The stock market was having a good week until just around 10 am last Friday. Stocks rallied during the week as earnings reports were pretty good – with exceptions as always – and the economic news wasn’t bad either. On earnings specifically, Q4 ’24 is shaping up as the best quarter in the last three years with earnings so far up about 15% year-over-year. Of the 289 companies in the S&P 500 that have reported earnings, 221 reported better than expected, 52 reported less than expected while 16 reported as expected. 174 companies have also reported sales above expectations. Those percentages are about average if you look at the last 10 years but the year-over-year earnings gains are pretty impressive and, at least for now, expected to continue. One potential problem is that earnings guidance is starting to fade with more companies lowering guidance than raising it. So far, 34 companies have issued negative guidance while just 21 have boosted their outlook.

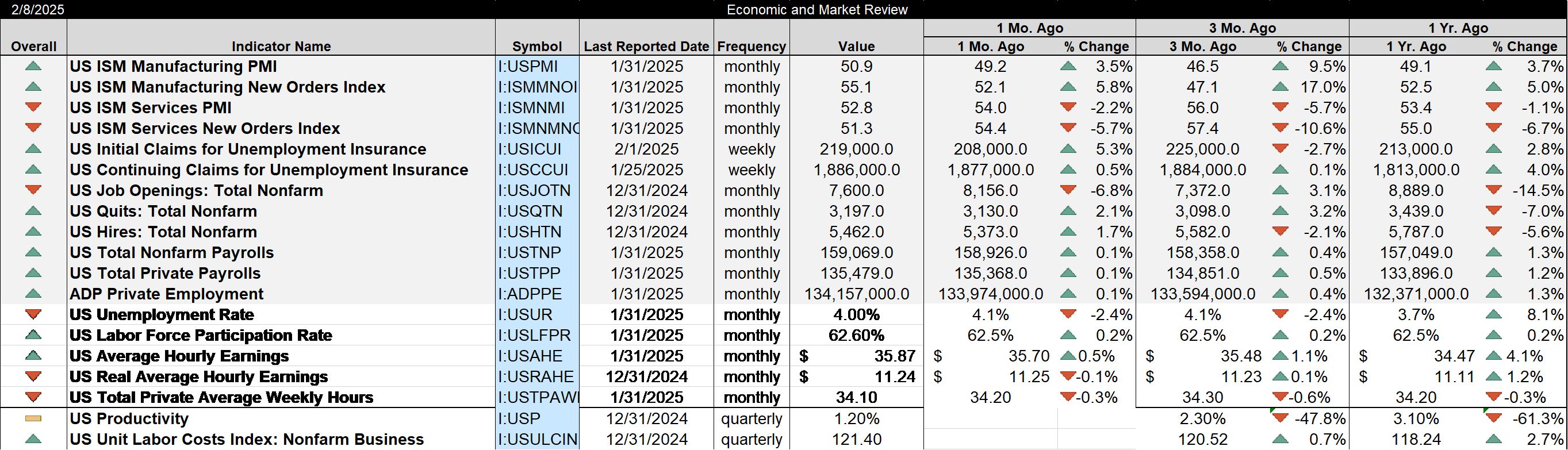

The economic news was also fairly upbeat. The ISM surveys are both back above 50, the dividing line between growth and contraction. The manufacturing version rose to 50.9, the first reading above 50 since March of last year but those are the only two 50+ readings in the last 27 months. This is the COVID supply chain hangover from companies over-ordering goods because they weren’t sure how much would actually arrive. The resulting inventory bulge has kept manufacturing in a recession since the economy opened back up, but there is hope that may be coming to an end.

In contrast, the ISM services PMI has been negative for just 3 months of the last 28 which is why manufacturing didn’t drag down the entire economy. Services consumption in the US is about $14 trillion annually while goods consumption is about $5.6 trillion so the US economy can endure a slowdown in manufacturing. A slowdown in services spending is obviously more problematic. The ISM Services PMI fell to 52.8 in January from 54 in December but that is still on the expansion side of 50. If manufacturing rebounds and services moderates that’s fine but if services start to fall consistently below 50, then we may have a problem.

Job openings fell in December but that isn’t necessarily a bad thing as the economy continues to fall back to pre-COVID norms. A high number of job openings relative to the available worker pool can pressure wages higher and impact inflation so fewer job openings may actually be good news – as long as it doesn’t go too far. Right now the ratio of unemployed workers to job openings is about 0.9, up from 0.5 in 2022. The current balance is about the same as it was prior to COVID but is still well below what we once considered normal. That’s a demographic issue that isn’t easy or quick to solve without a rational immigration policy, which we haven’t had for some time.

