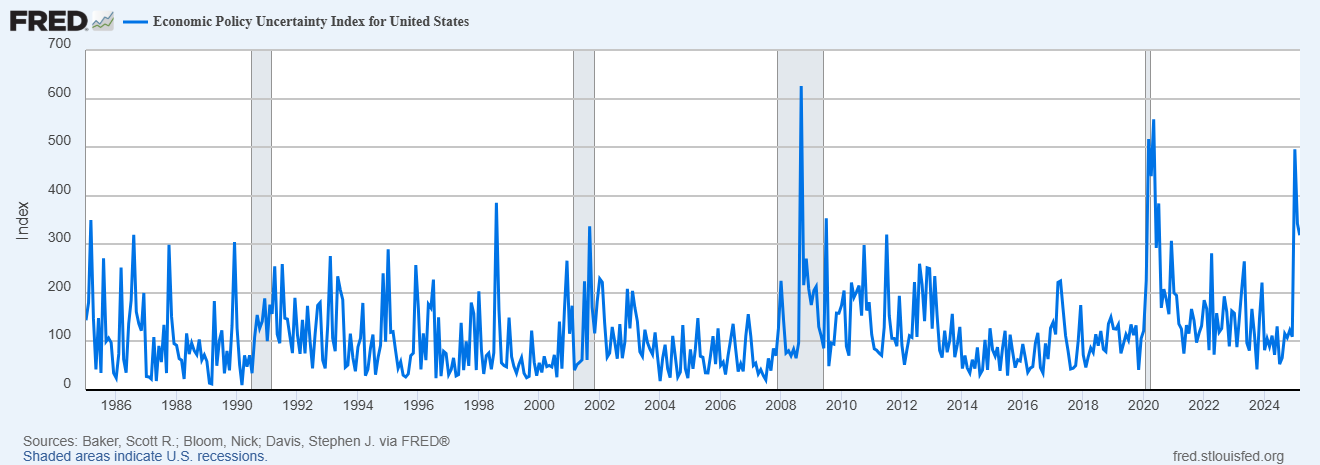

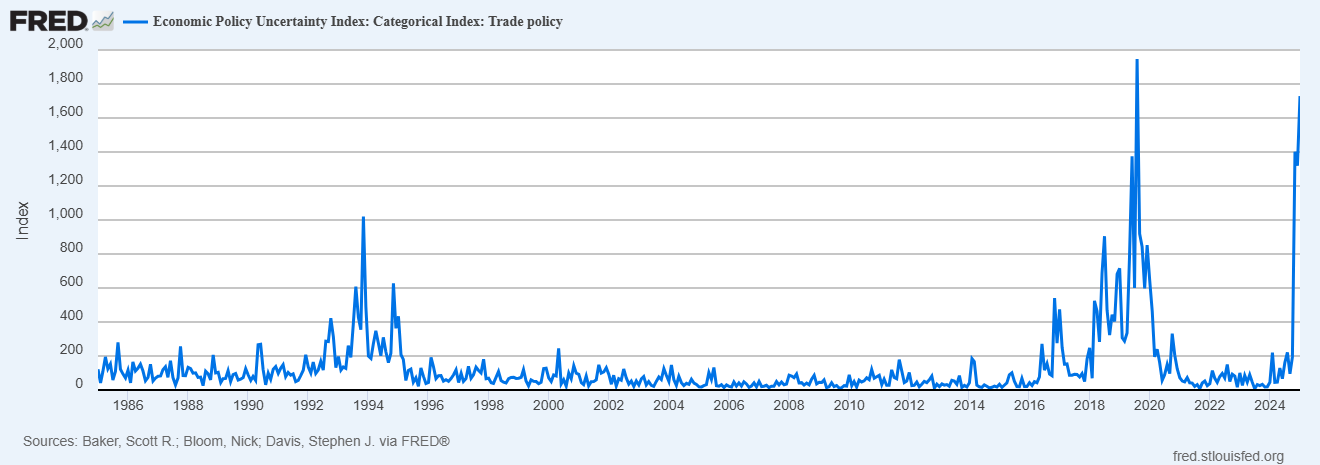

Uncertainty around economic policy is near all-time highs with most of that focused on trade policy. Is the uncertainty part of President Trump’s plan? Or part of his negotiating strategy? I have no idea but the effects are obvious and negative, not just for the stock market, but for the economy as a whole. But how negative? I’ve been getting a lot of questions about the economy recently, so let’s take a look at where things stand after the first six weeks of the new Trump administration.

The anticipated policies of Trump 2.0 have reduced both real growth and inflation expectations despite the fact that most people believe tariffs will raise prices; the market begs to differ. Tariffs, especially ones applied haphazardly, cause relative price changes – one thing goes up in price while something else goes down – but general inflation is caused by monetary factors. Since tariffs apply to goods, I would expect to see goods prices rise and services prices fall to keep the inflation rate (not level of prices) fairly stable. Of course, the reduction in services prices is likely to come from reduced demand for those services; there are no free lunches in economics.

Treasury Secretary Bessent has said that the US economy needs a period of “detox” as the administration’s policies transition the economy from public spending towards more private spending. I am all in favor of reducing the government’s footprint in the economy but reducing direct government spending in favor of other types of interference – like imposing tariffs – has a certain lack of intellectual coherence. Tariffs increase government control over US import markets and allow politicians to play favorites, to reward campaign contributors by granting exemptions and exceptions. Drain the swamp? Tariffs refill it.

In his recent speech to Congress President Trump said:

“Tariffs are about making America rich again and making America great again. And it’s happening, and it will happen rather quickly. There’ll be a little disturbance, but we’re OK with that. It won’t be much.”

Given President Trump’s penchant for exaggeration, “rather quickly”, “little disturbance” and “It won’t be much” don’t offer much comfort. No one knows what he will do with tariffs or any other policy; the only thing predictable about President Trump is his unpredictability. The uncertainty about future economic policy seems likely to persist for his entire term. Expect more volatility; you are unlikely to be disappointed.

Policy uncertainty makes it difficult for companies and individuals to plan and invest. The supposition is that the President’s trade policy will involve a high tariff barrier but what if that turns out to be wrong? Should a company make a multi-billion dollar bet on that by moving their supply lines? Even if he initially imposes a high barrier, what if he changes his mind, which happens frequently, and lowers them in the future?

Companies can’t use his last term as a guide because those tariffs were fairly narrow (mostly China), targeted (steel, aluminum) and came after other fiscal matters (tax cuts) were settled.

This time, the tariffs are widespread, non-specific (mostly) and are coming before any settlement of tax and spending priorities. The administration has already raised tariffs on China and has started the process of imposing 25% tariffs on Canada and Mexico. And he has promised more to come with reciprocal tariffs on the entire world and threats against the EU on automobiles, among other things.

History is pretty clear on the economic outcome of high tariff barriers. Tariffs are a regressive tax on US consumers that reduce growth, raise imported goods prices, lower productivity growth, waste domestic resources through misallocation and reduce the quality of products produced. And because other countries will retaliate, tariffs reduce exports and US employment in the affected industries. Other than that, they are a great policy. The only variable is the magnitude of the impact which is impossible to calculate or predict.

