Market Review

Asset Classes

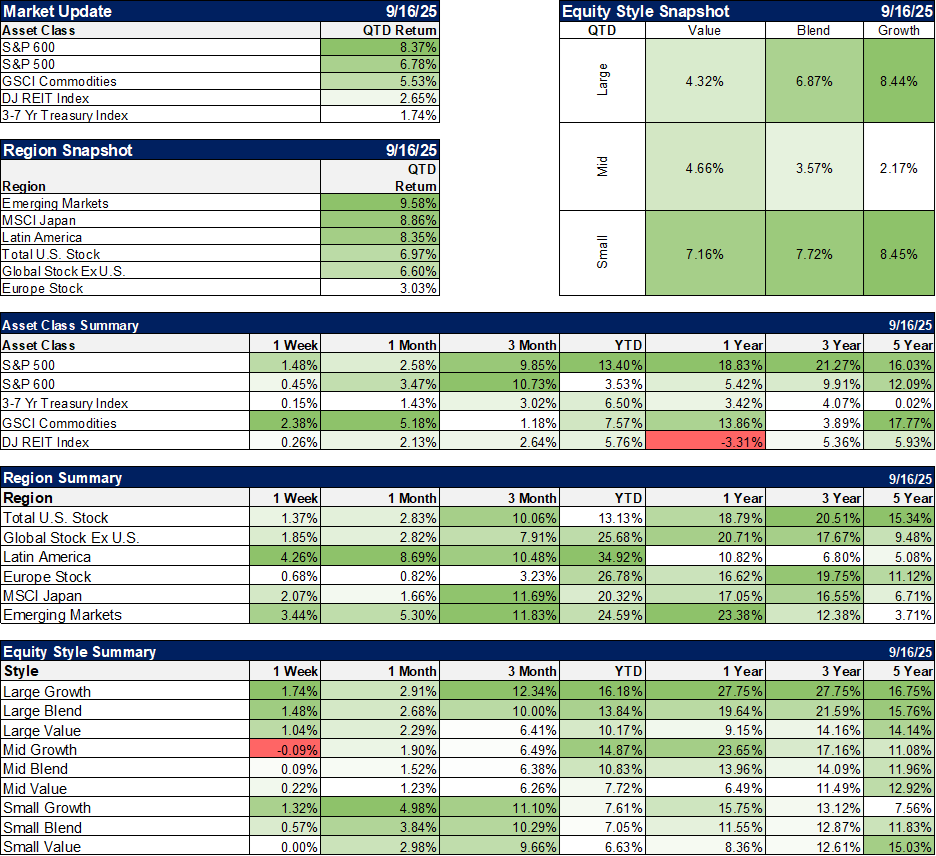

No Asset Classes or Regional Equity Markets are down.

-

Past week: None.

-

Past month: None.

-

Q3-to-date: None.

-

Year-to-date: None.

Quite the turnaround from February–March. Back then, tariff chaos sank the dollar 10% in March, volatility spiked, correlations went quickly toward +1, markets cracked, and only currency havens like the euro, yen, and gold found love.

Fast forward six months: trade and tariff noise is still messy, but volatility cooled, the Fed softened, markets healed, and speculative firepower is back. Margin debt tops $1T, options open interest into Friday’s quadruple witching is at record highs, and the USD has drifted lower for 6 of 7 weeks. Risk assets now move inversely with the dollar, risk on.

Call it momentum, front-running the Fed, dictating to the Fed, a melt-up, or just blind, machine algorithm faith—The Nasdaq’s nine straight up days and fresh all-time highs tell the story.

The Q1 turbulence is in the rearview. And, so are the out-sized positive weeks of the last 5 months. The strength—at least for now—is real. Onward.

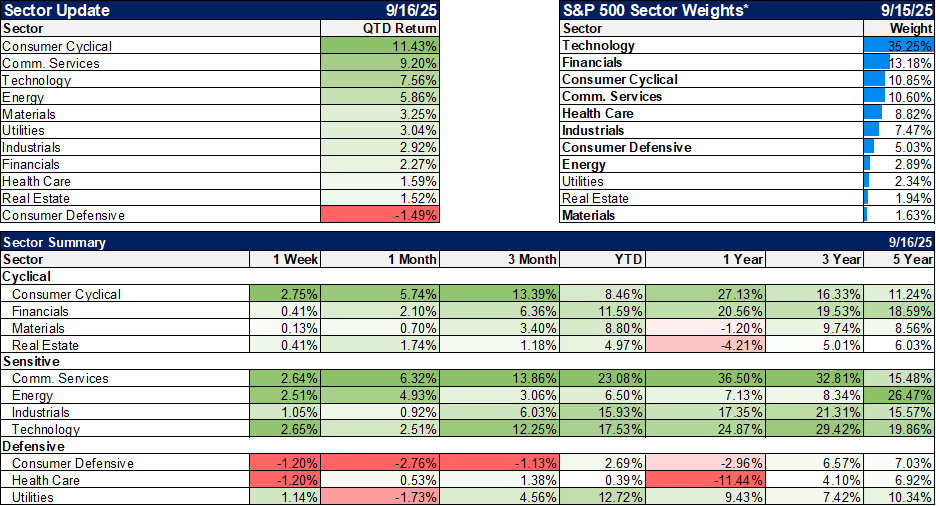

Sector Review

The Cyclical and Sensitive sectors have dominated the defensive sector in Q3, not an indictment of the economy, that’s for sure. The economically sensitive Energy sector has lagged YTD, but it has been clawing up a positive trend and may be poised for additional strength. Health Care continues to exhibit some of the cheapest relative historical valuations. But this market loves crowds, stories and growth, and Health Care currently lacks those large language favorites. We continue to watch and recent strength is interesting.

Stay In Touch