The economic news wasn’t all good but the bad news wasn’t all that bad. The employment report showed +143k jobs versus expectations of 170k and the average last year of 166K/month. But November and December were both revised higher by 100k total and the annual revisions we get every January were better than expected. Job gains were revised lower by 589k over the last year but that is a lot better than the preliminary estimate of nearly a million. There was better news in the household survey. There was a lot of talk last year from the doom and gloom crowd about how the household survey (from which the unemployment rate is calculated) was a lot worse than the establishment survey and showed the real state of the economy. The household survey data was just revised up by 2 million jobs so never mind I guess. I’ve said this many times in the past but I’ll repeat here again for the newcomers – the payroll report on which so many place a high degree of importance, is subject to large revisions and should not be relied on to adjust your portfolio.

Overall, the economic data last week may have modestly worsened the growth and inflation outlook but not enough to offset the good earnings growth and the stock market was reacting positively. Until, as I said above, around 10 am Friday. That was when President Trump decided to announce that his administration would be enacting “reciprocal tariffs that would affect everyone” this week. Until that moment the S&P 500 was up about 1% on the week but by the end of the day all that was gone and the market closed down 0.23% for the week. The damage wasn’t confined to large company stocks as small and midcap equities fell for the week as well. The uncertainty around the Trump administration’s tariffs is already causing problems in the corporate world. With earnings season about half over, 146 companies have cited the term “tariff(s)” on their earnings calls, the most since the second quarter of 2019. The record is 185 in the second quarter of 2018, a number that is almost certainly going to be surpassed this quarter.

Companies are citing tariffs mostly in the context of uncertainty and offering earnings guidance that is either exclusive of any tariff impact or of a wider range than normal. As far as I know, there have been no companies citing tariffs as a potential positive. Uncertainty around tariffs is already impacting capital spending plans and it is only going to get worse. I hope I’m wrong, but with President Trump seeing tariffs as some kind of economic Swiss Army knife, I don’t see this improving anytime soon. The administration’s use of tariffs as an everything tool, by the way, isn’t new:

That’s a cartoon from 1897 and shows President McKinley offering tariffs as “medicine for all ills”. Tariffs are a political tool, maybe a negotiating tool but they aren’t a very good economic tool and the arguments being offered by the administration in favor of them are not persuasive.

The President, in his Friday announcement of a potential announcement, cited European tariffs on autos as one reason to impose duties on that region. He also cited the VAT in Europe as a barrier to US/Europe trade. It is true that Europe’s tariff on US cars is currently 10% while the US charges 2.5%. But the US also imposes a 25% tariff on pickup trucks which, for some reason, the President failed to mention. As for the VAT, equating it with a tariff, as the President has done repeatedly for years, is just plain wrong. Countries that have a VAT (a consumption tax similar to a sales or excise tax) do charge the VAT on imported goods and don’t charge it on exported goods. But the goods being imported are not competing against those being exported. Domestic goods pay the VAT just as imports do. This argument about VATs and tariffs is an old one and long ago settled.

The new Treasury Secretary has also used some dubious logic in trying to justify tariffs as non-inflationary. During his confirmation hearing he talked about currency offset and how that would mitigate the price impact of tariffs. He also talked about tax incidence – who ultimately pays the tax – saying that companies exporting to the US might cut their prices to make up for part of the tariff. He is absolutely correct that if the US raises tariffs on another country, their currency will likely decline to offset part of the impact of the tariff. But only if the country allows its currency to float freely. China does not and so makes a good target for tariffs. He is also correct that foreign companies may cut their price to share the cost of the tariffs with the US importer. So yes, he’s right, tariffs may not raise the price of imports and so won’t be inflationary. Unfortunately for him, the whole point of tariffs is to raise the price of imports so consumers buy more US made goods. You can’t have your cake and it it too. Tariffs can’t cut the trade deficit, cut the budget deficit, fund tax cuts and avoid price hikes all at the same time. Based on history, one should probably question whether tariffs can accomplish any of those things.

