The stock market rallied last week, the S&P 500 up nearly 6%, spurred on by the suspension of some of the tariffs imposed on April 2nd. The “reciprocal” part of the new tariffs was suspended for 90 days while the 10% universal tariff was retained. Tariffs on China, however, were raised further after they retaliated against President Trump’s previous retaliation for China’s earlier response to the initial tariffs, which were added on to tariffs from Trump’s first term and the Biden administration. Or at least I think so. There is some confusion about whether some countries even have the 10% universal tariff and whether it will be added to the 25% tariffs already imposed on Mexico and Canada (I don’t think so but who knows?). Just to further confuse things, the administration published a list of exemptions late Friday, after the market closed, for smartphones, laptops, memory chips, and other electronic items from some or maybe all of the tariffs. However, Howard Lutnick, the Commerce Secretary, said on Sunday that those items were only exempted because they’ll soon get their own set of specific tariffs, probably on the semiconductors they all contain. Maybe in a month or two. Or not, depending on how an investigation ordered by President Trump comes out.

Stocks may rally on Monday when the market opens, based on the exemptions, but I don’t know that I’d bet much on it sticking. The administration’s tariff policies are obviously not well thought out and the unintended consequences were either underestimated or, more likely, not considered at all. A few months ago, the administration crowed about Apple promising to invest $500 billion in US-based manufacturing but then threatened to devastate their profits with tariffs on China and India. How do they expect Apple to invest in US manufacturing if they don’t have the income to do so? The same could be said for the entire reshoring project. By imposing tariffs before companies have had a chance to build new US capacity they’ve made reshoring more expensive and even less likely to happen. A trade war is more likely to reduce investment in the US unless we simultaneously and drastically reduce our budget deficit. Reducing imports will mean reducing exports too because other countries won’t have the dollars with which to buy them. If we don’t trade with them, they don’t invest.

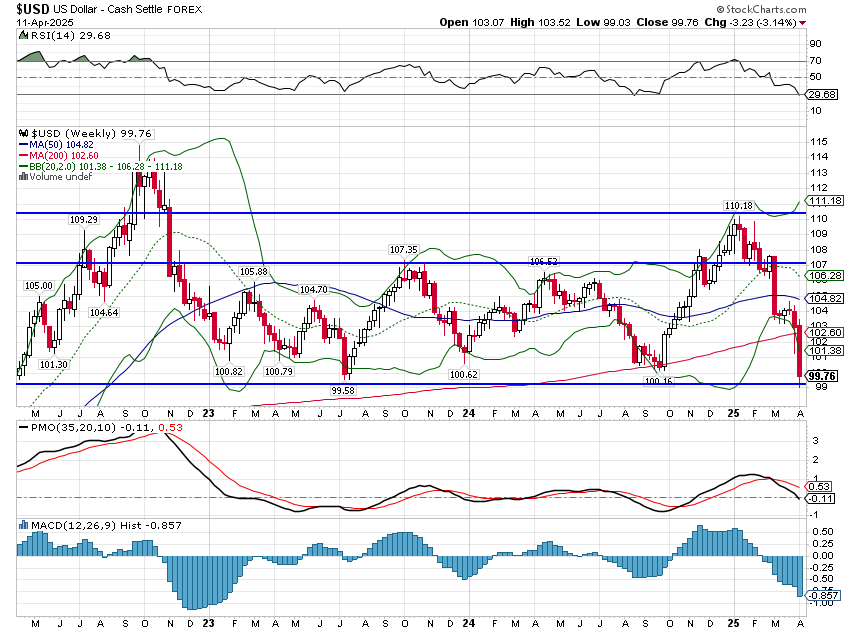

Last week’s stock market rally was accompanied by more negative moves in other markets. Gold was up more on the week than stocks and continued to climb even after stocks started to recover. The 10-year Treasury note yield rose 50 basis points last week while the 2-year note rose 32; term spreads widened. High yield credit spreads narrowed last week but only by a few basis points. Maybe most disturbing of all, the dollar fell over 3% as foreign investors took flight (which may be part of what was ailing the bond market too). The US, as I said above, needs foreign investment to fund our savings shortfall. With news last week from Elon Musk that after weeks of disruption they’ve managed to find a grand total of $150 billion of fraud, waste and abuse, that need does not seem likely to wane anytime soon. If foreign investors decide to pick up their capital and go home, we have a rather large problem.