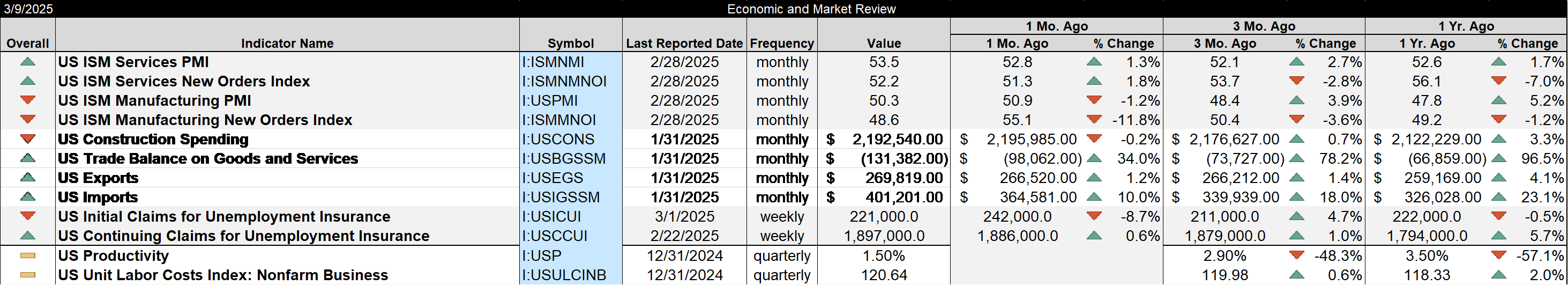

The uncertainty around tariffs has already had an impact on the economy as companies stockpile goods from overseas in advance of the tariffs. We’ve seen a surge in imports over the last two months and the trade deficit has expanded to a new record.

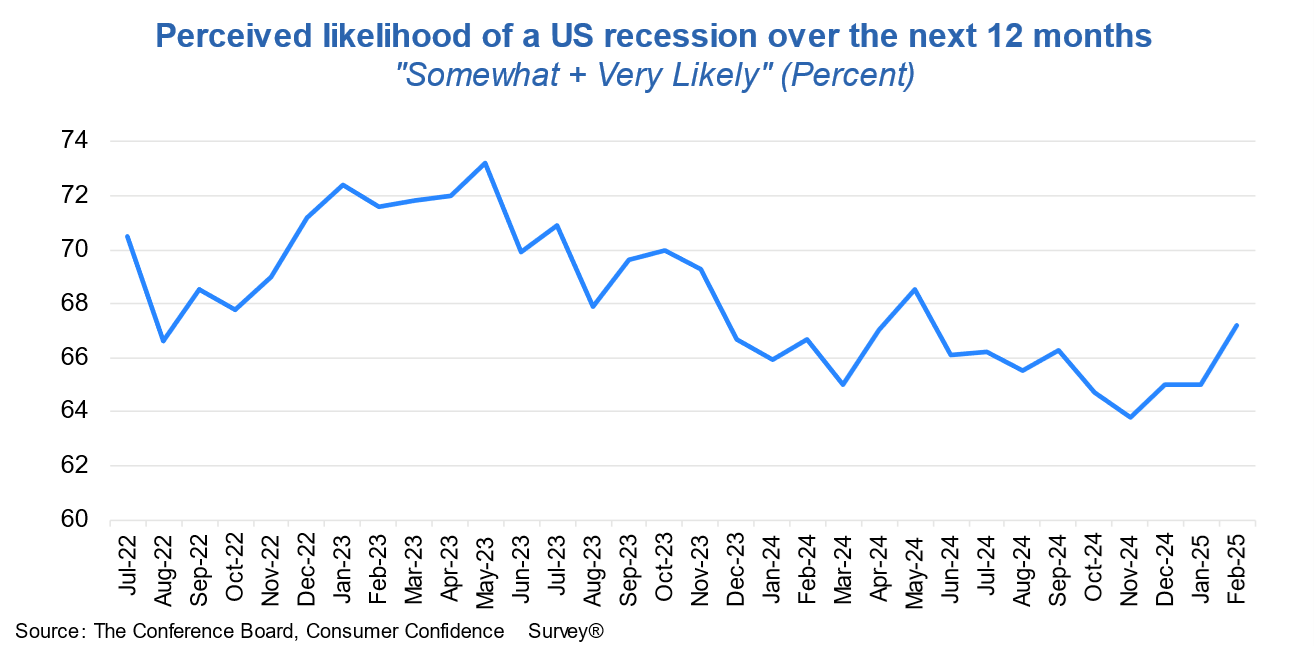

Consumer confidence fell 7 points in February to 98.3 while the expectations index fell 9.3 points to 72, well below the 80 threshold the Conference Board says signals a recession ahead. The perceived likelihood of recession has risen every month since the election.