While the US is trying to tax itself to prosperity, the EU is taking a different tack. They signed a free trade deal with Mercosur (Brazil, Argentina, Uruguay and Paraguay) in December. They have also negotiated free trade pacts with Colombia, Peru, Ecuador, Costa Rica, Guatemala, Honduras, Nicaragua, Panama, El Salvador, Chile and Canada. Outside of our backyard, they have free trade agreements with Japan, Singapore, South Korea and Vietnam. They are currently in negotiations with India and Indonesia. All of these agreements are not fully implemented but they are in place and on track; the EU is moving toward freer trade and more engagement with the rest of the world. The EU is obviously willing to negotiate on trade – they’ve signed 50 free trade agreements around the world (versus 20 by the US). Maybe a less confrontational approach could produce one with us too. And with China, Russia and now Europe buying goodwill in Latin America, we might consider the potential geopolitical costs of taking the region for granted.

Over the last three years, there have been a multitude of recession calls by a wide range of commentators. I have resisted them all because the conditions for recession weren’t present and they still aren’t. But this uncertainty about tariffs is pushing the US economy in the wrong direction. I keep reading that this is just President Trump’s style, that he is a master negotiator. Maybe, but the chaos of these first three weeks is already creating instability in the US economy. The uncertainty of his intentions may keep other countries off balance wondering what he’ll say or do next but it has the same effect here. By the way, this uncertainty and its impact on the economy is not new either:

The US economy is resilient but it can only take so much. Now that no one seems to be concerned about a recession, I’m starting to get worried. If President Trump is negotiating I wish he’d get on with it.