Foreign investors own about 20% of US stocks, 30% of US Treasuries, and 30% of corporate credit. Official accounts of other countries may stick with US Treasuries (bidding at Treasury auctions last week seemed fairly normal) but individual and institutional investors may feel differently. A Euro-denominated investor who bought a 10-year Treasury note at the beginning of this year would be about breakeven on the price and would have accrued a quarter’s worth of interest, but they’d be down about 10% on the change in the Euro/Dollar exchange rate. If that math continues for very long, the rise in rates and the drop in the dollar are likely to accelerate. The same is true of US stocks, especially the growth stock-heavy S&P 500 where a lot of that foreign equity money is sitting. Stocks may have come off the mat last week but they aren’t even back to the levels of “Liberation Day” eve. Just getting back to there would require a further 5.7% rally from Friday’s close. And the index is also still down 8.6% YTD and 12.6% since the February peak.

The chaos of the tariff rollout has created a level of uncertainty that makes investment in the US very difficult, maybe impossible, to justify. Policies change on a whim with seemingly little thought to the consequences. The exemptions granted last Friday seem good at first but consider that a part used in a smart phone – say a battery – will continue to face the full tariff but an imported phone that contains that battery will be exempt. How exactly will that incentivize investment in the US? The granting of exemptions also creates, at a minimum, the perception of favoritism if not outright corruption. The big tech companies who donated to President Trump’s inauguration fund or his campaign get an exemption for their products but what about the thousands of small and medium-sized businesses that don’t have access? What about the lower margin US-based manufacturer who relies on some critical input from China who will face the full force of Trump’s China tariffs? Do they get invited to the White House? Or will they be shuffled off to the Treasury Secretary? Or relegated to some lower level official who has no more chance of getting the White House’s attention than the petitioner?

The universal and “reciprocal” tariffs also make it harder, not easier, to sign trade deals. The universal 10% and “reciprocal” tariffs abrogated all of the free trade agreements the US had in place, demonstrating to the entire world that we do not abide by our agreements. Who wants to sign a trade deal with the country that just violated numerous trade deals? One of the reasons the rest of the world invests in the US is because we respect the rule of law, with agreements signed by previous administrations honored by the new one. Further, contrary to President Trump and Secretary Bessent’s poker analogies, the US doesn’t have a very good hand right now. As we just found out with the exemptions announcement, there are certain things we want – and need – in the US that we can’t produce ourselves and that is unlikely to change for a long time, if ever.

Treasury Secretary Bessent recently said that Chinese tariffs on the US don’t matter because they don’t buy anything from us. That is true and also exactly why Bessent is wrong about the hand he holds. If China loses all its US export sales, it hits them to the tune of about 2% of their GDP. The loss of US exports to China is trivial compared to the size of our economy but a lot of the things we import from China are critical inputs to our economy and will affect a lot more than 2% of GDP. For a lot of companies, particularly small and medium-sized ones, continued high Chinese tariffs are a death knell. China’s loss, on the other hand, is just money and they have a very high savings rate. They can try to open other markets to replace US sales, they can use fiscal stimulus to soften the blow of the loss and they can spread the pain across the entire economy. Which country do you think will better tolerate the hardships that result from a trade war?

