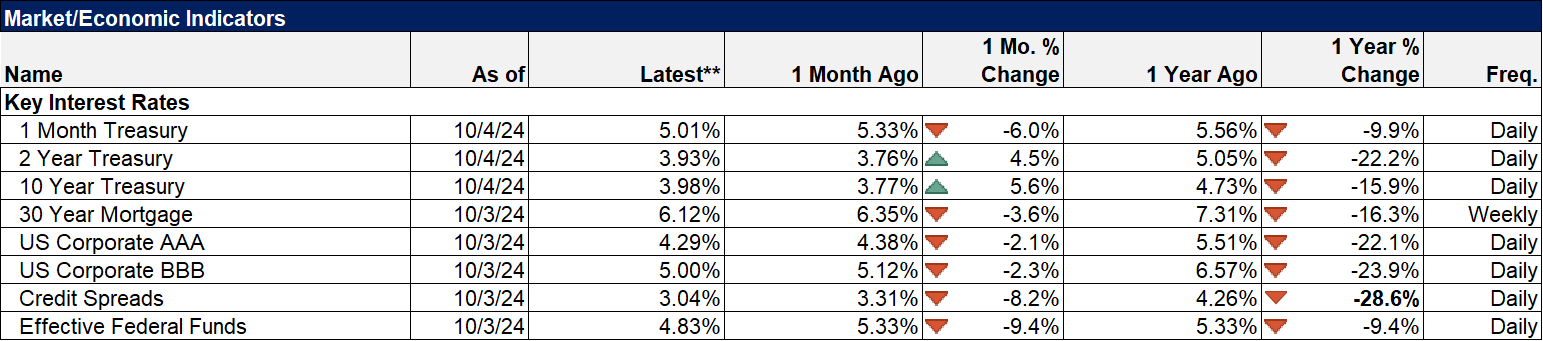

The 10-year yield rose 23 basis points last week with most of it coming on Friday. Real rates rose too but not as much as nominal so inflation expectations rose somewhat but not enough to raise any significant concern.

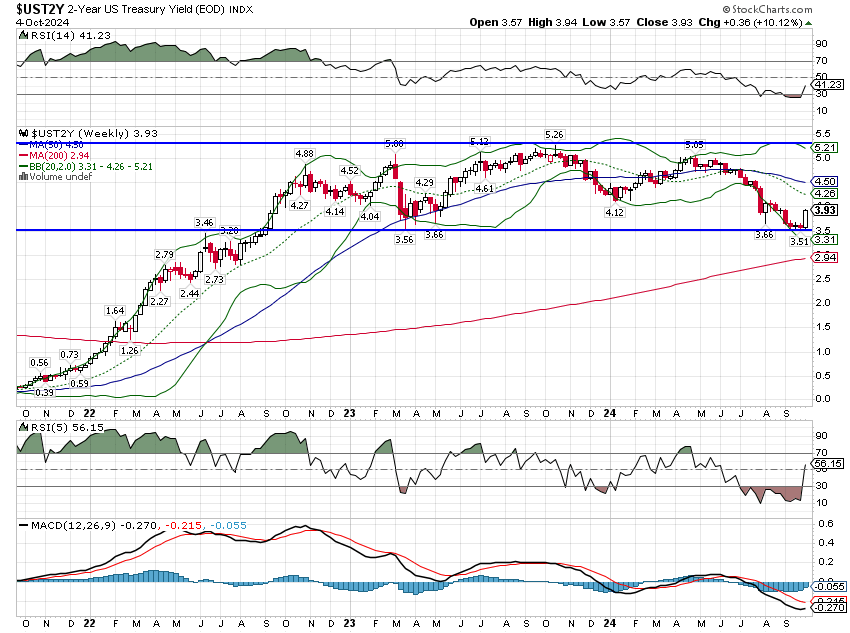

The 2-year yield rose a rather astounding 36 basis points on the week as the market reconsidered its view of future Fed policy. Coming into Friday, the market was almost fully pricing in 3 rate cuts before the end of the year. At the close Friday the market was barely pricing in two cuts. We aren’t there yet but I would not be surprised if another cut gets priced out in the coming weeks.

