The global economy is struggling. Markets are up significantly over the past year. The US Presidential election is a toss up. The fiscal cliff is a debate. Monetary policy is experimental. There is a certain lack of clarity.

Adding to the uncertainty, the global economic challenges come with accompanying central bank interventions. A major area of debate recently is the path of the US Dollar. If the dollar were to strengthen, we could see an increase in global demand. But, for a year the dollar rose and the global economy did not pick up. Without increases in global economic activity, a strong dollar can be deflationary and very painful for a credit driven (debt laden) economy.

The dollar was up over 10% off the lows last summer before the expectations of QE3 swept over the market. The dollar has given back about half those gains since the end of July. QE3 may be a program to merely contend with currency strength in a debt laden economy during a time of sluggish activity. But, does Bernanke want a lower dollar or just a stable dollar?

Honestly, there are arguments for both a strong and a weak dollar and the central bank can produce either scenario. But the most compelling argument, to me, is for a stable dollar. Here are some near term considerations for the dollar. We need to find out who wins on Nov 6th. We need to continue to watch the economic numbers for signs of acceleration or continued deterioration. For now, it is a delicate balancing act. A rise in the dollar may be negative for asset prices, but good for the real economy. Dollar weakness can help asset prices but be bad for the economy.

In the long run, an economy dependent on nominal growth, to the point of valueless, damaging credit extension, is a bad economy. And, extra dollars in the system appear to have reached a point of diminishing or disappearing returns.

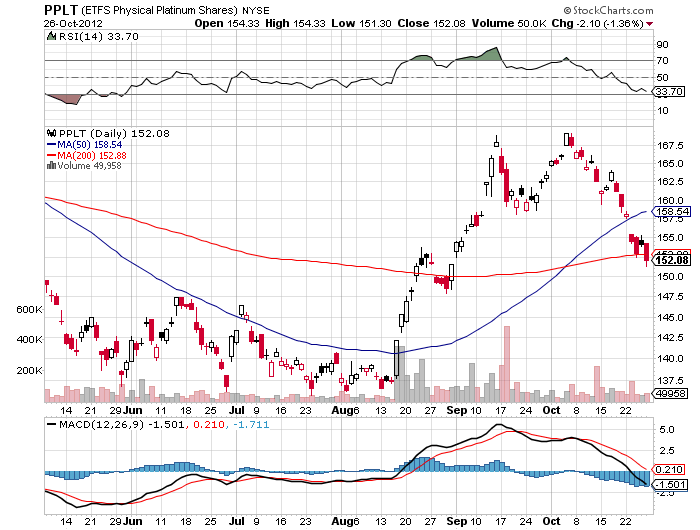

Uncertainty means caution. In late July we had added extra commodity exposure. This week we sold that extra exposure. After exhibiting weakness, we took profits in our platinum position. Platinum’s rise has been as much about strikes in South Africa as any fundamental factors. We also reduced our core commodities holding which got a boost from recent dollar weakness but did not provide any follow through.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

Stay In Touch