Joseph A. Gomez, Sr. Investment Advisor

Joseph A. Gomez, Sr. Investment Advisor

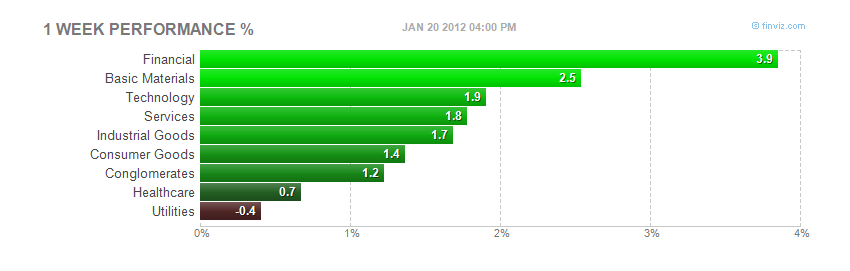

Will 2012 be a repeat of “Sell in May and Go Away”? Collectively, strategists are expecting the S&P 500 to finish 2012 at 1,350, which would be a gain of over 7%. HSBC has a year-end 2012 price target of 1,190 (down 5+%). Goldman Sachs is expecting the S&P 500 to finish the year at 1,250 (basically flat). Deutsche Bank has the highest price target at 1,500, almost 20% higher. On balance, strategists are bullish, but not overly so. Sectors that are projected to see double-digit earnings growth include: Telecom, Materials, Industrials and Technology. The only sector with lower expectations is Utilities. The remaining sectors are forecasted to see single digit growth in earnings.

In terms of the market’s valuation, the S&P 500 closed 2011 at 13 times earnings, below the historical average of 15.35. If the S&P 500 manages to “revert to the mean”, the S&P 500 would have to increase roughly 18% to the 1,500 level.

For three years, economists have been predicting higher interest rates. Will they finally be right in 2012? In terms of economic sentiment, all but two of the seven surveys of economic sentiment are currently in the lower end of their 6-year range. Economists are expecting the U.S. economy to grow modestly, around 2%-2.5% for the year. Inflation is expected to remain tame and unemployment is expected to slowly drift lower throughout the year.

As I see it, if Ben Bernanke wants to keep his job, he must make every effort for Obama to keep his. Unless there is some unexpected deterioration here or in Europe, the odds for an Obama re-election will continue to strengthen as growth, unemployment and inflation improve. Another positive development, is real estate. Housing seems to have seen its bottom in the last 30 days.

Last week’s earnings were heavily focused on technology and banking and it was ugly. Google’s shares are down more than 9% YTD. Next week, however,we get a much broader measure of the economy with earnings from oil & gas, medical devices, consumer non-durables and aerospace companies. Yet, all eyes will be on Apple’s earnings report (see calendar below). Whether you look at it’s valuation or growth numbers, Apple seems to satisfy both value and growth investors. A closer look reveals that the shares are historically undervalued when you look at conventional metrics. Apple shares are cheap, but how much is already discounted in the price?

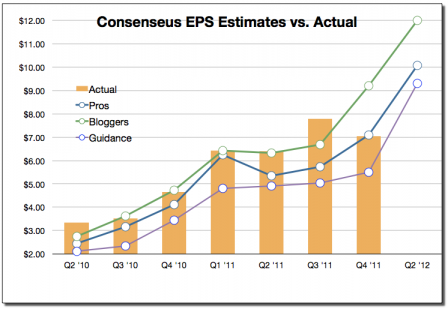

No doubt, preliminary channel checks indicate that Apple will blow past expectations this week. The key, however, is the whisper number. One good source of consensus estimates can be found at Estimize.com. Estimize is a platform where social finance users can share their earnings and economic estimates in a structured way. By contributing their estimates, community members will discover a more representative estimate of what the entire market believes, not just a narrow slice of opinion from sell side Wall Street analysts. Below are the consensus estimates for Apple:

- EPS CONSENSUS

-

-

Estimize 10.36

-

Wall Street 10.05

-

- REVENUE CONSENSUS

-

-

Estimize 39.17

-

Wall Street 38.72

-

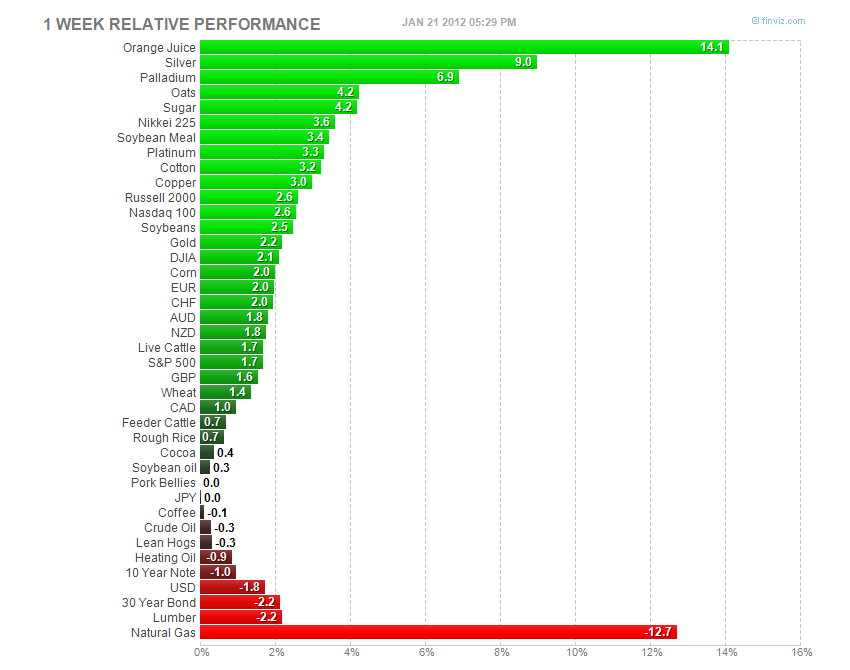

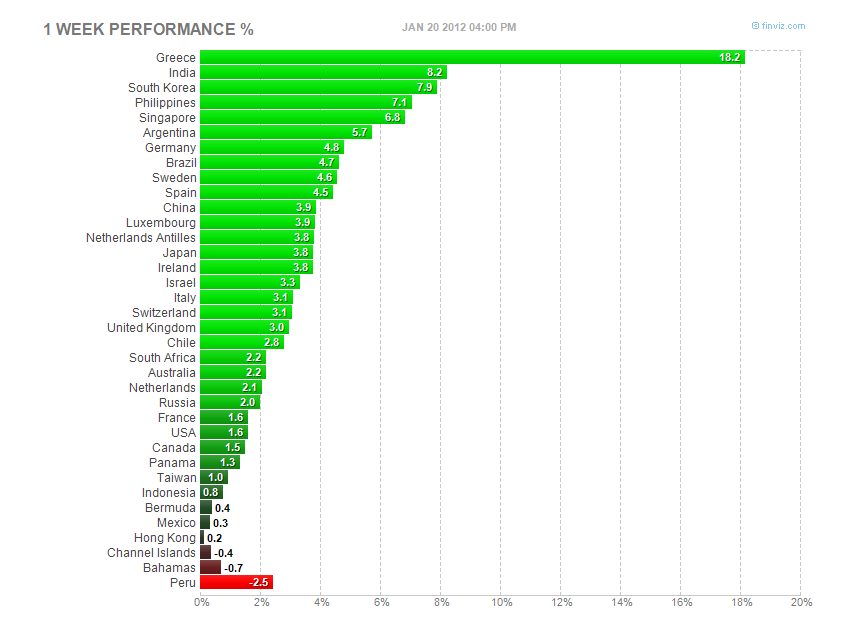

Below you’ll find chart trends that stood out last week as well as actual holdings from our model portfolios. I also include an earnings calendar, an economic calendar and key interest rates. Standouts in our portfolios last week include Barcalys, iShares Emerging Market ETF and Panera Bread.

Have a pleasant and productive week.

Apple Metrics since 2004

Source: Apple 2.0/Fortune Tech

Important Earnings Next Week (bold names are portfolio holdings)

| Ticker | Company | Industry | P/E | Market Cap | Yield | Earnings Date |

| AAPL | Apple Inc. | Personal Computers | 15.19 | 391782.63 | 1/24/12 16:30 | |

| JNJ | Johnson & Johnson | Drug Manufacturers – Major | 15.92 | 178242.57 | 3.49% | 1/24/12 |

| VZ | Verizon Communications Inc. | Telecom Services – Domestic | 15.65 | 110327.58 | 5.13% | 1/24/12 |

| MCD | McDonald’s Corp. | Restaurants | 19.95 | 104102.4 | 2.75% | 1/24/12 8:30 |

