Economies travel in cycles. Some factors contributing to economic cycles are the following:

- Periods of great innovation and capital formation

- Fluctuations in fiscal policies

- Credit/Money creation

- War, disease, natural disaster

At Alhambra, we often refer to Keynesian theory v Classical theory in reference to responses to the cyclical nature of an economy. The reality, economies inevitably have hiccups. In lay terms what did Keynes say? Essentially, pay cuts during economic down turns are difficult. Corporations will, therefore, fire workers to manage the bottom line, given a negative shock to their sales. This is a problem, a negative feedback loop ensues, increased savings and low product demand perpetuate.

The Keynesian solution, prevent job cuts by raising nominal prices, specifically targeting labor. To accomplish this, lower the savings rate and increasing credit and spending in the government sector. This can be viewed as borrowing against the future upturn in order to lower the amplitude of the current downturn, smooth the economic cycle and hopefully, elongate its wavelength with minimum effect on its upward trend.

The problem, you essentially subsidize poor investment, which can have implications for the next upturn. You lower the cost of capital which has the effect of stimulating current revenue. But, the lower hurdle rate on capital investment increases the probability of poor choices in the allocation of the capital and, thus, future returns. Additionally, to execute this current plan, you place a debt burden on the economy.

In the last 15 years we have repeated this cycle smoothing, Keynesian exercise 3 times; Asian crises, dotcom bust and 9/11, real estate bust. There are 2 additional factors to consider. We are importing labor deflation from places like China. And, the repeal of the Glass-Steagall Act in 1999 allowed our banks to increase their leverage and ability to create credit. These were the ingredients for the massive downturn just experienced.

Where do we go from here? Have we overcome all of these factors, is the current economy on a sustainable path to recovery? Wage headwinds exist. Basel III mitigates bank leverage. Monetary and fiscal policies remain Keynesian. At the very least, there is an increased probability for what Bill Gross has described as the “New Normal.” This is no different than the term “sclerotic,” used by our own Dr. John Chapman. These terms are analogies for “lower future returns.” The low cost of capital has led to potentially poor investment decisions and an accompanying debt burden to be carried forward.

The risk: the economy becomes more and more burdened by the interest on debt capital which is invested by rent seekers who destroy it. This is not sound economics.

