The S&P 500 Cap-Weighted Index blew through heavy resistance this past week, after surprising news from Europe. The index broke through the 50-day moving average and the 1350-1360 level. It has returned 9.58% so far this year.

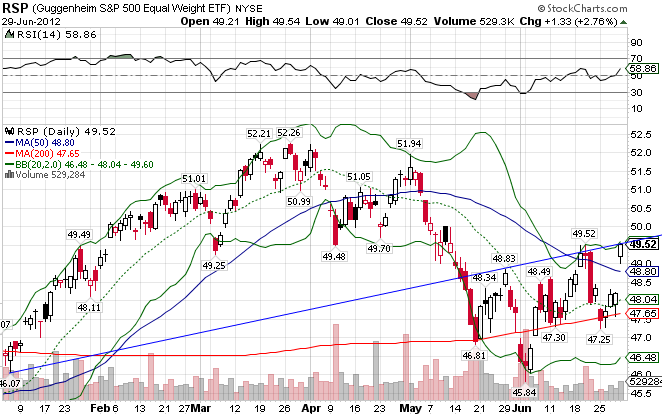

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the outperformance versus the cap-weighted index in the last ten years. The index has returned 7.81% YTD.

The S&P Mid Cap 400 Index ((IJH)) is slightly worse off technically than large and mega cap stocks. While the index also managed to break through its 50-day MA (barely), it finds itself right at resistance at the 94 level. It is up 8.12% so far in 2012.

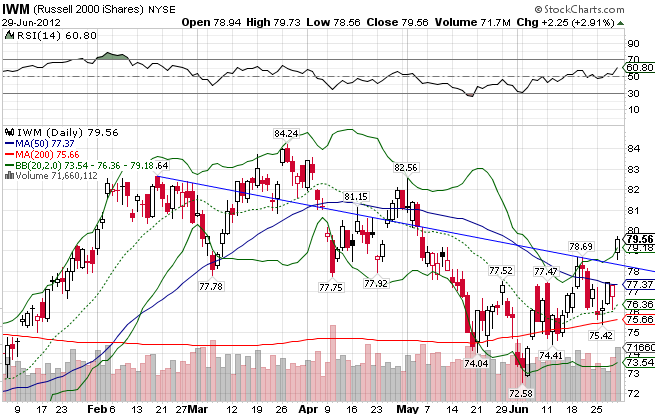

Small caps have been under-performing for most of 2012, but as of last week, things seem to be changing. While this by no means is a trend, it is nice to see smaller cap stocks outperforming the market as a whole, as over the long run smaller growth-oriented stocks tend to beat the performance of the overall market. The Russell 2000 Small Cap Index ((IWM)) is up 8.20% YTD.

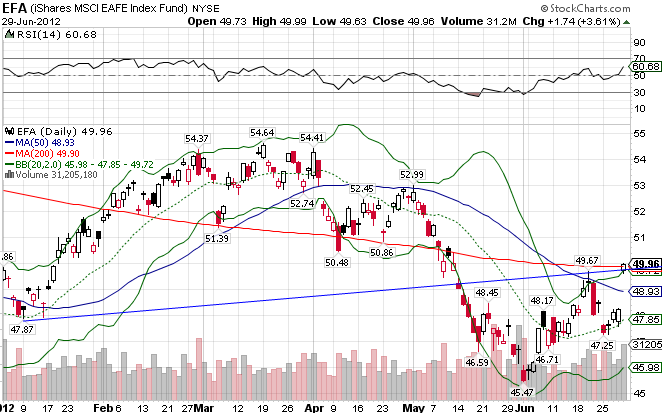

The MSCI EAFE Index ((EFA)) finds itself right at resistance at the 200-day MA. Look for the index to retest support at the 50-day MA, and possibly closing the gap at the 48 level, before potentially making a breakthrough technically. The index is up a below-par 3.27% this year.

The MSCI EAFE Small Cap Index looks technically identical to the EFA. With so much resistance in its path upward, look for it to temporarily stall and potentially cover the gap at 35. It is up only 5.68% in 2012.

Stay In Touch