Okay, I confess. It was my fault. I decided to take a couple of days off. I took my eye off the ball and the stock market fell a quick 2% while I was relaxing, eating too much, and seeing some great art in the Holy City, Charleston, SC. I promise it won’t happen again, at least until my wife tells me where we’re going next.

It is a running joke within Alhambra that every time I go away for a few days the market takes a hit. Of course, that isn’t true even if that’s how we remember it; all kinds of things look different in the rear view mirror. We humans are the masters of selective memory. We remember ourselves as being calm through every downturn in the market during our investing career; only our subconscious knows better. It’s easy to look at some past correction or bear market or recession and wonder how in the world anyone could have missed something so obvious.

But you know it isn’t that easy in real time. When markets take a hit like last Friday, we assign meaning to it even though we have no way of knowing what all the other traders and investors were thinking, why they were selling or why they were not buying. We will worry that is the start of something bigger, that the correction or bear market is finally here. It feels like the end of last week was significant but it always feels that way after a big down day. But, but, but last week we got weak economic data, there was a scary story getting passed around about a new coronavirus in China and it was options expiration day and, and, and….All that is true and yet no trends changed Friday. None. Every trend that was in place on Wednesday was still in place by the close Friday.

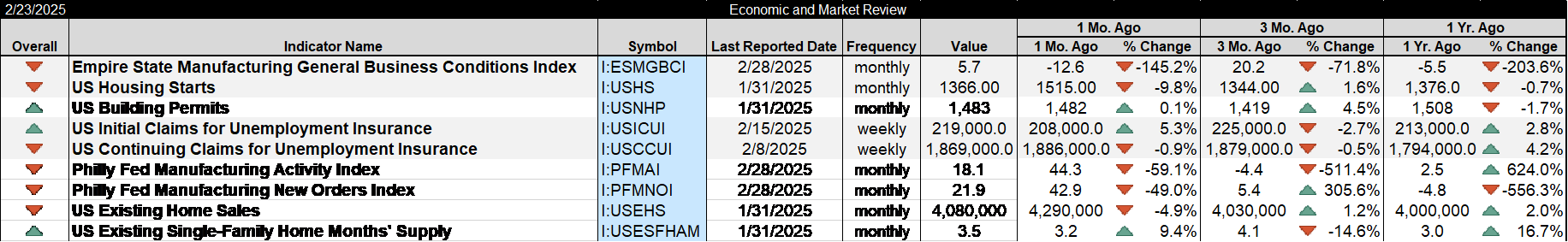

We did get some weak economic data last week. Housing starts, housing permits, and existing home sales all fell in January. The housing market is weak isn’t exactly news if you ask me and all of those metrics are improved from where they were 3 to 6 months ago. I wish the housing market would improve but with uncertainty about future economic policy at extremes, I’m more concerned about next month and the one after that. Last week’s data didn’t change anything. More weak economic news came from the S&P Global US PMIs where the composite fell to 50.4, barely above the expansion line of 50 and the services component fell to 49.7, below 50 for the first time since early 2023. On the more positive side, the manufacturing index rose to 51.6, just barely enough to offset the negative of the services part. That could be a trend change but if so it is one we expected and have talked about on our podcast.