Consumer and corporate sentiment is already negative and falling fast. The preliminary University of Michigan’s Consumer Sentiment Survey for April, released last week, was the second lowest level since 1952, when we were still in the middle of the Korean War:

Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month. The share of consumers expecting unemployment to rise in the year ahead increased for the fifth consecutive month and is now more than double the November 2024 reading and the highest since 2009.

Year-ahead inflation expectations surged from 5.0% last month to 6.7% this month, the highest reading since 1981 and marking four consecutive months of unusually large increases of 0.5 percentage points or more. This month’s rise was seen across all three political affiliations. Long-run inflation expectations climbed from 4.1% in March to 4.4% in April, reflecting a particularly large jump among independents.

The reprieve offered last week by President Trump just further complicates the economic outlook. The delay is for 90 days, but how many actual trade agreements can the administration negotiate in that time? Will the deadline be extended? How long will the exemptions announced last Friday last? The President has recently renewed this threat to put tariffs on pharmaceuticals. When will that be announced and how high will the tariffs be? The future is no less uncertain now – and maybe more so – than it was at the beginning of last week.

I hope – and expect – to see more changes to the tariff plan in coming days and weeks. Best would be to call the whole thing off and concentrate on policies that offer greater incentives to companies – US and foreign – to invest in the US. They will be reluctant to do that with interest rates rising and the dollar falling. If that continues, more alterations to the tariffs seem almost certain. The trade war likely has a long way to go but the tactical retreat by the Trump administration last week was probably the end of the beginning phase. What comes next? In the age of Trump no one knows the answer to that question.

Joe Calhoun

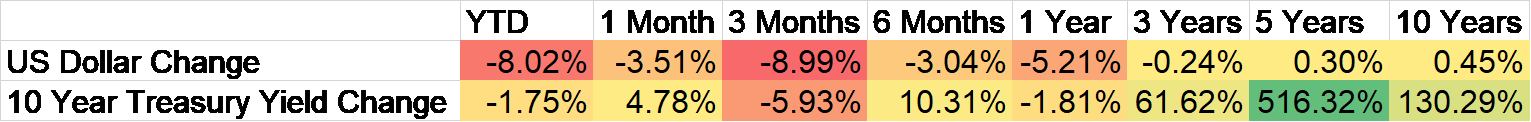

Environment

The dollar is now down over the last three years and at the very bottom of its recent range. Currently at about 100, the dollar index is on the verge of falling through support that has held for the last three years. A breakdown through 99 would likely beget a lot more selling, with a further 10% correction to 89-90 likely in coming months. We are in a short-term downtrend and if we do break lower here, the 115 peak in 2022 will likely be seen in the future as a generational top. I suspect we are entering a weak dollar period that will last a long time. This loss of confidence in the US will be very hard to repair.

The 10-year Treasury yield surged last week and appears to be aimed directly toward 5%. Rates that high would do irreparable harm to the Trump agenda. Remember Treasury Secretary Bessent said he and the president were focused on the 10-year yield. Well, it isn’t going where they want it to go and it won’t without a change of plan.