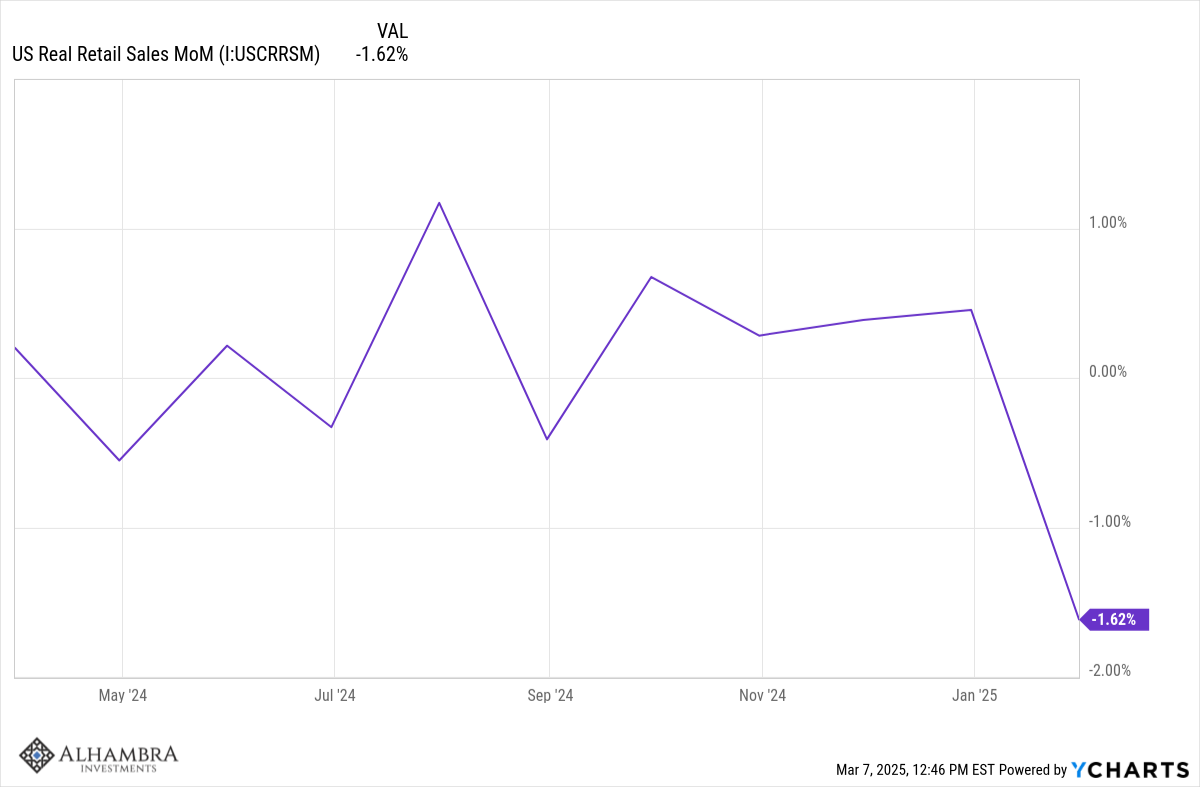

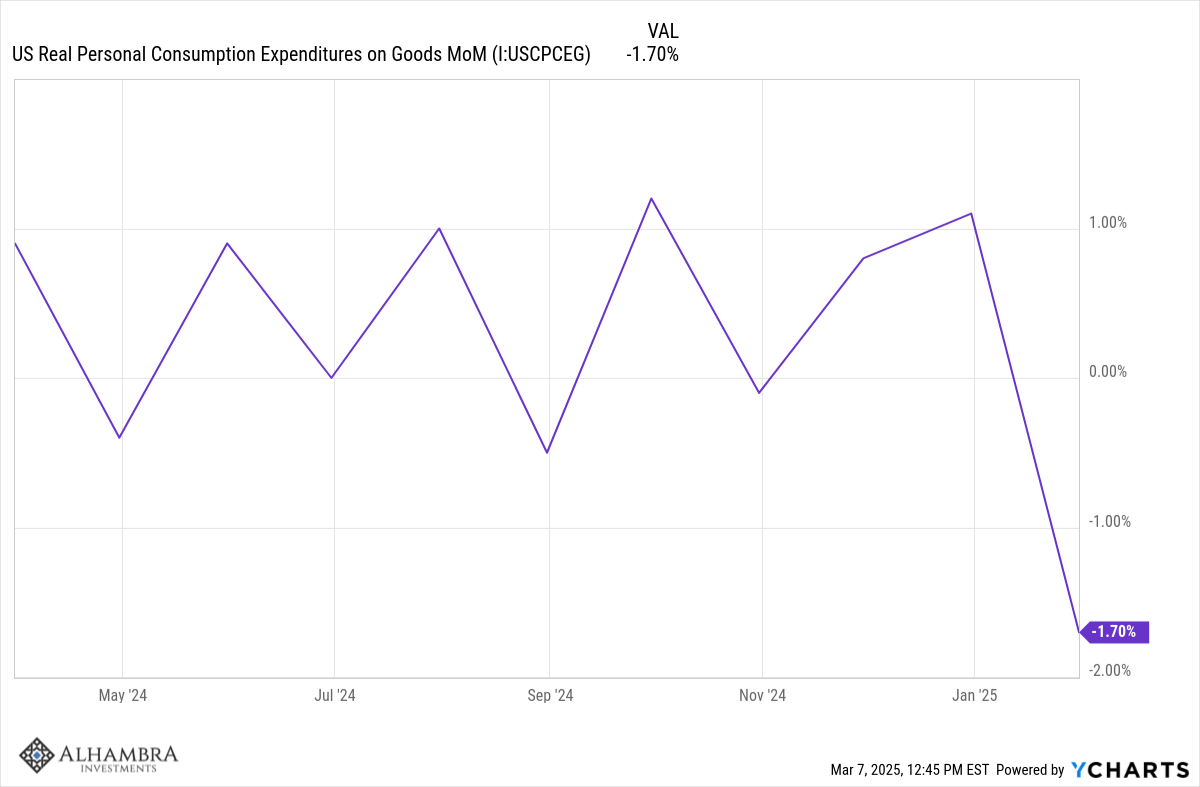

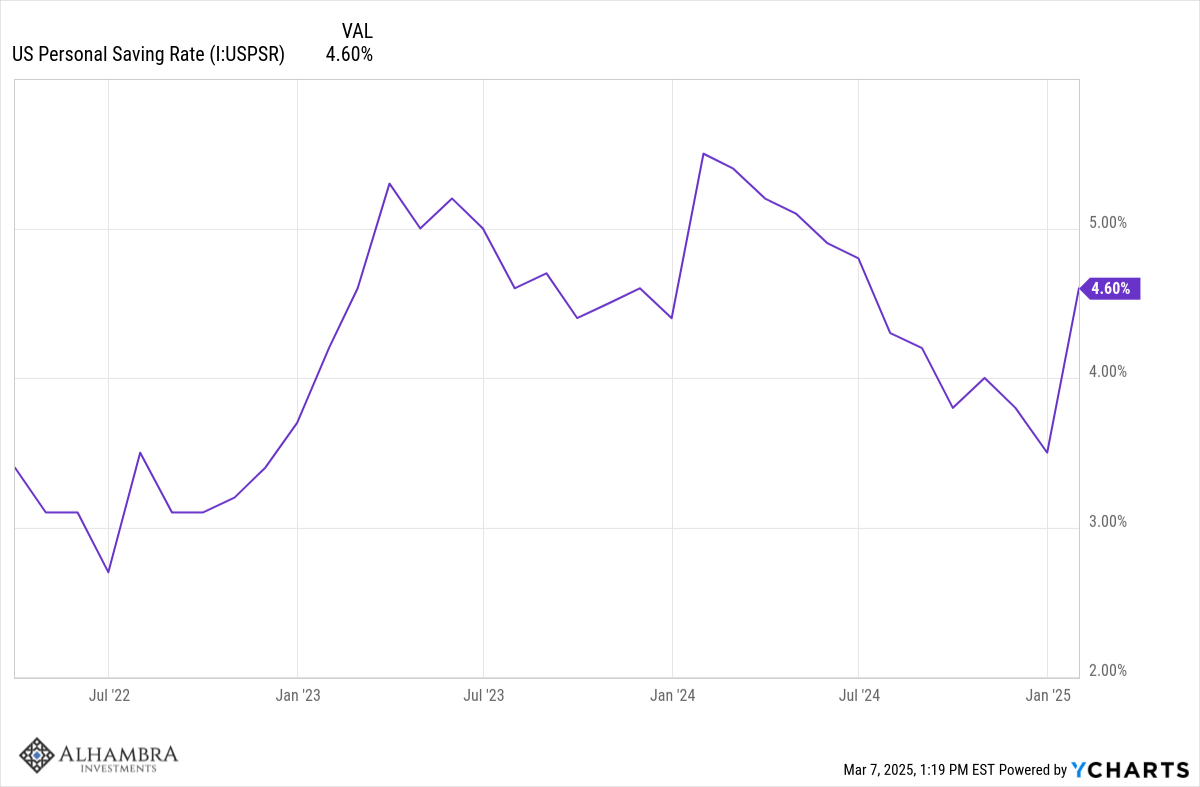

The result has been a pullback in consumption and a rise in savings.

Wholesale inventories rose 0.8% in January while sales fell 1.3%. Real retail sales fell 1.6% in January, auto sales were down 7.5% and real personal consumption of goods fell 1.7%. The fall in sales could be from reduced consumer confidence but January was also the coldest since 1988 and that likely also had an impact.

Incomes, however, are still rising so the savings rate jumped 31% in January to 4.6%.

These economic data points are ones I think (or in some cases know) have already been affected by the uncertainty of the new administration but this is January data and Trump wasn’t in office until the latter part of the month. Markets and economic actors do anticipate and act in advance of actual change though so while some of this slowdown in January may have been weather related or in the pipeline already, some of it was likely in anticipation of Trump 2.0.