| COP | ConocoPhillips | Major Integrated Oil & Gas | 9.12 | 94535.08 | 3.71% | 1/25/12 8:00 |

| ABT | Abbott Laboratories | Drug Manufacturers – Major | 19.23 | 86862.93 | 3.44% | 1/25/12 8:30 |

| OXY | Occidental Petroleum Corporation | Major Integrated Oil & Gas | 13.12 | 81479.36 | 1.83% | 1/25/12 8:30 |

| UTX | United Technologies Corp. | Conglomerates | 14.39 | 69488.04 | 2.50% | 1/25/12 8:30 |

| BA | Boeing Co. | Aerospace/Defense Products & Services | 14.95 | 56128.73 | 2.33% | 1/25/12 7:30 |

| TXN | Texas Instruments Inc. | Semiconductor – Broad Line | 14.02 | 38438.75 | 2.02% | 1/23/12 16:30 |

| VMW | VMware, Inc. | Technical & System Software | 58.75 | 37202.5 | 1/23/12 16:30 | |

| HAL | Halliburton Company | Oil & Gas Equipment & Services | 12.23 | 33310.15 | 0.99% | 1/23/12 |

| PX | Praxair Inc. | Synthetics | 24.29 | 32769.76 | 1.83% | 1/25/12 8:30 |

| KMB | Kimberly-Clark Corporation | Personal Products | 17.66 | 29096.4 | 3.79% | 1/24/12 |

| ADP | Automatic Data Processing, Inc. | Business Software & Services | 22.1 | 27753.27 | 2.78% | 1/25/12 8:30 |

| SYK | Stryker Corp. | Medical Appliances & Equipment | 16.87 | 20335.08 | 1.60% | 1/24/12 16:30 |

| AEP | American Electric Power Co., Inc. | Electric Utilities | 12.58 | 19804.14 | 4.58% | 1/23/12 |

| YHOO | Yahoo! Inc. | Internet Information Providers | 19.46 | 19795.19 | 1/24/12 | |

| COH | Coach, Inc. | Textile – Apparel Footwear & Accessories | 21.47 | 19217.28 | 1.39% | 1/24/12 |

| APD | Air Products & Chemicals Inc. | Chemicals – Major Diversified | 16.22 | 19083.64 | 2.56% | 1/24/12 8:30 |

| MSI | Motorola Solutions, Inc. | Communication Equipment | 21.15 | 15492.45 | 1.85% | 1/25/12 8:30 |

| TEL | TE Connectivity Ltd. | Diversified Electronics | 12.78 | 15292.93 | 2.00% | 1/25/12 8:30 |

| GWW | W.W. Grainger, Inc. | Industrial Equipment Wholesale | 22.65 | 13995.34 | 1.32% | 1/25/12 8:30 |

| CCI | Crown Castle International Corp. | Diversified Communication Services | 94.33 | 13149.59 | 1/25/12 16:30 | |

| ALTR | Altera Corp. | Semiconductor – Specialized | 15.4 | 12946.7 | 0.79% | 1/24/12 16:30 |

| CTXS | Citrix Systems, Inc. | Business Software & Services | 38.06 | 12704.38 | 1/25/12 16:30 | |

| SNDK | SanDisk Corp. | Semiconductor- Memory Chips | 10.69 | 12613.35 | 1/25/12 16:30 | |

| SYMC | Symantec Corporation | Security Software & Services | 19.08 | 12376.92 | 1/25/12 16:30 | |

| STJ | St. Jude Medical Inc. | Medical Appliances & Equipment | 14.07 | 12300.25 | 2.18% | 1/25/12 8:30 |

| XRX | Xerox Corp. | Business Equipment | 11.84 | 12150.56 | 1.94% | 1/25/12 8:30 |

Economic Calendar by Econoday.com

| Monday Jan 23 | Tuesday Jan 24 | Wednesday Jan 25 | Thursday Jan 26 | Friday Jan 27 |

|

4-Week Bill Announcement

11:00 AM ET 11:00 AM ET3-Month Bill Auction

11:30 AM ET 11:30 AM ET6-Month Bill Auction

11:30 AM ET 11:30 AM ET |

ICSC-Goldman Store Sales

7:45 AM ET 7:45 AM ETRedbook

8:55 AM ET 8:55 AM ET4-Week Bill Auction

11:30 AM ET 11:30 AM ET2-Yr Note Auction

1:00 PM ET 1:00 PM ETObama Speaks |

MBA Purchase Applications

7:00 AM ET 7:00 AM ETFHFA House Price Index

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif)  10:00 AM ET 10:00 AM ETPending Home Sales Index

