Coming into last week’s FOMC meeting, Jerome Powell was expected to be hawkish. I know that because numerous articles in the financial press told me so which makes me wonder if the articles themselves affected those expectations. Maybe. Bloomberg is now producing a Fed Sentiment index that is powered by a natural language processing algorithm trained on more than 60,000 headlines about the Fed. That index shows that Powell’s statements after the December FOMC meeting were perceived as a major dovish shift in Fed rhetoric. That shift, according to Bloomberg, “gave stocks and bonds a boost and helped the economy dodge a downturn”, a conclusion based on some pretty flimsy evidence, if you ask me. If you assume the economy was headed for a slowdown and it didn’t, then I guess you could also assume that Powell’s language change in December is the reason. The fact that economists have been “expecting” a downturn for the last two years and have been dead wrong might point you in a different direction but I guess Bloomberg needs to recoup their investment in AI.

When the economy refused to heed the economists predictions of a growth and inflation slowdown in the first quarter, Powell’s tone changed to a more hawkish one, saying at the IMF’s recent meetings that “it is appropriate to allow restrictive policy further time to work”. That was a hawkish offset to the “stimulus” provided by the dovish December pivot and the economy has responded, if you believe all this, by producing some soft economic growth data recently. Powell’s recent hawkishness and some not quite as good as expected inflation data is why the expectation for this meeting was that he would continue to talk that way. So, of course, he didn’t and stocks and bonds rallied after his press conference. I can’t help but wonder what the market would’ve done if he had continued to channel his inner raptor Wednesday afternoon. After all, the hawks were already expected, so their arrival should have already been priced in. Would that have been dependent on how hawkish he was? What if he was dovish in a hawkish kind of way? Or hawkish in a dovish kind of way?

I find all this pretty ridiculous, that market participants have been reduced to parsing the words of the Fed chair to figure out what they should think about the economy and markets. I have always been a fan of Keynes’ explanation of markets as like a special beauty contest where the goal is not to identify the contestant you think the most beautiful but to guess which one the majority of guessers will think the most beautiful. In today’s markets, it isn’t the actual economic data that matters, but rather how Jerome Powell and the herd of economists at the Fed interpret the data. Their opinion, because they set short-term interest rates, has been deemed the most important factor to the economy and markets, at least in the short term. Their words, especially those of Jerome Powell, have become policy.

Once upon a time, the inner workings of the Fed were mysterious and most investors didn’t even know the Fed Chair’s name. The FOMC didn’t even announce changes in policy and they sure didn’t hold any press conferences. I remember anxiously watching the Dow Jones newswire after a meeting to see what, if anything, the Fed would do so I could figure out if policy changed. They preserved their independence by staying in the shadows and letting their actions speak while mostly ignoring markets (especially stocks). That all changed with Ben Bernanke, who decided that the Fed could guide the economy better – as if it needed his guidance – with more talk and less action. At the time, I thought it a good idea because the less the Fed does the better in my book. But that isn’t what happened. The members of the Fed do certainly talk a lot more, but they aren’t all singing from the same hymnal so the message is garbled and inconsistent, often creating market volatility where none would have existed before. Now every investor knows who Jerome Powell is and which Fed members are on the current FOMC. Those really trying to get an advantage know who the next members of the FOMC will be.

Unfortunately, just because they talk more doesn’t mean they do less. If anything, they do more, constantly inserting themselves into the conversation like some teenager looking for attention. But I can’t help but wonder if that is starting to change under Powell. I’m not sure his words are as calculating as everyone wants to believe. Did he really change his tone at the December press conference to intentionally affect markets and therefore the economy? I think that might be giving him more credit than he deserves; maybe he was just answering questions honestly, with no particular agenda. Or maybe all the Fed whisperers just heard what they wanted to hear. He talked about a lot of things at last week’s press conference but the one thing everyone reported on was when he said their next move was unlikely to be hike. Really? Did anyone seriously think that was one of their options right now? He basically said he’s just going to stand pat and see what happens and offered little other guidance, maybe because he’s tired of being wrong.

