I’m sure many of you have recently read about the risk of bonds or that bonds are the next bubble. Should we consider bonds a safe place to invest, to earn income or to diversify the risk present in today’s world?

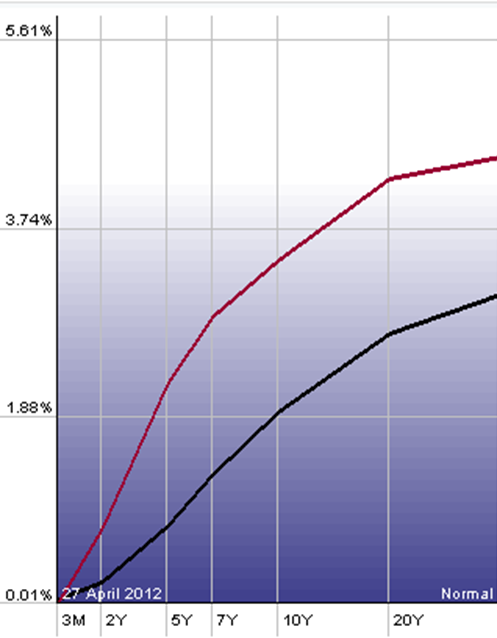

The current environment is definitely challenging. The Fed, in its attempt to charge the economy, is nearing the end of “Operation Twist.” As bonds in the Fed portfolio return principal and interest, the Fed reinvest the money in longer dated bonds. This strategy does not increase the nominal amount of bonds in the portfolio, but extends the duration of their portfolio. The goal here is to drive down longer term rates. The graph below shows their success. The red line represents yields on 4/1/2011, the black line is where we sit currently.

Duration can be thought of in two ways. First, it is a proxy for a bond portfolio’s maturity, the weighted average years until bonds expire. Second, it is the price sensitivity of the portfolio given a small change in interest rates. Here is a simple example. For simplicity, I’ve eliminated the present value calculation on future income.

Suppose you hold a portfolio consisting of 1 10yr bond. Its duration would be approximately 10. A 1% rise in interest rates would cause this bond to drop approximately 10%. That is to say the bond price changes approximately 10x the underlying interest rate change.

The capital loss in the above scenario is the opportunity cost lost from buying the bond today at a 1% yield and watching rates rise to 2%. If we had waited until yields rose to 2%, we would be earning an extra 1% per year in income for 10 years or 10% over the life of the investment, the missed opportunity.

Yes, we still make our 1% for 10 years, but we could have earned 2% for 10 years.

Today we find ourselves faced with this exact predicament. We currently believe that waiting is the best decision we can make on behalf of the client.

In the present there are 2 ways to increase yield in a bond portfolio. Both involve higher risk.

- Buy longer dated bonds, which are more sensitive to changes in interest rates.

- Buy lower credit quality bonds which have a higher probability of default.

The alternative, current yields are not attractive investments, you can sit in cash and hope to receive a higher yield at a later date.

Cash is essentially a zero duration bond. The interest rate is reset on a daily basis so changes in interest rates have minimal effects on our principal. Said another way, the opportunity cost mentioned above is only 1 day. The choice to invest in cash instead of 10 year bonds is made because one is disinterested in lending for extended periods at current rates of return and would prefer to buy some time.

Some may wonder about holding gold as an alternative. Gold can be thought of as a zero to negative duration bond. If inflation is higher than the current rate of interest, then sitting in cash erodes our buying power. Gold, because of its finite supply, would be expected to rise in this type of environment. What we are speaking of is an environment where real rates are negative, inflation is higher than yield.

The real rate of interest is calculated by subtracting inflation rates from yields. The inherent problem becomes, what is the right rate to use for inflation.

- CPI – Consumer Price Index-the price of a changing basket of goods, the government essentially replaces hamburger in the basket when we can no longer afford steak—this understates inflation.

- PCE-Personal Consumption Expenditures, imputed and actual prices of goods a consumer is most likely to buy-better but still probably understates inflation.

- PPI – Producer Price Index-the price producers receive for their output-because inventory plays a huge role here, this index tends to be extremely volatile and cyclical and is therefore not a great tool to measure inflation

- M2 Growth- the change in the money supply- not a bad macro measure for longer term inflation

- Shadow Stats Alternative CPI-compares year to year changes in an equivalent basket of goods, an estimate of inflation as it was measured in 1990

Let’s choose M2 growth a good long term indicator, Shadow Stats CPI a good short term indicator and PCE the Fed’s preferred indicator.

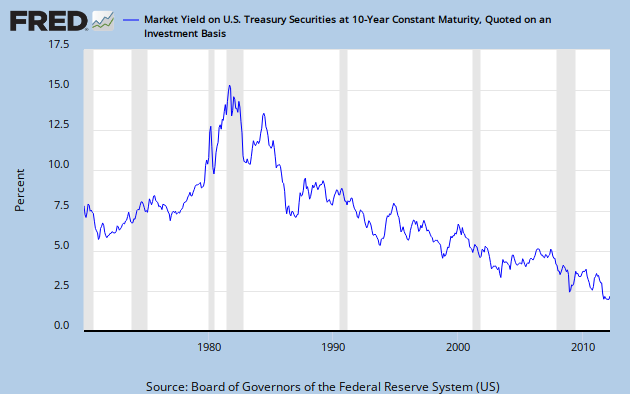

Looking at 10 year US Treasury yields we see that they have been in continuous decline for 30 years.

Inflation

Real Rates

Looking at these three graphs, one draws a few conclusions. 10 year bonds, yielding 1.94%, given inflation measures of upwards of 10% today and a long term average inflation of close to 7%, are not likely a good long term investment. One would be locking up their money for 10 years and receiving about 2% income while their buying power erodes. For this reason, our friend Mark Stuart of Stuart investments has coined bonds the Reward-Free investment. Should we encounter intense volatility from events in Europe, domestic slowing or a Chinese cliff dive, bonds may rise further as alternatives are scarce. But the risks here lean decidedly to higher future interest rates. The Fed is scheduled to end Operation Twist this June and a congressional debt ceiling debate is looming on the horizon. These are some of the reasons we have chosen to hold our defensive positions in cash rather than long term fixed income instruments; we also hold a small position in Gold.

Just for fun let’s place a data series of gold prices on top of real interest rates. Using the growth of M2 measure for inflation, real rates turned decidedly negative just about 1997 as deflationary forces crept into the world.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at dterry@4kb.d43.myftpupload.com

Stay In Touch