Moody’s Ratings downgrades United States ratings to Aa1 from Aaa; changes outlook to stable

New York, May 16, 2025 — Moody’s Ratings (Moody’s) has downgraded the Government of United States of America’s (US) long-term issuer and senior unsecured ratings to Aa1 from Aaa and changed the outlook to stable from negative.

This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.

Successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs. We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration. Over the next decade, we expect larger deficits as entitlement spending rises while government revenue remains broadly flat. In turn, persistent, large fiscal deficits will drive the government’s debt and interest burden higher. The US’ fiscal performance is likely to deteriorate relative to its own past and compared to other highly-rated sovereigns.

The stable outlook reflects balanced risks at Aa1. The US retains exceptional credit strengths such as the size, resilience and dynamism of its economy and the role of the US dollar as global reserve currency. In addition, while recent months have been characterized by a degree of policy uncertainty, we expect that the US will continue its long history of very effective monetary policy led by an independent Federal Reserve. The stable outlook also takes into account institutional features, including the constitutional separation of powers among the three branches of government that contributes to policy effectiveness over time and is relatively insensitive to events over a short period. While these institutional arrangements can be tested at times, we expect them to remain strong and resilient.

Moody’s Ratings

Walmart should STOP trying to blame Tariffs as the reason for raising prices throughout the chain. Walmart made BILLIONS OF DOLLARS last year, far more than expected. Between Walmart and China they should, as is said, “EAT THE TARIFFS,” and not charge valued customers ANYTHING. I’ll be watching, and so will your customers!!!

– Donald Trump, Truth Social

At a certain point over the next two to three weeks I think Scott and Howard will be sending letters out essentially telling people … we’ll be telling people what they’ll be paying to do business in the United States.

– Donald Trump, At a business roundtable during his trip to the Middle East

US government debt has lost its final AAA rating, with Moody’s joining Fitch and Standard and Poor’s in downgrading the bonds of the US by one notch. S&P downgraded US debt in 2011 and Fitch in 2023, both citing the weakening of governance as a major cause:

Erosion of Governance: In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. In addition, the government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process. These factors, along with several economic shocks as well as tax cuts and new spending initiatives, have contributed to successive debt increases over the last decade. Additionally, there has been only limited progress in tackling medium-term challenges related to rising social security and Medicare costs due to an aging population.

– Fitch, August 1, 2023

More broadly, the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges…

– Standard and Poor’s, August 5, 2011

Everyone will be focused on this when the futures open a few hours from now and US markets open Monday morning. The easy guess is that stocks and bonds will both fall, but the easy guess is not always right. When S&P downgraded US debt in 2011, the S&P 500 lost 6.7% on the Monday following the late Friday announcement but were down only 1.6% a week later. Bonds, which would seem to be most negatively affected by the downgrade, actually rose in price, with the 10-year yield dropping from 2.58% to 2.24% over the following week. The Fitch downgrade came on a Tuesday and bond yields did almost nothing over the ensuing week, falling a mere 3 basis points. Stocks did fall but just 1.4% on the day after the downgrade (also announced after the close) and 1.7% a week after the announcement.

S&P had given US debt a negative outlook in April of 2011 and the downgrade came just 3 days after Congress passed the Budget Control Act of 2011 which, as S&P anticipated, did nothing of the sort. The Fitch downgrade also came after a budget deal that was signed in December of 2022 after putting the debt on negative watch in May of 2023. It can’t be said that the downgrades were unexpected and surely the one last Friday by Moody’s was even less of a surprise. We are, once again, in a budget standoff and last week a group of Republicans on the House Budget Committee refused to vote President Trump’s budget bill out of committee, complaining that it didn’t cut Medicaid and green energy spending enough. Clearly, Moody’s was not impressed and they shouldn’t be. Whatever additional cuts these Republicans are looking for won’t come close to doing anything substantive about the deficit.