Bernanke seemed to believe that uncertainty about future Fed policy was creating volatility in the economy and that if some of that was relieved, the economy would function better. The only problem is that the Fed can’t predict the economy so they can’t provide much in the way of certainty about future policy. In fact, by providing guidance, they back themselves into a corner and cause more economic volatility. The guidance they gave about their balance sheet after COVID is a perfect example. They had set a schedule for winding down QE that they were determined to stick to so as not to ruin their “credibility”. The result is that they continued to buy mortgage backed securities until the spring of 2022 even though house prices were surging, up 21% year-over-year in March of that year. The rigidity caused by forward guidance created a policy mistake. Powell may be starting to understand that now. Or maybe he’s just tired of being embarrassed by giving guidance he subsequently has to walk back because despite employing more economists than any other organization on the planet, the Fed is no better at predicting the economy than a Magic Eight Ball.

Mostly what Fed talking does is create noise in the markets. I don’t think their words move markets enough to have a lasting impact on the economy. I don’t have any doubt that the elevated level of bond volatility is being driven by the Fed but it is hard to quantify. But it does seem to be, well, transitory. If you fell asleep last November 3 and woke up last Friday, you’d see that the 10-year and 2-year Treasury rates are unchanged, the dollar is unchanged and the 10-year TIPs yield is higher by 3 basis points. The outlook for the economy, as seen by the markets, is exactly the same today as it was six months ago. Think of all the time and effort wasted on parsing Fed speeches and all the trading based on whether someone sounded “hawkish” of “dovish”. And it was all just so much noise, the real economy, in the end, unaffected. Maybe if we all stop listening to them they’ll stop talking.

