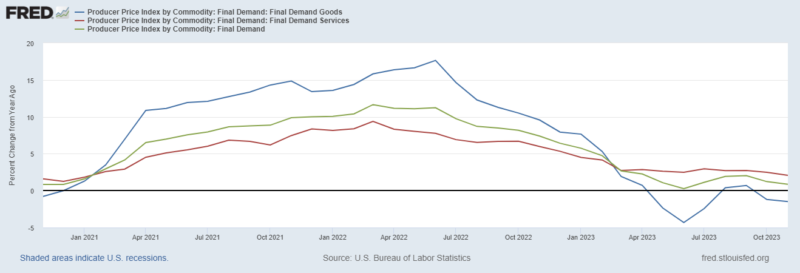

PPI Goods = -1.5%

PPI Services = 2.1%

PPI FD = .9%

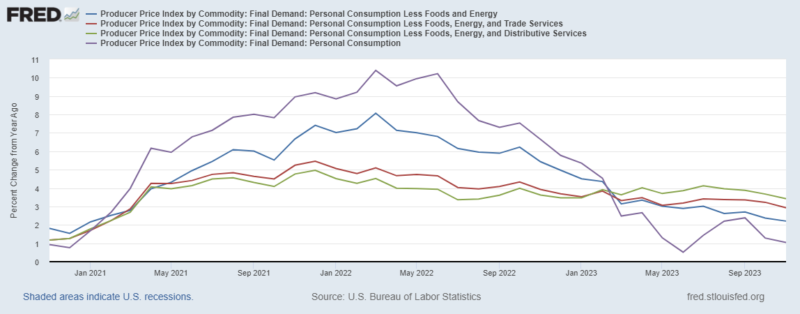

PPI translation to the consumer:

PPI FD Personal Consumption = 1.04%

PPI FD Personal Consumption less Food and Energy = 2.2%

PPI FD Personal Consumption less Food, Energy and Trade Services = 2.9%

PPI FD Personal Consumption less Food, Energy and Distributive Services = 3.4%

We continue to see inflation coming down and energy costs leading the charge lower.

What Powell said: Essentially Powell said that supply side issues with the pandemic were a bigger factor than they all thought in causing inflation. He said labor was normalizing as work force participation goes up and immigration resumes. From his perspective, this was easing labor market pressures. He also mentioned supply chains normalizing.

The interpretation: jobs and the economy could continue to be strong and inflation could come down concurrently. And, in this scenario, they would be able to become less restrictive. He also said that they would want to cut rates well before we got to 2% inflation.

2 year yields were down 30 basis points. 10 year yields went down 20 basis points, close to 4%. Gold was up 2.5%. Oil was up 1.75%. Stocks were up 1.4% with small caps and real estate foreign and domestic doing even better. The dollar was down over 1%.

The ECB, BOE, SNB and Taiwan all meet tomorrow and the BOJ at the beginning of next week. All are expected to leave rates unchanged.

Stay In Touch