After disappointing job numbers this past week and a relentless Euro crisis, the S&P 500 closed lower for the week and seems likely to retest the 50-day moving average. But despite the bad news, the index is still is on more solid footing technically than it was a few weeks ago, when the 200-day MA was breached. The index is up 9.56% for the year.

The S&P 500 Value Index, which consists primarily of US large-cap value stocks in the financial services, industrial, and consumer cyclical industries, tend to have lower price to earnings ratios and higher dividend yields than average. The index, represented here by the ishares ETF, looks likely to fall further, maybe to the 61 level, before inching forward. The index is up 8.83% YTD.

The S&P 500 Growth Index, which consists primarily of US large-cap growth stocks in the tech, healthcare, and energy industries, tend to have higher earnings growth rates, higher earnings multiples, and little or no dividend yields. Technically, the the chart for growth index is much healthier than that of the value index, but it still seems poised to break a short-term uptrend line in order to fill the gap at 72. Expect a bounce after retesting the 50-day. The index has returned 9.84% so far this year.

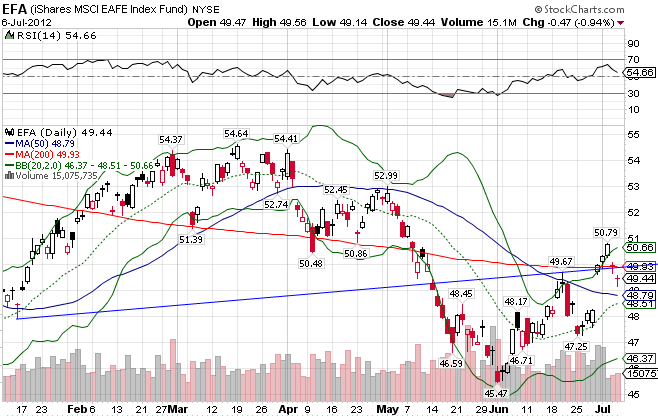

The MSCI EAFE Index, a global developed market index that encompasses Europe, Australasia, and the Far East, seems to be making a base and establishing a bottom. Things like these take some time, as the market has to see fundamental changes take place in the global economy for technical analysis to be confirmed, but for now the index stands above a falling 50-day MA, and slightly below the 200-day. The index is up 3.28% YTD.

The MSCI EAFE Value Index, which consists primarily of low P/E international large-cap value stocks in the financials, energy, and communications industries, finds itself below strong resistance and seems likely to retest the 50-day as well. The Value index is up 2.50% for the year.

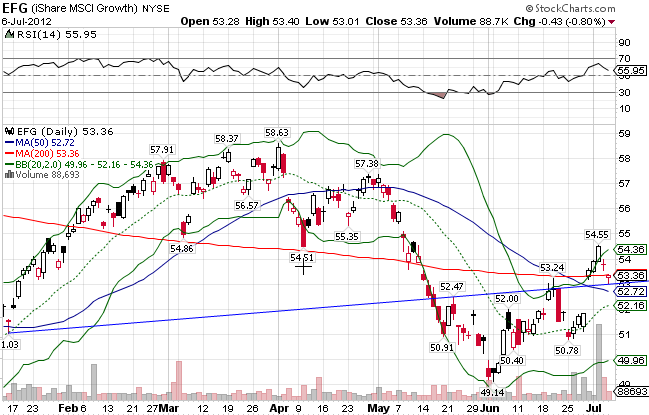

The MSCI EAFE Growth Index, which consists primarily of high-growth international large-cap growth stocks in the industrial, healthcare, and consumer cyclical industries, is technically better off than the value index. The growth index is up 4.77% YTD, substantially out-performing its rival.

Stay In Touch