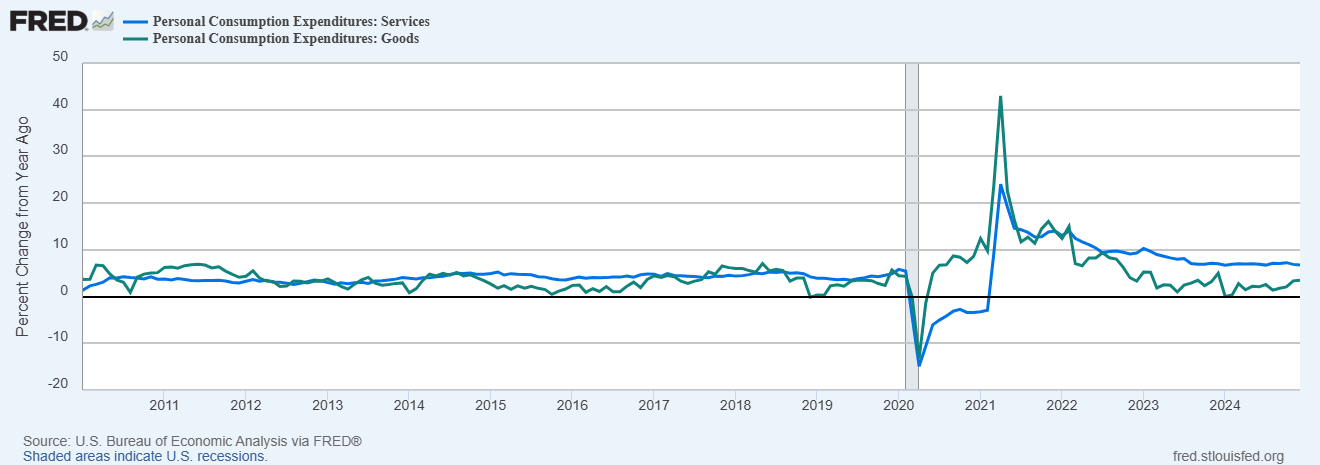

We have been anticipating a ramp up in goods production since last year because the inventory overhang from COVID has been worked off. Even if goods consumption just continued to grow at the current pace, production (and imports) would have to rise to meet demand. As for services, despite the below 50 reading on the S&P PMI, the latest figures from December show a 6.7% year-over-year change in services consumption. That’s well above the average of 4% we saw during the 2010s. There is also a pretty good explanation of why services consumption may be starting to lag some. The Trump administration’s emphasis on tariffs as an everything tool means that lots of US businesses and individuals are buying goods today just in case the President does actually follow through. We’ve seen this in the import numbers and I suspect we’ll see it in the durable goods and personal consumption numbers this week. If goods consumption rises artificially, it shouldn’t be a surprise that services has to pull back to make room for it.

There was also good news last week, data that confirmed the upturn in manufacturing. The Empire State manufacturing survey was back in positive territory where it’s been for 5 of the last 7 months. The Philly Fed manufacturing survey was also well above zero (although down from last month’s huge jump) at 18.1 and has now been positive for 9 of the last 12 months. The only bad news in the survey was the rise in prices paid from 31.9 to 40.5.

Even without the threat of tariffs, the growth rate of goods consumption was likely to rise and the growth rate of services was likely to fall; the tariff threat just accelerated the process. Prior to COVID, the growth rate of the two was similar and if one turned down so did the other, but since COVID that hasn’t been true. That’s why so many market pundits got the recession call wrong. When goods consumption turned down they expected services to follow but it didn’t because services consumption was supported by COVID savings and rising incomes. COVID changed consumption patterns, which still aren’t back to normal – and now they’re being distorted by the Trump administration’s tariff agenda. Goods consumption is more volatile than services consumption and the rate of change was already turning higher before the threat of tariffs. Goods production will have to ramp up some to meet that rising demand. Meanwhile, services consumption – whose growth rate was already falling pre-Trump – is still rising at a rate well above the pre-COVID average so it isn’t surprising that it continues to moderate. All the data from last week merely confirmed trends that were already in place.

We don’t know what the consumption and durable goods reports will show next week. We don’t know what tariffs will actually be enacted and sustained or which ones will never be imposed because a trade deal gets done. We don’t know what the corporate tax rate will be for 2025 or ensuing years. We don’t know if Congress can somehow produce a bill that reduces taxes and also reduces the deficit, although history says it is unlikely. We can never know the future but usually change is incremental while the current environment feels more unsettled than it has in a long time. It would be natural for people to wait and see how some of these things get resolved. It is what we warned about before the election; one party control creates more uncertainty because they try to make big changes (something that applies to either party by the way). But is that uncertainty enough to cause a recession? We don’t know. We have only markets to guide us and, as I said at the top, no trends changed last week. (see the sections below).