Will this downgrade mean any more than the last two? I have no idea if investors will react more negatively this time but I doubt it will do anything to actually improve the US budget situation and that does have implications for investors. The budget deficit is a main cause of our trade deficits which President Trump is trying to reduce with tariffs. If the tariffs don’t work – and they won’t unless they cause a recession and even then only temporarily – will President Trump double down? Since his second administration is essentially a doubling down of his first term, I think the answer is obvious. Tariffs are not going away anytime soon because the budget deficit isn’t going away anytime soon so even higher tariffs are probably in our future. The only off-ramp would be if the courts eventually rule the tariffs unconstitutional but even then, it would be up to Congress to set the tariff rates and neither party has shown any appreciation for the benefits of free trade.

Of the quotes above, it is the second two that have the larger implications for investors and the US economy. President Trump seems to see himself as the CEO of America, charged with managing the entire economy, from macro to micro. He wants Walmart, with an operating margin of 4.3%, and China to “eat” his tariffs. Tariffs are a consumption tax and what the President is trying to do is force the incidence of the tax onto corporations like Walmart rather than consumers. In the end, it doesn’t matter though because tariffs, like all taxes, are paid by people. If Walmart “eats” the tariffs, they will make less money, their stock price will fall and investors will pay the tax. And if investors pay the tax, there will be less private investment, less future economic growth and therefore less income for the consumers the President is trying to protect. Politicians have tried numerous recipes through history but not one has yet been able to produce the elusive free lunch. President Trump will not be the exception.

The President also wants to dictate what foreigners will be “paying to do business in the United States” or more accurately what US consumers will be forced to pay for the goods they want that just happen to come from foreign countries. Or in some cases, if the tariffs are high enough, what products they will be allowed to buy at all. President Trump offers a simple solution to this, saying that all you have to do is produce your goods in the US and you don’t pay the tariff. But, oh, yes we will. To the extent that lower value manufacturing is re-shored to America, the investment in that production will have to be diverted from some other area of the existing economy which is likely of higher value. We don’t have enough workers to do both. So, yes, we will pay the tariff in the form of lower future growth. Again, no free lunches.

The US is not going to default on its debts because they are all dollar denominated and we have the ability to produce those with a keystroke. The value of that repayment may, however, still be impaired by an erosion in the appeal of US investments, by a reduction in the value of the dollar. President Trump’s admonishment of Walmart, about as American as a company can get, is not going to encourage foreign companies to invest in the US. If President Trump is “watching” a company like Walmart, how is he going to treat a foreign company that dares to raise prices? I don’t know if Walmart will ignore the President or whether they will “eat” the tariffs. But I am quite sure that Walmart knows a lot more about running Walmart than a New York real estate developer. I also happen to think that US consumers are perfectly capable of deciding which products to buy regardless of where they are produced. And more than anything, I believe that the market will make better investment decisions than a committee of Presidential advisers in Washington, D.C. That was equally true when Joe Biden’s crew was pushing the CHIPS Act and the ironically named Inflation Reduction Act.

The stock and bond markets may well open lower Monday morning due to the Moody’s downgrade. But the real news of all the debt downgrades is that “the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges”. Our budget deficit forces us to rely on foreigners for investment to fund our future growth. Scaring them off with a dysfunctional government, tariffs, and threats doesn’t seem very wise.