February reports at this point are mostly of the survey/opinion type but they don’t look particularly strong. The ISM manufacturing survey fell in February to 50.3, barely above the 50 level that separates expansion from contraction. The new orders and employment components of the index are already below 50 (48.6 and 47.6 respectively). Meanwhile the prices paid index rose from 54.9 to 62.4.

More interesting were the comments:

ISM: “Demand eased, production stabilized, and de-staffing continued as panelists’ companies experience the first operational shock of the new administration’s tariff policy. Prices growth accelerated due to tariffs, causing new order placement backlogs, supplier delivery stoppages and manufacturing inventory impacts. Although tariffs do not go into force until mid-March, spot commodity prices have already risen about 20 percent.”

Respondents:

- “The tariff environment regarding products from Mexico and Canada has created uncertainty and volatility among our customers and increased our exposure to retaliatory measures from these countries.” [Chemical Products]

- “Customers are pausing on new orders as a result of uncertainty regarding tariffs. There is no clear direction from the administration on how they will be implemented, so it’s harder to project how they will affect business.” [Transportation Equipment]

- “The incoming tariffs are causing our products to increase in price. Sweeping price increases are incoming from suppliers. Most are noting increases in labor costs. Vendors are indicating open capacity. Inflationary pressures are a concern. Our company is working diligently to see how the new tariffs will affect our business.” [Machinery]

- “The uncertainty about tariffs keeps us cautious on spending, despite the strong sales right now.” [Electrical Equipment, Appliances & Components]

- “Management now has us running scenarios to project tariff impacts to our business. They want numbers in 24 hours on variables that equate to a wild guess. Interesting times we live in.” [Nonmetallic Mineral Products]

- “….customers are still very hesitant to commit to long-term volumes due to the market uncertainty caused by proposed tariffs on steel/aluminum imports.” [Primary Metals]

Manufacturing has only recently been recovering from a 2-year slowdown caused by the supply chain disruptions during COVID. With uncertainty around availability during the pandemic, companies double and sometimes triple-ordered goods to make sure they had sufficient inventory to keep products on shelves. When supply chains normalized, they were stuck with large inventories that had to be worked down. That inventory correction kept the ISM manufacturing survey under 50 for 26 consecutive months until January and February of this year.

While the uncertainty around tariffs is impacting manufacturing now, I tend to think the recovery will continue although maybe at a more subdued pace. Inventory/sales ratios are not at levels that would require a rapid ramp up in production even at the previous consumption pace but the pressure will be even less if consumption slows, as it appears to be doing.

Other evidence that tariffs are already impacting businesses comes from quarterly earnings conference calls. Factset recently ran a search for the term “tariff” and “tariffs” on conference call transcripts of all the S&P 500 companies that conducted calls between 12/15/24 and 3/5/25:

“Of these companies, 259 have cited the term “tariff” or “tariffs” during their earnings calls for the fourth quarter. This marks the highest number of S&P 500 companies citing “tariff” or “tariffs” on quarterly earnings calls over the past 10 years (using current index constituents going back in time). The previous record-high number during the past 10 years was 185 companies, which occurred in Q2 2018.”

The four sectors that mentioned the terms most also happen to be the sectors that have seen the largest cuts in future earnings estimates for Q1 to date. One might also note that the number of companies talking about tariffs is over 50% of the index. This is not a concern confined to a specific sector; it is widespread.

Market Indicators

Using the markets to gain insight to the future economy allows one to do so without one’s personal beliefs interfering with the analysis. What markets are saying right now is that the economy is slowing modestly from the Q4 pace. That may well change as we get more clarity on future trade and fiscal policies but that is the current situation.