There is no way to know if last week’s minor selloff in stocks was the start of something bigger. We can’t know whether the economy will continue to slow or when the economic policy uncertainty will be reduced. All we can do is observe and respond when necessary. Last week’s data and market action certainly weren’t sufficient to warrant any response. One week doesn’t make a trend.

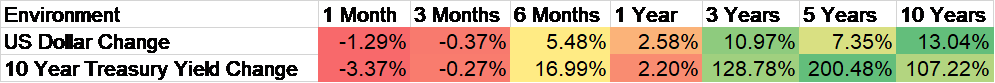

Environment

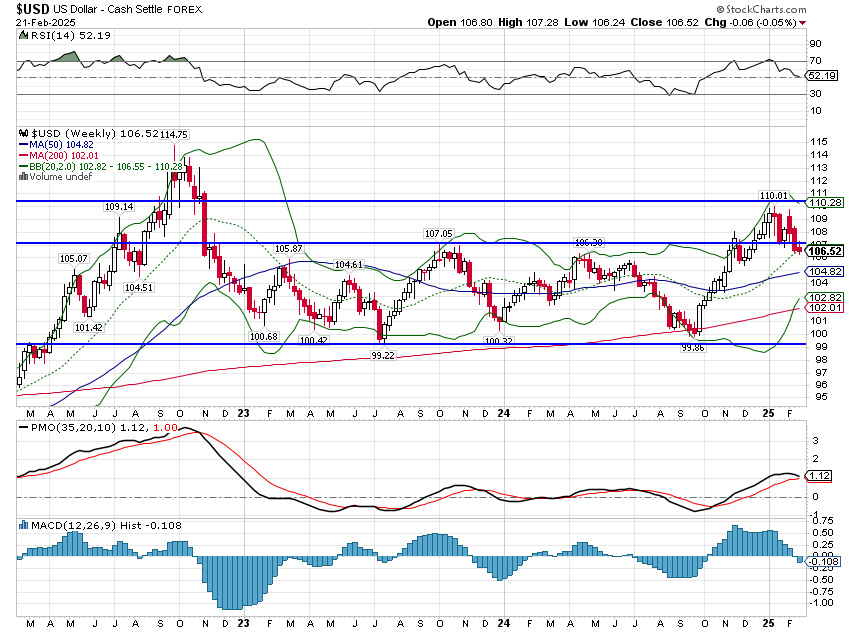

The dollar was unchanged last week and remains near the high end of the range that has persisted for the last 2+ years. If you’re just looking at technicals, I think most traders would prefer to be short. But the uncertainty of tariffs adds some additional risk that it seems a lot of traders aren’t willing to assume; speculators have built a decent sized long position in the DXY. They’ve also built large – very large – short positions in the Canadian $, the Aussie $ and the New Zealand $. There’s also a large short in the Swiss Franc vs the US buck and a pretty big one in Euro futures too. Maybe all those speculators are right and the dollar is about to soar but I’d be careful making any assumptions about the Trump economic team. A lot of them seem to think a weaker dollar would solve a lot of problems but their tariff agenda is getting in the way. Maybe their bet is that tariffs will be seen as so bad, a little currency appreciation will seem like a small price to pay to avoid them. Whatever their plan, right now the dollar is just marking time.