Joe Calhoun

Environment

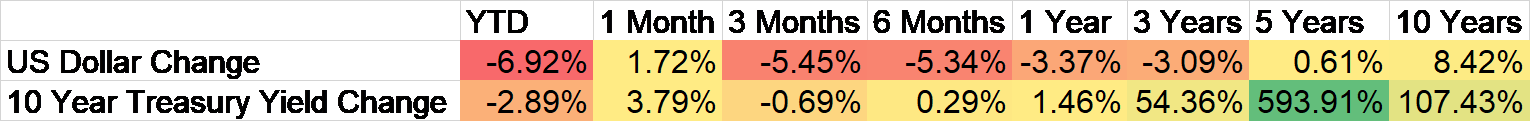

The dollar continues in its short-term downtrend but coming off the lows in pretty feeble fashion. I don’t have a read on how it will open on Monday after the Moody’s downgrade but I would guess the knee jerk reaction will be lower. The Trump administration made a point of saying last week that a cheaper dollar was not going to be part of their trade negotiations but the market was always going to make that decision for them anyway. And, by the way, if you believe they aren’t pressing Taiwan, Korea, and other Asian countries to let their currencies rise, I’ve got some oceanfront property in Kansas you might be interested in. But for now, nothing has changed. This is a short-term downtrend that I think will turn into a longer term downtrend but I don’t have sufficient evidence yet to get aggressive about positioning for it. Wait for the trend to develop. Currency trends tend to last years so you don’t need to be in a hurry.