Environment

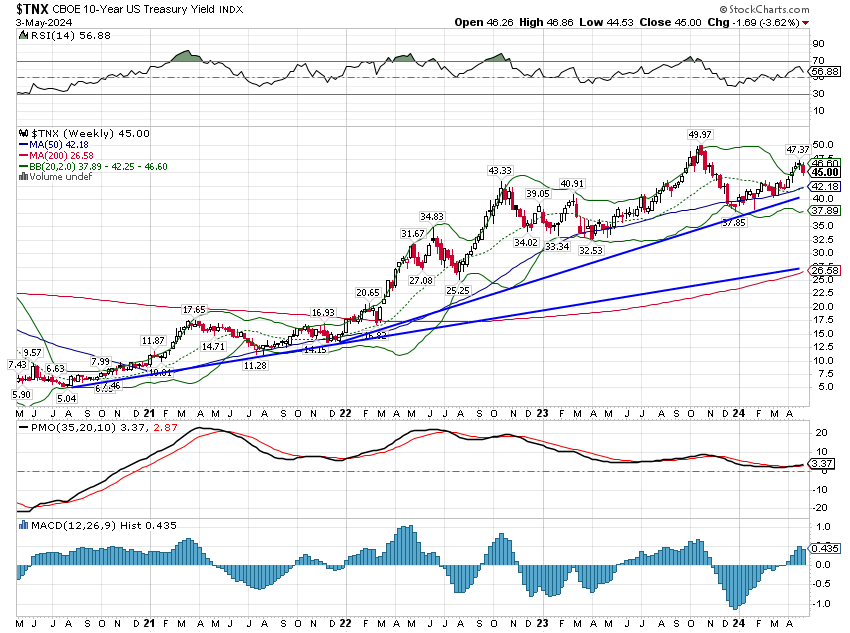

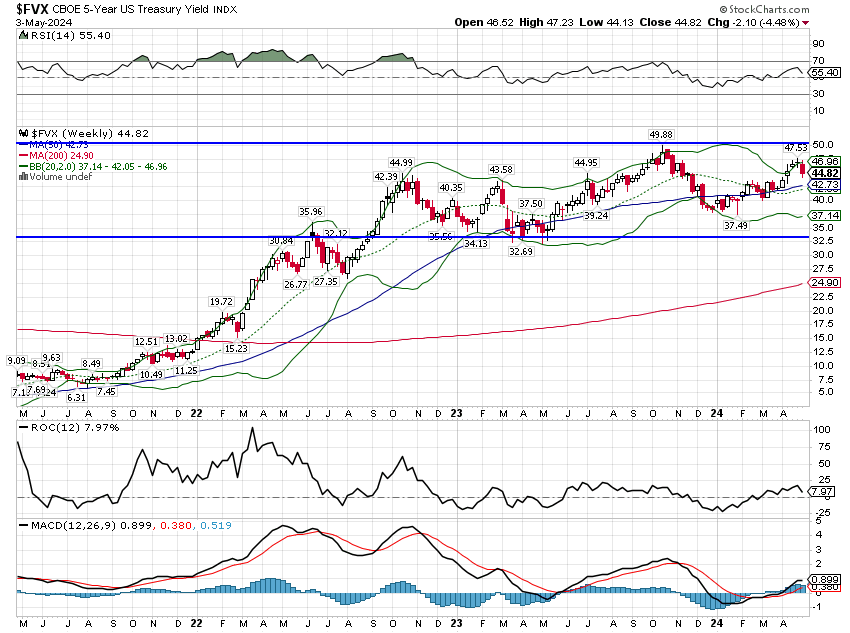

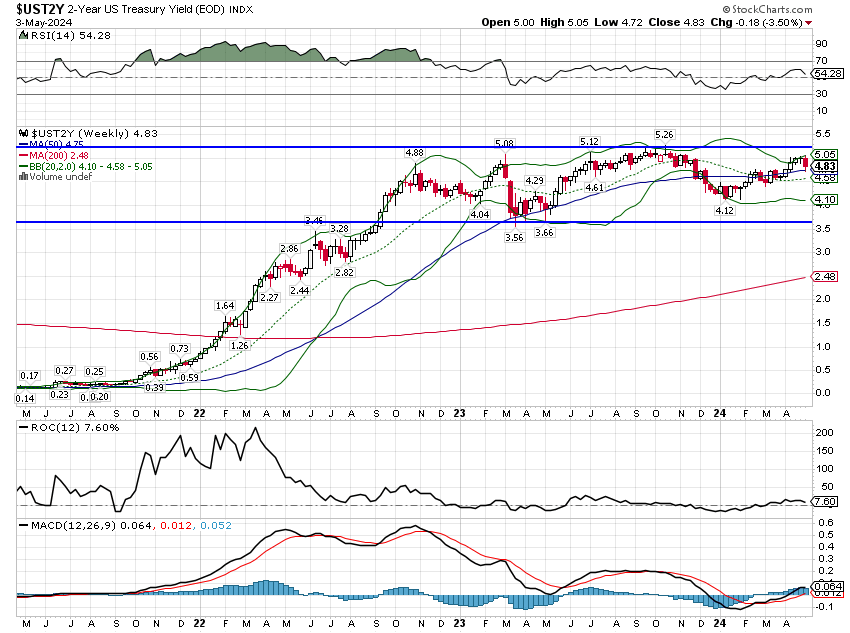

As I noted above, interest rates are unchanged over the last six months. The recent rise in rates that has had markets in an uproar the last few weeks appears to have run its course. While the 10-year Treasury yield is still in a short-term uptrend, the technical pattern is not that favorable. Shorter-term rates are in more defined sideways trends and looking a lot like head and shoulders tops. I’m not a big fan of technical analysis but others are – especially traders – so patterns like this can be significant as others act on them. We’ll see but I’ve said before and I’ll say again – I think rates have likely peaked for this cycle. The question is how low they might go or to ask it in another way, how much Nominal GDP might slow.

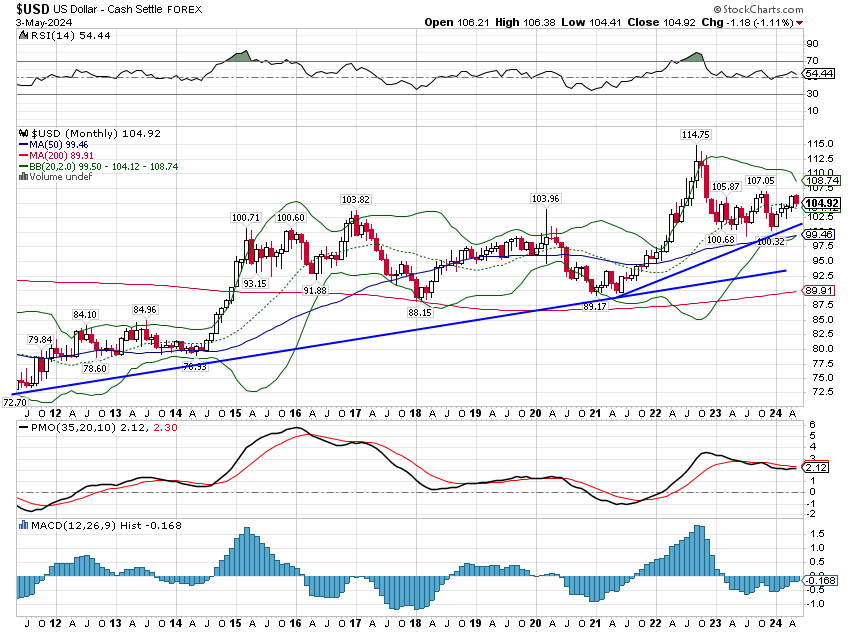

The dollar’s trend continues to mirror interest rates. The very short term trend is still up but barely and there has been almost no movement in the last 7 years. If you go back to the beginning of 2017 the dollar is up just 1.1%. I think that’s called stability and it isn’t a bad thing.