Markets

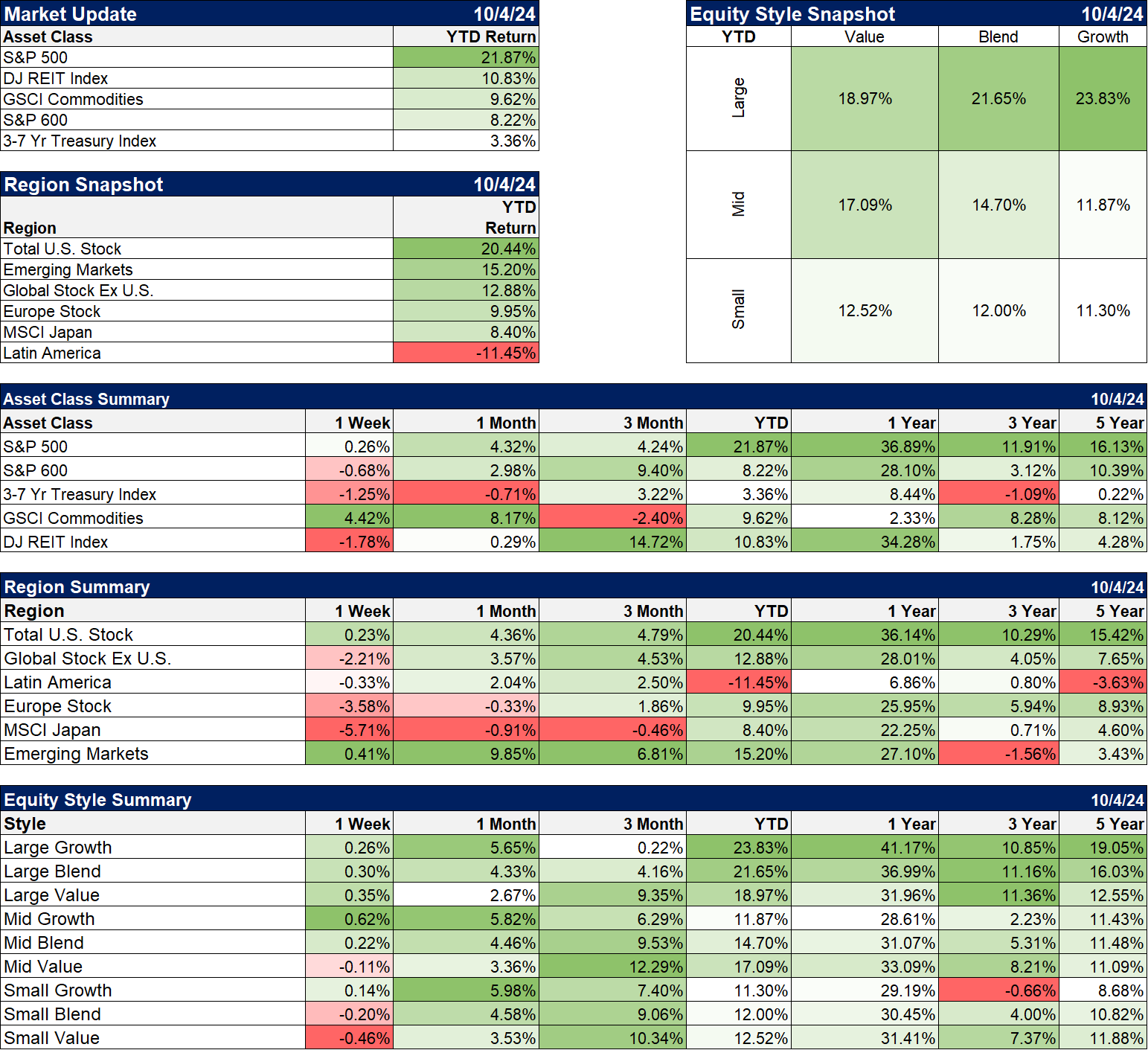

Good news is bad news I guess. The employment report shored up concerns about economic growth and stocks rallied on Friday but it was mostly a down week. That may be because while the employment report got the most press, the other economic reports of the week were pretty good too and interest rates were already firming before Friday’s blowout. Or maybe stocks were on the back foot because of concerns about what Israel might do in response to Iran’s ballistic missile strike. Commodities certainly had a good week on the back of a monster rally in crude oil, up a bit over 9% on the week. REITs were weak with rising rates but they were due for a correction anyway after a quick 20% rally since the beginning of May.

Growth stocks led the way last week but still lag value over the last three years across all market caps (large, mid and small). EM stocks were up last week but that was entirely due to China. EM ex-China was down 3.7% on the week.