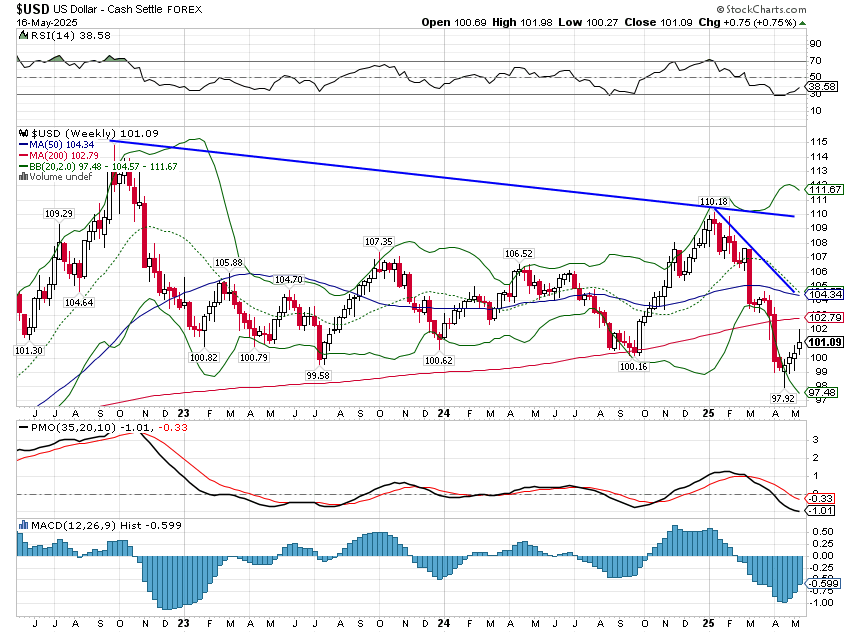

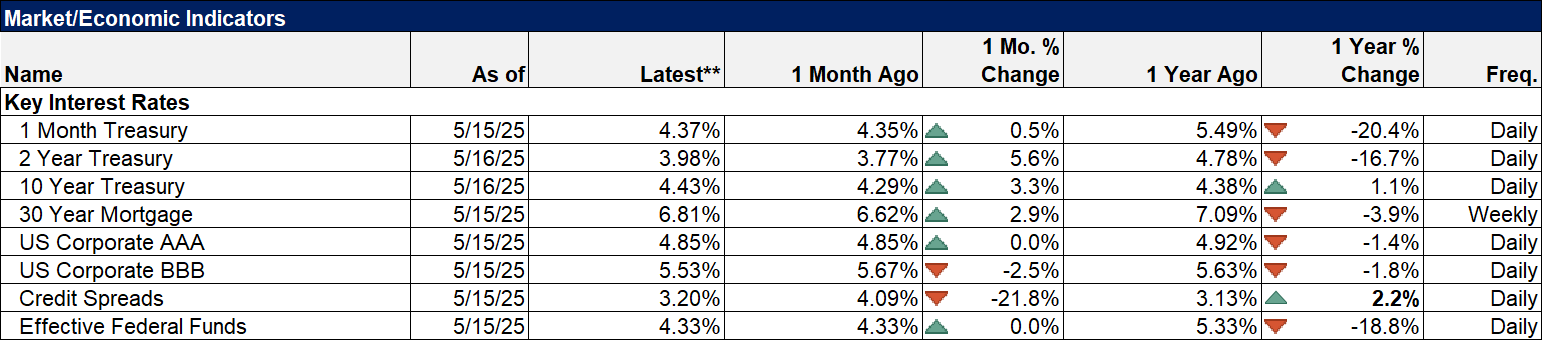

Like the dollar, I don’t have any way to see how bonds will react to the downgrade but the obvious expectation is that rates will rise. Will they finally break out of this range? I have no idea but if they do, a 5% 10-year is going to put a big crimp in the administration’s tax cut plans. With the deficit hawk wing of the Republican party already in open revolt, this downgrade isn’t going to make it any easier to get a bill that can pass the House and Senate.

Real rates have been rising along with nominal rates but last week saw a rise in inflation expectations as nominal rose more. The 10-year breakeven rate is now 2.34% while 5-year is at 2.42%. Not at the Fed’s target but not all that threatening either.