Today’s economic environment is about as neutral as you can get with both interest rates and the dollar going mostly sideways for nearly two years. That is an unusually long topping process – assuming the top in rates has already been seen – but every cycle is different and this one especially so. What trends will emerge from this period of stability? I don’t know for sure, but a lower resolution for rates and the dollar seems the most likely outcomes at this point. Whether those will be cyclical changes or secular I can’t say yet. And I don’t have to; we can wait to see how things develop – like Jerome Powell – and follow the trends that emerge. Don’t put yourself in the same position as Jerome Powell by trying to anticipate changes. If your forward guidance turns out to be wrong, it can be hard to change your mind.

Markets

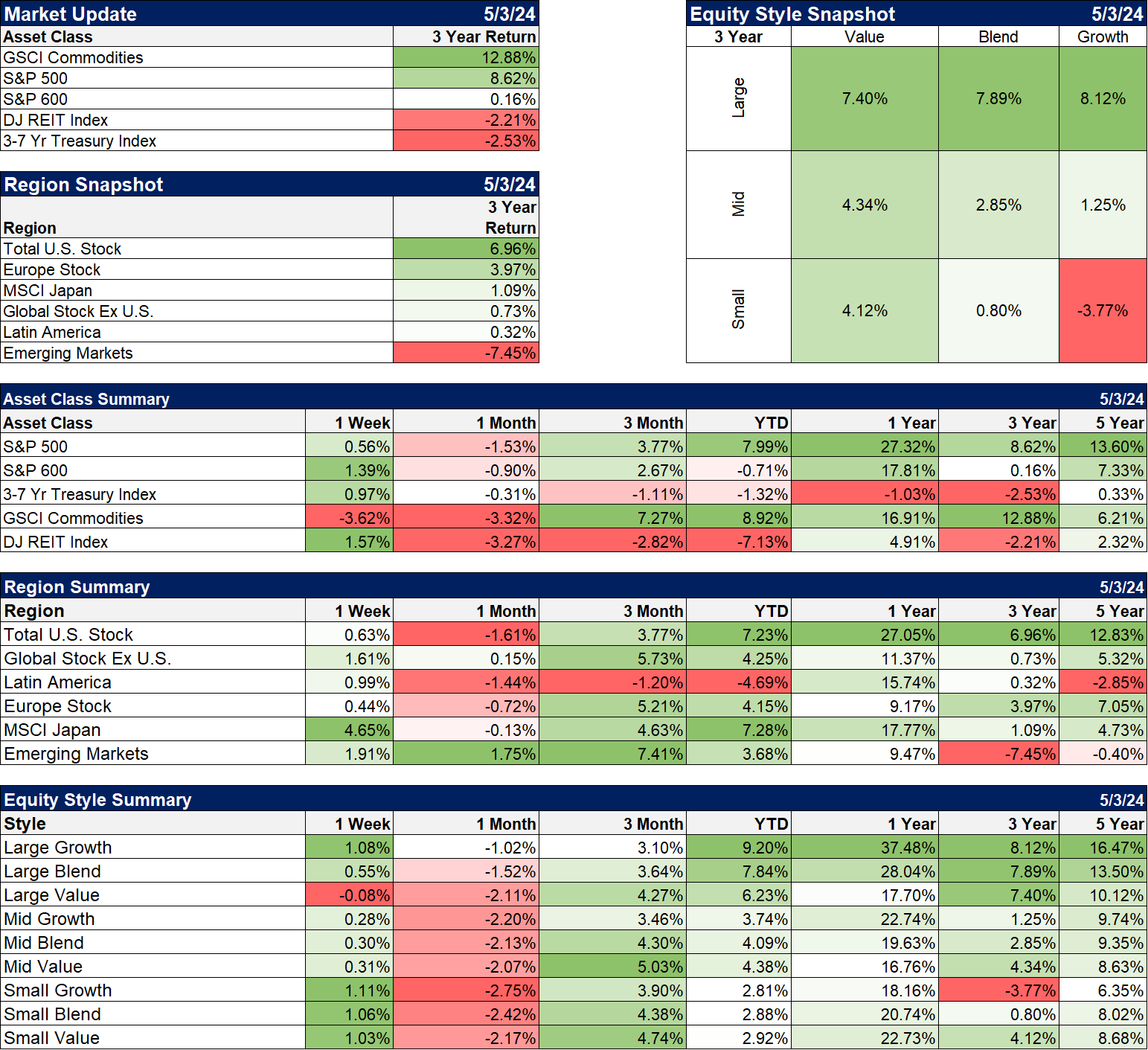

I changed the period in the Market Update section to three years to highlight the long-term trend change currently underway. As an asset class, commodities are a great diversifier but not a great long term investment; over the really long term, commodities basically track inflation. But in the shorter term, commodities can provide some explosive returns. Commodity cycles tend to run around 5 to 7 years but this one might go longer because the period of underperformance that preceded it was so long.

Note too that the shift to value is well underway, which is odd because I hear constantly that it hasn’t started yet. Value is dramatically undervalued relative to growth and the only real question is how that will be corrected. The last time we had a big shift from growth to value (2000-2003) we saw growth fall a lot while value fell less. But they both fell a lot. From July 2000 to October 2002, the S&P 500 growth index fell 53.4% while the S&P 500 value index fell 35.8% both of which are pretty awful. But by the end of 2003, the value index was back to even while the growth index was still down 37%. And that was in the context of a very mild recession by the way so even if we get the soft landing, that is no guarantee that we won’t get a bad bear market too. Every period is unique though and there were some pretty bad exogenous events during that cycle, 9/11 most prominent among them.

With interest rates falling back some last week, small cap, bonds and REITs outperformed while commodities struggled with crude oil prices down. Japan also rebounded as the Yen found at least a short term bottom.

Sectors