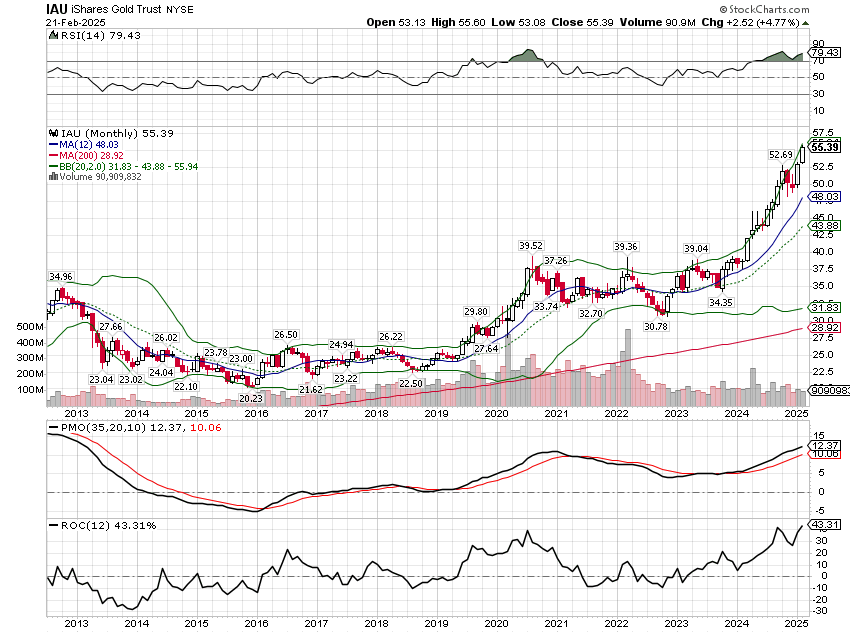

Despite the fairly stable dollar index, gold continues to defy gravity which is not, as I’ve said before, a good sign. People don’t buy gold when they’re confident about the future; they buy gold when they’re scared. From a technical perspective gold is way overbought so a pullback of some kind should be expected. Which makes me wonder what might assuage people’s fears.

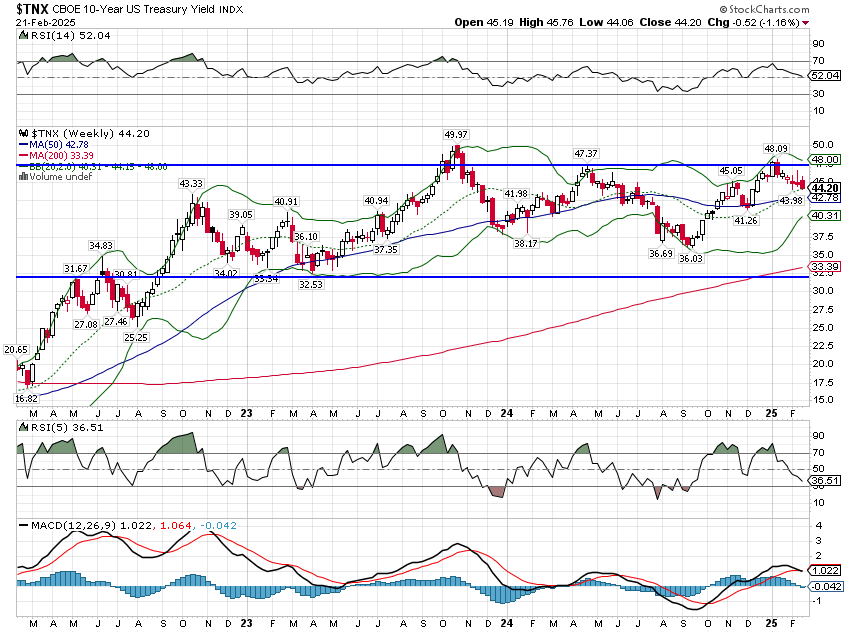

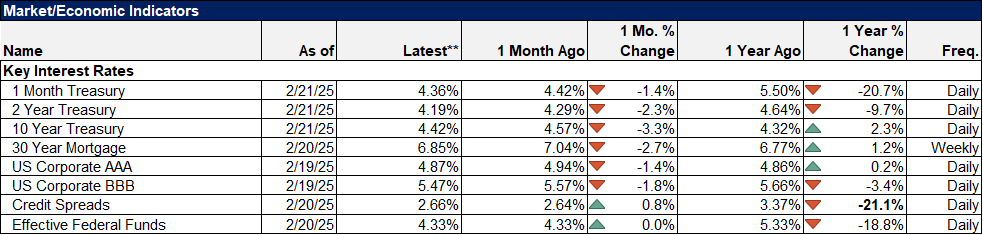

Bond yields were little changed last week which makes perfect sense when you have a week of balanced economic data, some weaker, some stronger. We did see the odds of a Fed rate cut in May rise last week, from 18.5% to 74% so the data was seen as weak. Odds of another cut later in the year remain low though so not a lot changed. The 10-year Treasury yield is a pretty good approximation of market expectations for nominal growth and those expectations have risen considerably since the September Fed rate cut. They’ve only come down slightly from the peak at the end of last year.