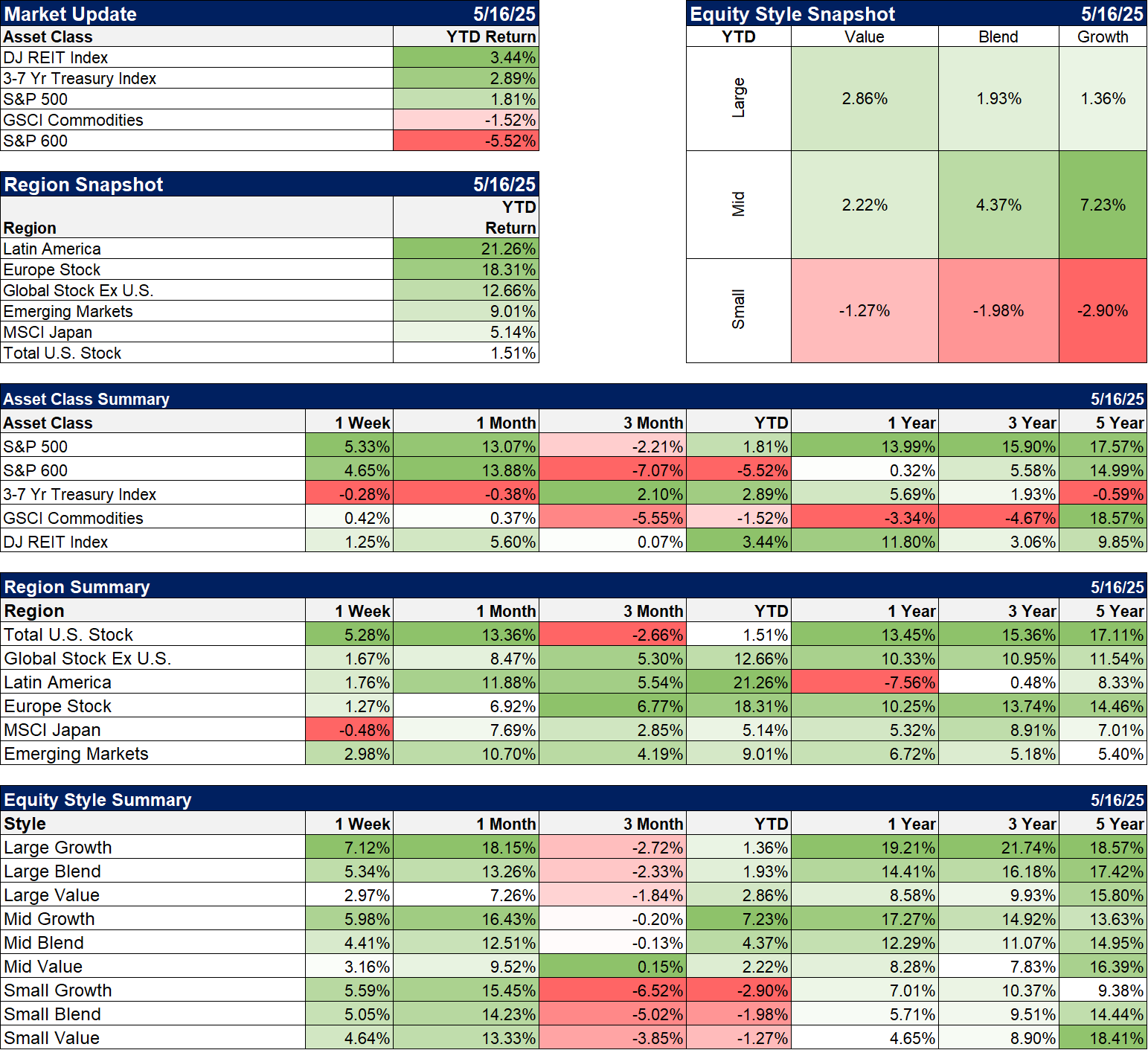

Markets

It was a good week for stocks and the S&P 500 is now in positive territory YTD but I wouldn’t be making any big bets that it is going to stay that way. Market sentiment has soared over the last couple of weeks based on tariff progress (that isn’t much progress at all in my opinion) but the downgrade and some less than positive tariff rhetoric over the weekend (see here) seems likely to put a crimp in the rally.

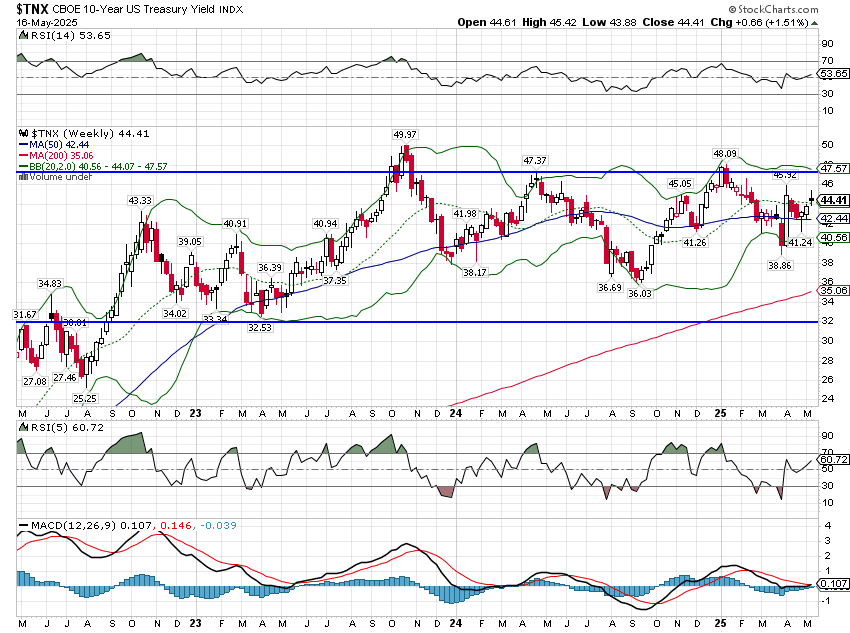

It was growth stocks leading the market higher last week but value still holds a lead YTD. Over the trailing 1 and 3-year periods, growth has a considerably lead but over time the returns tend to even out. Look at the 5-year numbers where mid and small cap value have outperformed. Large value has underperformed some but the gap isn’t that wide and will likely close over time. Value and growth produce remarkably similar results long term so concentrate on the one that is lagging because it probably won’t be for long.

