The main take away from this quarter’s earnings release is the following:

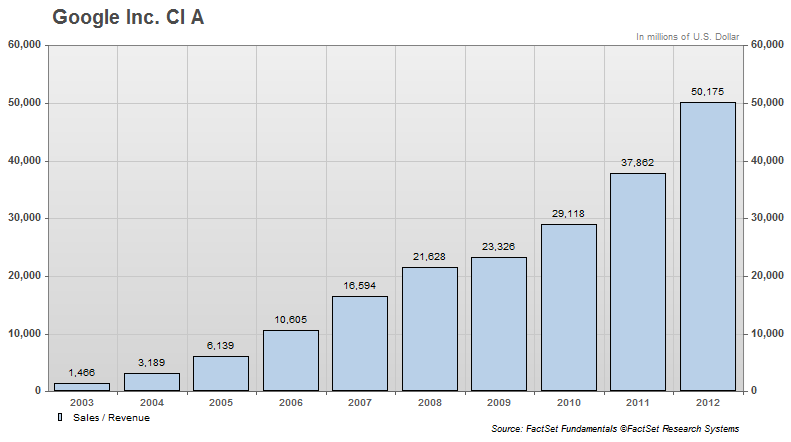

Torrid top line growth.

32.5 yoy%

24.8 5yr CAGR%

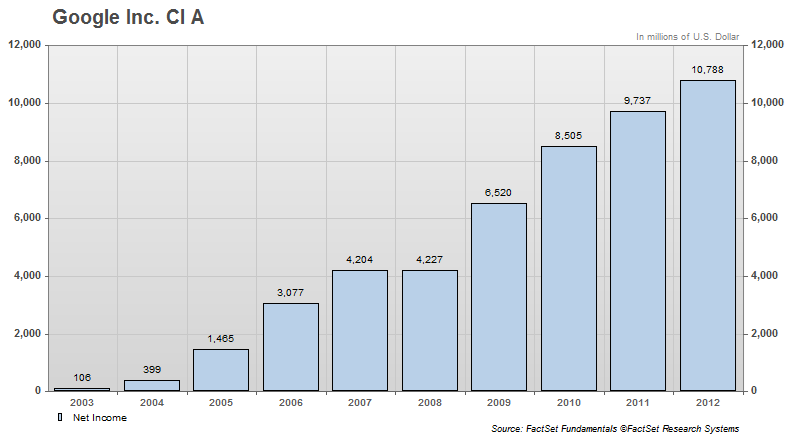

But, the growth has been expensive, lower margins (25.43% down from 32.22%):

Therefore, bottom line growth has slowed.

10.8 yoy%

20.7 5yr CAGR%

Google makes the majority of their money as an advertiser. In order to drive this advertising revenue, Google spends a lot of money innovating and creating technology. Google creates products you enjoy using like chrome, gmail, or the android phone. They purchase content you enjoy viewing, youtube and make it simpler for you to find what you’re looking for, google search. They are trying to create an environment that you find beneficial, entertaining, and easy-to-use. A cyber mall where people come to be productive, be entertained, consume information, and perhaps make a purchase. Once there, Google has a captive audience and advertisers pay big money to market to them.

This technology and infrastructure that Google creates for us is expensive. The cost of content, cloud servers and all the R&D is eating into margins. But the technology is good, margins are still healthy, return on equity is 16.6% and people are flocking to Google’s playgrounds.

Last year, Google spent $6.8 bln in R&D and $10.5 bln in acquisitions. There are indications that these investments are slowly becoming revenue generators instead of cost of goods sold expenses. This reinvestment of cash into innovative technologies may be Google’s single best value proposition. We think the top line can continue to grow. And we think, as a technology leader, higher margin revenue can emerge.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

Stay In Touch