More of the same this week. Markets inching higher on low volume. Crude oil spiking. Tensions in the Middle East. The Bank of Japan trying to do too much. The markets do seem overbought right now, but have been for weeks now. Will this correction ever come?

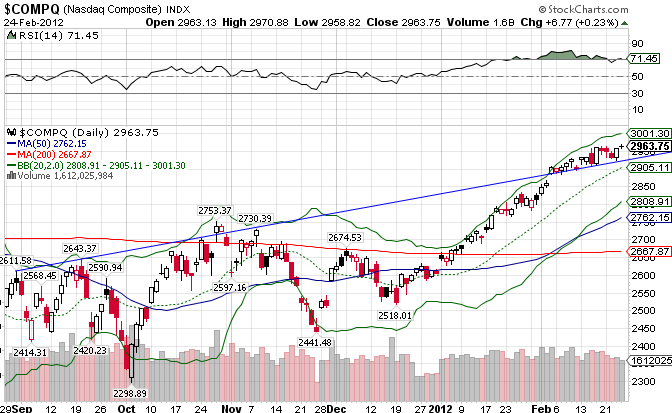

The Nasdaq Composite is holding its trend line. The index is overbought, and a correction will come eventually. But that doesn’t mean it can’t continue to go up in the near future.

The VIX index seems to be making a base. Is it only a matter of time before we we an extended upward move? The “fear” index is calculated based on the implied volatility of of S&P 500 index options, where a high value corresponds to a more volatile market and therefore more costly options.

The US Dollar failed at its 50-day moving average. The index seems poised to test the 200-day MA.

Euro blew threw the 133 level this week. That level of resistance now becomes support.

The Japanese Yen is breaking down, after last week’s news that the Bank of Japan will increase quantitative easing and adopt an inflation target. It looks like the Yen is headed to a new era of extended weakness.

Crude oil is surging, mainly on the backs of Iran-Israeli tensions and a weakening dollar. This rise, in conjunction with a rising stock market, feels eerily similar to 2008, when crude oil acted as a boon to the markets, before $4 gas prices were seen as a net-negative to the economy. Well, $4 gas is right around the corner again.

Stay In Touch