Joe Calhoun

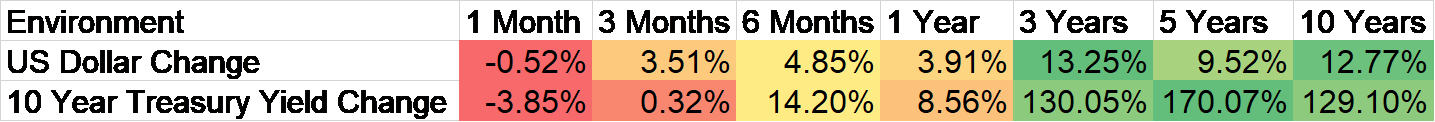

Environment

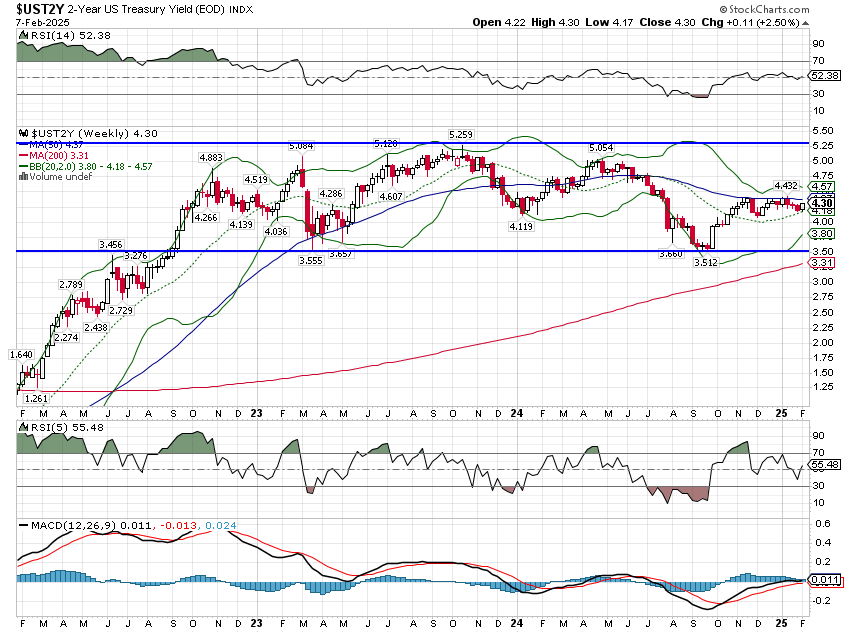

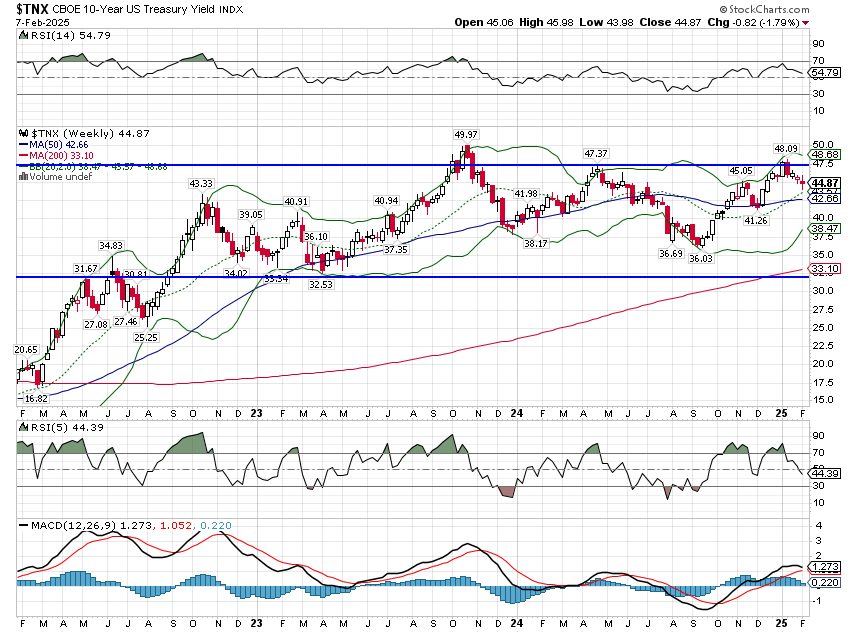

The 10-year Treasury note yield fell 8 basis points last week while the yield of 3-month T-Bills and 2-year Notes rose. That flattening of the yield curve is a warning about growth and inflation but the move so far is too small to draw any conclusions. Make no mistake though, if these trends continue it means the market is anticipating lower growth and higher inflation, neither of which falls into the good category.

Rates are still trading in the range they’ve been in for most of the last 2+ years. I don’t know whether this is a long topping process or a way station on the trail to higher rates.

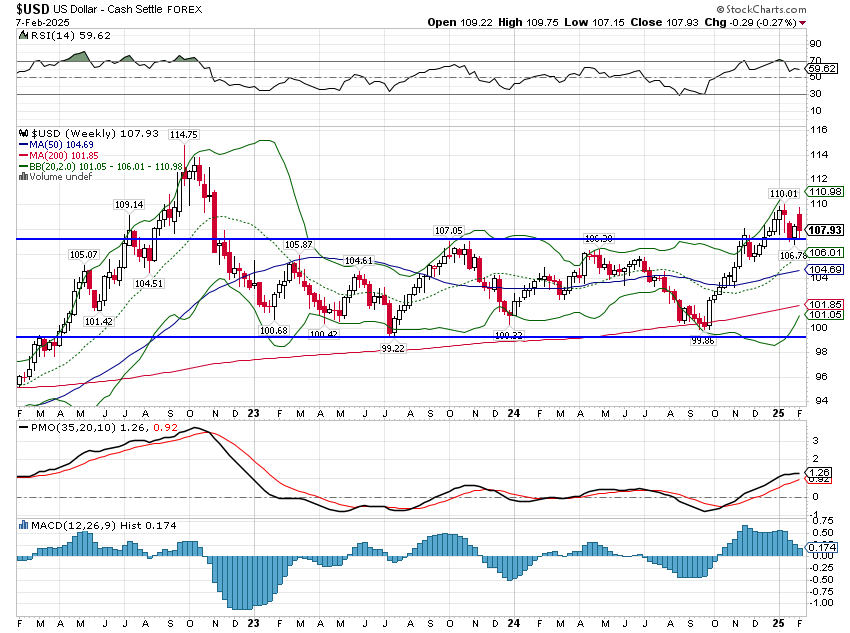

The dollar index was also down on the week but only by 0.27%. The dollar had rallied on Monday last week but failed to take out the January 13th high and fell until Friday’s tariff announcement. The move higher Friday though was muted so maybe the Trump tariff announcement effect is starting to fade. One wonders what will happen if he actually keeps his word and starts imposing tariffs against “everyone” next week.

