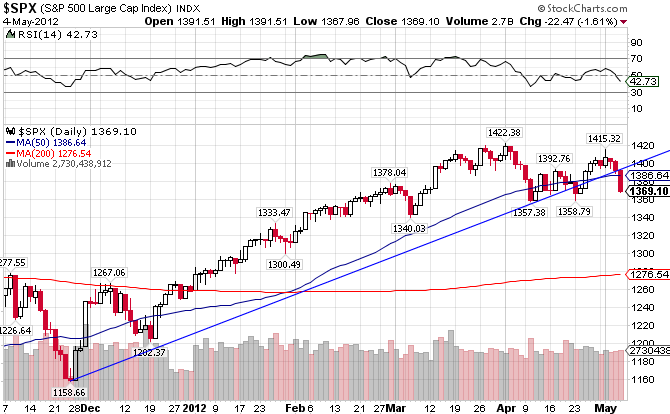

The Euro crisis and worsening economic statistics back home have knocked the wind out of the sails for the US stock market. It’s been quite a bull run since the November lows, but now the S&P 500 has corrected and finds itself under its 50-day moving average and its short-term uptrend line. The index made a lower high at 1415 this past week, after peaking at 1422 last month. Look for a continued down draft.

As expected, once the Latin America Index broke the 50-day MA, it was headed to the 200-day. Now that it has tested support at the 200-day, it looks very likely that that will fail as well. Latin America is strongly correlated to the performance of the commodity markets, and as the global economy worsens, so does the demand for commodities.

The EMU index, or the European Economic and Monetary Union, is breaking down. The Euro crisis has taken a toll on the European markets of late.

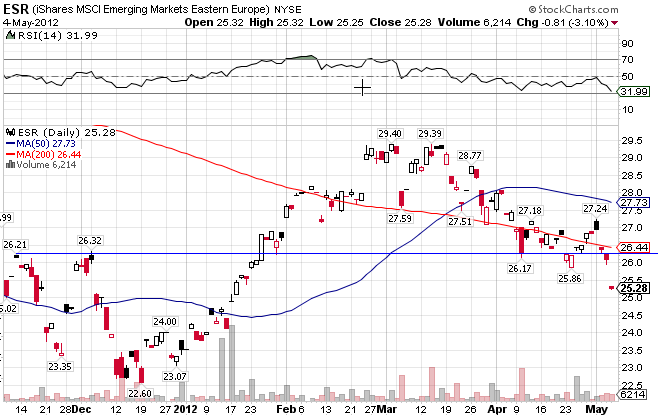

More of the same for Eastern Europe. The index broke strong support at the 26 level.

The Russian economy is also very dependent on commodities, so as commodities go, so goes Russia. The index has lost over 6% in the last few days.

The Middle East has performed much better than most despite turmoil in Syria and the Israeli-Iran friction. It’s currently right at support at 15.15.

Africa is solid technically, but looks likely to break the 50-day MA.

Pacific x-Japan just broke support at the 50-day. Look for it to test the 200-day.

Japan

Stay In Touch