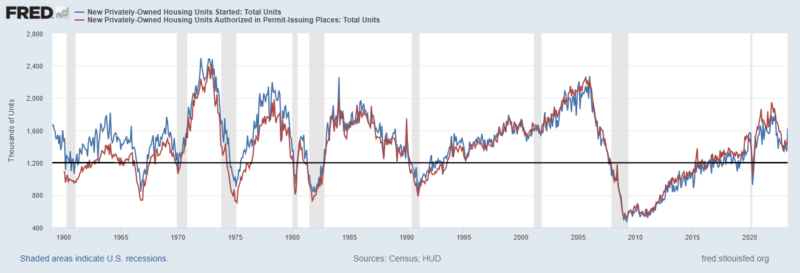

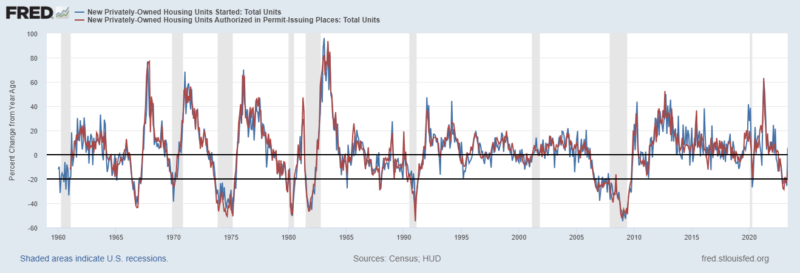

Housing starts rebounded nicely in May to 1631 units from a revised lower 1340 units in April. Permits went up sequentially as well, just not as much. Both series are above the historic mean and median levels. Housing starts actually showed 5.7% growth YOY. Permits declined 12.7% from a year ago, this was a slower decline and the smallest decline since October 2022. Perhaps housing is finding some footing.

The jump in starts was significantly above the highest consensus estimate. There continues to be excess volatility in the series from the pandemic. In the summer last year, we saw a drop in starts even as permits remained relatively elevated. Perhaps the drop was an issue with finding labor to build more houses. Perhaps the relative surge in starts this month can be considered backlog?

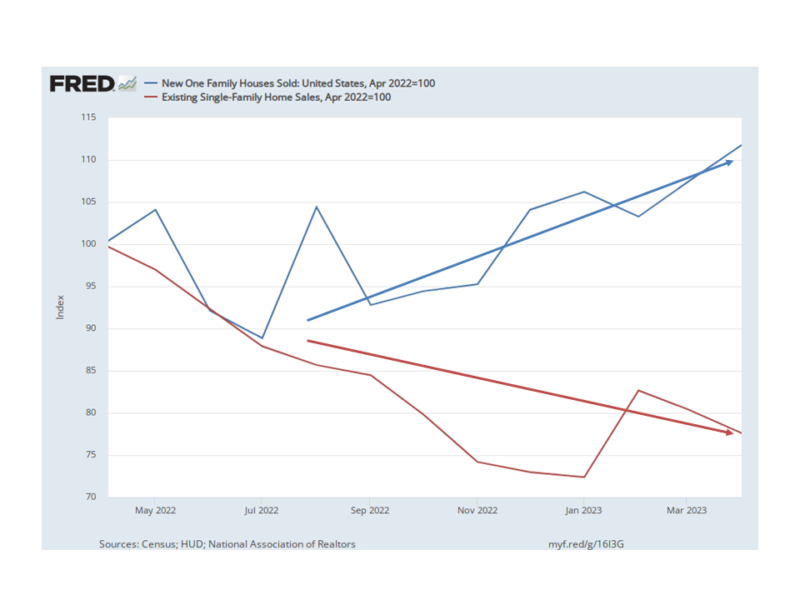

Internally, we continue to discuss the supply chain disruptions caused by different factors all extending from the pandemic or policy during the pandemic. Today we are discussing the possibility of a “frozen” market for existing houses, a result of the unprecedented pace of interest rate hikes. The contention is that interest rates have gone up so fast that families are frozen in their existing home. With mortgage rates rising over 4% in the last 2 years one’s house would be more expensive to carry and perhaps unaffordable if purchased today. At the new interest rate, a family would likely have to downsize if they decided to move and needed to keep the same monthly payment. Thus they choose to stay.

But, if there is some level of illiquidity from a slightly frozen market for existing homes, this may stimulate the building of new homes. Again a supply chain constraint. Supply is lowered in the existing market, a bigger supply of new construction could come in to meet the demand. As sales in the existing home market have been on the decline for the past year, sales of new homes are on the rise.

Stay In Touch