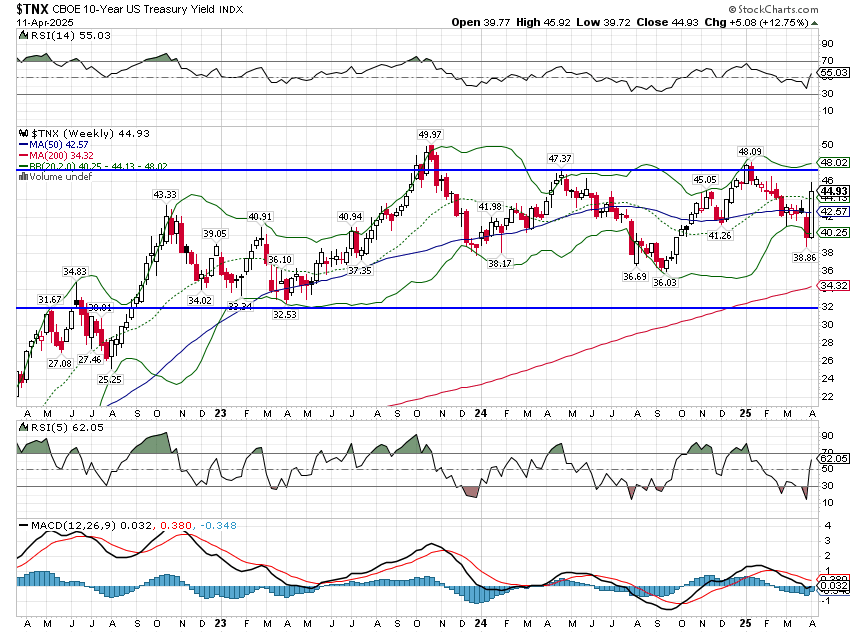

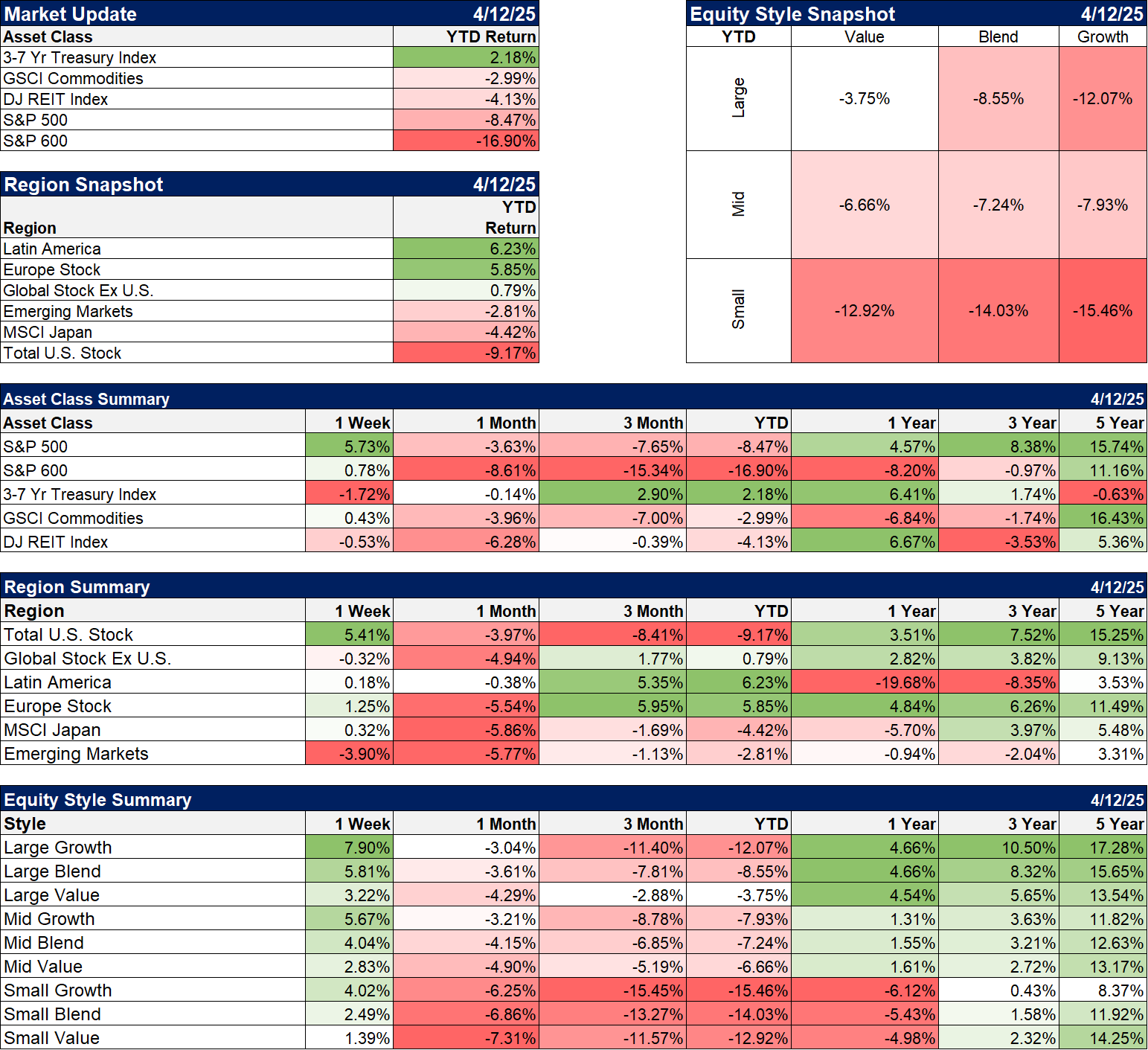

Markets

The focus has been on the S&P 500 in this selloff but small cap stocks have taken this the hardest. It shouldn’t be lost on investors that small caps came into the year with a considerable valuation advantage over large cap. That hasn’t mattered one bit.

The falling dollar does have one silver lining – international stocks. Latin America and Europe are both up over 5% this year and the broader international index is slightly positive. This is what we expect with a weak dollar but it isn’t always the case that better-than-the-US means profitable. A global recession wouldn’t be good for any country’s stock market although a falling dollar might still keep non-US stocks outperforming by falling less in dollar terms.

