A report on our tactical portfolio moves for the week, all which occurred Thursday.

Global Opportunities portfolio:

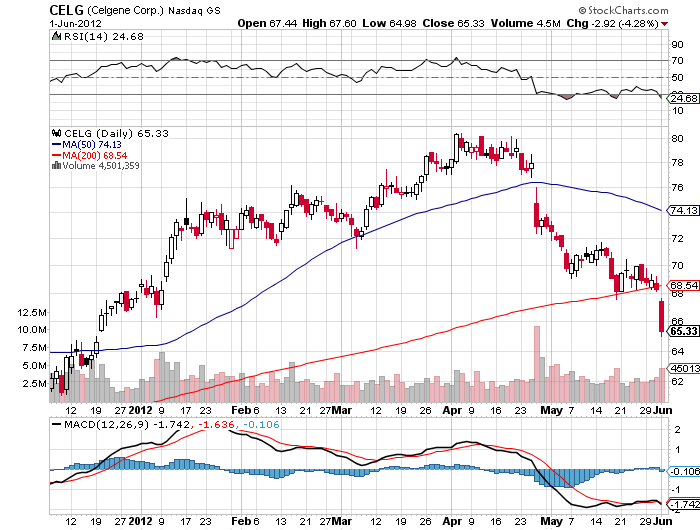

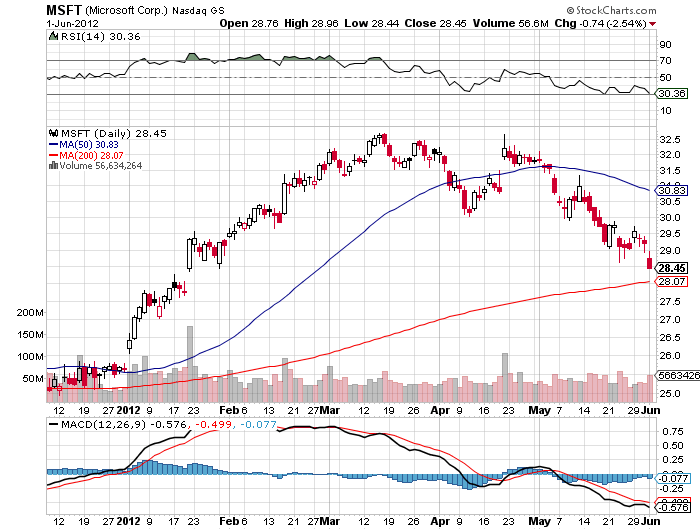

Sell AHT, Sell UPL, Buy CELG, Buy MSFT

Ashford Hospitality Trust is a hotel Reit we purchased in the first quarter of 2011. With low interest rates, our thesis held that Ashford would obtain cheap refinancing of existing debt and leverage the performance of prime properties picked up during the recent crises. Unfortunately they have struggled with some joint venture luxury properties and management has spent valuable resources capping interest rate exposure in the derivatives market.

Ultra Petroleum is a natural gas producer we recently purchased as a leveraged play on a rebound in the price of natural gas. Ultra is one of the low cost producers in the industry. As natural gas prices sunk further in Q4 2011 and Q1 2012 this company began experiencing some balance sheet problems. With their natural gas hedges expiring, Ultra is facing the possibility of selling assets to meet obligations. We still like this company, but there is a risk of it falling toward $11 in the near term.

Celgene: Biotech companies have a business model we find compelling in the current environment. Healthcare is a major mandate for the government and spending continues to increase. Biotechs are able to fund investment in research labor and technology with profits on existing drugs. They then reap the benefit of new drugs which garner tomorrow’s dollar revenue. We find biotechs to provide investors outstanding protection against inflationary policies. Celgene has grown revenues by 40% for the past 5 years and 45% for the past 10. This has funded a strong pipeline in cancer drugs. The recent pullback provided a compelling entry point into this company.

Microsoft is a defensive equity purchase. MSFT pays a 2.25% dividend and buys back about 4% of its stock each year. This is a 6.25% return on equity capital. Microsoft has been maligned for being conservative, protecting its legacy revenue but not entering new markets. There are definitely challenges; MSFT must supplement desktop operating systems with opportunities on the cloud computing platform. With a ton of intellectual equity and $50bln in cash, we are confident MSFT will continue to find areas to make a buck. Who ever said conservative was bad; MSFT has net margins north of 30% and has provided investors an average of 44% return on their equity for the past 5 years. Recent macro equity weakness provided us a compelling entry into this stock.

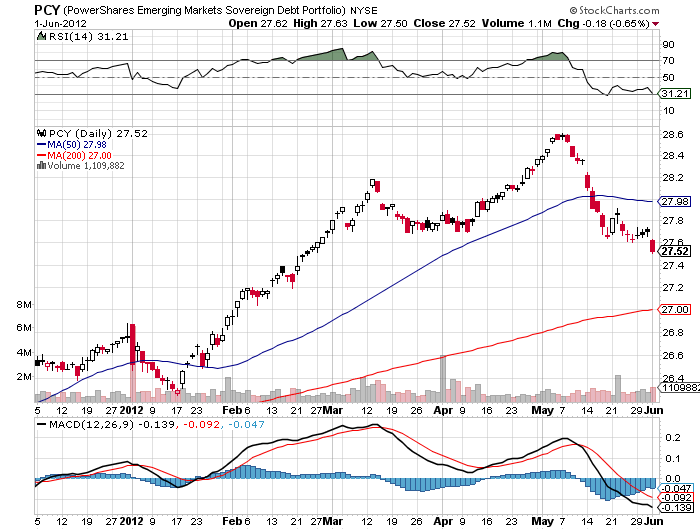

World Allocation:

We initiated a 4% allocation to emerging market government bonds.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at dterry@4kb.d43.myftpupload.com

Stay In Touch