Markets

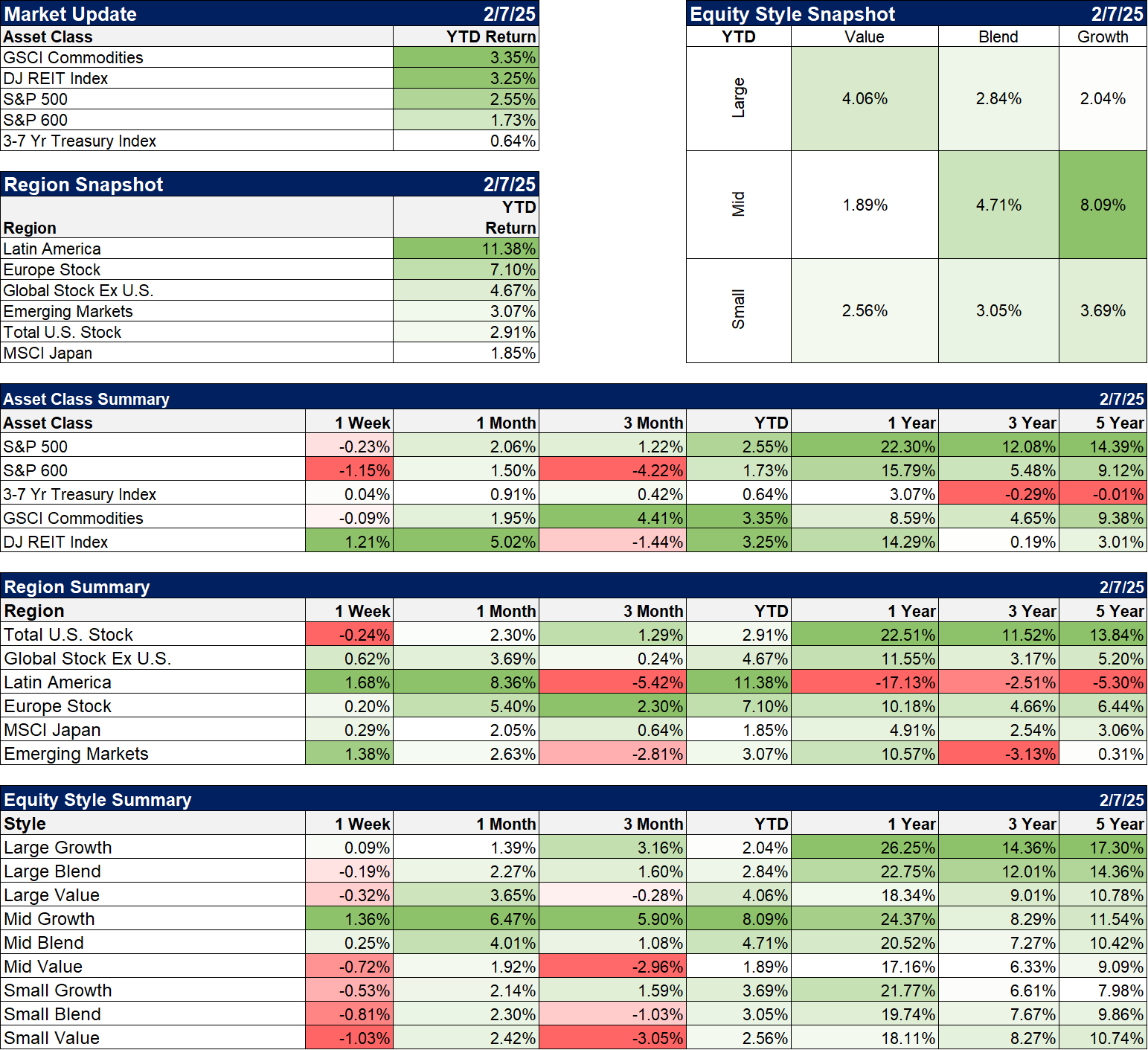

Commodities, REITs, and international stock markets are leading the way this year. Bet you didn’t have that on your bingo card.

The growth vs value battle is taking a strange turn this year too. Large value is outperforming large growth but small and midcap growth are outperforming value. I have no idea what that means; I suspect nothing since it’s such a short period of time.

As for international stocks, Latin America is leading the pack which is, at least partially, a function of the rise in the regions currencies. Brazil is the biggest weighting in the LA index and the Real is up 8% YTD.