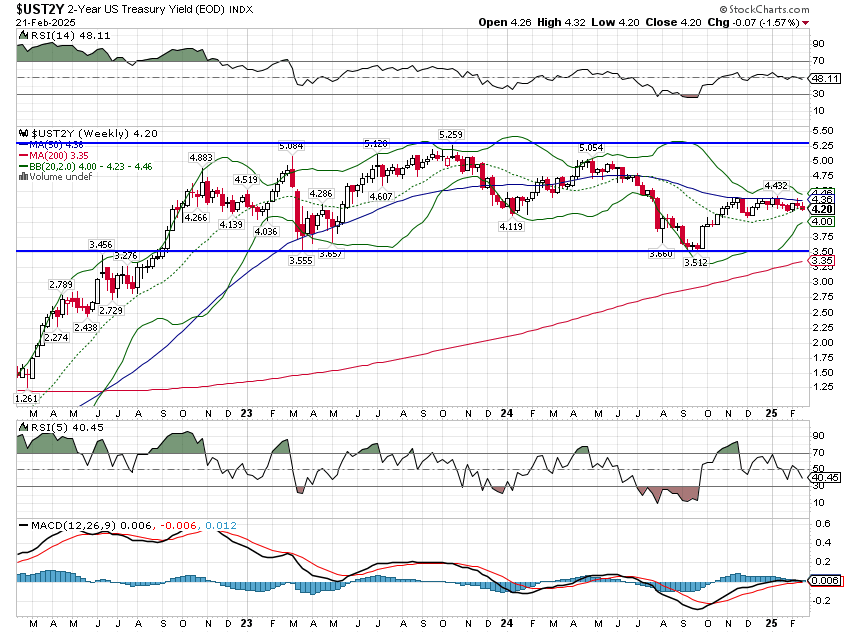

The 2-year Treasury yield is mostly influenced by Fed policy and is essentially unchanged since the end of October. The news flow may have accelerated but it isn’t having a lot of impact on markets – yet.