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif) ![[djStar]](https://bloomberg.econoday.com/images/bloomberg-us/djstar.gif) 10:00 AM ET 10:00 AM ETEIA Petroleum Status Report

![[djStar]](https://bloomberg.econoday.com/images/bloomberg-us/djstar.gif) 10:30 AM ET 10:30 AM ET5-Yr Note Auction

11:30 AM ET 11:30 AM ETFOMC Meeting Announcement

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif) ![[Star]](https://bloomberg.econoday.com/images/bloomberg-us/star.gif) 12:30 PM ET 12:30 PM ETChairman Press Conference

![[Star]](https://bloomberg.econoday.com/images/bloomberg-us/star.gif) 2:15 PM ET 2:15 PM ET |

Weekly Bill Settlement

Durable Goods Orders

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif) ![[Star]](https://bloomberg.econoday.com/images/bloomberg-us/star.gif) 8:30 AM ET 8:30 AM ETJobless Claims

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif) ![[Star]](https://bloomberg.econoday.com/images/bloomberg-us/star.gif) 8:30 AM ET 8:30 AM ETBloomberg Consumer Comfort Index

9:45 AM ET 9:45 AM ETNew Home Sales

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif) ![[Star]](https://bloomberg.econoday.com/images/bloomberg-us/star.gif) 10:00 AM ET 10:00 AM ETLeading Indicators

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif)  10:00 AM ET 10:00 AM ETEIA Natural Gas Report

10:30 AM ET 10:30 AM ET3-Month Bill Announcement

11:00 AM ET 11:00 AM ET6-Month Bill Announcement

11:00 AM ET 11:00 AM ET7-Yr Note Auction

1:00 PM ET 1:00 PM ETFed Balance Sheet

4:30 PM ET 4:30 PM ETMoney Supply

4:30 PM ET 4:30 PM ET |

GDP

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif) ![[Star]](https://bloomberg.econoday.com/images/bloomberg-us/star.gif) 8:30 AM ET 8:30 AM ETConsumer Sentiment

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif) ![[djStar]](https://bloomberg.econoday.com/images/bloomberg-us/djstar.gif) 9:55 AM ET 9:55 AM ET |

Key Rates by Bloomberg.com

| CURRENT | 1 MO PRIOR | 3 MO PRIOR | 6 MO PRIOR | 1 YR PRIOR | |

|---|---|---|---|---|---|

| Fed Funds Rate | 0.08 | 0.08 | 0.08 | 0.09 | 0.10 |

| Fed Reserve Target Rate | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| Prime Rate | 3.25 | 3.25 | 3.25 | 3.25 | 3.25 |

| US Unemployment Rate | 8.50 | 8.70 | 9.00 | 9.10 | 9.40 |

| 1-Month Libor | 0.28 | 0.29 | 0.24 | 0.19 | 0.26 |

| 3-Month Libor | 0.56 | 0.57 | 0.42 | 0.25 | 0.30 |

Mortgage* (National Average)

| CURRENT | 1 MO PRIOR | 3 MO PRIOR | 6 MO PRIOR | 1 YR PRIOR | |

|---|---|---|---|---|---|

| 30-Year Fixed | 3.95 | 3.93 | 4.18 | 4.49 | 4.80 |

| 15-Year Fixed | 3.27 | 3.28 | 3.47 | 3.62 | 4.08 |

| 5/1-Year ARM | 2.90 | 2.83 | 3.03 | 3.01 | 3.45 |

| 1-Year ARM | 2.71 | 2.96 | 2.95 | 3.17 | 3.17 |

| 30-Year Fixed Jumbo | 4.55 | 4.70 | 4.81 | 4.96 | 5.49 |

| 15-Year Fixed Jumbo | 3.80 | 3.96 | 4.15 | 4.29 | 4.84 |

| 5/1-Year ARM Jumbo | 3.14 | 3.17 | 3.17 | 3.32 | 3.98 |

Click here to sign up for our free weekly e-newsletter.

Alhambra Investment Partners and/or its clients have positions in: GOOG, AAPL, BCS and PNRA.

Stay In Touch