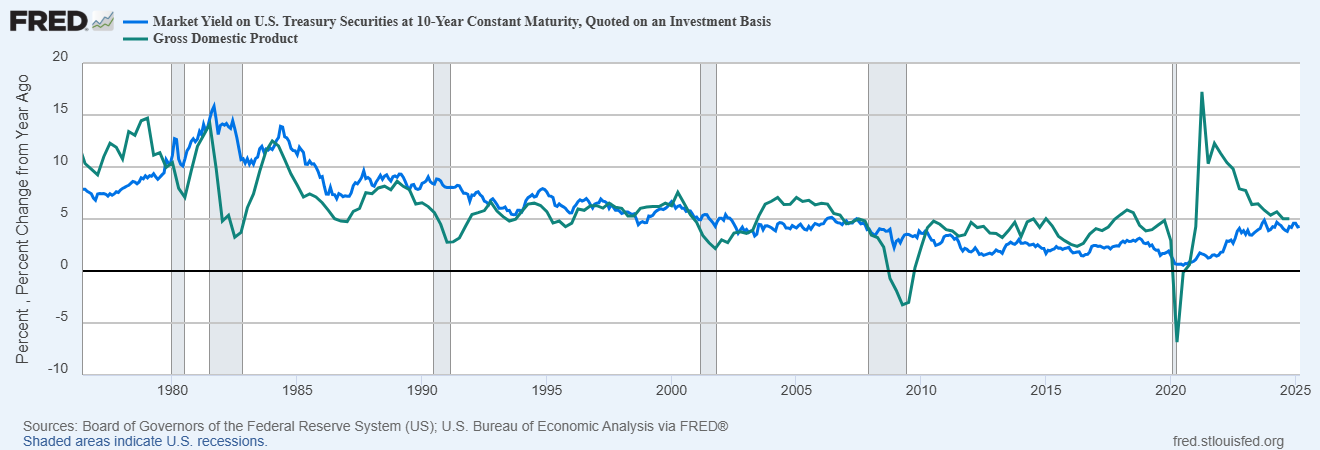

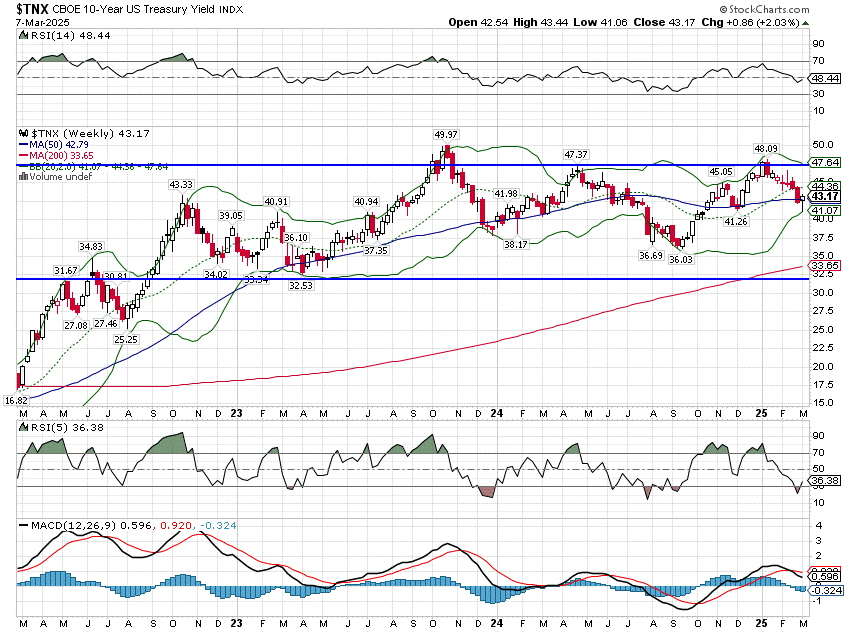

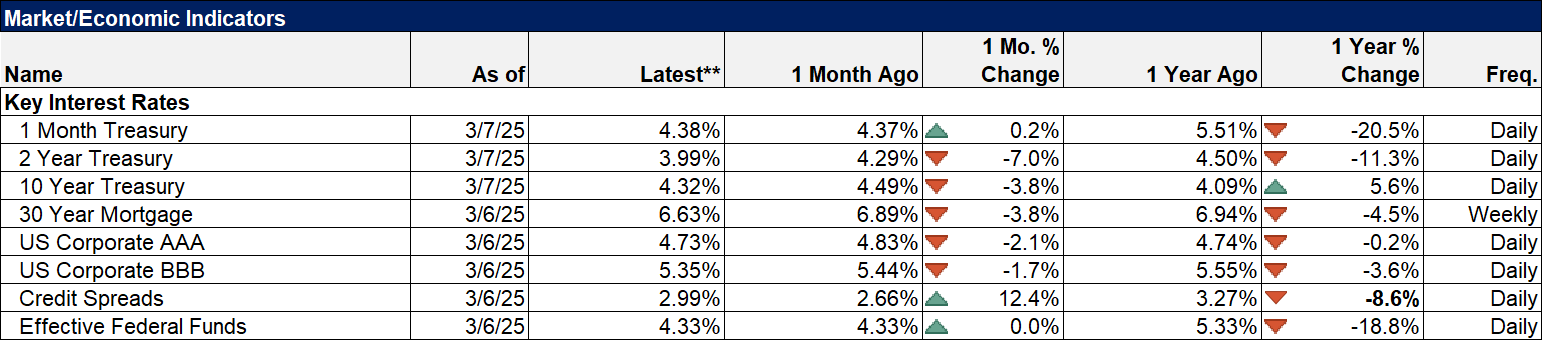

The market proxy for Nominal GDP growth is the 10-year Treasury yield which has fallen recently, from 4.8% on 1/13/25 to as low as 4.18% on 3/3/25 and 4.32% today (3/8/25) for a total drop of 47 basis points. Real yields (TIPS, adjusted for inflation) have fallen 35 basis points while inflation expectations have fallen by 12. Since the peak, a week ahead of President Trump’s inauguration, the nominal 10-year yield has dropped 47 basis points, 75% of which is a result of lower real growth expectations while the other quarter is from reduced inflation expectations.

With the 10-year yield below the year-over-year change in NGDP of 5%, the market appears to be anticipating a modest slowdown:

However, the 10-year yield is still in a fairly narrow range that it has been in for most of the last two years. Despite all the recent turmoil regarding economic policy, the overall change in the outlook for NGDP growth hasn’t yet changed significantly:

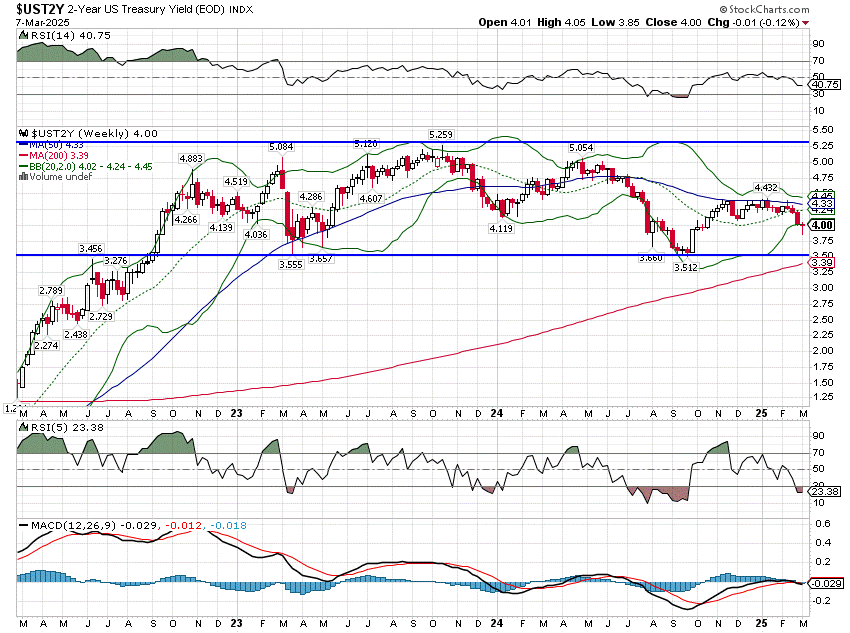

The 2-year yield also hasn’t changed significantly:

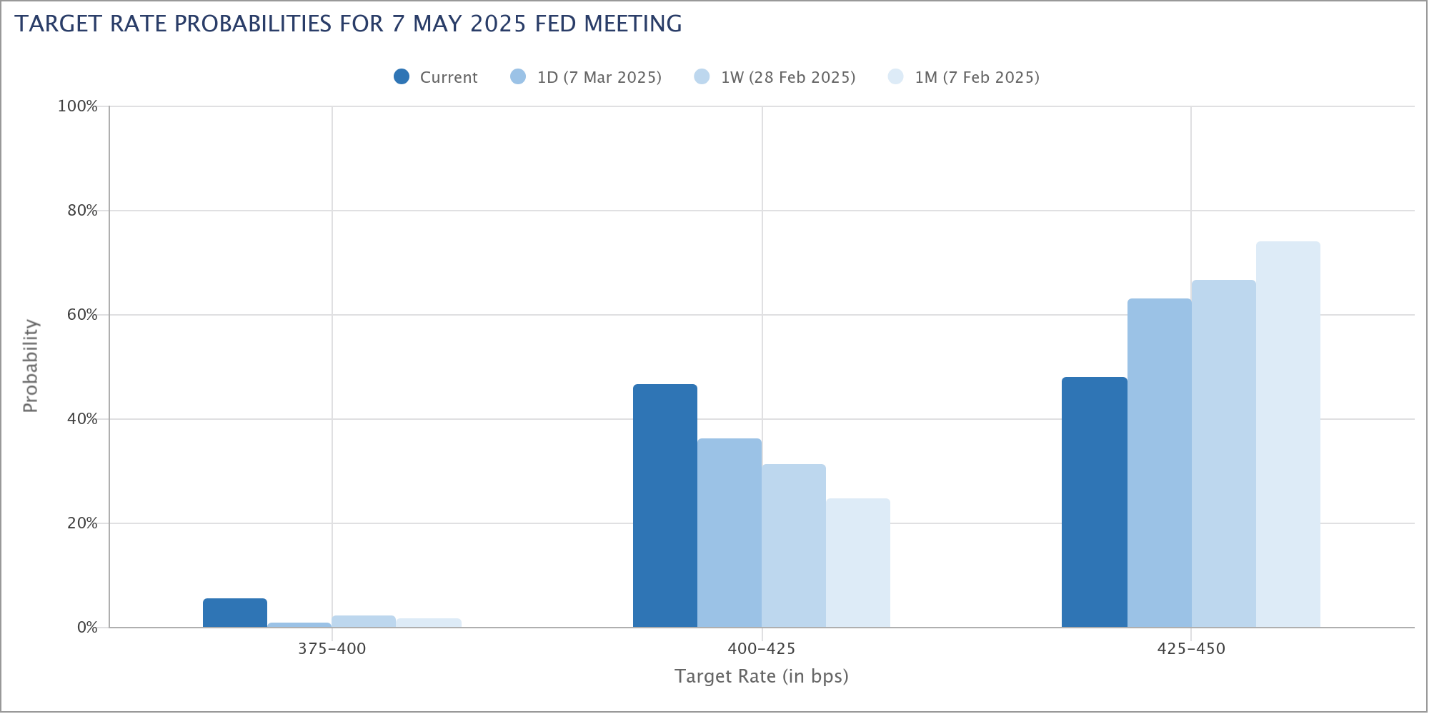

Not much change in the Fed Funds market either. The odds of a Fed rate cut in March have barely changed while the odds of a cut in May have risen but are still less than 50%:

In fact, there is no month the rest of the year that has a greater than 50% probability of a rate cut. The outlook for traders betting on the Fed hasn’t changed much at all.