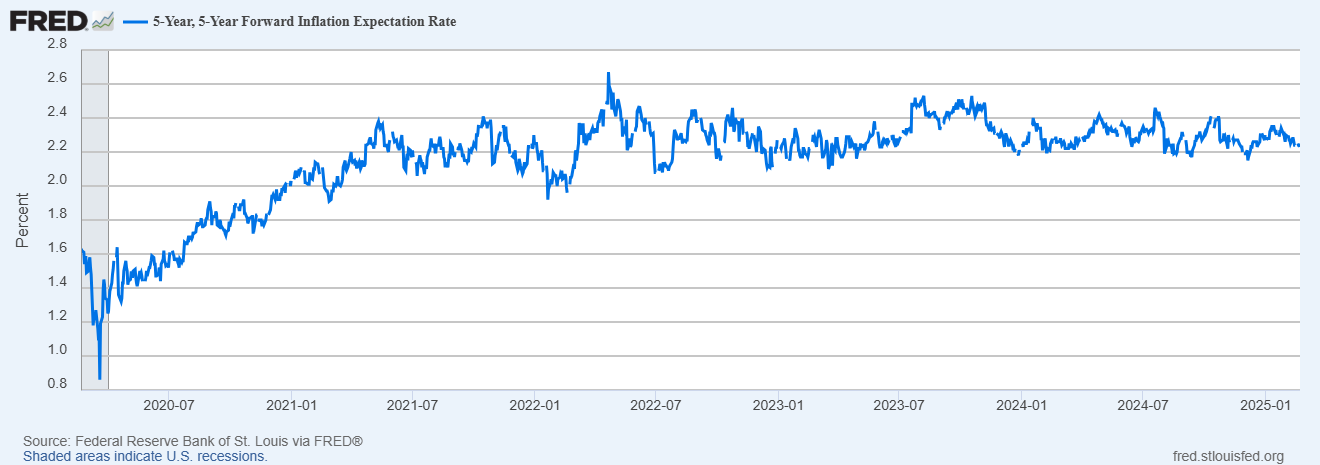

TIPS yields and nominal yields together give us information about inflation expectations in markets. It is quite interesting right now because while 5 and 10-year breakevens are rising, the longer term 5-year, 5-year forward is steady as a rock. The market is looking for more inflation in the short term (5-year breakeven rising from 1.86% when the Fed cut in September to 2.61% today) but stability in the long run (5-year, 5-year forward inflation expectation is 2.23%, unchanged since the first Fed rate cut).

Markets

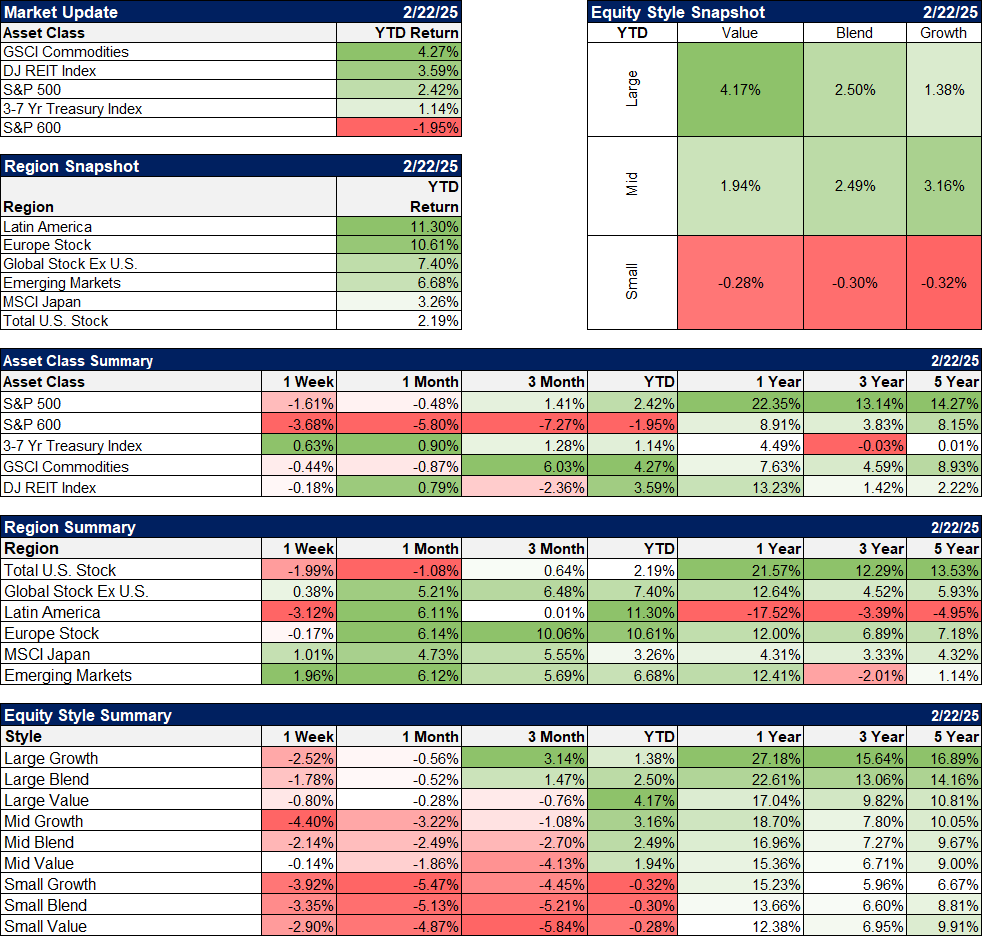

Not a fun week but not too much damage either. I’d suggest zooming out a little because the year is still off to a good start (with the exception of small caps which can’t seem to catch a break). Commodities and real estate are leading YTD against US stocks and bonds but the real surprise continues to be non-US markets. It is hard, to say the least, to figure out what is motivating investors to buy non-US stocks but if the dollar weakens more, it would be a tailwind for the trade.