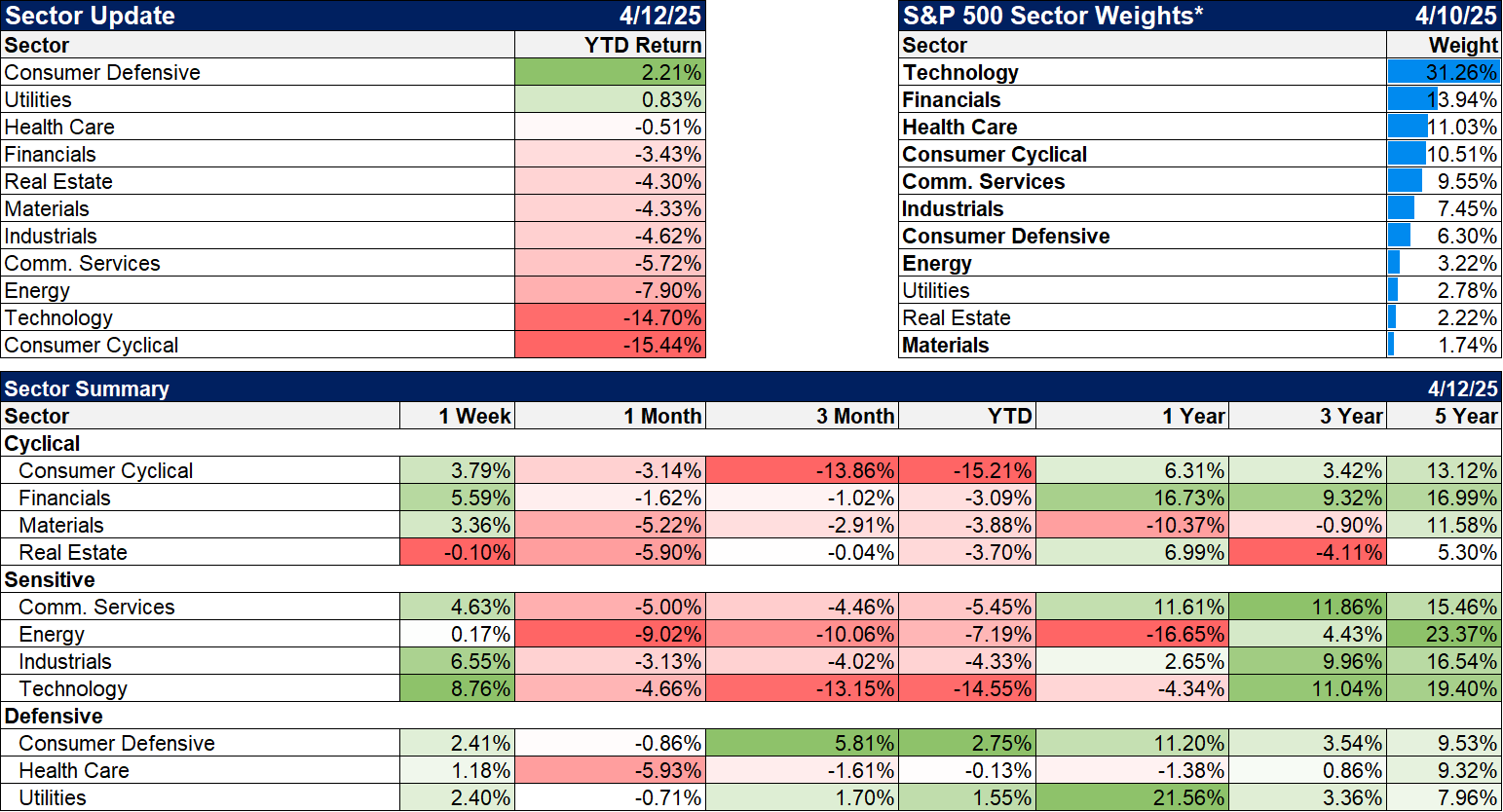

Take a look this week at the 3-year returns in the chart below. The S&P 500 traded down 20% at one point last week but didn’t close there so according to some, that isn’t a bear market – yet. But if you think it was – and I do – then this is the second bear market in a little over 3 years and the 3rd in 5 years. We haven’t seen that since the 1930s so congratulations if you survived it.

Sectors

Consumer staples and utilities are the lone winners this year with technology and consumer discretionary bringing up the rear. I’d start looking at the 3-year laggards for potential buys. The worst performers are materials, real estate, energy, and healthcare.

Economy/Market Indicators

Credit spreads are still at the top of my worry list but they did improve a little last week.

Economy/Economic Data

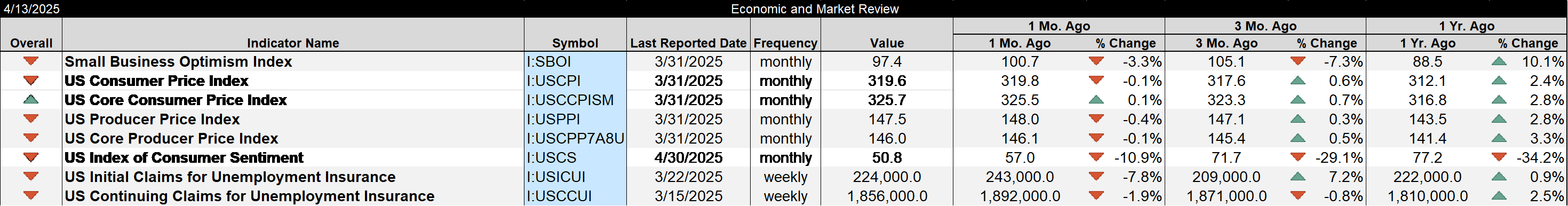

- Small business optimism fell but is still up considerably over the last year.

- Inflation was less than expected with headline CPI and PPI both negative month to month. Don’t expect that to continue.

- Unemployment claims are, remarkably, still only at 224k. Again, don’t expect it to stay that way. We’ll start to see layoffs – government and private sector – hit those numbers soon.

- The consumer sentiment numbers were pretty awful and, I think, more importantly crossed all political lines. Democrats, independents and Republicans all reported a more dour mood. Being upset with the current economic situation is a bipartisan affair.

Stay In Touch