The Standard & Poor’s 500 is a stock market index based on the common stock prices of the biggest 500 publicly traded American companies. The index is close to its 2012 highs but the rally seems to be stalling out. It hit resistance at 1470 and proceeded to sell off this past Friday, so look for a continuation of the selling pressure to the 1450 level. Technically, the index is still on solid footing, but we are entering a historically volatile time in the markets, the period right before presidential elections. The S&P 500 is up 16.33% for the year.

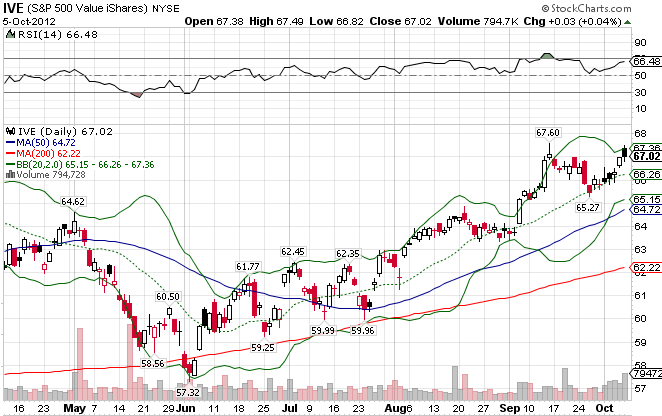

The S&P 500 Value Index, which consists primarily of US large-cap value stocks in the financial services, industrial, and consumer cyclical industries, tend to have lower price to earnings ratios and higher dividend yields than average. Compared to the S&P 500, the index is under-performing slightly, returning 15.65% YTD.

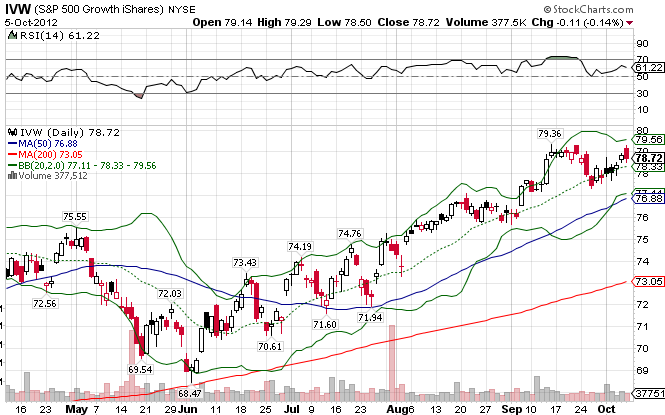

The S&P 500 Growth Index, which consists primarily of US large-cap growth stocks in the tech, healthcare, and energy industries, tend to have higher earnings growth rates, higher earnings multiples, and little or no dividend yields. Year-to-date, the index is up 16.86%.

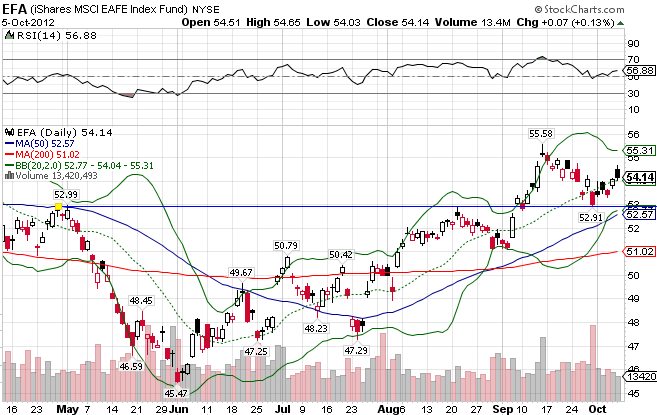

The MSCI EAFE Index, a global developed market index that encompasses Europe, Australasia, and the Far East, has established a nice uptrend since its lows in June. You would think with all the negative chatter surrounding China and Europe that the index would be broken, or at least under any one of its moving averages. It seems that much of it was already priced into the markets. The index is up 9.57% YTD.

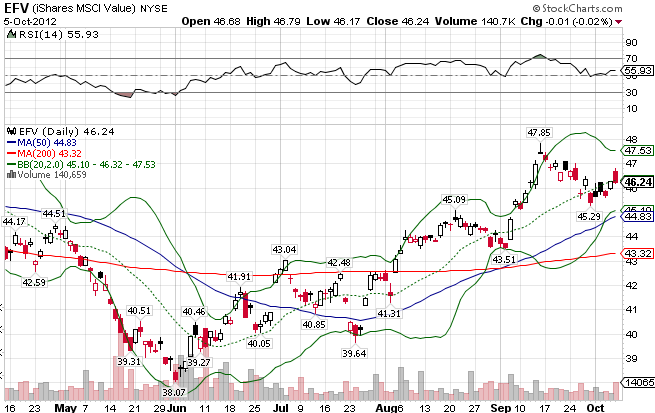

The MSCI EAFE Value Index, which consists primarily of low P/E international large-cap value stocks in the financials, energy, and communications industries, also finds itself at support. The index is up 9.63% for all of 2012.

The MSCI EAFE Growth Index, which consists primarily of high-growth international large-cap growth stocks in the industrial, healthcare, and consumer cyclical industries, has performed better than its parent index, inline with the theme of growth outperforming value stocks for 2012. The index is up 10.48% YTD.

Stay In Touch