Eurodollar University’s Making Sense; Episode 30; Part 3: Always Backward by Always Looking Backwack

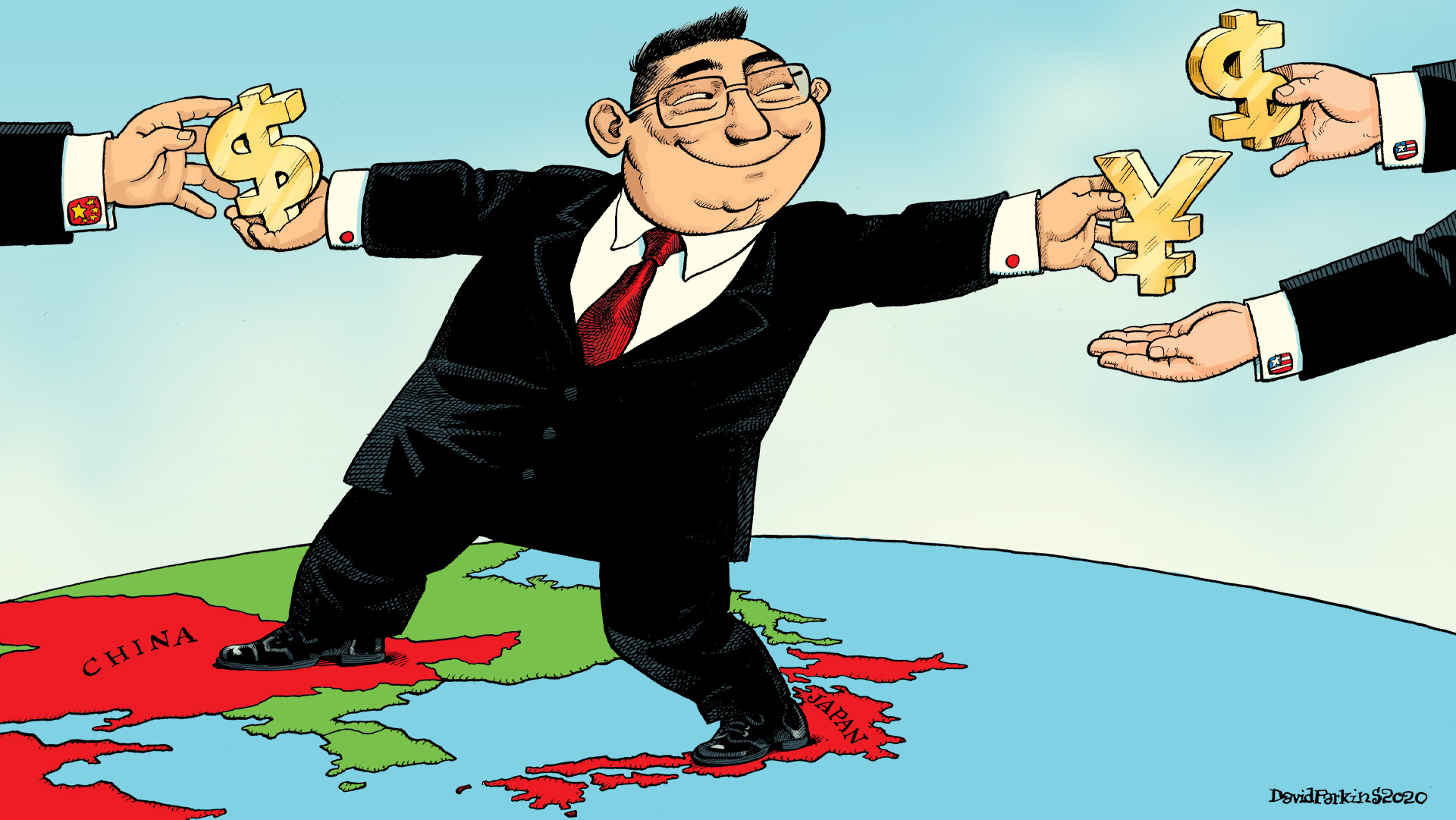

———WHERE——— AlhambraTube: https://bit.ly/2Xp3roy Apple: https://apple.co/3czMcWN iHeart: https://ihr.fm/31jq7cI Castro: https://bit.ly/30DMYza TuneIn: http://tun.in/pjT2Z Google: https://bit.ly/3e2Z48M Spotify: https://spoti.fi/3arP8mY Breaker: https://bit.ly/2CpHAFO Castbox: https://bit.ly/3fJR5xQ Podbean: https://bit.ly/2QpaDgh Stitcher: https://bit.ly/2C1M1GB Overcast: https://bit.ly/2YyDsLa PocketCast: https://pca.st/encarkdt SoundCloud: https://bit.ly/3l0yFfK PodcastAddict: https://bit.ly/2V39Xjr ———WHO——— Twitter: https://twitter.com/JeffSnider_AIP Twitter: https://twitter.com/EmilKalinowski Art: https://davidparkins.com/ Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski (is that a ponytail?). Artwork by David Parkins. ———WHY——— 30.3 Fed's Inflation Targets Unmet, their Credibility ShotThe Federal Reserve has been fighting [...]

Stay In Touch