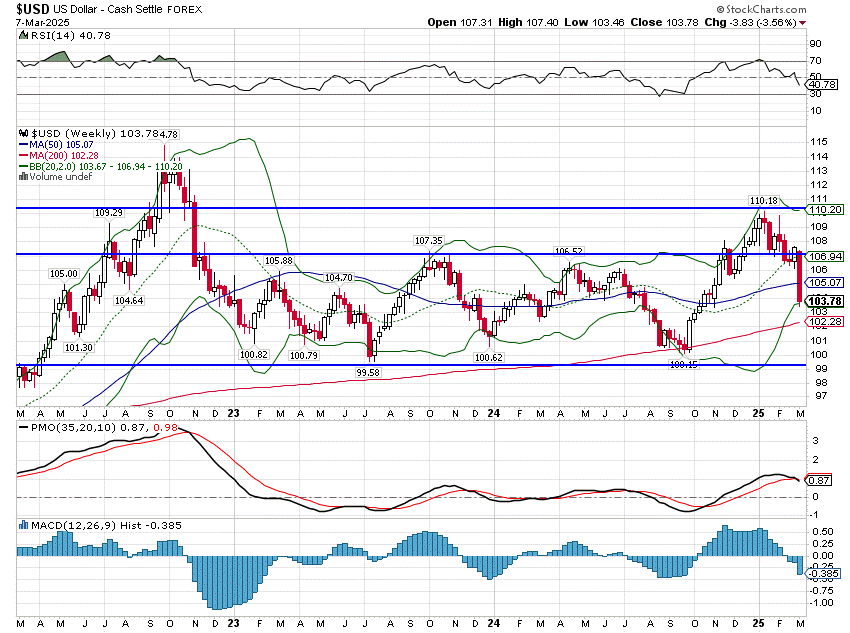

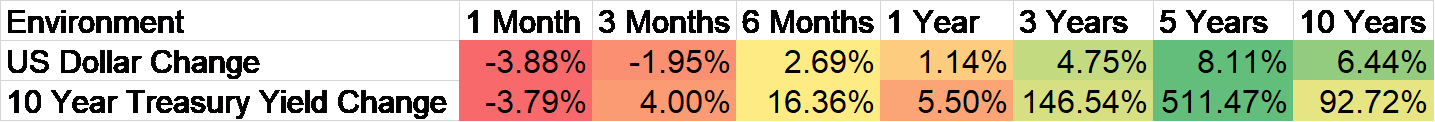

The surge in the dollar immediately after the election – the textbook effect of imposing tariffs on other countries – has proved to be a head fake. Maybe the dollar will have a big rally as more tariffs are imposed, but even after this pullback that is the very conventional wisdom. Maybe threatening a trade war against the entire world isn’t such a great idea if you want a strong currency. On the other hand, it is far from a secret that the administration favors a weaker dollar. The head of the CEA, the Treasury Secretary, the Vice-President and the President himself, have all said publicly they want a cheaper dollar. And they are getting it, at least for now. I’ll ask the same question I did a few weeks ago: do you know anyone who is bearish on the dollar?

- The overwhelming bullish attitude on the dollar since the election on the “certainty” that Trump would impose high tariffs and the “certainty” that it meant a stronger dollar was too extreme to hold. We’ll see how this plays out but I’d be shocked if it played out in textbook fashion. Markets don’t read textbooks. 12/1/25 Questions For The New Year (DXY = 106.4)

- Currency markets usually don’t allow disparities like this (labor cost differences) to persist; the currency of the country with uncompetitive wages will fall to balance things out. That hasn’t happened to the dollar yet but if tariffs can’t fix this, currency markets will. 1/21/25 Tariffs Aren’t The Answer (DXY = 108.03)

- The dollar is overvalued (my guess is about 20%) but that has been true for some time; as with stocks, valuation is a lousy timing tool. But with a President who has made it known he wants a weaker dollar, we’re likely to get it. 1/26/25 Is The Honeymoon Over Already? (DXY = 107.75)

- If I were a trader, I’d be looking at getting short the buck since no one seems to have the guts to actually bet against it right now. The market generally acts to frustrate the maximum number of people and right now that would be the longs. 2/17/25 Odd Happenings (DXY = 106.74)

Despite the recent dollar weakness (currently 103.78) like interest rates, the dollar remains in the range it’s been in for most of the last two years. Conventional wisdom after the election was that tariffs would be good for the US and bad for the rest of the world, but the recent market moves indicate the opposite. Conventional wisdom is certainly conventional but rarely wise.

So far, despite the volatility from erratic policy making, all that has happened is that the dollar and interest rates have fallen back to where they spent most of 2024, a year when real GDP grew by 2.5%. Not great but surely not recession either.