Very interesting that utilities are starting to outperform, now leading over the last three months. I don’t think that is a defensive play this time either as investors are looking for ways to participate in the electrification trend. While utilities are one way, I am wary because they are so heavily regulated with caps on returns on equity. Utilities are also the companies that will bear the brunt of the investment in upgrading the grid and adding capacity. A better place to invest might be in the companies that provide the equipment to make those upgrades.

Market/Economic Indicators

I am starting to see more weakness in the economy recently but not anything that I’d call recessionary yet. As the US slows, the rest of the world is picking up, which would likely be negative for the dollar if it continues.

Last week’s economic reports:

- Dallas Fed manufacturing index showed almost no change from March. Still negative at -14.5. This is likely a function of the slowdown in the oil patch where production growth has stalled.

- German retail sales +1.8% from February to March. Europe appears to be in recovery mode.

- Employment Cost Index +1.2% and higher than expected.

- Redbook retail report +5.5% YOY; still robust

- Case Shiller home prices +0.9% in February; house prices appear to be resuming their uptrend.

- Chicago PMI 37.9. This is close to the December 2008 (32.5) and May 2020 (32.9) readings. This has been an outlier for some time now and I’m not sure what to make of it. Is the Midwest region really that bad?

- Consumer Confidence 97.0 and less than expected. This has been going sideways in a range for the last two years. This drop was driven by the expectations component which fell from an already low 74 to 66.4. Elevated price levels, politics, and geopolitics dominated responses. Interestingly, the expectation for inflation over the next 12 months was 5.3% which shows how most people perceive inflation versus reality.

- ISM Manufacturing index 49.2 and a bit less than the 50 expected. Just hovering around the line between expansion and contraction.

- JOLTS – Job openings, Quits, and Hires all fell. Openings are still above the pre-COVID level but quits are not. Jobs market is finally softening.

- Non-Farm Productivity: 0.3% and very disappointing

- Jobs report: The number of jobs was less than expected but that isn’t why the bond market rallied on this report. Average hourly earnings were up just 0.2% and 3.9% year-over-year. Wage inflation needs to be around 3.5% to get overall inflation to stabilize.

- ISM Services index: 49.4 is the first reading below 50, indicating contraction, since December of 2022. Readings below 50 are pretty rare. The December 2022 reading of 49.2 is the only sub-50 reading that wasn’t during a recession but this index only goes back to 1998.

Stay In Touch