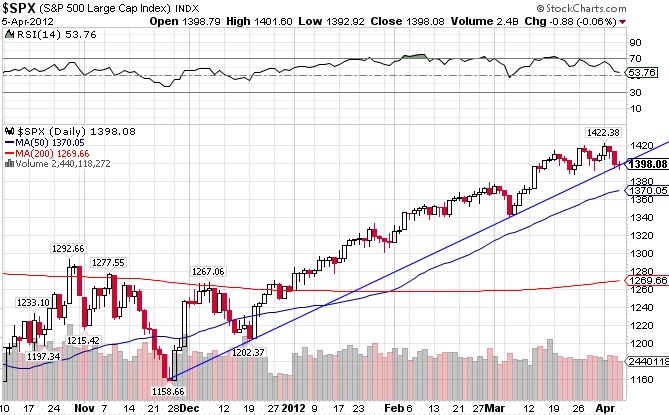

It’s been quite a bull run since the November lows, but now the US market has corrected and finds itself right at its short-term upward trend line. While its a toss up to pinpoint market direction from here, the US market, particularly the S&P 500, looks solid technically. Every other world market highlighted is at least under its 50-day moving average, and some under the 200, but the S&P 500 has been resilient so far this year.

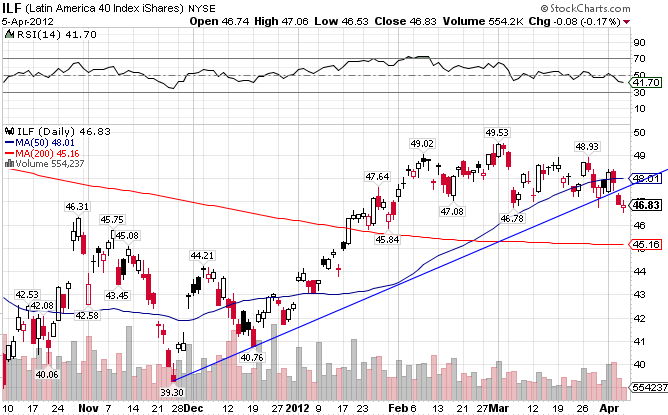

Latin America broke both the 50-day and its short-term upward trend line in the last two weeks. Expect it to test support at the 200-day MA.

It’s more of the same for the Brazilian market. It may be at risk of breaking the 200-day if the world markets turn lower over the next week.

The EMU index, or the European Economic and Monetary Union, seems to be breaking down. In the last week, it broke its trendline, the 50-day MA, and the 200-day MA.

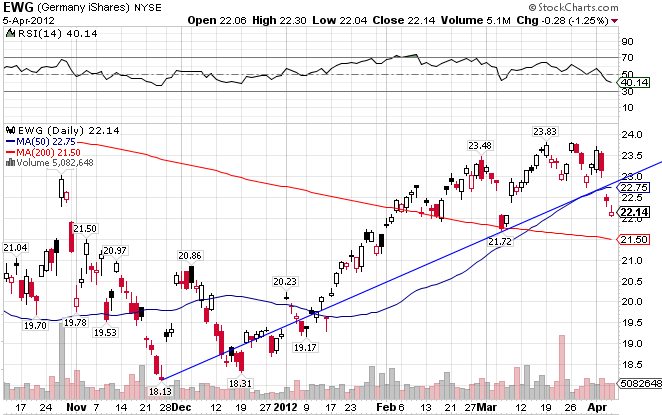

Germany

Eastern Europe

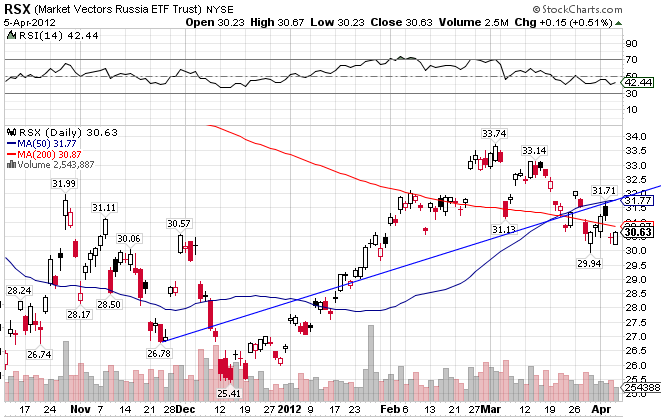

Russia failed on its attempt to cross the 50-day and proceeded to break down.

The Middle East index held support at its 50-day.

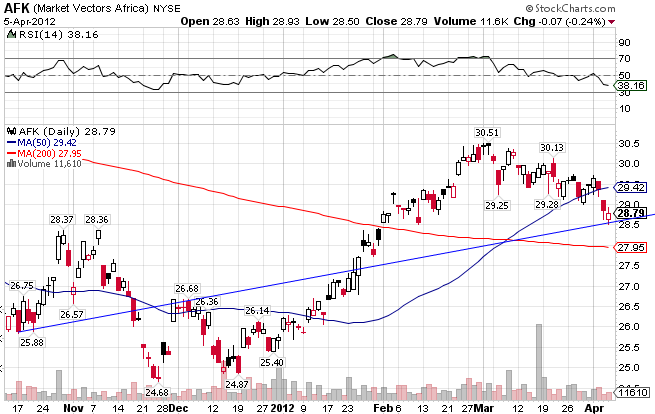

Africa

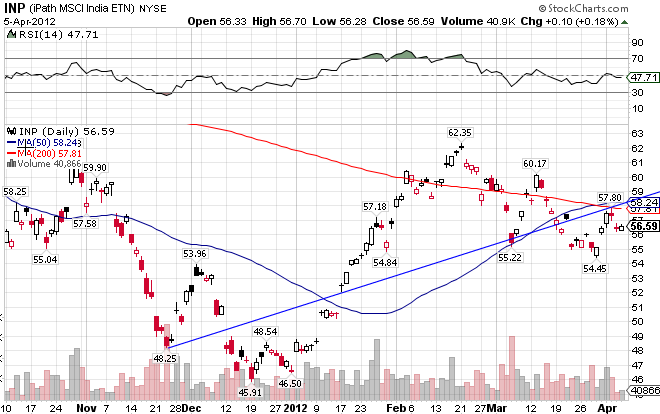

India

China

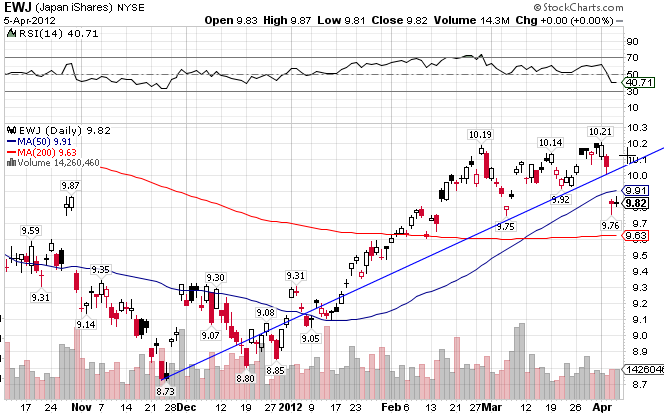

Japan

Stay In Touch