The S&P 500 Cap-Weighted Index ((IVV)) has had a rough week. Not only did the index break its 50-day moving average, it also ripped through its short-term up-trend line. But with market sentiment quickly reversing, this downturn could be short-lived. The index is up 16.33% year-to-date.

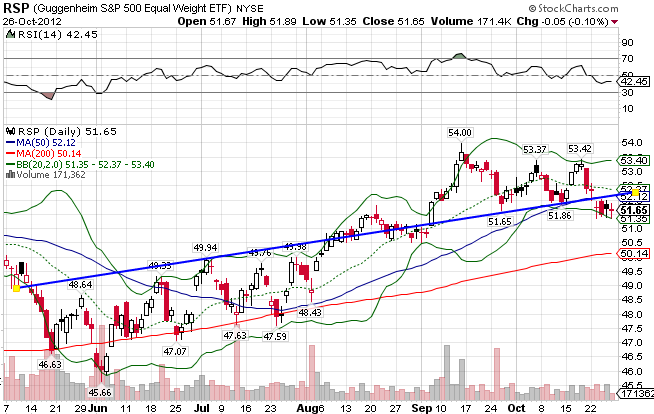

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the outperformance versus the cap-weighted index in the last decade. Technically, the index also broke support levels and now finds itself under resistance. It’s up 14.06% so far in 2012.

As evidenced by the under-performance of the S&P Equal-Weighted Index, one of the themes for the year has been high quality, blue chip stocks outperforming growth-oriented, smaller cap stocks. That thesis applies to the performance of the S&P Mid Cap 400 Index ((IJH)) as well. It’s up 13.64% YTD.

The Russell 2000 Small Cap Index ((IWM)) is up 14.49% for the year.

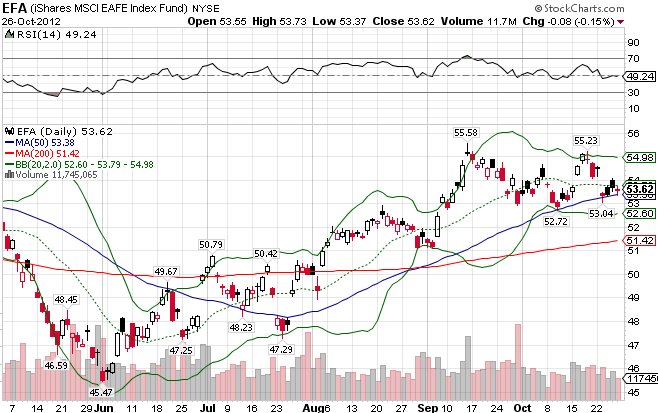

It’s no surprise that the MSCI EAFE Index ((EFA)) lags far behind the world in economic performance, given the circumstances. What is a surprise is the fact the the index is up 9.57% year-to-date and that technically the EAFE looks better than the US stock market. The index currently sits just above the 50-day MA, and above the 200-day MA. International markets, specifically Europe, may be the place to be soon.

The MSCI EAFE Small Cap ((SCZ)) has performed slightly better, with a YTD return of 13.17%.

Stay In Touch