Joseph Gomez, Sr. Investment Advisor and Portfolio Manager

Apple was, once again, the star performer in client accounts last week, rising 7.41% and hitting another milestone – $600 per share. The rapid increase in AAPL’s share price has also caused a bit of a problem for analysts, as the stock keeps catching up with their price targets. Right now, the lowest price target belongs to Pacific Crest at $630 and the highest is Piper Jaffray at $718.

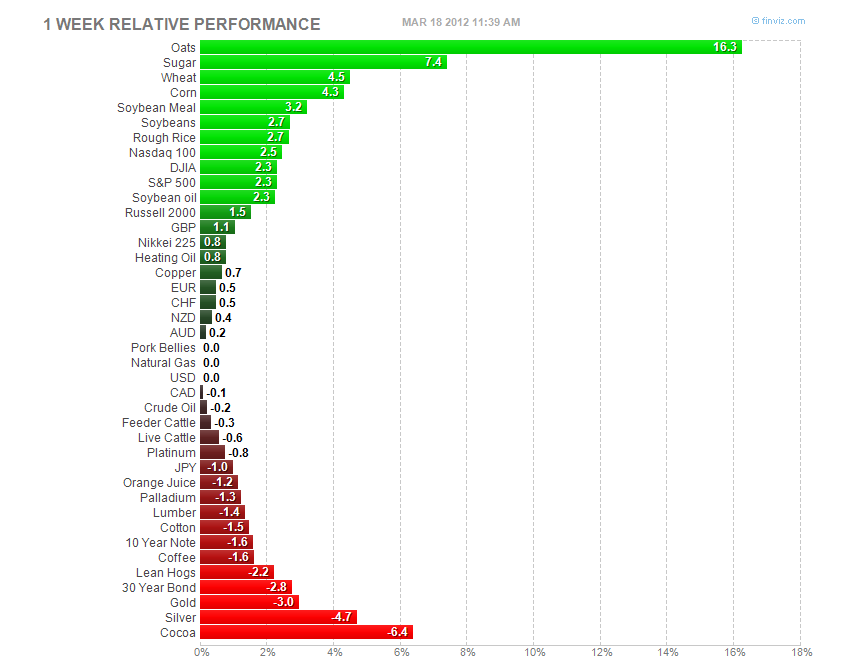

The S & P 500 rose a solid 2.3% for the week. Not surprisingly, given the gains so far this year as well as this week, there is a growing chorus out there suggesting that the equity market is overdue for a pullback. Some of the most oft cited arguments behind these correction calls include the low VIX, lack of volume, underpeformance of small caps and the transports, and the strong dollar.

The lack of volume argument has also been a popular reason to say the market is headed for a fall. It seems like a day doesn’t go by where someone isn’t writing off the rally due to its low volume. This isn’t just a recent trend. It has been going on the entire bull market, which coincidentally has been one of the ten longest in history. In my earlier post, The 17-Year Market Cycle – Revisited, I describe how low volumes are really another way of investors expressing skepticism in the rally.

The S&P 500 is currently trading two standard deviations above its 50-Day Moving Average. Normally, when the market gets this extended, you either see at least a short-term pullback or sideways trading so that the index’s moving averages can catch up to the price. At this point and at this rate, I’m inclined to see this occurring sometime in April. The main reason for this is the recent strength in financial and bank stocks.

One of the biggest concerns for investors was the lack of participation from the banking sector. Year to date, and now after the stress test, bank stocks have been hot led by the Regional Mid-west Bank group of 92 banks (see chart below). Our second best performer last week was Barclays Bank (BCS) which rose 6.67%.

Developed by Sherman and Marian McClellan, the McClellan Oscillator is a breadth indicator derived from Net Advances, the number of advancing issues less the number of declining issues. The McClellan Oscillator on the Nasdaq finished the week at 12.43. This indicates that the Nasdaq still has potential to continue higher in the short-term.

Below, I have included key interest rates, an economic calendar and the charts of the above-referenced securities. Have a pleasant and productive week.

Key Rates by Bloomberg.com

| CURRENT | 1 MO PRIOR | 3 MO PRIOR | 6 MO PRIOR | 1 YR PRIOR | |

|---|---|---|---|---|---|

| Fed Funds Rate | 0.15 | 0.12 | 0.07 | 0.12 | 0.15 |

| Fed Reserve Target Rate | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| Prime Rate | 3.25 | 3.25 | 3.25 | 3.25 | 3.25 |

| US Unemployment Rate | 8.30 | 8.30 | 8.70 | 9.10 | 9.00 |

| 1-Month Libor | 0.24 | 0.25 | 0.28 | 0.23 | 0.25 |

| 3-Month Libor | 0.47 | 0.49 | 0.56 | 0.35 | 0.31 |

Mortgage* (National Average)

| CURRENT | 1 MO PRIOR | 3 MO PRIOR | 6 MO PRIOR | 1 YR PRIOR | |

|---|---|---|---|---|---|

| 30-Year Fixed | 4.02 | 3.85 | 3.92 | 4.18 | 4.74 |

| 15-Year Fixed | 3.24 | 3.14 | 3.27 | 3.36 | 3.98 |

| 5/1-Year ARM | 2.89 | 2.84 | 2.84 | 2.98 | 3.33 |

| 1-Year ARM | 2.81 | 2.73 | 2.78 | 2.97 | 3.02 |

| 30-Year Fixed Jumbo | 4.57 | 4.65 | 4.70 | 4.74 | 5.34 |

| 15-Year Fixed Jumbo | 3.78 | 3.91 | 3.97 | 4.04 | 4.63 |

| 5/1-Year ARM Jumbo | 3.02 | 3.22 | 3.21 | 3.18 | 3.74 |

Economic Calendar by Econoday.com

Clients, principals and/or employees of Alhambra Investment Partners may have long or short positions of any above-mentioned securities. For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joseph Gomez can be reached at jag@4kb.d43.myftpupload.com.

Click here to sign up for our free weekly e-newsletter.

![[Report]](https://bloomberg.econoday.com/images/bloomberg-us/byconsensus_butt.gif)

![[djStar]](https://bloomberg.econoday.com/images/bloomberg-us/djstar.gif)

![[Star]](https://bloomberg.econoday.com/images/bloomberg-us/star.gif)

Stay In Touch