The S&P 500 has once again bounced off its upward trend line on its way to new highs, on the back of the announced Facebook IPO and pretty much nothing new from Europe. The index is very overbought at the moment though, so buyer beware. It’s above the 70 level in the Relative Strength Index, and closed above the upper level of the bollinger bands. This week we did see a bullish technical pattern develop as the 50 day MA moved above the 200 day MA in what is known as a golden cross.

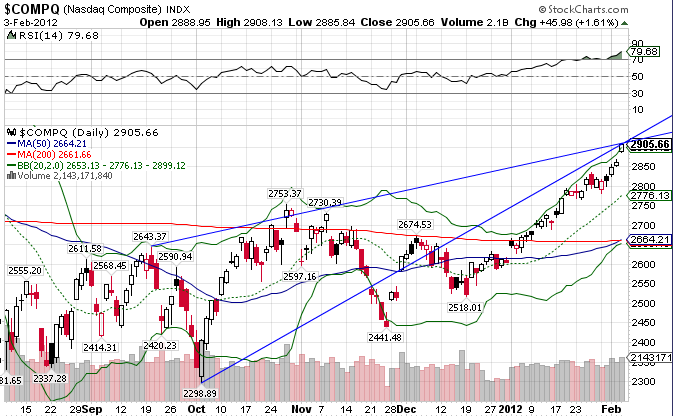

The Nasdaq Composite Index is a short-term screaming sell. The risk-on trade came back furiously in the last few weeks and most of the new money seems to have gone into tech stocks. While tech is still a good long term proposition, prudent buyers might want to wait for a pullback.

The VIX is close to is lowest levels in some time. If the market were to make new highs, the VIX would probably need to break the 15 level.

The US Dollar is in a precarious state right now. It is at risk of breaking its uptrend line and seems likely to do so, with all the money being pumped into the system.

Gold, as stated previously, is a sell at the $17 level. This is a short-term call though, as it can easily go to the 16.40 level and bounce right back up. Longer-term, the direction of the dollar will determine the sentiment on gold, so stay tuned.

The Europe index has quietly rallied, despite no solution yet on Greece and unemployment levels in the southern states that pierce the 20% level. The index managed to break the 200 day MA, but I’m not confident it will hold.

And to finish off, here are a few stats on why the New York Giants will manhandle the New England Patriots in today’s Super Bowl.

Travel And Leisure: City Face-Off – New York vs Boston

Stay In Touch