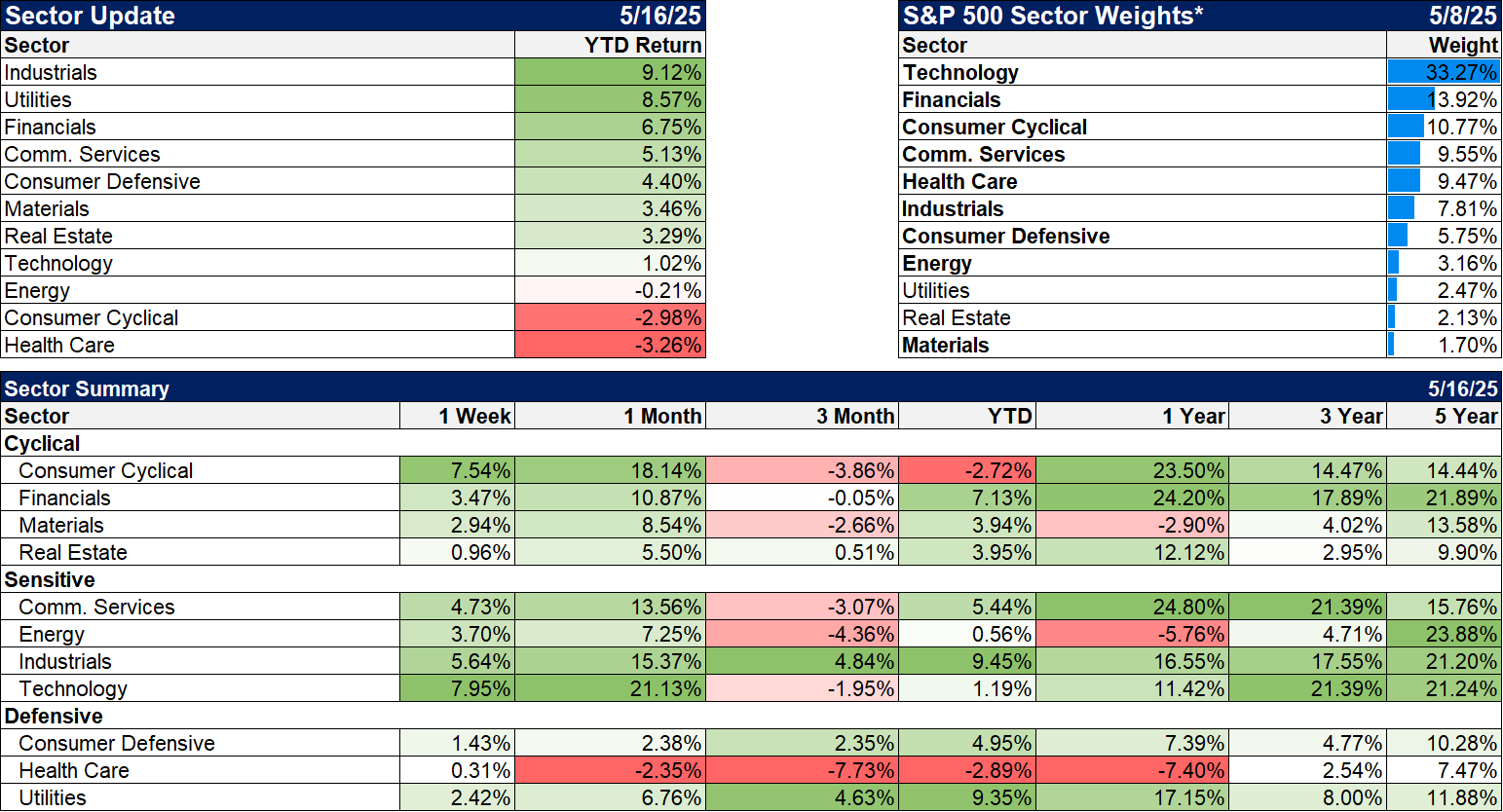

Sectors

Technology took the lead last week but is barely positive on the year. A lot of that was driven by optimism about the President’s trip to the Middle East where he announced some big tech deals. You might want to temper your enthusiasm since a lot of what was announced was already known and announced even before Trump took office. And, as is often the case with politicians, a lot of what was announced was also wildly exaggerated. The $200 billion in “new commercial deals” announced with the UAE, for instance, is based on a cloud computing deal between Amazon and the UAE owned telecom company. That deal though was announced in October of last year before the election and includes only a commitment to spend $1 billion over the next six years. The $200 billion figure was based on a study by Amazon that the deal would produce $181 billion in economic impact in the UAE by 2033. There are several other examples from the trip but the details aren’t important. All politicians exaggerate even if this one does give new meaning to the word.