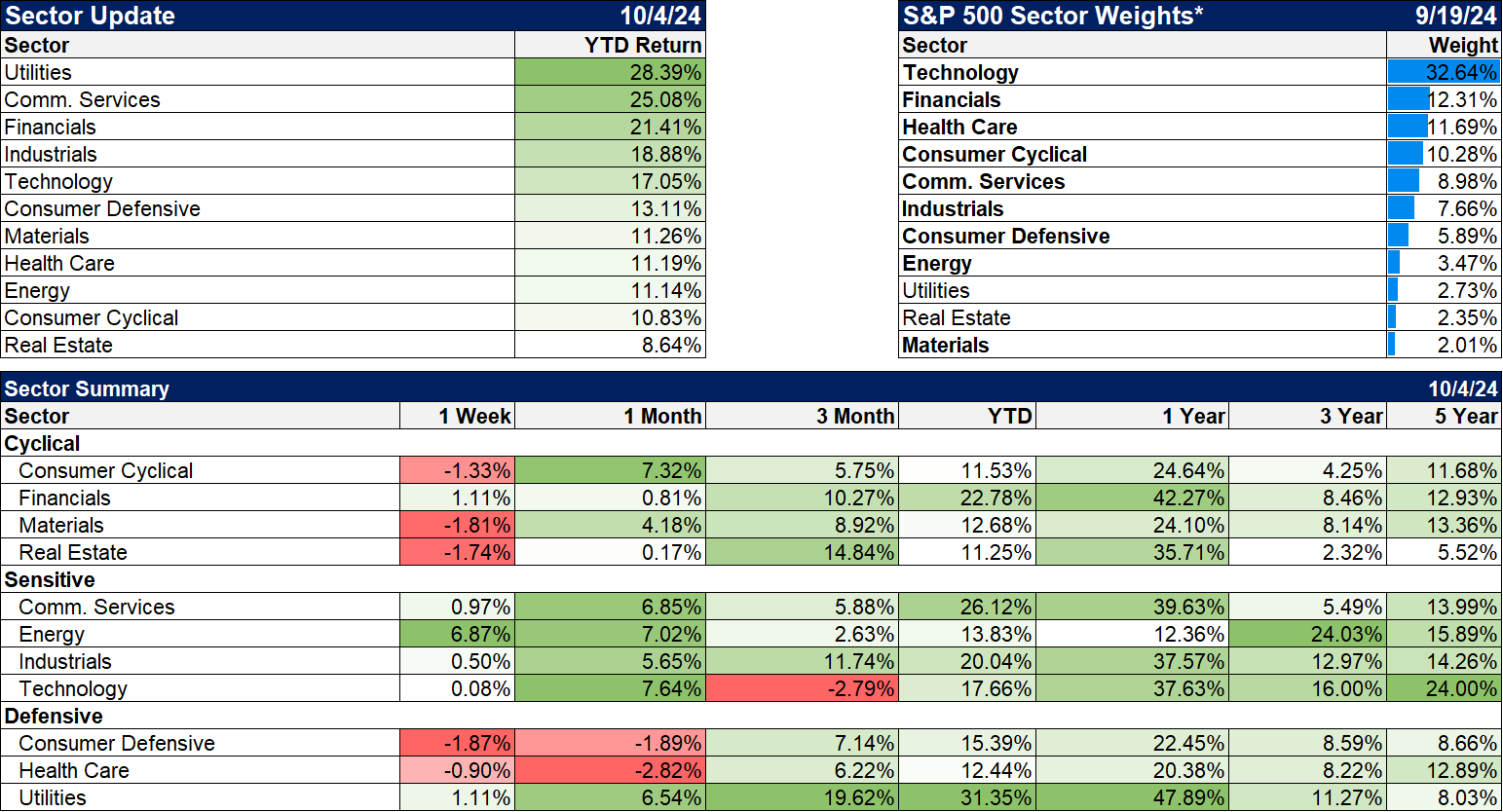

Sectors

The big winner for the week was energy (obviously) but financials, communications services, industrials, and utilities also posted gains. Energy is still lagging the S&P 500 this year but leads over the last three years. It is still a fairly narrow rally this year with only 3 of the 11 sectors outperforming the S&P 500 YTD. Utilities have been the big winners this year and I have to say I underestimated the AI push in these stocks. I wonder if Microsoft committing to buying the entire output of a Three Mile Island reactor might mark the top in electricity demand expectations.

Market/Economic Indicators

Last week’s data:

-Dallas Fed Mfg survey; minor improvement from -9.7 to -9

-Redbook 5.3% vs 4.4% rebounding nicely

-ISM mfg survey 47.2 vs 47.2, internals weak

-Construction spending -0.1%, third negative month in a row but improving from worst level. Private spending down a little, public spending up a little

-JOLTs – job openings back above 8 million, up 329k, quits were down – anxiety about jobs?

-Jobless claims 225k, still very low

-ISM Services jumped to 54.9, much higher than expected 51.7 and 51.5 last month; business activity 59.9, new orders 59.4; very strong numbers

-Payrolls +254k, unemployment rate down to 4.1%, avg. hourly earnings +0.4%, 4% yoy (real very good w/CPI +2.6% yoy and PCE +2.2% yoy), participation rate 62.7 and steady.

-Household survey: 150k increase in workforce, +430k employed, -284k unemployed, part time for economic reasons -206k

The only data of any significance next week is CPI and PPI on Thursday and Friday respectively. Expectations for CPI are for 0.1% overall and 0.2% for the core reading. The Cleveland Fed’s inflation nowcast has current core expectation at 0.27% which would be rounded off to 0.3% if that is where it prints. So the potential for a negative surprise is there.

Credit spreads are basically back to their lows for the cycle so risk appetite is robust in credit.

Mortgage rates rose back to 6.5% on Friday in the wake of the employment report.

Stay In Touch