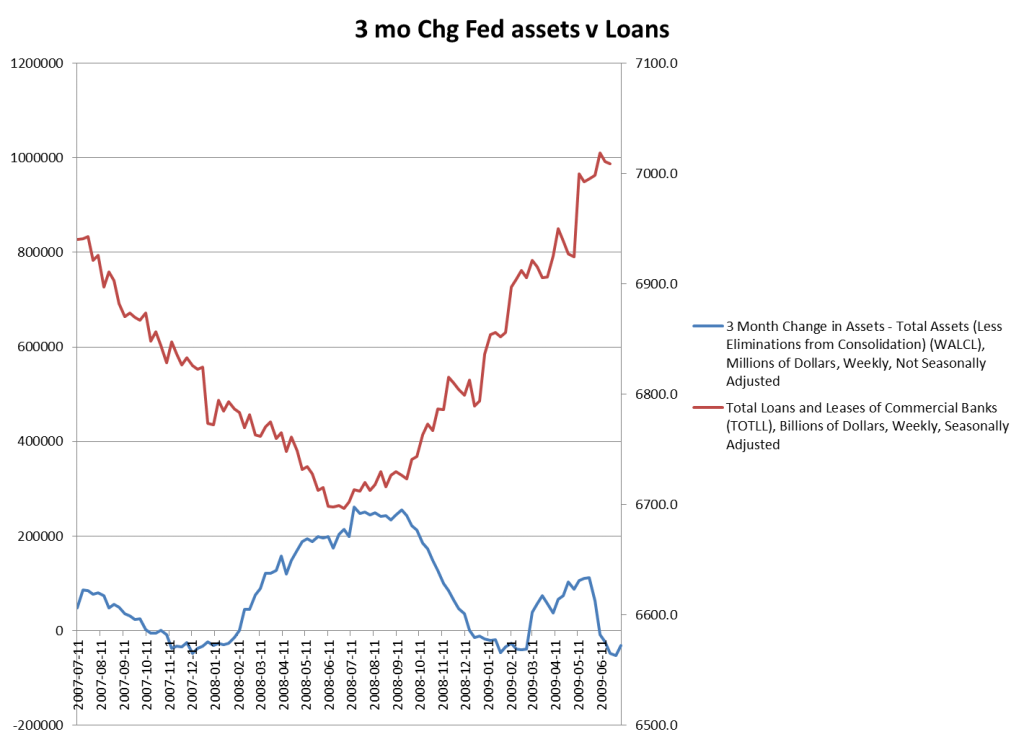

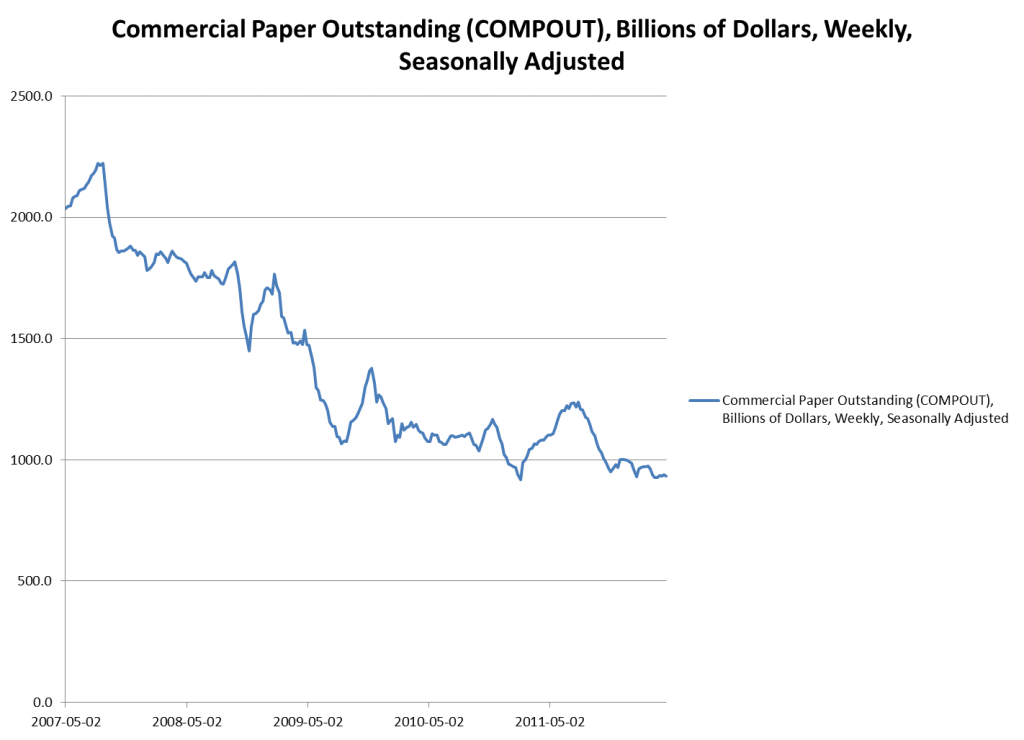

Credit creation in the economy returned at the peak of QE2. Good news.

But working capital sits at an all-time low.

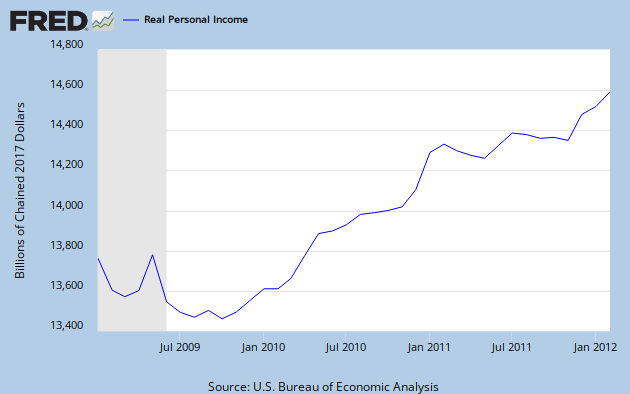

Real Income growth may have peaked.

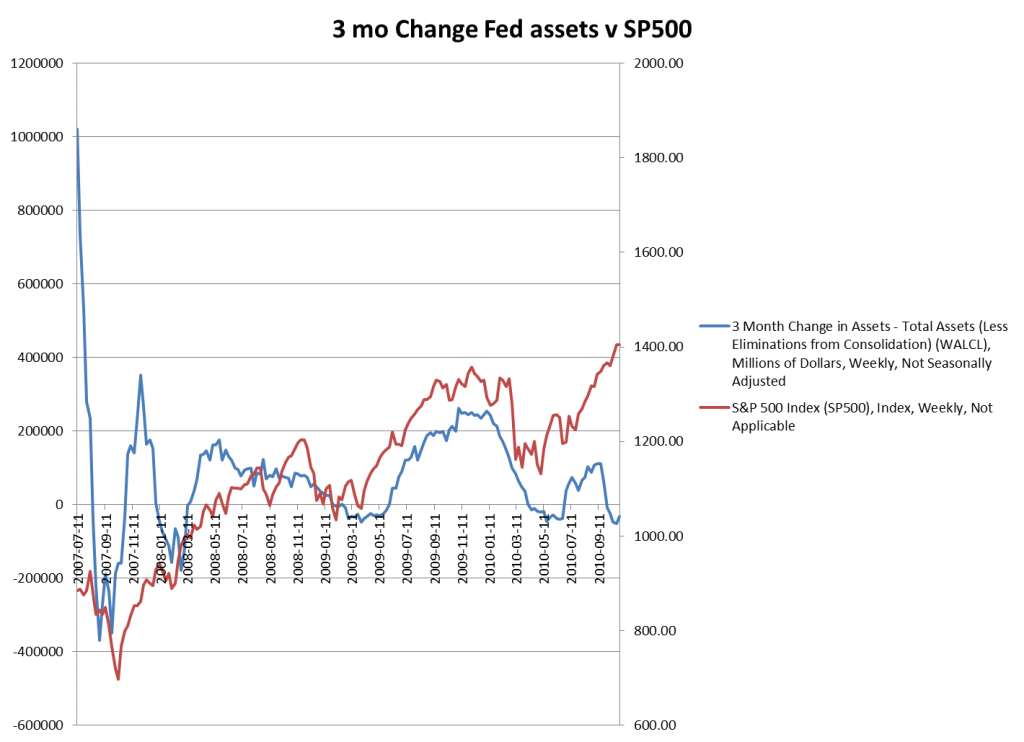

Equity prices have taken a recent upswing, against the recent correlation with the Fed balance sheet.

We have been questioning the sustainability of this rally and believe the risks for a downturn exist. The extreme optimism must be questioned. We do not dismiss the potential for a sustainable economy, in spite of the embedded macro issues. We feel it is prudent to be cautious here. For these reasons we remain on hold, invested slightly below risk neutral baselines over all tactical strategies.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at dterry@4kb.d43.myftpupload.com

Stay In Touch