Health care, the worst performing sector YTD, is getting interesting. It is not only the laggard this year but also over the last 5 years.

Economy/Market Indicators

Credit spreads continued to narrow last week, falling back to 3.2%, still above where they fell to after the election but at roughly the same level where they spent most of last year.

With the US government no longer AAA, will investors start shifting over to corporate AAA borrowers? There are only two: Johnson & Johnson and Microsoft. There are more choices in countries: Australia, Canada, Denmark, Germany, Lichtenstein, Luxembourg, Netherlands, Switzerland, Norway, Sweden, and Singapore. Of course with most of those you’ll have to take currency risk.

Economy/Economic Data

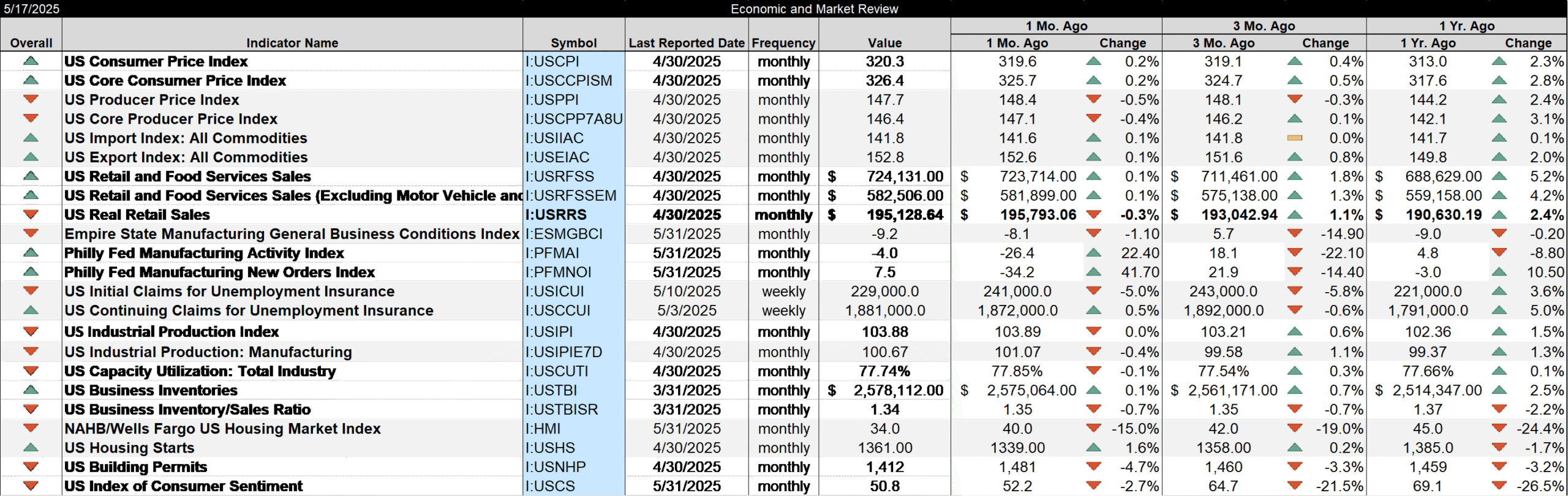

The economic data last week was pretty much as expected although the inflation data was a tad better. The PPI reading though had some less than encouraging news as a big part of the drop came from “margins for final demand trade services, which dropped 1.6 percent”. That means that corporations are choosing to “eat” some of the tariffs for now, but as Walmart let everyone know, that won’t continue forever.

We saw some improvement in the Empire State and Philly Fed indexes but with all the tariff distortion I’m not sure much information can be gleaned from it. Retail sales was less than expected in April but that came after a surge in March that was pretty obviously driven by tariff frontrunning.

Housing continues to be a problem with the Housing Market index, building permits, and housing starts all coming in less than expected. I’m shocked.

Overall, as I’ve been saying for weeks, the economy continues to mostly ignore the tariffs and keeps chugging along. Keep watching markets – interest rates and the dollar – for clues that is changing.

Stay In Touch