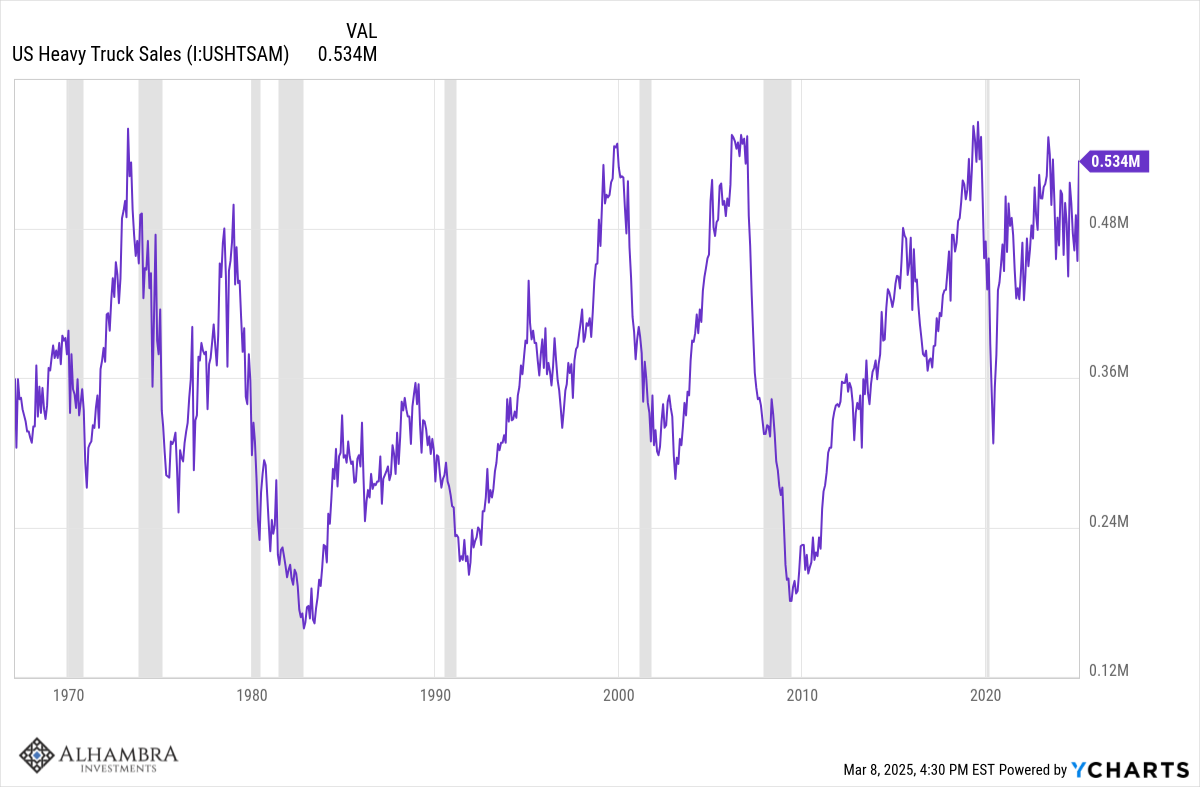

There are other signs that the economy remains on solid footing. Heavy truck sales, which tend to fall prior to recession, remain near the highs of the cycle:

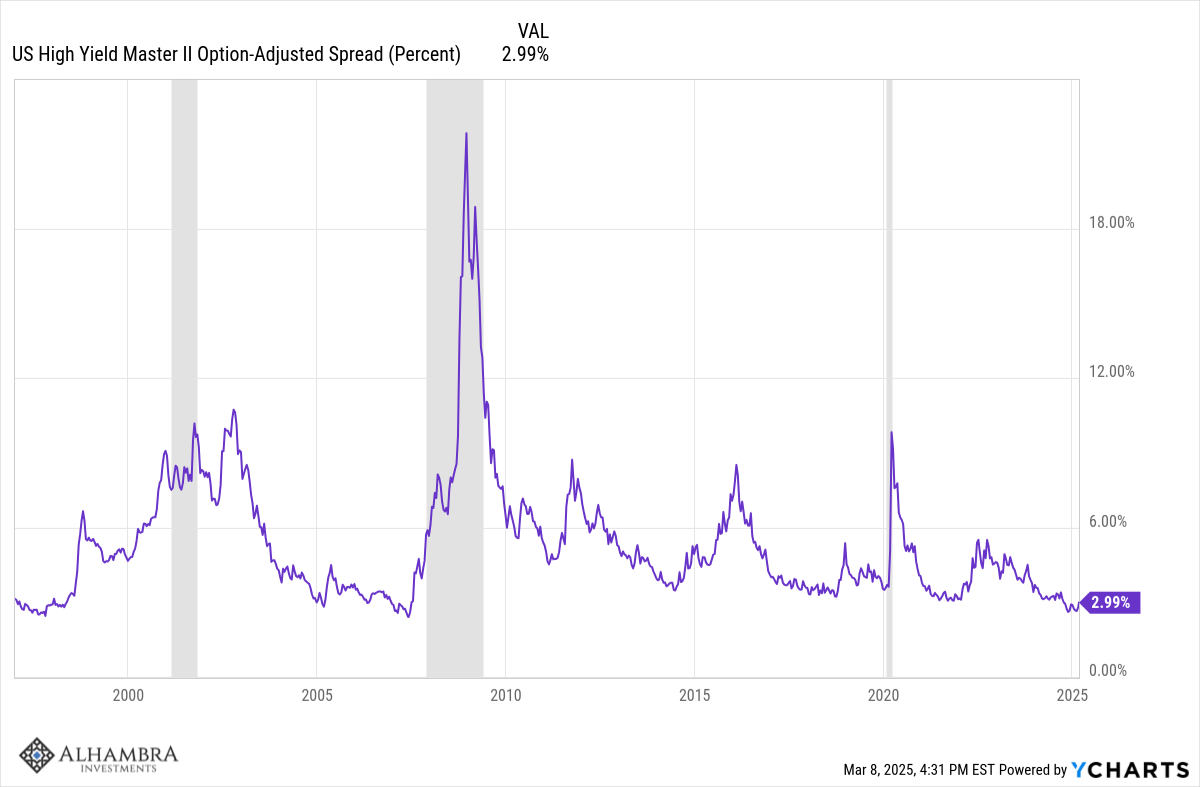

Credit spreads (the difference between junk bond yields and treasury yields) have come off their lows but remain near the lows of the cycle. There is plenty of risk appetite in the risky parts of the bond market:

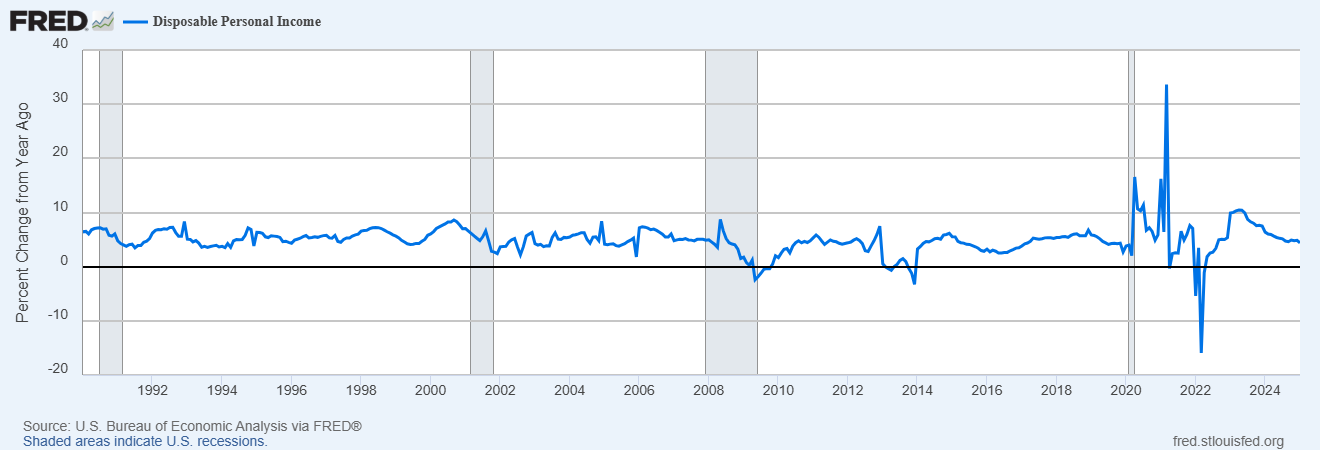

Disposable Personal income growth is still good (+4.4% yoy) if slightly less than the long-term average of 4.9%:

Conclusion

Immediately after the election, markets started to price in the positive aspects of President Trump’s campaign promises. Better fiscal management, that includes lower government spending and lower taxes, is seen as a positive for economic growth. A lighter regulatory touch is also seen as positive for growth or at least corporate profits, although the history of banking in this country would argue for a pretty tight rein on that sector.

Since the inauguration, however, the new administration has created more confusion and chaos than positive change. The introduction of DOGE could have been a positive source of change if it had actually concentrated on reducing costs, rooting out waste and fraud and improving efficiency rather than creating chaos for chaos’ sake.