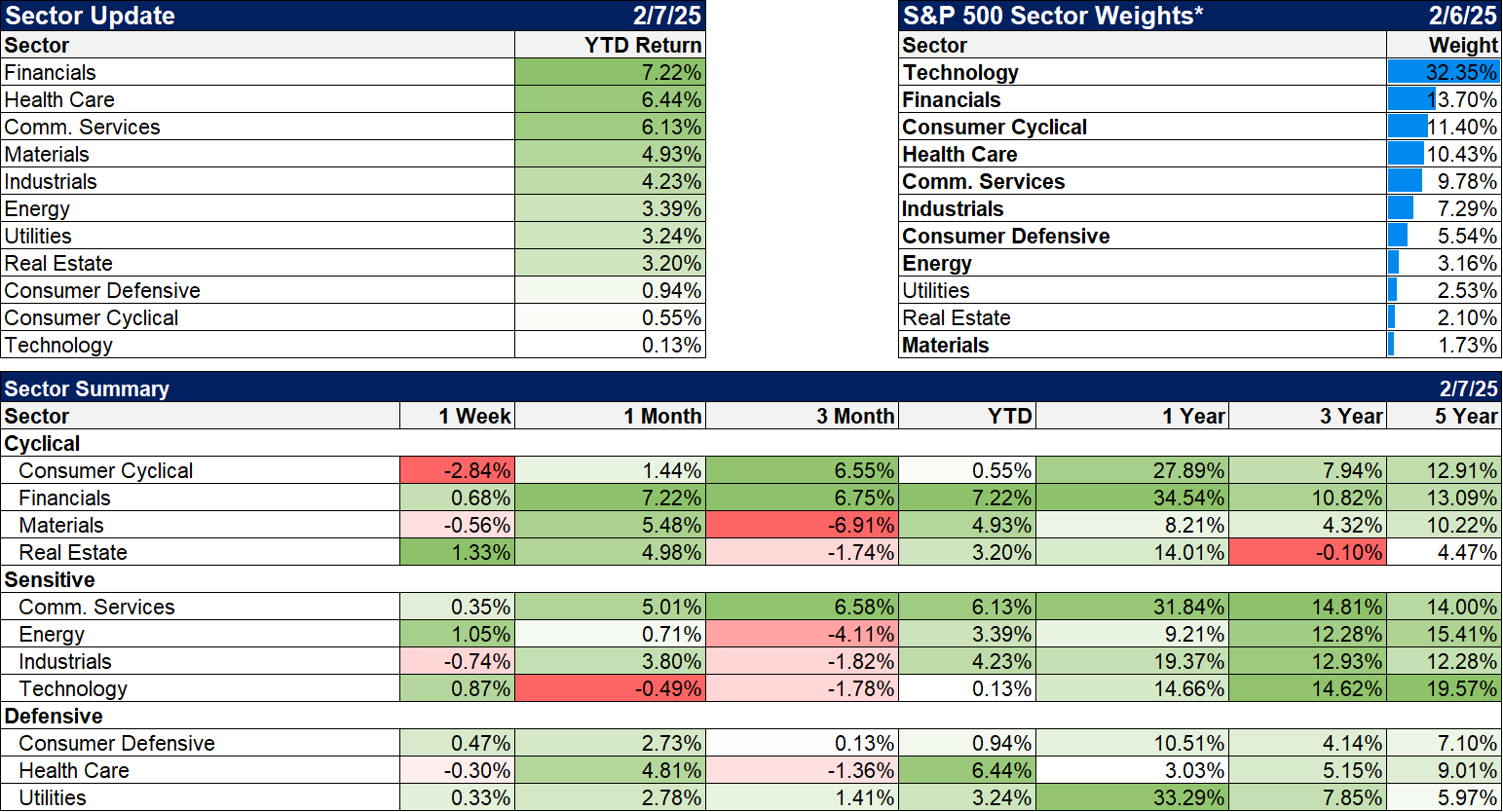

Sectors

It was a down week but 7 of the 11 sectors were higher led by Real Estate. Financials, another rate sensitive sector, are leading for the YTD. Health care is also off to a great start this year and is pretty cheap based on history.