Large cap value stocks continue to lead in the US markets as the rally has broadened out this year. It hasn’t, however, broadened enough to get small caps off the mat.

Bonds are off to a pretty good start this year after three straight years of losses. On the other hand we don’t want to see big returns from our bonds because that would, more than likely, coincide with a weaker economy.

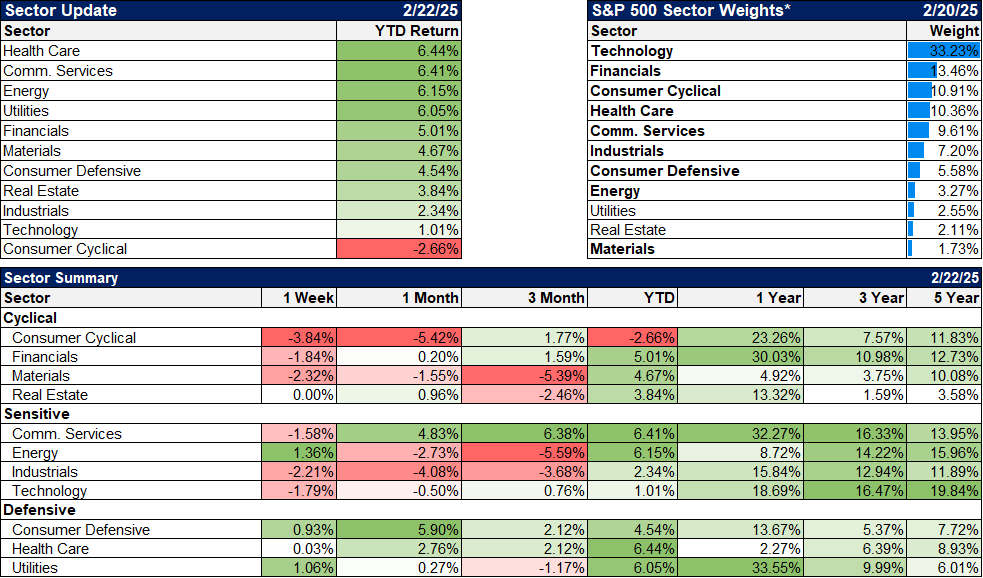

Sectors

Things that were previously unloved are performing well this year. Health care, energy, materials, real estate and defensive stocks are all beating the S&P 500. Consumer staples did very well last week, up nearly 2% as the market went the other direction. Within that defensive sector, food companies had a great week with Mondelez and Hershey both up over 4% after performing terribly in the last quarter of 2024. General Mills and Kraft Heinz were up over 3% for the week.

Economy/Market Indicators

Housing weakness last month wasn’t a surprise as mortgage rates had surged back above 7%. But they’re coming back down so let’s see how February looks.

Economy/Economic Data

I covered this economic data at the top but one report not mentioned was the University of Michigan consumer sentiment poll. I don’t put much weight on it because, like a lot of survey-based “data”, it has become politically polarized. The fact that Democrats are negative about things when a Republican is in the White House is no more surprising than the opposite. But these reports do seem to still have some impact on markets and last week’s was not that great. The headline number came in at 64.7 down from the mid-month read of 67.8 and way below last month’s 71.1. Expectations and current conditions also fell. It is mildly interesting that Republican consumer sentiment stalled in February, only matching January’s 86.7. Their view of current conditions also fell from 59.3 to 55.7. That contrasts with how Democrats sentiment changed after Biden won in 2020. By February both Overall sentiment and Current Conditions were much higher than where Republican attitudes stand today. Maybe that’s just the business cycle playing out but with Republican expectations so high (106.6) disappointment seems likely, at least in the short term.

The inflation measures in the U of Michigan polls reflect the current TIPs market where short-term expectations are rising while long term stays constant. For this survey, the one-year forward expectation is for 4.3% while the 5-year expectation is for 3.5%. Both of those were up from last month but they have never been very correlated with the actual outcome so don’t get too worked up about it. This survey is a lot smaller sample than the TIPS market.

Stay In Touch