The S&P 500 Index fell over 3% for the latest week, as a disappointing jobs report number and lingering Euro-worries managed to knock the index below its 200-day moving average. The index does find itself at support at 1278, and seems likely to recover. It may be a short-lived rebound though.

The S&P 500 Value Index, which consists primarily of US large-cap value stocks in the financial services, industrial, and consumer cyclical industries, finds itself below both its 50-day MA and 200-day MA. It currently sits atop support at 58.25, but with strong resistance right above where it now stands, it seems that the index will be headed for a rough patch. Its YTD performance is 11.37%.

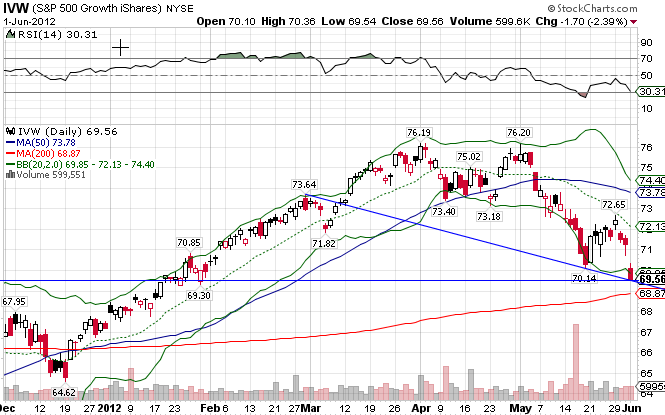

The S&P 500 Growth Index, which consists primarily of US large-cap growth stocks in the tech, healthcare, and energy industries, currently sits atop its 200-day moving average. Technically, the the chart for growth index is much healthier than that of the value index. Its year-to-date performance is also superior, with a gain of 12.17%.

The MSCI EAFE Index is currently in a free fall since the beginning of May. It’s under both its 50-day and 200-day MA, and made new short-term lows.

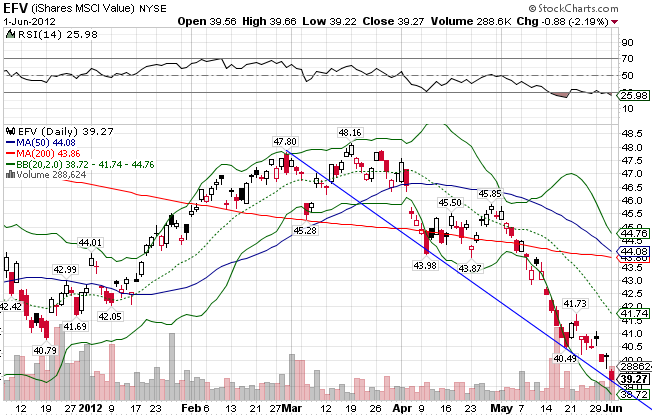

The MSCI EAFE Value Index, which consists primarily of international large-cap value stocks in the financials, energy, and communications industries, is under both its 50 and 200-day moving averages. No bottom has been established as of yet, but the index is significantly oversold as evidenced by the Relative Strength Index. The index has returned only 6.44% YTD.

The MSCI EAFE Growth Index, which consists primarily of international large-cap growth stocks in the industrial, healthcare, and consumer cyclical industries, is technically slightly better off than the value index. It’s under both its 50 and 200-day moving averages, but has yet to make new lows. The index has returned 11.42% so far this year.

Stay In Touch