Economy/Market Indicators

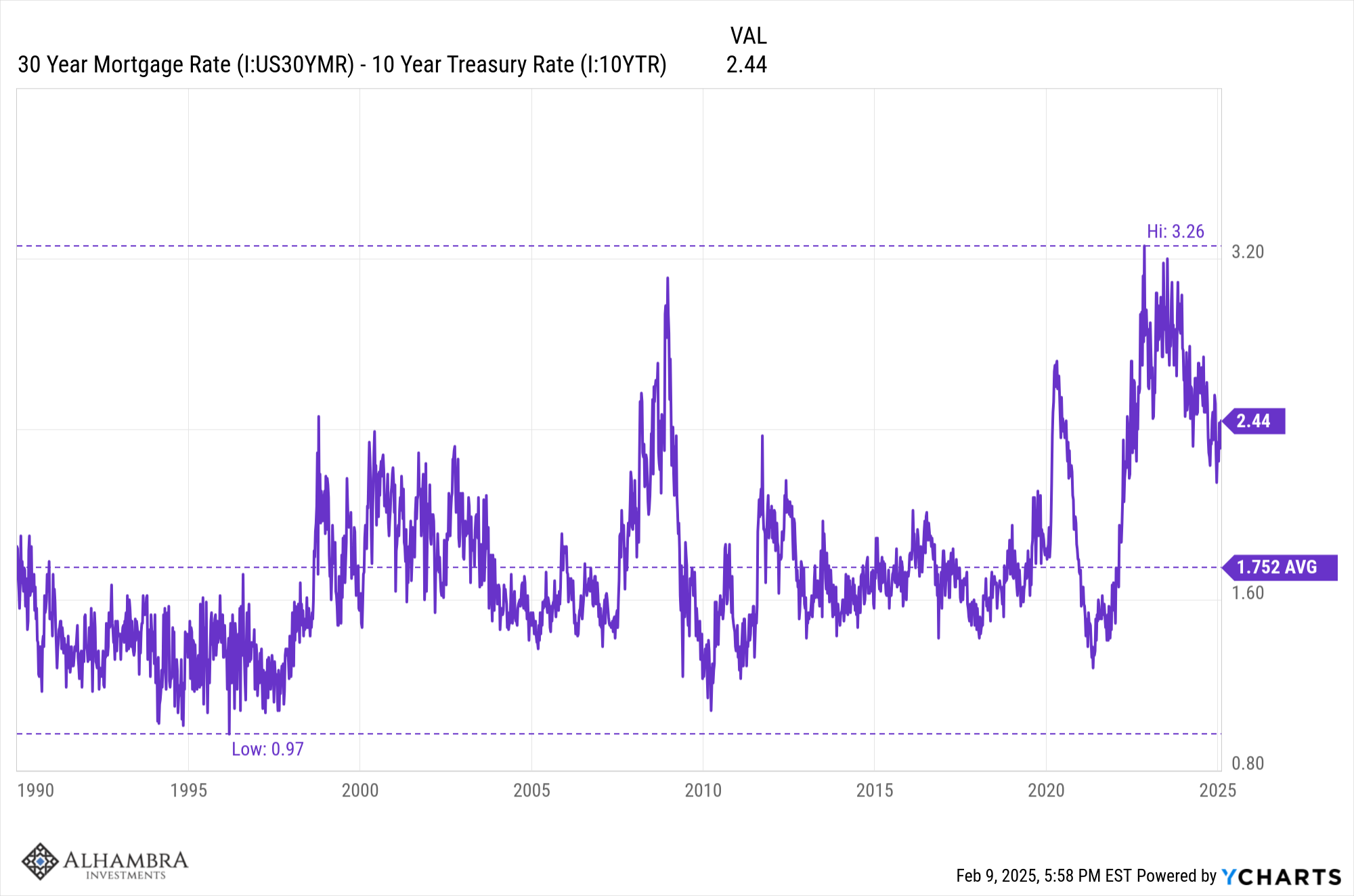

Mortgage rates are back under 7% and the spread to the 10-year Treasury yield continues to narrow. It is still historically high though and has scope to improve further.

Economy/Economic Data

I covered most of these in the opening essay but there were some other fairly important reports. In the employment report, average hourly earnings were reported up 0.5% month to month and 4.1% year-over-year in a good news/bad news situation. The rate at which wages are rising means workers are beating inflation but it could also mean increased costs for businesses. Combined with the news from earlier in the week that productivity was only up 1.2% in Q4, the outlook for inflation worsened a bit last week.

Productivity is the only leg the economy has to stand on right now. Economic growth is about productivity growth and workforce growth. Since we have none of the latter – and seem determined to make it worse – we are totally reliant on the former and it peaked in Q3 ’23. Current productivity growth is not nearly high enough to reach Treasury Secretary Bessent’s goal of 3% growth. It is more consistent with the 2010s when it averaged just 1.1%. We need something more like the 60s when it averaged 3.4% a year. What set of policies take us from here to there? I don’t know exactly but raising taxes (tariffs) probably isn’t in the mix.

Stay In Touch