Even trade policy could have been a positive if it had been approached in a logical and systematic way. If President Trump had announced that the US was going to pursue an aggressive global effort to reduce trade barriers, markets would have taken that as a positive. Instead, he has pursued a series of aggressive, bilateral trade wars and abrogated treaties he negotiated in his first term, which would seem to make future agreements harder to come by.

While markets are obviously not pleased with the approach to policy taken by the Trump administration, it will not benefit investors to overreact to Trump’s every utterance. Although he has threatened Canada and Mexico with steep tariffs, he has yet to impose them and has left himself an out if they prove too damaging to the US. Much of his tariff rhetoric is contradictory – are the Canada/Mexico tariffs about fentanyl, producing revenue for the budget, or improving the trade balance between the three countries? – but that may be strategic. If he needs to reverse the tariffs he can always say that Canada and Mexico have done a great job of reducing fentanyl trafficking.

We don’t know yet how damaging the short-term uncertainty created by the Trump administration will be. If it continues, if the uncertainty is not relieved in some way, the slowdown could theoretically morph into a recession, but that is not my base case. For now, based on what we’ve seen from markets to date, all I can really say is that markets have priced out the potential positives of Trump 2.0.

Has the market fully priced in the potential negatives? I can certainly see a very negative outcome on trade that has not even come close to being priced in but focusing exclusively on the worst case scenario is not an optimal approach to tactical investing. As the Buffett maxim says, an investor should be greedy when everyone else is fearful – or the opposite when appropriate – but that is hard to do if you always expect the fear to be fully realized.

Investor sentiment has become very negative over the last few weeks and it could get more so, but any positive development at this point would likely produce a sizable positive move in the markets. The good news is that we’ve arrived at this negative sentiment juncture with the S&P 500, the Russell 2000 (small caps), and the NASDAQ 100 down less than 10% (which most consider the benchmark for a “correction”) from the peak on 2/19/25.

From a market perspective, the outlook today is no different than it was 5 months ago. Interest rates, the dollar, the S&P 500 and NASDAQ 100 are essentially unchanged since the election. Dividend stocks, international stocks and some value stocks are up since then. Intermediate-term bonds, gold and commodities are also higher. In a more volatile world, diversification pays.

Environment

As noted above, interest rates and the dollar remain in the same range they’ve been in for most of the last two years. Both are in very short-term downtrends.

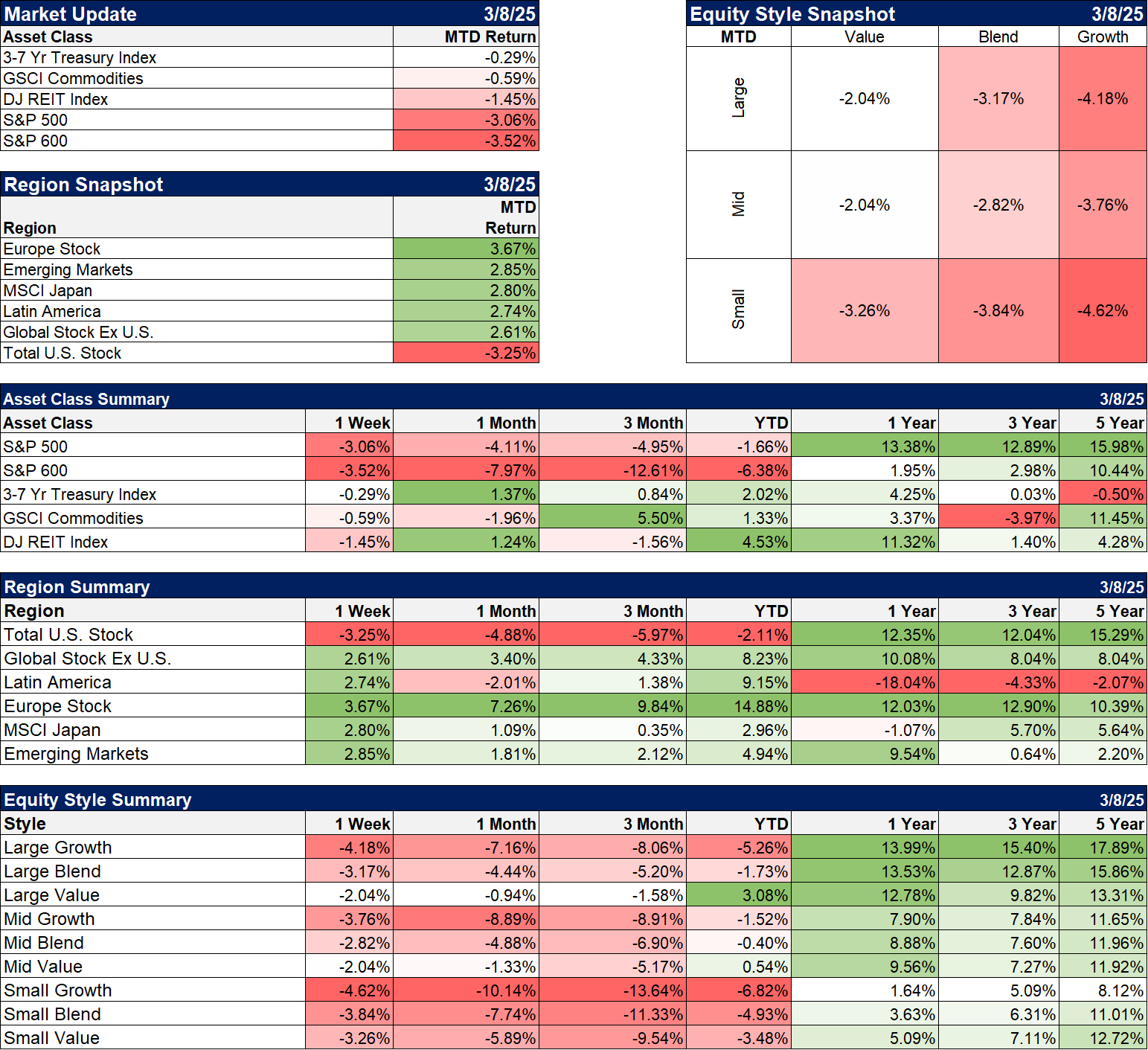

Markets

March has not been a good month for investors with all US assets down on the month. By contrast, almost everything outside the US is up. I don’t know if an explanation is necessary for such a short period of outperformance but if it continues, the Trump administration is going to have some explaining to do. Short-term pain, long-term gain is all they’ve offered so far which will work as long as the short term is really short term.

YTD gains are all in the diversifying assets (not stocks) and non-US equities. REITs are leading the way with bonds, commodities and gold also up on the year. Large cap value stocks are up on the year as are some other factors not shown here.

Sectors

Only one sector (healthcare) is positive for the month of March. Interestingly, 9 of 11 sectors are higher YTD despite the indexes being down. Over the last year, only one sector – materials – is down.

Economy/Market Indicators

Economy/Economic Data

The most noteworthy report of the week was the trade report. Imports were up an astounding 10% month-to-month and a 78% expansion of the trade deficit in the last three months. That is obviously companies trying to get ahead of the tariffs. Of course, a surge in imports today will be offset by lower imports and a smaller trade deficit later. The Trump administration will almost certainly point to that shrinkage of the trade deficit as evidence their tariffs are working. Don’t be fooled. Because companies have taken action to protect themselves from the tariffs, it will take at least 3 to 6 months to start seeing the damage of the tariffs.

Stay In Touch