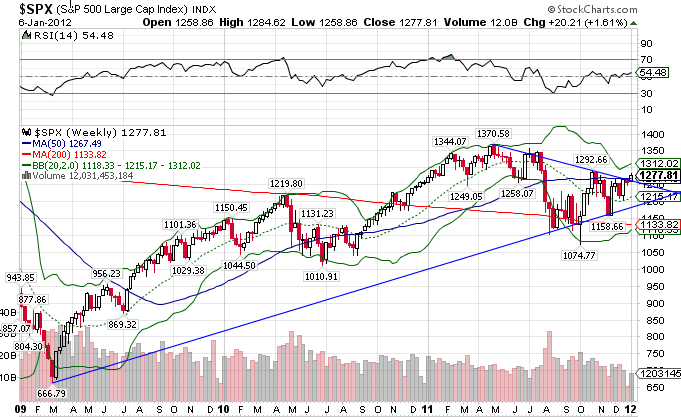

Looks like we dodged the worst of it. Although on very low volume, the S&P 500 held support at the 1200-1220 level before breaking the 50 and 200-day moving averages. In the very short-term, the S&P 500 crossed and subsequently held a clearly defined trend line outlined below. Although we’ll probably correct slightly back to the 200 day, the moving averages now become support.

The long-term picture shows a little bit more of the same. The S&P 500 crossed both the 50-week MA and a downtrend line that was established since the market highs in the spring of 2011. Technically, it seems like we might be in for an unexpected rally, so long as the news from Europe doesn’t worsen.

The VIX continues its trek downward. It failed once again in its quest to break its downtrend line, and now is over 20% below the 200 day MA.

The US Dollar index tested and held support once more. With the 50 and 200 week MA both turning positive, and with the index well above both, the US Dollar seems poised to rise further.

It is the exact opposite for the Euro Index, as both the 50 and 200 week MA turned negative. The index itself is oversold, as the relative strength index is approaching 30 and its at the lower end of the Bollinger bands. Any good news? Well, the Euro has reached support at the 127 level, so we’ll see what happens in the next week or so. The US Dollar might be due for a slight pullback, so a short term bounce may be coming.

Emerging Markets look like they’re building a base in the longer term. After breaking the 200 week MA to the downside in September of 2011, it rebounded, then retraced to make a higher low twice, to then finally stay positioned above the 200. A bounce to the 50 week MA would not be a surprise, if it can hold the 200.

On the home front, the US Home Construction index has been on a tear of late. In the short and long term, the index is now positioned above the 50 and 200 day and week moving averages. Since making new lows in October, the index is up over 50%.

Stay In Touch